Non-fungible tokens – or simply NFTs, are digital assets that allow you to prove ownership of a store of value. This could be a non-tangible item like a virtual drawing or something physical such as real estate or fine art.

In this beginner’s guide, we explain everything there is to know about the best NFT tokens in the market. We’ll also explore how you can buy your first-ever non-fungible token today.

What Does NFT Stand For? NFT Definition

NFT stands for non-fungible token. Although we explain the fundamentals of how NFTs work in more detail throughout this guide, the key takeaway is as follows:

- Non-fungible tokens are cryptocurrency assets that are represented in digital form

- However, unlike Bitcoin – which is fungible, each NFT token is unique from the next

- This allows both tangible and non-tangible assets to be tokenized

- This is in stark contrast to fungible tokens, which are similar to cash

- After all, one $10 bill is the same as another $10 bill – in terms of its ability to be used as a medium of exchange

Ultimately, the main concept with NFTs is that you can invest in something of value without needing to physically own or store the respective item. As such, this makes it a breeze when it comes to buying and selling NFTs in the open marketplace.

What is an NFT? NFTs Explained

In many ways, NFTs are not too dissimilar to traditional digital currencies like Bitcoin, Ethereum, and Dogecoin. The reason for this is that NFTs are represented as digital assets and they operate on top of a blockchain network.

This ensures that NFTs can be transferred from wallet to wallet in a fast, secure, and low-cost way. Being built on top of a blockchain network also ensures that NFTs are verifiable in a transparent way.

However, where NFTs are different from the aforementioned digital currencies is that each token is identifiable via a unique transaction hash. In simple terms, this means that no two NFTs are the same.

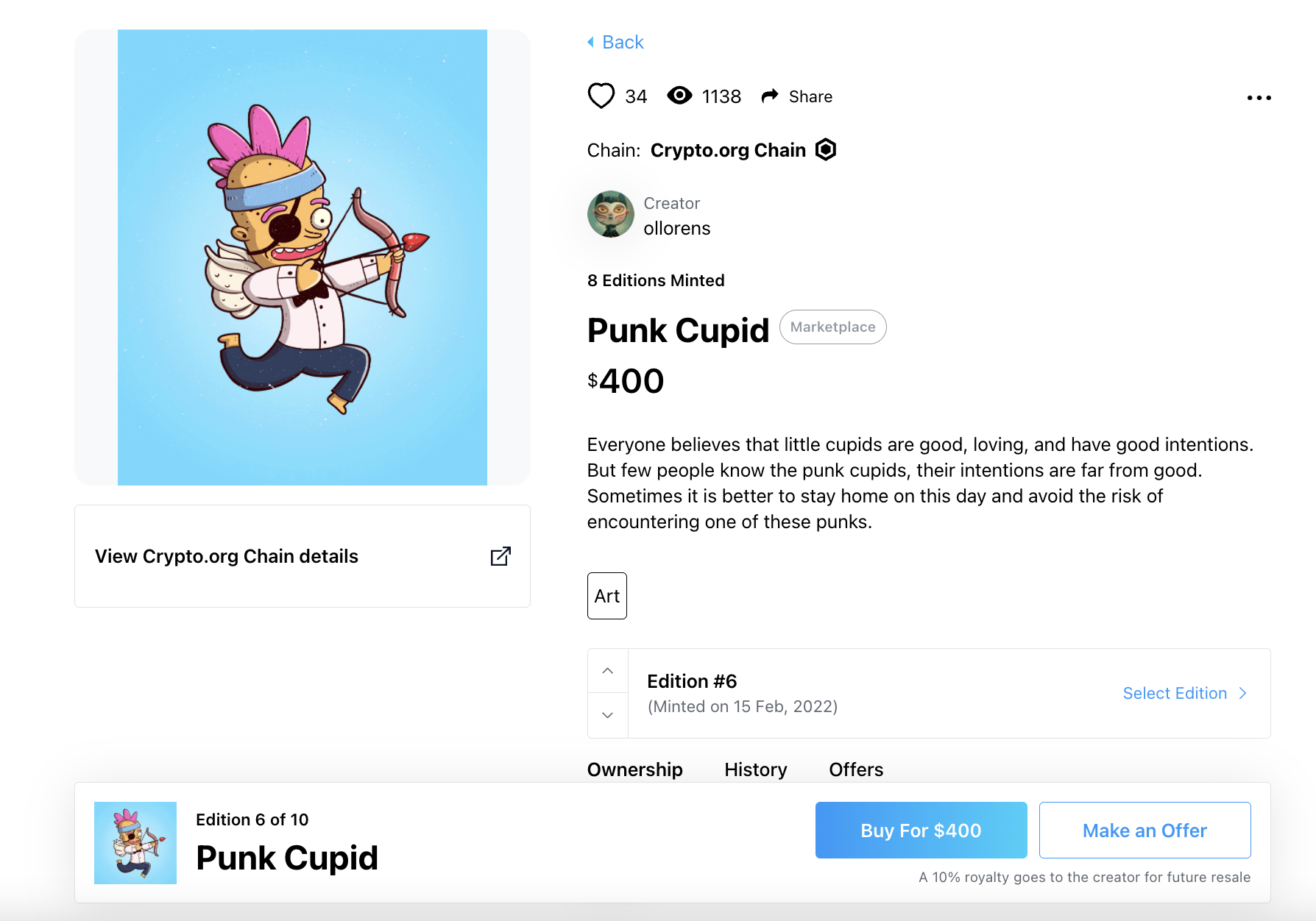

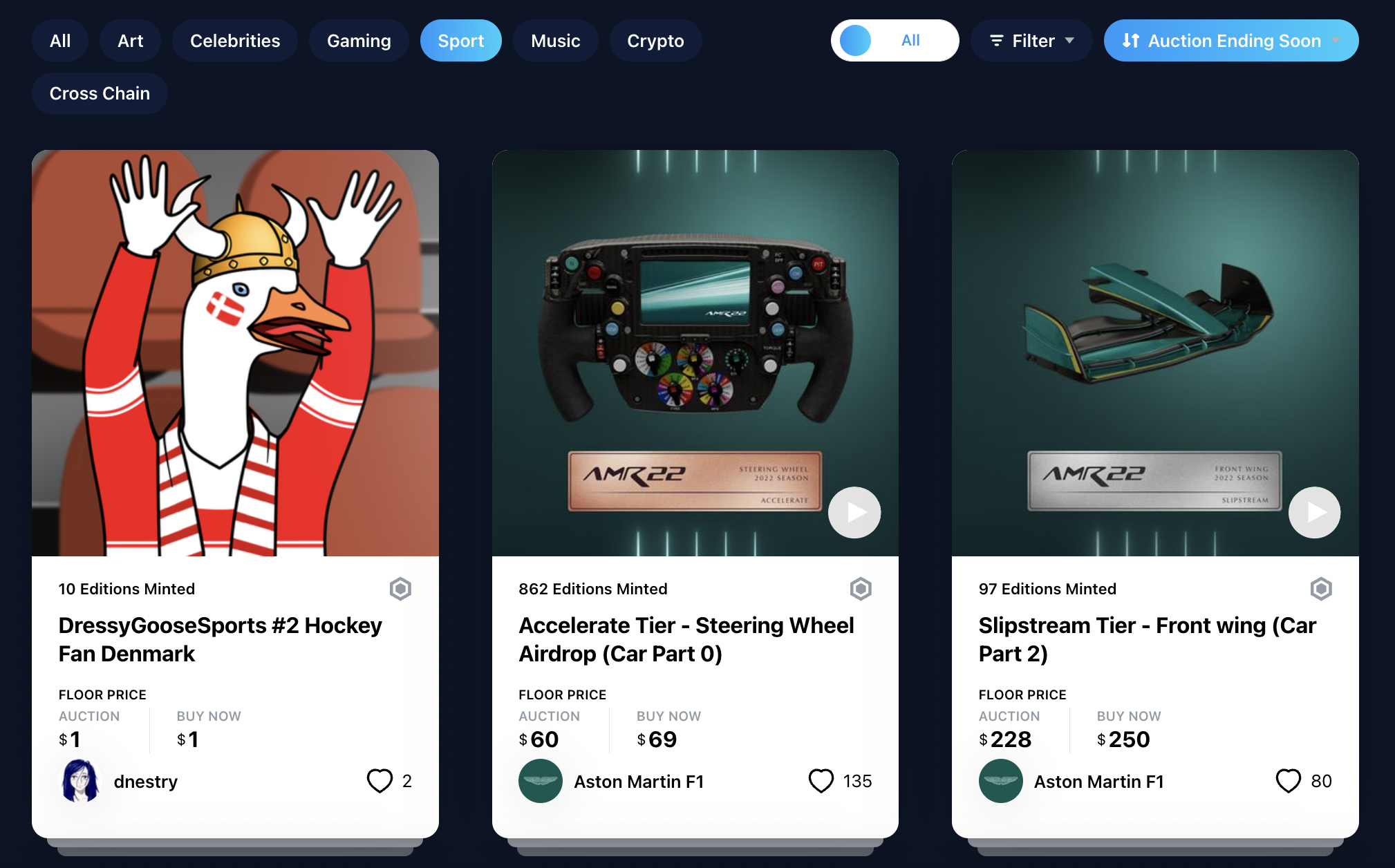

Cheap NFTs auctioned at Crypto.com

And as such, NFTs are ideal for storing real-world value. On the other hand, cryptocurrencies like Bitcoin are fungible – meaning that if you were to swap 1 BTC for another 1 BTC, nothing much changes. That is to say, you still have 1 BTC worth of value in your wallet.

But, in the case of NFTs, no tokens have a relationship with any other circulating digital assets, which is why they are described as non-fungible.

Popular NFT Categories

The NFT market has expanded into diverse categories, each attracting unique communities and investors. Key categories include:

- Digital Art and Collectibles: The most well-known category, where artists and creators tokenize their work to sell as exclusive digital assets. Iconic projects like CryptoPunks and Bored Ape Yacht Club fall into this group, allowing collectors to own unique digital items.

- Gaming and Virtual Real Estate: NFTs enable true ownership of in-game assets such as characters, skins, or virtual land. Games like Decentraland and Axie Infinity offer players the chance to buy, sell, and trade these assets, with some virtual properties selling for millions.

- Music and Entertainment: Musicians, filmmakers, and celebrities use NFTs to distribute exclusive content or grant fans access to special experiences. Artists can sell unique music tracks, concert tickets, or fan memorabilia directly to supporters.

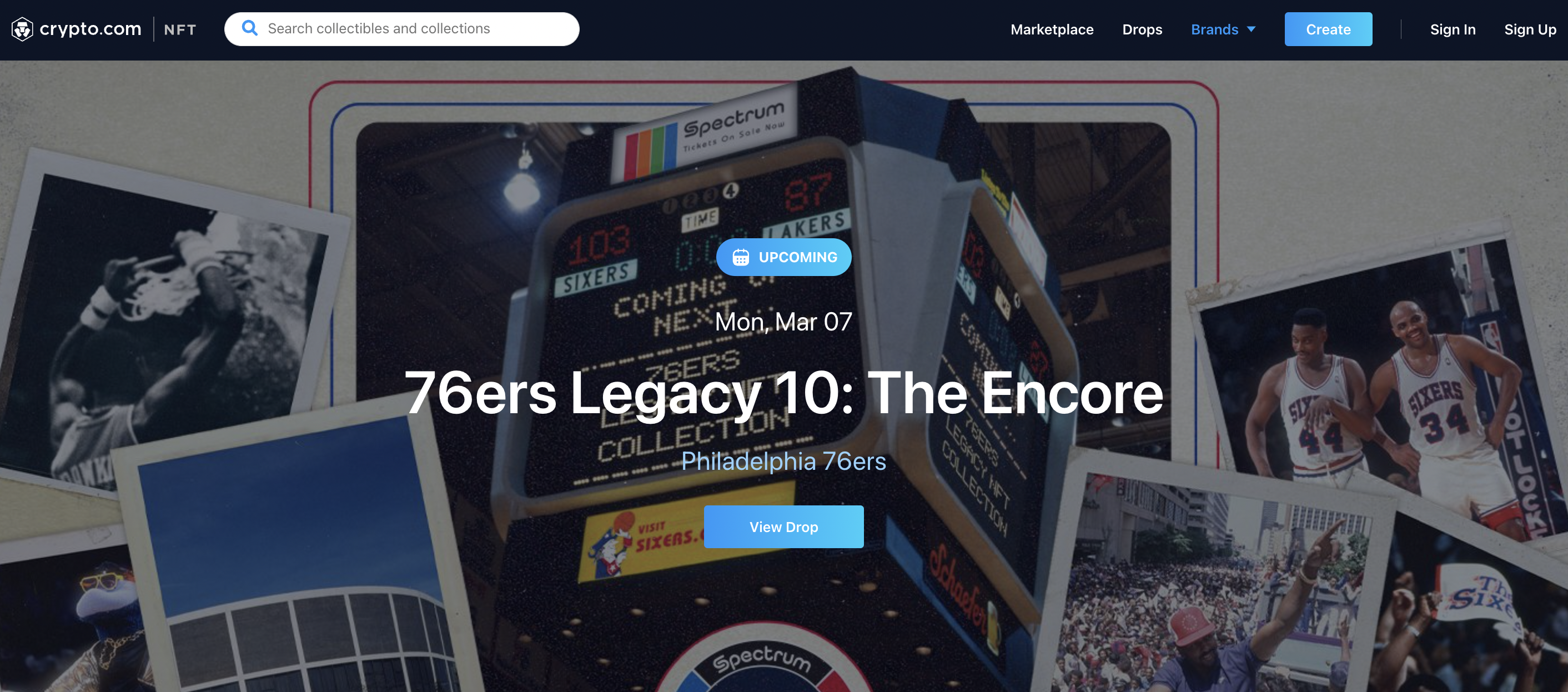

- Sports and Memorabilia: Professional sports leagues like the NBA and NFL have entered the NFT space by offering clips of iconic moments and player collectibles. Projects like NBA Top Shot let fans purchase “moments” as NFTs, transforming the sports memorabilia industry.

- Fashion and Virtual Goods: High-end brands are creating virtual fashion items and accessories as NFTs, especially within metaverse environments. Brands like Gucci and Louis Vuitton are pioneering the concept of digital-only fashion collections.

How do NFTs Work?

Now that we have covered the basics, we can now dive a little bit deeper into how the best NFTs work.

Crucially, if you’re thinking about buying NFTs yourself, it’s important that you have a firm grasp of how this niche blockchain sector works before risking any money.

Fungible vs Non-Fungible

Although we briefly explained the difference between fungible and non-fungible tokens in the section above, we’ll now elaborate in much more detail.

In a nutshell, the physical dollars and cents that we use every day to make purchases are fungible.

For instance:

- Let’s suppose that you have a $20 bill, but you need some change for the vending machine – which only accepts $1 bills

- As such, you ask somebody to swap your $20 bill into small denominations.

- In turn, you are given a $10 bill, $5 bill, and 5 x $ 1 bills

- Ultimately, although you now have different notes from your original $20 bill, nothing has changed in terms of value

- This is because you still have a total of $20 at your disposal

As per the above example, cold-cash cash is a fungible asset class. And, this is also the same with virtually all of the cryptocurrencies in circulation today.

However, as we have established, NFTs are non-fungible asset classes. This means that you cannot swap one NFT for another and expect to retain the same value – as each token is unique.

For example:

- Let’s say that an artist creates a new physical painting

- The artist then decides to create an NFT, which represents the value of the said painting

- This means that the NFT is unique only to the respective painting and thus – it cannot be imitated or copied

- Once again, this is because each NFT can ve verified for its authenticity through a unique transaction hash

Naturally, and as we cover in more detail shortly, NFTs can represent pretty much anything that has perceived value. Whether that’s a virtual painting, house, car, or sporting moment – NFTs allow you to store ownership in a digital manner.

Blockchain Protocol

All top NFT tokens are built on a blockchain protocol. So far, many NFT creators choose the Ethereum blockchain, mainly because it supports ERC-721 tokens. In short, this particular part of the Ethereum blockchain is great for NFTs, since each ERC-721 token is different from the others.

With that being said, several other blockchain networks have since begun supporting NFTs – such as the Binance Smart Chain. Many argue that the latter is more suitable for buying and selling the best NFTs tokens, not least because Ethereum transaction fees are often super-high.

NFT Minting

When searching for the best NFT tokens to buy, a term that you will often come across is ‘minting’. In its most basic form, minting simply refers to the process of creating a new NFT token that is yet to exist.

This means that when you buy NFT tokens, you are purchasing a digital asset that has already been created by somebody else.

Crucially, if you have something unique that you wish to represent via a unique crypto-asset, then NFT minting is well worth exploring further.

For example:

- You might have created a groundbreaking study on an independent basis, and wish to protect your findings.

- You can do this with ease by minting an NFT on top of a blockchain network such as Ethereum or the Binance Smart Chain.

- In doing so, your NFT verifies beyond all reasonable doubt that you are the true owner of the said study.

And, as soon as your NFT is minted – which often takes just minutes, it can then be traded in the open marketplace. In fact, you could even mint the NFT token so that you receive royalties on each sale that third parties generate

Fractional NFTs

You likely know that standard cryptocurrencies like Bitcoin and Ethereum can be split into smaller units – which ensures that you don’t need to purchase a full token to gain access to the market.

For instance, if Bitcoin is trading at $30,000 per token and you invest $300, then you own 1% of a single BTC.

Now, many people are unaware that the process of splitting digital tokens into small units can also be achieved with NFTs. In fact, this is one of its greatest characteristics, as it allows multiple people to own something of value.

- As a basic example, image a $1 million property that is represented as an NFT.

- You are the sole owner of the property and thus – the respective NFT token

- You wish to release some equity on the real estate so you decide to split the NFT 10 ways

- You keep 6 NFTs (60% ) and decide to sell the remaining 4 NFTs on the open market

Those buying each NFT would therefore own a percentage of the property – should the agreement be backed by relevant contract law.

Types of NFTs

Now that we have explained how NFTs work, we can explore the many different types of non-fungible digital assets in the market.

By this, we mean a collection of real-world examples of the best NFT tokens to have sold in recent years.

Physical Real Estate

Real estate is perhaps the most interesting aspect of the NFT marketplace, not least because it covers both physical and virtual property.

Starting with the former, physical real estate is a perfect example of an asset that can be represented by an NFT token. After all, no two properties are the same – meaning that each house or condo is unique in its own right.

- A recent example of a traditional property that was sold in conjunction with an NFT took place in Florida.

- The 4-bedroom house was sold for just over $653,000 – and paid for with Ethereum.

- Moreover, the house is now represented as an NFT token on top of the Ethereum blockchain

- This means that in theory, should the owner of the NFT wishes to sell all or some of their newly purchased property, this can be achieved via a simple wallet-to-wallet transaction.

With that being said, perhaps an even bigger use-case for NFTs in the real estate sector is part-ownership. For instance, let’s say that a property development company is looking to build a new luxury hotel in New York.

Ordinarily, the developer would turn to traditional financial institutions in order to raise capital to help fund the project. However, to open up investment opportunities to retail clients, the developer could represent ownership via NFTs.

And, each NFT could be linked to a certain percentage of ownership – which could then be traded on the open market.

Virtual Real Estate in the Metaverse

NFTs and the Metaverse are two terms that are often used in the same discussion. For those unaware, the Metaverse is a digital representation of the real world – and interest in this space is expected to grow exponentially in the coming years.

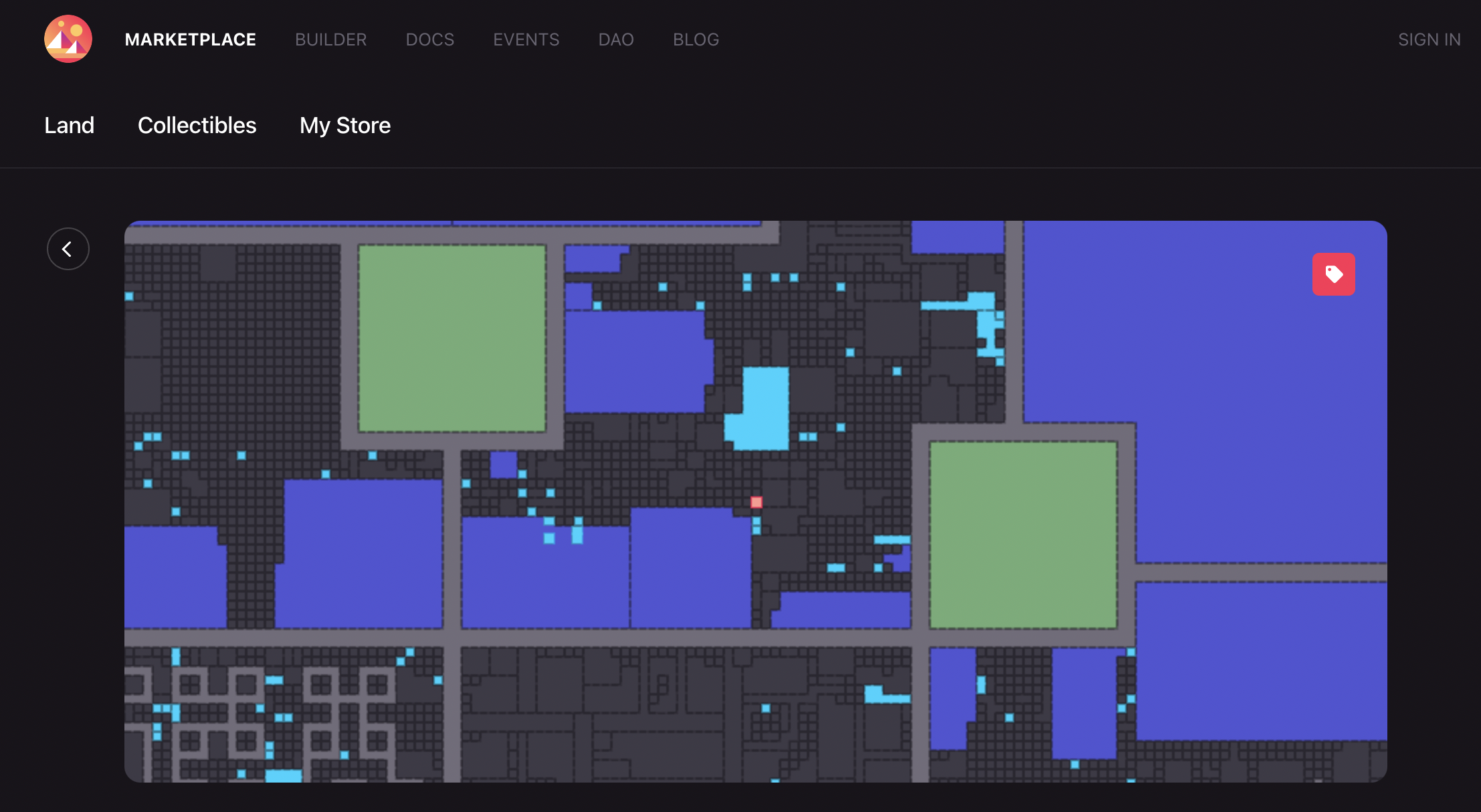

A great example of this is Decentraland, which is a 3D gaming world that allows players to buy virtual land and then build real estate. Each plot of land is subsequently represented by a unique NFT token, which can then be sold on the open market.

As a prime example of just how popular real estate NFTs are becoming in the Metaverse – consider this:

- In November 2021, a plot of land in Axie Infinity – which is a Metaverse gaming, sold for over $2.3 million.

- Just one month later, a plot of 100 virtual islands on the Sandbox platform – which is another popular Metaverse game, sold for over $4.3 million.

Considering that virtual real estate NFTs are now generating millions of dollars per sale, this is certainly a marketplace to keep an eye on.

CryptoPunks and Other Digital Collectables

In searching for the best NFT tokens, you are likely to have come across CryptoPunks. In a nutshell, CryptoPunks represent a collection of 10,000 digital characters that were created in 2007.

Each CryptoPunk is unique and backed by an NFT token. Although the design of each character looks like it was created in the 1970s, CryptoPunks are arguably the most sought-after NFTs in this marketplace.

- For example, a single CryptoPunk NFT was sold in February 2022 for 8,000 Ethereum tokens, which, at the time, equated to the crypto-equivalent of over $23 million making it one of the most expensive NFTs out there.

- According to the founders of the CryptoPunk series – Larva Labs, this particular NFT was sold in 2017 by its original owner for just $1,646.

With that being said, CryptoPunks has since spurned thousands of other NFT collectibles to enter the market, so this space is getting somewhat oversaturated.

Sporting Moments

Another rapidly growing space in the NFT marketplace is ‘sporting moments’. By this, we mean that major sporting brands – such as the NBA and ATP, are now selling ownership of video clips from key in-game events.

- An example of one of the best NFT tokens in terms of value is the $100,000 that NBA star Zion Williamson raised for a clip of the player blocking a shot.

- In another example, the recent Australia Open event sold individual items from its tournament in the form of NFTs – such as the center court and even the umpire’s chair.

The theory here is that over the course of time, the value for these sporting moment NFTs will continue to rise. Many sports stars, athletes and other celebrity icons have backed NFT collections of other types too.

Gaming NFTs

Some of the best NFT tokens in the market today can be found in popular gaming titles. In many cases, these games are referred to as ‘play-to-earn’ or simply P2E.

For example:

- As the name suggests, the newly launched P2E title Pirate X Pirate is a game based on pirates.

- The main concept is that users can build their own crew and win digital tokens as they progress through the many worlds that the game has to offer.

- And, in order to give themselves the best chance possible of maximizing earnings, players can buy unique NFTs that represent virtual ships.

Other examples of NFT play-to-earn spaces include Axie Infinity, Decentraland, and the Sandbox. Ultimately, gaming developers are now incentivizing players to engage with their platforms via tradable NFTs that can be minted when certain tasks are achieved.

Alternatively, some crypto enthusiasts are looking for the best utility NFTs to invest in.

Why People Invest in NFTs

There are many reasons why people decide to invest in the best NFT tokens that the market has to offer. From regular retail investors to millionaire celebrity NFT owners.

If you’re wondering whether or not this space is right for you – consider the benefits discussed below.

Store of Value

One of the main reasons why more and more people are looking to buy NFT tokens is that they can represent a store of value.

As we covered earlier, it is now a simple process to mint an NFT token so that it represents something of value – such as a sporting moment or piece of land.

Either way, the NFT that you mint or buy will, in theory, be worth what people are prepared to pay for it when you eventually decide to cash out.

For example, we mentioned that the CryptoPunks NFT series is now attracting individual sales in millions of dollars. Those buying a CryptoPunk typically do so because they believe that it will be worth more in the future.

Great for Content Creators

Content creators – such as artists, writers, and musicians, often have to go through third parties to sell their products. This typically means giving away a large percentage of any future sales and royalties.

For example, a successful singer on YouTube might make a sizeable amount of money each month from advertising revenues. But, YouTube itself will take a significant cut that often outweighs what the content creator receives.

This is where the best NFT tokens come into play – not least because creators no longer need to partner with third parties to sell their content. On the contrary, ownership of each song, video, or painting can now be represented by a unique NFT.

Investment Product

It goes without saying that many people decide to buy NFT tokens as an investment product. This means paying a price today that is much lower than what the buyer thinks the NFT could be worth in the future.

- As a prime example of a successful NFT investment, let’s once again take the case of the $4.3 million purchase of 100 virtual islands in the Sandbox Metaverse.

- Although this might sound like an obscene amount of money to invest in digital real estate, the buyer has already created virtual villas on each island – 90% of which sold out within one day at $15,000 each.

- Moreover, some of these virtual villas have since been relisted for sale at over $100,000.

In theory, this means that the traditional real estate development industry has now moved into its own niche sector via the Metaverse.

That is to say, people are looking to buy NFT tokens that represent virtual plots of land, and are then building digital real estate with the intention of making a profit.

Conventional Restrictions Have Been Removed

Attempting to invest in a physical store of value in the real world can be challenging – not least because jurisdictional restrictions are often in place.

For instance, buyers in some regions may struggle to purchase real estate in the US. Even if they can access the land they want, the buying process is often complicated by red tape, leading to high costs and a lengthy verification process.

However, by engaging with non-fungible digital assets, there are generally no restrictions on who can buy NFT tokens.

Small Barrier to Entry

Another major reason why so many people are looking to buy NFT tokens is that the industry has opened the investment space to those on a budget.

Sure, this guide has given some real-world examples where people have paid millions of dollars for a single NFT. However, some of the best NFT tokens can actually be accessed with a small amount of money.

- For example, we mentioned earlier that the Australian Open created a range of NFTs that were subsequently available to buy.

- One such example was a set of decade-by-decade NFTs that were linked to tournament games within each 10-year period.

- The 1970s edition, for instance, initially sold an umpire chair NFT for just $24.99 AUD (about $19 USD).

Crucially, this means that even if you only wish to risk a small amount of money into this space, some of the best NFT tokens can be accessed with a modest amount of capital.

Huge Marketplace

Although estimates on the future total value of the NFT marketplace vary quite considerably depending on the source, what we can do is look at just how much money has changed hands in recent years.

For example, in 2021 alone, Bloomberg notes that almost $41 billion worth of NFT sales took place. If you believe that the growth of the NFT space will continue over the course of time, this industry could soon surpass the $1 trillion market.

Yuga Labs, the company that created the Bored Ape Yacht Club NFT collection, has been valued at $5 billion according to Yahoo Finance, after rumours of an investment by Silicon Valley venture capital firm Andreessen Horowitz.

On March 12th 2022 Yuga Labs acquired CryptoPunks and Meebits NFTs, taking over the leadership of those NFT projects. Currently BAYC, Punks and Meebits are ranked the #1, #2 and #6 most valuable NFTs by floor price and floor cap.

NFTs can be Used as Collateral

There are now a number of innovators that allow you to access financing in return for putting your NFT token up as collateral.

This works in a similar nature to conventional secured loans, where the borrower will put up a certain amount of money in order to secure the financing agreement.

However, in the case of crypto loans, as the borrower is putting up an NFT that has real-world value, not only will the lending agreement be approved near-instantly, but no credit checks are required.

After all, if the borrower fails to repay the funds, the crypto lending site can simply sell the NFT to recover their losses.

NFTs vs Cryptocurrency

The terms NFT and cryptocurrency are often used interchangeably. After all, both phenomena are represented in digital form and are built and stored on top of the blockchain protocol.

However, in the vast majority of cases, crypto assets are virtual currency – meaning that they can be used as a medium of exchange. This once again goes back to the discussion on fungible tokens like Dogecoin.

That is, if you buy $100 worth of Dogecoin from two different brokers – there is no difference between the two sets of tokens that receive. This is because two individual Dogecoin tokens will always be worth the same – as per the current market value.

However, NFTs have, in essence, a completely different concept and use-case from cryptocurrencies. After all, each NFT token is unique. For instance, if one NFT represents a full plot of land in Decentraland, no other token can claim to do the same thing.

With that being said, there is another major similarity between NFTs and cryptocurrencies – that the market is often driven by speculation and hype.

In other words, while many people have had great success with both NFTs and cryptocurrencies in terms of value, there is no guarantee that this will continue to be the case.

In the case of CryptoPunks, for instance, there is every chance that someone that paid millions of dollars for a single token will find that the value of this NFT series could be worth significantly less in the future.

NFT Marketplaces

NFT marketplaces are not too dissimilar to crypto exchanges – insofar that they sit between buyers and sellers. That is to say, if you want to buy NFT tokens today – then you will first need to choose a suitable marketplace. To learn how to buy NFTs on Binance read our guide today.

In terms of choosing the best NFT marketplace to sign up with – there are certain things to consider, such as:

Reputation

You will, of course, need to consider the reputation of the respective NFT marketplace. For example, how long has the platform been in operation, how many users does it have, and what trading volumes does it typically generate on a day-to-day basis?

Choosing an NFT marketplace without a solid track record in this space can be a risky venture. After all, you need to be confident that your funds are safe and that the NFT token you wish to buy is actually available on the respective platform.

Supported NFTs

You also need to ensure that the marketplace offers the specific NFT that you are interested in.

Fees

NFT marketplaces generate the vast bulk of their income by charging transaction fees. This is often charged to both buyers and sellers, so this is something to consider before choosing a provider.

Typically, as a buyer, you will pay a percentage of the total transaction amount. For instance, if the NFT marketplace charges 2% and your chosen token costs $1,000 – then you will pay a fee of $20.

Payments and Wallets

When you buy NFT tokens online, you typically have to fund your purchase via cryptocurrency. For instance, if your chosen NFT was built on top of the Ethereum blockchain, then it’s likely that fees need to be paid with ETH tokens.

Moreover, NFT marketplaces usually collect payment through a wallet connection.

For instance, you might need to connect your Trust Wallet or MetaMask to the NFT marketplace, which, after you authorize the transaction, the platform will deduct the respective number of tokens.

Where to Buy NFTs

Taking the above points into account, if you’re wondering where to buy NFTs today – then you might consider Crypto.com. In the sections below, we explain why Crypto.com is potentially the best NFT marketplace for 2024.

Crypto.com – Overall Best Place to Buy NFTs in 2024

If you’re learning how to buy NFT tokens for the very first time, you will appreciate that the Crypto.com platform has been designed with beginners in mind. Founded in 2016, Crypto.com is now one of the world’s largest crypto ecosystems, with the platform offering a wide suite of products and services.

In addition to trading services, loans, savings accounts, and a crypto card issued by Visa, the provider also offers a popular NFT marketplace. This covers thousands of unique NFTs – many of which are tokens created by well-known brands. This includes the likes of Aston Martin, UFC, and the Philadelphia 76ers. In terms of market value, Crypto.com hosts NFTs that range from just a few dollars to over $1 million.

For example, NFT series such as Ryker, AlphaBot, and OG Jack come alongside auction bids that start from just $1. At the other end of the spectrum, you have the likes of PsychoKitty and Loaded Lion, which carry starting bids of $1 million. Irrespective of cresus casino how much you are looking to spend, what we really like about Crypto.com is that the platform allows you to buy NFT tokens with fiat money.

This means that should you not have any crypto tokens to hand, you can pay for your NFT purchase with a debit/credit card. In terms of fees, you won’t be charged anything to buy NFT tokens at Crypto.com. Sellers, however, are charged a processing fee of 5%. Another standout feature is that if you use Crypto.com to sell an NFT, you can attach royalties. This means that you will recieve a percentage of any future sales that your NFT token generates.

What We Like:

- Thousands of NFT tokens for sale

- Buy NFT tokens from just a few dollars

- Pay for your NFT purchase with a debit/credit card

- No fees charged to NFT buyers

- Crypto.com has a solid reputation in the crypto space

Cryptoassets are a highly volatile unregulated investment product.

How to Buy NFTs

If you’re looking to learn how to buy NFT tokens today – follow the quickfire guide below to get started with Crypto.com right now.

- ✅ Step 1: Open a Crypto.com Account

The first step is to open an account with Crypto.com. This will initially require some personal information and contact details from you. As a trusted platform, Crypto.com will also need to verify your identity. You can do this by uploading a copy of your government-issued ID. - Step 2: Deposit Funds

Crypto.com allows you to buy NFT tokens in several different ways. If you already have crypto to hand, you can transfer the tokens over to your Crypto.com wallet. Or, you can even connect a wallet like MetaMask to the Crypto.com website. Alternatively, Crypto.com also allows you to deposit funds with a debit/credit card or bank wire. - Step 3: Search for NFT

Head over to the Crypto.com NFT marketplace. You will then be presented with thousands of NFTs that are available to trade. To find the best NFT token for you, use the filter buttons. - Step 4: Buy NFT Token

The final step is to buy your chosen NFT token. Click on the token you are interested in and follow the on-screen instructions to complete your purchase.

When you buy an NFT at Crypto.com, you have the option of withdrawing the token to a private wallet.

Pros & Cons of Investing in NFTs

Before searching for the best NFT tokens in the market, consider the pros and cons of investing in this niche space:

Pros

Cons

Risks and Considerations in NFT Investment

Investing in NFTs presents unique risks, and prospective buyers should keep these factors in mind:

- Market Volatility: NFT prices can fluctuate significantly. The value of an NFT is often influenced by hype, market demand, and trends, which can make prices unpredictable.

- Speculative Nature: Many NFTs are purchased as speculative assets, meaning buyers hope to resell them at a profit. This aspect can lead to market bubbles, where prices are driven by hype rather than intrinsic value.

- Environmental Impact: Some blockchains, like Ethereum, are energy-intensive, raising concerns about the environmental footprint of NFTs. Solutions such as Ethereum’s move to proof-of-stake are helping address this, but it’s still a consideration for eco-conscious investors.

- Liquidity Challenges: Unlike stocks or cryptocurrencies, NFTs may not be easily sold when you want to cash out. Finding a buyer for specific assets, especially less popular ones, can take time.

- Intellectual Property and Legal Ambiguity: Ownership of an NFT doesn’t always grant IP rights to the content itself. Investors must research what rights come with an NFT, as legal and copyright issues continue to evolve.

NFT Utility Beyond Art and Collectibles

NFTs are proving valuable beyond traditional art and collectibles, with applications in various industries:

- Ticketing and Access Passes: NFTs offer a secure, transparent way to manage event tickets and passes, preventing issues like scalping. NFT-based tickets can provide entry to concerts, conferences, and even virtual events in the metaverse.

- Intellectual Property and Licensing: By embedding ownership rights on the blockchain, NFTs enable digital rights management, ensuring content creators retain control and earn royalties from secondary sales.

- Real Estate and Fractional Ownership: NFTs can represent ownership of physical properties, allowing multiple investors to own fractions of real estate assets. This democratizes access to real estate investment, making it available to more people.

- Digital Identity and Verification: NFTs can help individuals create and manage verified digital identities, which is useful in secure online interactions, certifications, and even metaverse avatars.

- Loyalty Programs and Rewards: Companies are exploring NFTs as loyalty points or rewards, allowing customers to collect, trade, or redeem digital assets as part of a brand’s engagement strategy.

How to Avoid NFT Scams

The rapid growth of NFTs has led to scams, so it’s crucial to exercise caution when buying. Here’s how to protect yourself:

- Verify Authenticity: Use reputable platforms like OpenSea, Rarible, or Crypto.com, and look for verified collections and creator accounts. Beware of copycat accounts posing as famous creators or collections.

- Avoid Phishing Links: Scammers often use phishing links that look like legitimate NFT marketplaces. Always double-check the URL and avoid clicking on suspicious links sent through email, social media, or unofficial channels.

- Research the Creator: Ensure the NFT creator is legitimate by checking their online presence, past work, and reputation within the NFT community. Many top projects have active social media profiles and community followings.

- Understand Gas Fees and Transactions: Some scammers lure buyers into “fake minting” events where high gas fees are collected without any NFT being issued. Make sure to understand how gas fees work and only participate in minting events from reliable sources.

- Beware of Unrealistic Promises: Be cautious of NFTs promising guaranteed financial returns or “too good to be true” offers. NFTs, like other investments, have inherent risks, and no returns are ever guaranteed.

Expert NFT Guides

Want to learn more about NFTs? The guides below have got everything you need.

Conclusion

Many market commentators believe that the rising popularity of NFTs is only set to increase in the coming years. After all, in 2021 alone, NFT trading volume surpassed $40 billion – with many tokens selling for over a million dollars.

If you’re looking to gain exposure to this space today, Crypto.com is home to some of the best NFT tokens that the market has to offer. And, not only can you pay for chosen NFT with a debit/credit card, but no fees are charged to buyers.

Cryptoassets are a highly volatile unregulated investment product.