Accounting firms, as with practically every industry, use workflow software to improve accuracy, collaborate effectively, and save time by automating mundane tasks.

In this guide, we’ll share 10 of the best workflow accounting software solutions built to help you handle your firm and client accounts efficiently — shall we get started?

The Best Accounting Workflow Software 2025: Our Top 10 List

Before we review each platform in more depth, we’ve outlined what each one is best suited for below:

- ZohoBooks — Overall, the best workflow software for accounting firms

- FreshBooks — Accounting software with its own payment processing portal

- Patriot — An ideal accounting software for businesses with limited needs

- Monday.com — The best accounting software for automation

- ClickUp — A popular and affordable tool for small-to-mid-sized businesses

- Smartsheet — Top spreadsheet-style workflow management tool for collaboration and accounting templates

- Nintex — One of the best accounting firm workflow management software tools for larger businesses

- Karbon Accounting — Leading accounting workflow software for larger firms

- Trello — A simple and inexpensive workflow tool for small businesses

- Jetpack Workflow —Great for accounting firms using QuickBooks

- Kissflow — User-friendly workflow platform for larger accounting companies

- Wrike — Quality workflow automation software for mid-sized accounting firms

We compiled this list by considering functionality, ease of use, pricing (and scalability potential), integration and mobile support, plus genuine customer reviews.

Only the best software made the cut, and our list has a solution for every need and budget.

Compare Quotes on Accounting Workflow Software

Use the questionnaire below to get a tailored quote from the best services in the industry.

Top 10 Workflow Management Software for Accounting: Reviewed

The following sections will delve more deeply into each platform to help you find the best software to manage your client accounts and workflows.

We’ll explore each one’s features, pricing, pros and cons (as expressed by their customers), and more to give you an overview and explain exactly what each platform has to offer.

Let’s dive right in.

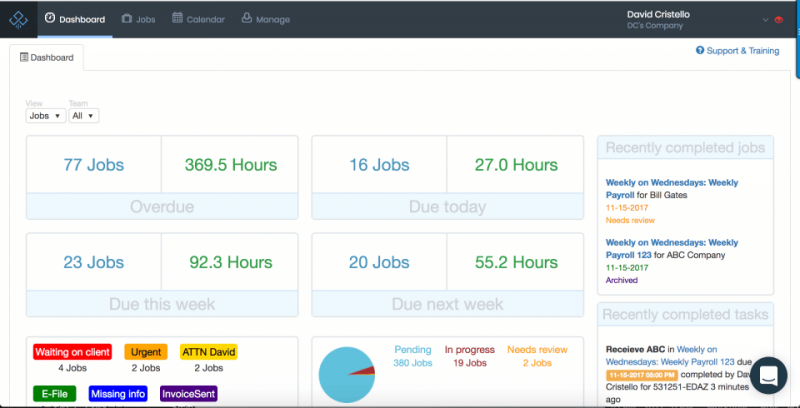

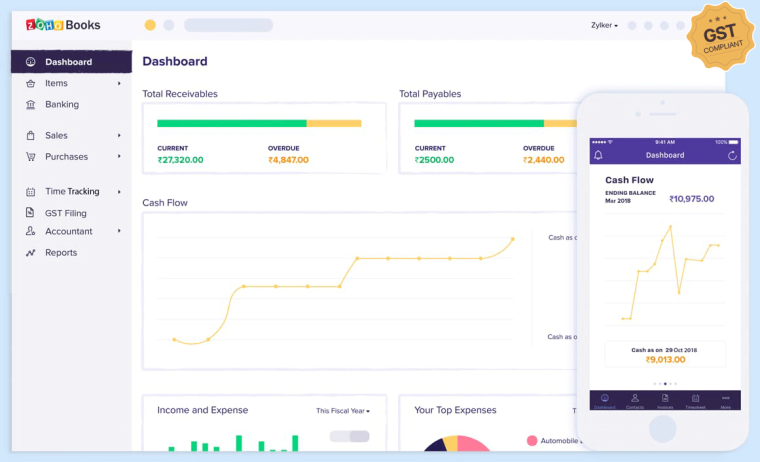

1. ZohoBooks — Overall, the Best Workflow Software for Accounting Firms

Zoho Books is an easy-to-use accounting software that is designed for individuals with limited finance, accounting, or tax filing knowledge. It comes with a variety of advanced features that simplify personal accounting tasks.

One of the unique features of Zoho Books is its receipt scanning capability, which allows users to easily track expenses by uploading pictures of paper receipts. The software also automatically records any online payments or bank transactions, providing a clear overview of where funds are being allocated.

To help users manage their spending, Zoho Books allows for the creation of recurring payments for expenses like subscription services and phone bills and also offers transaction tracking and management by automatically reconciling entries with the user’s bank account.

Overall, Zoho Books is a useful tool for avoiding overspending and optimizing financial planning.

Zoho Books’ automatic reconciliation feature checks that all payments, whether made with a credit or debit card or through a bank account, are accurately recorded by comparing them with the corresponding records from the user’s bank. This helps to catch any mistakes or unauthorized payments.

In addition to this, the software also allows users to manually review and categorize transactions by payment type and purpose, which makes it easier to organize and find specific entries. By grouping similar payments together, it becomes more straightforward to locate and track specific transactions.

| Starting Price | Top Features | Free Trial | Customer Support |

| $0 | 1. Invoice creation tool

2. Time tracking 3. Automated follow-ups |

14 days | 24×5 – email or |

Pros

- Integration options with SurePayroll

- Has both Android and iOS app

- Multiple task automation options

- Information-driven dashboards

- 14-day free trial

- Various transaction types and forms

Cons

- Takes time to learn

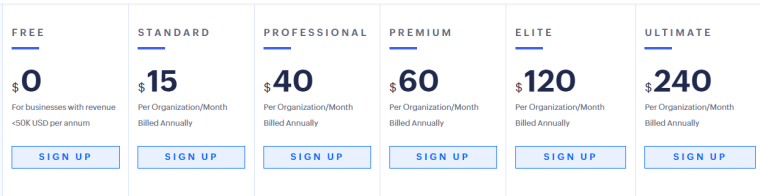

Pricing

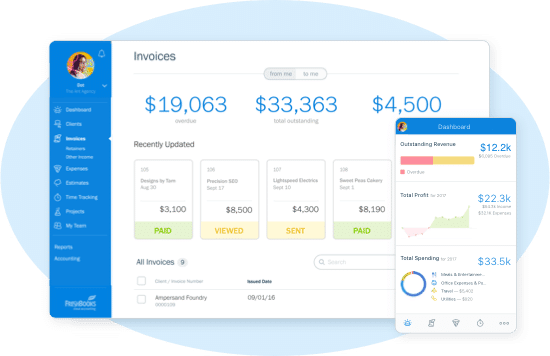

2. FreshBooks — Accounting Software With Its Own Payment Processing Portal

FreshBooks is a financial management tool that is tailored for solopreneurs and freelancers. It has flexible features that allow users to easily track their financial information.

Similar to other accounting software such as Zoho Books and QuickBooks, FreshBooks also automatically records transactions made with a bank or credit card.

FreshBooks offers a feature that automatically records transactions, saving users the time and effort of manually entering financial information and reducing the risk of errors or missed entries. This feature updates expenses in real-time, allowing users to check their live budget balance before making significant investments.

FreshBooks also offers multiple payment options, including PayPal, credit cards, and direct bank deposits, which makes it a convenient choice for start-ups and small businesses as it allows for faster payments.

The Advanced Payments feature includes additional capabilities, such as the ability to establish recurring billing profiles for automatic monthly payments. This can help users avoid missed payment deadlines and late fees.

FreshBooks has integrated with Stripe to enable its users to easily accept and make payments in various currencies across the globe. This integration offers a safe and encrypted platform for transactions with low fees and no hidden costs, making it easy to handle both local and international payments on a single platform.

| Starting Price | Top Features | Free Trial | Customer Support |

| $6/month | 1. Expense tracker

2. FreshBooks Payments 3. Compatible with major banks |

30 days | Call |

Pros

- Offers different settings for different clients and users

- Allows customized country-specific tax calculation

- Ideal for proposals, project statements, and retainers for each client

- An easy-to-use initiative design

- Keeps track of your paper receipts

Cons

- Not ideal for large businesses

Pricing

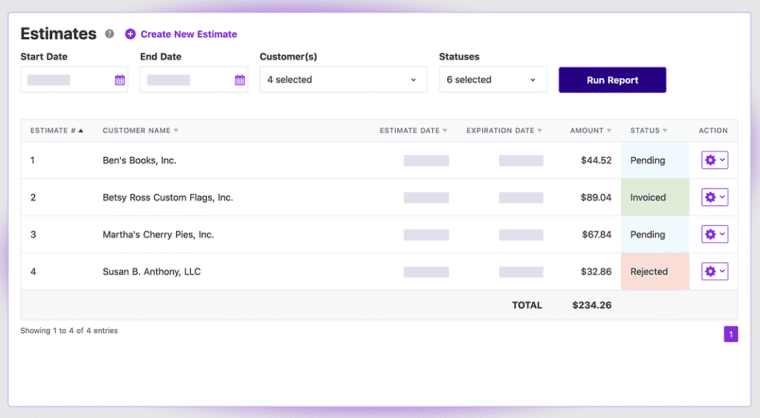

3. Patriot — An Ideal Accounting Software for Businesses With Limited Needs

Patriot is one of the few accounting software that helps you manage both independent contractors and salaried employees.

For independent contractors, it lets you handle forms 1096 and 1099 designed for filing information about income types other than salaries & tips and summarizing payments made out to such independent contractors, respectively. You can track as many of these forms at no extra cost.

If you choose to file the 1099 form online, you can do it directly from Patriot at a small fee. The fee is nominal and totally worth it since Patriot will take care of all the proceedings with the IRS for you.

We also like how Patriot lets you break down the expenses department-wise. For example, you check how much you are spending on the sales department, marketing team, and customer service department individually.

Then you can calculate how much each of these departments is contributing to the final revenue. This way, you can see if any of these departments need more investment or a small budget cut.

Patriot is also one of the few accounting software that lets you add unlimited users for free. You can hire an accountant or bring your entire accounting team on board at no additional cost.

Don’t worry, you don’t have to give complete access to the users you add to Patriot’s dashboard. Thanks to Patriot’s user-based permissions, you can control what data or files each newly added team member can see. After all, interns and new recruits shouldn’t have the same access to company account records that senior executives do.

| Starting Price | Top Features | Free Trial | Customer Support |

| $20/month |

1. Drill-down financial reporting 2. User-based permissions 3. Patriot Smart Suggestion |

30 days | Call, chat and e-mail |

Pros

- 1096 and 1099 forms to make your tax filing easy

- Ideal for small businesses with limited budgets

- Detailed segregation of expenses

- Easy-to-use dashboard

- Allows you to set up user-based permissions

- 24/7 customer support

Cons

- Not meant for medium or large enterprises

Pricing

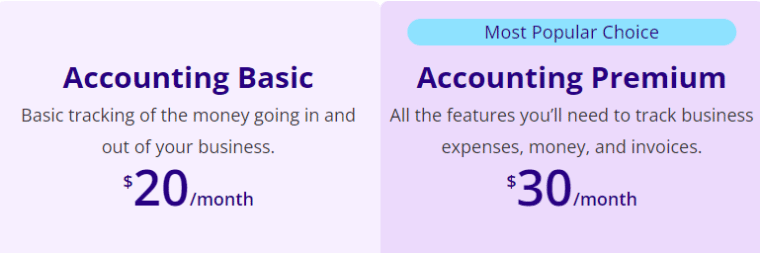

You can get started with Patriot at just $20 per month with its “Accounting Basic” plan.

This plan tags along with almost everything a small, medium, or even a relatively large business would need, including easy data imports, unlimited customers and invoices support, the ability to bring unlimited users on board, and more.

For premium features like account reconciliation, custom invoice templates, subaccount additions, and the like, we recommend you get Patriot’s “Accounting Premium” plan at just $30 per month.

Try Patriot without spending a single cent, thanks to its 30-day free trial. No risk.

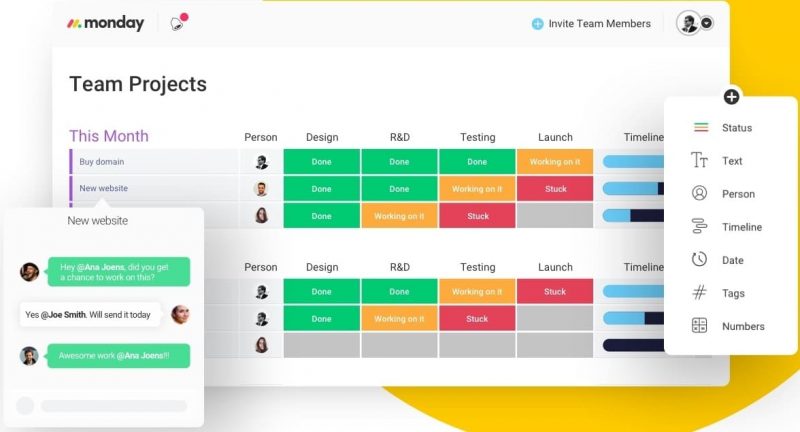

4. Monday.com — The Best Accounting Software For Automation

Thousands of accounting firms trust Monday.com. Why? Well, it lets you manage your tasks, financial data, communications, and more, all on one intuitive and user-friendly platform.

You can choose from over 20 dashboard widgets to find the best visualization method to analyze and share your financial reports with stakeholders and auditors.

Plus, you get a jaw-dropping 250,000+ human actions that can be automated with this tool! From invoicing to status changes, task dependencies, and even notifications and messages!

Even more impressive is that you get cross-platform automation to set up IF/THEN triggers between Monday.com and your external app integrations.

Special Features:

- View conversation, task, and financial data histories with clients and employees

- Use time tracking and automation to improve payroll efficiency and accuracy

- Manage your resources, dependencies, budgets, and portfolios

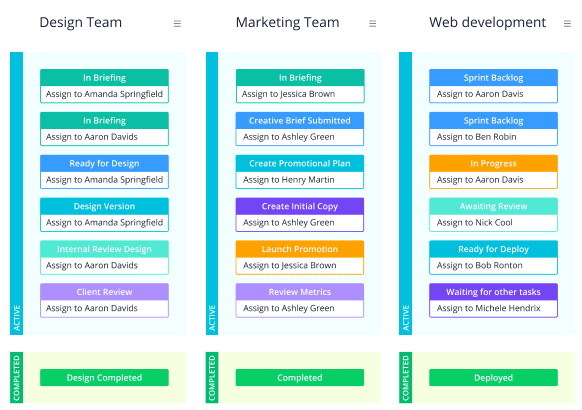

- Assign tasks, set deadlines, and track progress with Kanban boards, Gantt charts, and other views

- Communicate and collaborate in the app with tagging, instant messaging, and sharing capabilities

- Use one of over 200 customizable templates

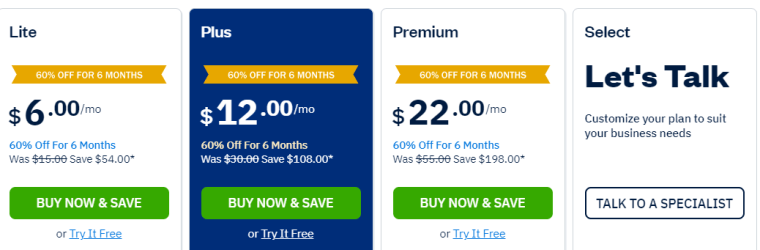

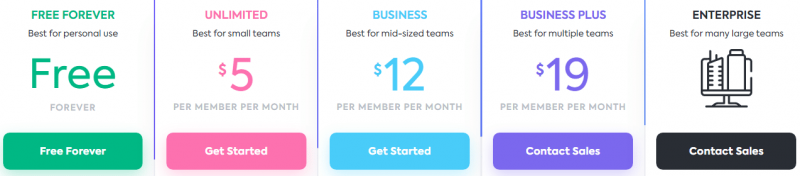

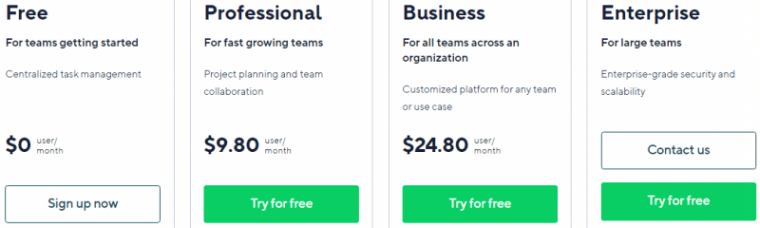

Pricing:

Monday.com has a free plan plus 4 paid plans for varying needs and budgets — here’s the pricing for 3 user seats:

For just $8/month (or $10 per month if you opt for a monthly subscription), you get insane value for money. The higher plans offer additional features like different project views, automation, and time tracking.

With Monday.com’s free trial, you can see exactly what the platform has to offer risk-free for a full 14 days.

Pros:

- Drag-and-drop workflow design

- Quality collaboration and automation tools

- Highly customizable, powerful, and intuitive

Cons:

- Advanced workflow automation is only on the Standard+ plans

|

Best For |

Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Any-sized firm | Starts at $10/user | $8/month (annual) | 1 | Plan and 14-day trial |

30-day refund policy |

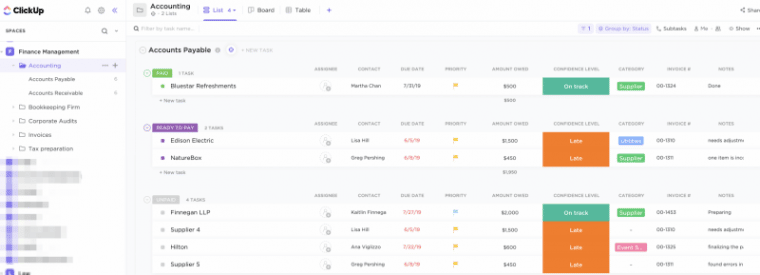

5. ClickUp — A Popular and Affordable Tool for Small-to-Mid-Sized Businesses

ClickUp is a powerful work management system that’s fantastic for accounting firms looking to manage their client accounts, billing, and invoicing.

Besides being highly customizable, this tool also gives you a centralized location for your sensitive financial data, communications, processes, and more.

You can set custom statuses for tasks, such as “invoice sent,” “issues found,” etc. Plus, there are pre-made customizable accounting templates to get you started in seconds.

Of course, ClickUp’s automation is as impressive as the rest of its features. You can set up recurring workflows like invoicing, tax filing, sending payment reminders, and more!

Special Features:

- Automate sending invoices and reports through email

- Create and share custom reports and dashboards

- 1,000+ integrations to sync with your existing accounting tools

- Manage team workload, plus task priorities, and dependencies

- Track billable hours and create reports and time estimates

- Get alerts for new comments, task status changes, and more

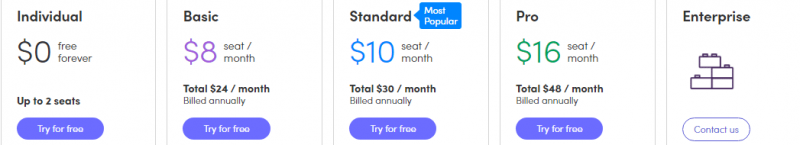

Pricing:

ClickUp also has a free plan, plus loads of paid options:

With the pricing starting at a mere $5/month (or $9 if you choose a monthly subscription), ClickUp one of the most affordable tools for workflow management.

This does depend on your needs of course, features like advanced automation, time tracking, and workload management are only available on the higher-tier plans.

But committing to a paid plan is also risk-free as there’s a solid 30-day money-back guarantee if you find it isn’t for you.

Pros:

- Great accounting templates

- Superb for managing client accounts and projects

- It’s loaded with collaboration tools

Cons:

- There’s a slight learning curve

- Automation is only available on the Business plan and up

|

Best For |

Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Automation and integrations | Starts at $9/user | $5/month (annual) | 1 | Free plan |

30-day guarantee |

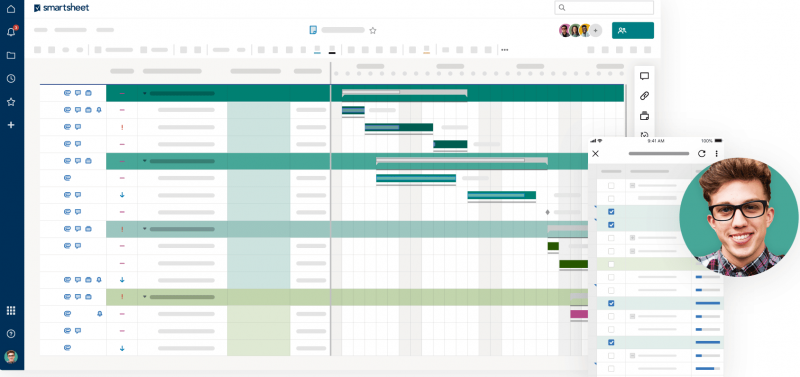

6. Smartsheet — Top Spreadsheet-Style Workflow Management Tool for Collaboration and Accounting Templates

Smartsheeet is basically a spreadsheet on steroids, and it does a great job at accommodating the needs of those in the financial industry. For example, you can automate compliance, audit, approvals, and risk processes.

Plus, there are accounting templates for budget and asset management, expense tracking, accounts payable and automated approvals, cash flow statements, and more!

As a leading collaborative work management tool, you’ll be able to make your clients your top priority while improving transparency and collaboration between your departments.

Overall, Smartsheet is far more than just a spreadsheet — it offers great flexibility to manage your projects, portfolios, and resources in a way that best suits your firm. You even get card, Gantt, and calendar layouts to view your work.

Special Features:

- Work together with internal and external collaborators

- Create automated workflows and custom forms

- Track the time spent on tasks and clients

- Manage your team’s workload, budgets, and portfolios

- Create and share comprehensive reports and dashboards

- Set up automatic alerts for Slack and MS Teams

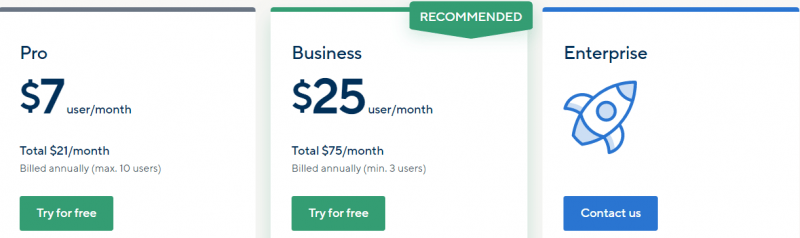

Pricing:

Smartsheet has 3 plans on offer. Here’s what it’ll cost for 3 users:

What’s nice is that, unlike most of its rivals, you get automation, unlimited sheets, and all the project views on the Pro plan for just $7 per user per month (or $9 with monthly billing).

Plus, there’s also a lengthy 30-day trial that you can use to try Smartsheet for free.

Pros:

- It’s incredibly flexible and customizable

- Efficiently manages multiple departments and projects

- It has accounting-specific templates

- Superb workflow automation capabilities

Cons:

- The interface and conditional formatting could be improved

- Reporting can be sluggish

|

Best For |

Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Spreadsheet-style workflow management | Starts at $9/user | $7/month (annual) | 1 | 30-day trial |

No |

7. Nintex — One of the Best Accounting Firm Workflow Management Software Tools for Larger Businesses

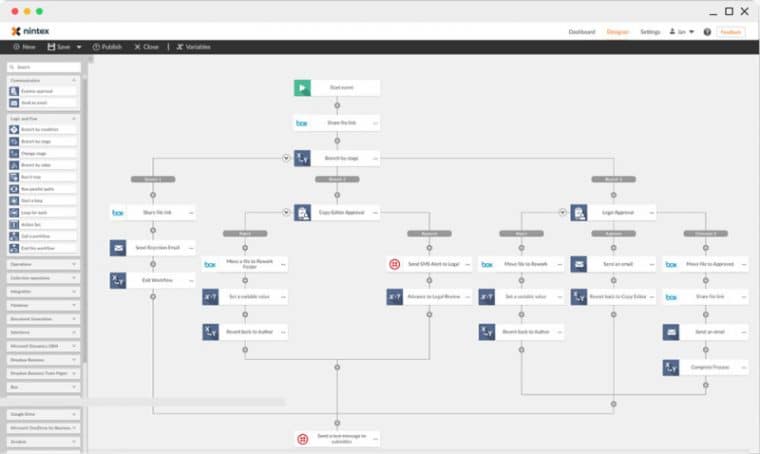

Nintex is one of the best workflow design tools, and although it’s very powerful, the drag-and-drop interface makes it super easy to use.

From streamlining your administrative tasks to automatically creating, signing, and storing documents to keep you compliant — Nintex is an excellent solution for accounting firms.

You can also automate your account collection process, invoices, and notifications, and the approvals process is made incredibly simple too.

Overall, Nintex gives you the collaboration and workflow design capabilities to stay compliant, keep clients happy, and have your firm run efficiently.

Special Features:

- Create custom forms and dashboards

- Connect with built-in integrations with drag-and-drop ease

- Reduce risk with approvals, escalations, and notifications

- Integrate with Microsoft, Salesforce, and more

- Comprehensive payroll and expense reporting

- Seamlessly manage tasks and assets

Pricing:

Nintex’s process automation platform is priced as follows:

Although the Standard plan is limited to 10 workflows, you get most of Nintex’s features. Plus, both plans give you unlimited users, which makes the price sit better with us.

Nevertheless, it’s pricier than other solutions on this list, so we’d recommend testing it with the 30-day free trial before deciding whether it’s right for your firm.

Pros:

- One of the best client management tools

- The platform is user-friendly and visually attractive

- Simple drag-and-drop workflow interface

- Seamless expense and invoice workflow management

Cons:

- It’s expensive compared to other tools

- The web version could be improved

|

Best For |

Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Large businesses | Starts at $910 | $910/month | Unlimited | 30-day trial |

No |

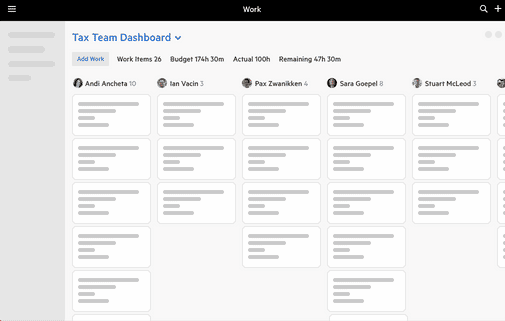

8. Karbon Accounting — Leading Accounting Workflow Software for Larger Firms

Karbon is a popular collaborative practice management tool designed specifically for accounting firms to achieve greater transparency.

With this tool, you’ll have a central hub for your tasks, data, documents, and communications, and you’ll be able to track your project and task progress with Kanban boards.

You also get loads of workflow templates for things like client onboarding, payroll, tax preparation, and more.

What Karbon users love most about this platform is its ability to consolidate all of your team member’s emails in one location — you can comment on an email message and even assign tasks directly from your inbox!

Special Features:

- Client and document management to keep a record of all interactions

- Automatically collect client data with client requests and reminders

- Collaborate with clients via the client portal

- Time and budget tracking tools

- Create subtasks and checklists, and set recurring tasks

- Tag members and comment on a task, note, or email

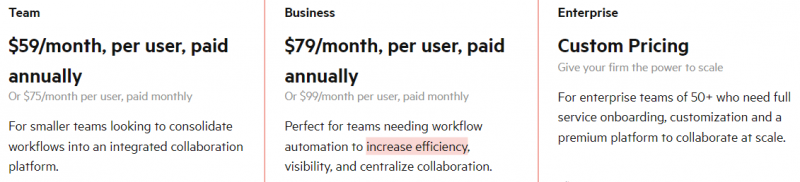

Pricing:

We believe that the below pricing makes Karbon best suited for mid-to-large-sized accounting firms, but that’s up to you to decide — here are the plans:

You’ll want to opt for the Business plan and get automatic client reminders, tasklist automation, Karbon time tracking, custom reporting, and user permission controls.

You can test Karbon for free for 14 days.

Pros:

- Integrates seamlessly with your email

- Robust platform for accounting firms to track tasks

- Incredibly simple to use

- Fantastic workflow automation capabilities

Cons:

- Pricier than other options

- Limited project tracking views

- Deadline reminders would be handy

|

Best For |

Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Mid-sized and large accounting firms | Starts at $75 per month | $59/month (annual) | 1 | 14-day trial |

No |

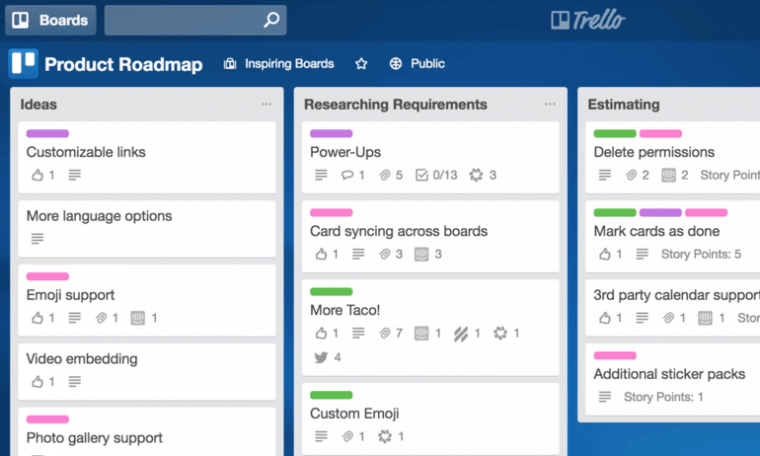

9. Trello — A Simple and Inexpensive Workflow Tool for Small Businesses

Although Trello isn’t specific to accounting needs, we believe it offers great value to this industry, and we’ll tell you why now.

As one of the best Kanban software solutions, Trello lets you easily track what’s done by whom, what still needs to be addressed, or what’s overdue.

It also helps your teams collaborate and complete projects on time, and you’ll have ample ways to visualize the progress of your projects and tasks.

Plus, there’s practically no learning curve to this software, loads of customizable templates, and workflow automation capabilities. You can automate your task checklists, card movements, and email and Slack alerts.

Special Features:

- Board, timeline, table, calendar, dashboard, and map project views

- Custom fields and in-app collaboration

- Integrate with Slack, Microsoft Teams, Gmail, plus several others

- Set user permissions and attachment restrictions

- Assign members and set due dates with reminders

Pricing:

Trello is one of the best free PM tools, but this is best suited for individuals. For firms, you’ll want to opt for one of the paid plans below:

Trello offers small businesses an affordable workflow automation solution, and monthly billing is just one dollar more at $6/user.

There’s also a 14-day free trial and a 30-day refund policy.

Pros:

- Great for collaborating and tracking projects

- Affordable plans for small accounting firms

- It offers excellent automation capabilities

- Simple platform to organize your tasks

Cons:

- Isn’t suitable for larger businesses

- Subtask tracking requires you to expand the cards

|

Best For |

Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Small firms | Starts at $6/month | $5/month (annual) | 1 | Free plan + 14-day trial |

30-day refund policy |

10. Jetpack Workflow — Great for Accounting Firms Using QuickBooks

Jetpack Workflow is a unique tool for accountants and bookkeepers looking to keep their firm organized and to know the status of client work and day-to-day tasks.

As far as this goes, Jetpack Workflow delivers. You have a platform to handle most of your accounting duties, but unfortunately, it falls short when compared to others on this list.

Because of this, we mainly recommend Jetpack Workflow for firms that use QuickBooks, as its easy integration will allow you to manage your payroll and billing from within the Jetpack app.

Overall, this tool offers robust project management features for small firms — but let’s take a closer look at what’s on offer.

Special Features:

- Create or use pre-made checklist templates

- Set up recurring tasks and manage deadlines

- Message your team and keep all notes and documents within the app

- Automatic task reminders with team members

- Progress, done, and timesheet reporting

- Integrate with 2,000+ external apps through Zapier

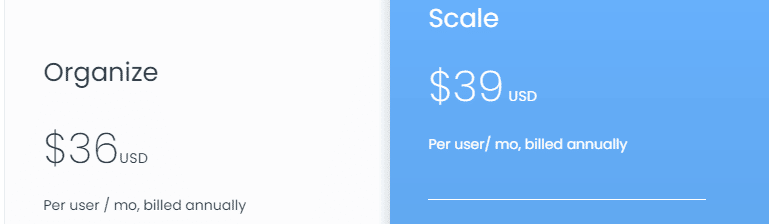

Pricing:

Jetpack Workflow has the following 2 plans:

You can test the platform for free for 14 days, and there’s a 30-day guarantee on offer if you opt in and find that it’s not suitable for your firm.

Pros:

- The platform is straightforward to use

- Great for tracking tasks

- Offers handy accounting templates

Cons:

- Costlier than some other tools

- Could use more automation and client reminders

- Isn’t as feature-rich as other options

|

Best For |

Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Firms using QuickBooks | Starts at $45/month | $36/month (annual) | 1 | 14-day trial |

30-day guarantee |

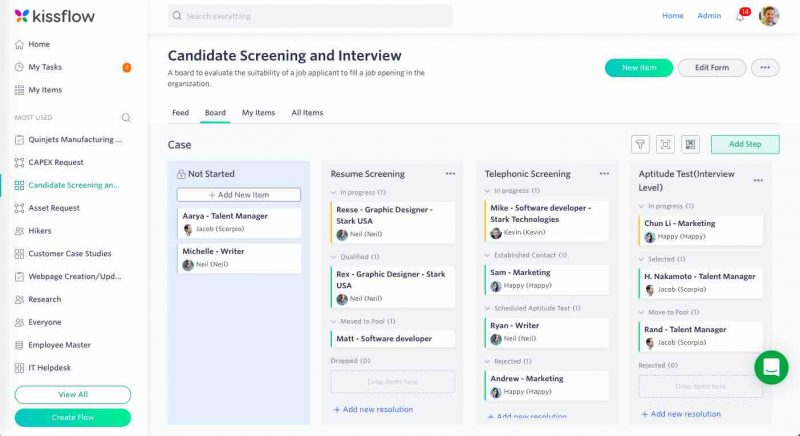

11. Kissflow — User-Friendly Workflow Platform for Larger Accounting Companies

From managing accounting approvals to automated policy compliance and having the means to create custom workflows that suit your firm, Kissflow makes it happen.

You can streamline your finance processes and improve your firm’s efficiency with excellent communication and task management capabilities and great workflow automation.

Kissflow also allows you to create business process apps with zero coding knowledge, generate custom reports and dashboards, and use things like dynamic routing to reassign tasks to the right team members.

Special Features:

- Automate assignments and notifications

- Manage your project budget and your firm’s expenses

- Cash and asset management tools

- Set role-based access for tightened security

- Hundreds of templates for accounts payable, contract renewal, etc.

- Track invoices and purchases

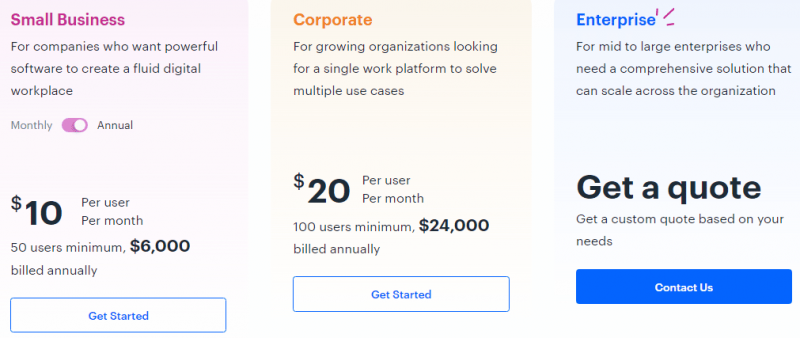

Pricing:

These are the 3 plans on offer with Kissflow:

Unfortunately, Kissflow requires a minimum of 50 users for the first plan, and 100 on the second plan, making this tool better suited for larger businesses.

However, you get killer tools like workflow design and automation, intelligent routing, and custom reports on the starter plan.

Monthly billing starts at $18/user, for a total of $360/month for 20 users, and there’s a 14-day trial for you to test the tool risk-free.

Pros:

- Creating and managing workflows is easy

- The interface is visual, intuitive, and user-friendly

- Includes a workflow testing environment

Cons:

- Setting up integrations could be simpler

- The reporting capabilities could be improved

- Plans include a minimum user requirement

|

Best For |

Monthly Price | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Larger accounting firms | $360/month — 20 users | $500/month (annual) — 50 users | 20-50 | 14-day trial |

No |

12. Wrike — Quality Workflow Automation Software for Mid-Sized Accounting Firms

Wrike had to make our list. It has built-in time tracking, templates for things like requests and approvals, and workflow automation — a win, win, win for accounting firms.

You get automations like automatically moving work through your workflow phases, sending custom reminders and notifications, assigning tasks, and initiating approvals.

You can also easily create custom dashboards and track projects (no matter how complex) using boards, Gantt charts, spreadsheets, and chart views.

Plus, you have in-app collaboration capabilities to keep team members and clients involved and in the loop about project progress.

Special Features:

- Track time and create billable reports

- Manage resources, workload, and project dependencies

- Integrate with 400+ external apps

- Pre-made, customizable accounting and task templates

- Real-time customizable reporting

- Get live updates on all project progress

Pricing:

Wrike has loads of pricing options, including a free version! Here’s what growing with this tool will cost you:

The free plan is generous, but the Business plan offers the most valuable features — including custom workflows, time tracking, and project, task, and guest approvals.

There’s also a 14-day free trial that you can use to test all of Wrike’s capabilities.

Pros:

- Great for collaboration and time tracking

- Offers superb project management capabilities

- Reporting is customizable and detailed

Cons:

- In-app search and the interface could be improved

- Lacks integration support

|

Best For |

Monthly Price | Cheapest Plan | Users for Starting Price | Free Version | Guarantee/Refund |

| Mid-sized firms | $9.80/month | $9.80/month | 1 | Free plan + 14-day trial |

No |

Best Accounting Workflow Software: Table Comparison

For a complete overview of the main aspects discussed for each software, we’ve compiled this master table to give you everything you need to compare the platforms at a glance:

|

Workflow Accounting Software |

Best For | Monthly Billing | Cheapest Plan | Users for Starting Price | Free Version |

Guarantee/Refund |

|

Monday.com |

Any-sized firm | Starts at $10/user | $8/month (annual) | 1 | Plan and 14-day trial | 30-day refund policy |

| ClickUp | Automation and integrations | Starts at $9/user | $5/month (annual) | 1 | Free plan |

30-day guarantee |

|

Smartsheet |

Spreadsheet-style workflow management | Starts at $9/user | $7/month (annual) | 1 | 30-day trial | No |

| Nintex | Large businesses | Starts at $910 | $910/month | Unlimited | 30-day trial |

No |

|

Karbon |

Mid and large accounting firms | Starts at $75 | $59/month (annual) | 1 | 14-day trial | No |

| Zoho Projects | Small businesses | $5/month | $4/month (annual) | 1 | Free plan and 10-day trial |

30-day money-back guarantee |

|

Trello |

Small firms | Starts at $6/month | $5/month (annual) | 1 | Free plan + 14-day trial | 30-day refund policy |

| Jetpack Workflow | Firms using QuickBooks | Starts at $45/month | $36/month (annual) | 1 | 14-day trial |

30-day guarantee |

|

Kissflow |

Larger accounting firms | $360/month — 20 users | $500/month (annual) — 50 users | 20-50 | 14-day trial | No |

| Wrike | Mid-sized firms | $9.80/month | $9.80/month | 1 | Free plan + 14-day trial |

No |

What is Workflow Accounting Software?

Workflow accounting tools are cloud project management software that allows you to allocate and track the progress of your client’s work, projects, and day-to-day tasks to ensure timely completion.

With the best software, you can assign tasks to team members, track deadlines, and even monitor the time spent on projects and clients.

They also allow you to automate and streamline processes such as client invoicing for complete efficiency.

Why do I Need Accounting Workflow Management Software?

We could write an entire post on the benefits of using this kind of software for your firm, but these are the 5 key reasons why you can’t do without it:

1. Centralizing Your Data

One of the key benefits of this software is that you’ll have an online hub for all your business tasks and projects, financial data, client and coworker communications, and more — all in one location for easy storing and retrieval.

2. Reduce Human Error

It goes without saying that it’s far more efficient to have technology do all your mundane tasks so that you and your teams can focus on more valuable work.

This also means that you’ll reduce human error from things like manual data entry and you’ll minimize the risk of forgetting important details, plus you’ll be able to speed up the process and get more done in less time.

3. Gain Insight

With powerful custom reporting, you’ll get an overview of important KPIs and monitor the metrics important to your business, team, or clients.

Having this in-depth data at your fingertips — regarding your projects, financial data, or anything else, will give you crucial insight into the success of your firm, teams, etc.

You’ll also be able to pinpoint areas where improvement is needed.

4. Maximize Efficiency

By reducing the need for things like manual data entry and other repetitive parts of your workflow, you’ll be able to speed up your processes and get more done in less time.

This means fewer errors and inconsistencies and more time on what’s important — we can’t emphasize the value of this enough!

5. Improved Visibility and Collaboration

Besides being able to manage your firm’s day-to-day tasks easily, everyone involved will know what’s being done by who and when it needs to be done by.

This lets you establish accountability and efficiently manage your employees’ workloads.

The best PM workflow software for accounting firms also comes with collaboration tools. This generally includes things like live commenting and editing, team channels, client portals, etc. Or you’ll have integration options with leading platforms like Slack, Microsoft Teams, and Gmail.

At the end of the day, these tools let you have a centralized location for everything, including your employee and client communications.

Factors to Consider When Choosing the Best Accounting Workflow Software

You’ll want to keep certain key factors in mind when making your decision. Here are the top 4:

1. Pricing

The costs related to software can be a significant determining factor for most, and rightfully so. As we’ve seen, the more users you want to onboard, the costlier the subscription is in most cases.

So you’ll want to note the number of users your firm needs to onboard now, but you might also need to consider this in the long term if your business is or will be expanding.

2. Features

Depending on your business’s specific needs, some features may be more important than others.

If this is the case, you’ll want to consider how scalable the software is and bear in mind that some features are only available on the higher-tier plans.

Nevertheless, here are some of the most valuable features that you’ll find with the best accounting workflow software:

- Accounting/Process Templates — Saves time and helps you get started quicker. Simply customize them, and you’re good to go!

- Time Tracking — Find bottlenecks, know where you’re spending your time, and set up timesheets for billing

- Billing and Invoicing — Handle your financials in-app or integrate with external tools

- Collaboration Capabilities — Built-in chat messenger, integrated email, etc. to localize all your communications

Other features include CRM tools, task, and project tracking software, and in-depth reporting.

3. Integrations

Your firm may already use specific software for other areas of your work, such as recruitment CRM software, email marketing tools like Mailchimp, or anything else.

As each accounting workflow software has varying support for external integrations, you’ll want to double-check that you can connect your existing tool stack with your chosen platform.

4. Support and Ease of Use

Workflow management tools should simplify everything — but unfortunately, some come with steeper learning curves than others. Although they’re all fantastic, this is important to consider.

Thankfully, most have top-notch support with around-the-clock assistance, in-depth guides, and more.

And with all things considered, we have a final note. Regardless of your needs, budget, or business size, we recommend testing any demos, or free trials/plans, before you commit to a paid plan.

Conclusion: What is the Best Workflow Management Software for Accounting Firms?

For many (including us), the best workflow accounting software is Monday.com, but whether it’s your top pick is up to you to decide.

However, there’s no doubt in our minds that whether you’re looking for simple or robust software to have your firm achieve ultimate efficiency, Monday.com won’t disappoint.

The best part about Monday.com is that you can get all the bells and whistles for as little as $8/user/month.

There’s tough competition, though, so we’re confident that regardless of your needs, you’re sure to find a solution that ticks all the right boxes with this list of the very best accounting workflow software.