Small businesses often run short on staff, which makes maintaining their accounts a difficult task. As the business grows, so does the number of transactions, invoices, bills, and payments which is certainly not manageable by a small team.

While expanding your team might not be a very feasible option, you can always count on the accounting software to get the job done with better efficiency and at a much lesser price.

Wondering what is the best accounting software for small businesses? We’ve made a list of the best small business accounting software to simplify your company’s finance management, so read this article until the end.

Our Best Pick for Best Small Business Accounting Software in the UK: FreshBooks

Every accounting software mentioned below has something unique to offer, but in our opinion, FreshBooks is the best of all.

Trusted by top brands, here is what makes FreshBooks our top pick:

Widely Available

FreshBooks is available in 12 countries, including the USA, India, the UK, etc. Accounting software that’s widely available in different countries certainly simplifies international payments.

Easy Integration

FreshBooks offers over 40 different business applications of its own, which can be easily integrated with FreshBooks. This allows businesses to manage multiple operations from one single platform.

Multi-Faceted Features

FreshBooks is feature-rich. From stock management to payment processing and bank reconciliation, it takes care of mundane as well as advanced business finance needs.

Best Small Business Accounting Software UK 2024 – Top 11 List

Here are our top picks on the best online accounting software for small businesses:

- FreshBooks – The Best Accounting Software for Small UK Business in 2024 | Put It to the Test With a 30-Day Unlimited Free Trial

- Sage – The Most Affordable Software for Small Business Accounting

- Zoho Books – An Up-and-Coming Solution for Modern UK Businesses

- Xero – Accounting Software with the Best Customer Support

- QuickBooks – The Best Accounting Software for Inventory Management

- Tide – Popular Accounting Software for Cashflow Insights and Loans

- Bonsai – Quality Accounting Tool for Small UK Businesses

- Free Agent – The Best Accounting Software for Invoicing

- Accounting Seed – The Most Flexible Small Business Accounting Software

- Zip Books – The Best Accounting Software for Team Collaboration

- Wave – The Best Free Accounting Software for Small Businesses

Best Small Business Accounting Software UK | Reviewed

Here we delve into the functionality of each of the tools mentioned above to help you zero in on the best small business accounting software for your needs.

1. FreshBooks: Most Widely Available Small Business Accounting Software in the UK

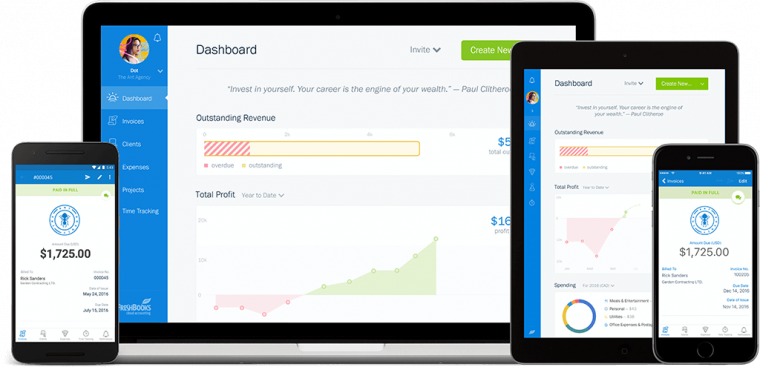

Freshbooks is the top accounting tool for small businesses in the UK. Many small businesses struggle with accounting software because it often focuses on just a few specific needs, but Freshbooks is different. Its features and interface are designed for everyone: small businesses with employees or contractors, freelancers, and self-employed people.

From time tracking and making a report of billable hours to managing your expenses, and transactions, and raising invoices, FreshBooks does it all from a single dashboard.

Another impressive feature of FreshBooks is that it can integrate with up to 100 business software, including Gmail, Slack, Mailchimp, etc., making operating your business easier by simplifying communication and information updates.

Best Features

Here is what we love about FreshBooks:

- Estimates & Proposals: FreshBooks takes out the guesswork from your accounting and helps you create winning business proposals and fast estimates to win over new clients.

- Time Tracking: The time tracking feature of FreshBooks allows you to keep a note of how much time you are spending on each client or project so that you can raise invoices accordingly.

- Client Management: FreshBooks keep track of your client estimates, invoices and transactions, and payments all in one place.

- Insights: FreshBooks gives you a quick glance into where your business is standing in terms of profit and scalability. You can then identify the areas that require improvements to maximize your profit.

Pricing

After the 30-day free trial of FreshBooks ends, you can choose from any of these paid plans:

- Lite: $6/month for up to 5 billable clients

- Plus: $10/month for up to 50 billable clients

- Premium: $20/month with unlimited billable clients

- Select: Custom pricing

Pros

- Available in over 160+ countries

- Trusted by more than 30 million users

- Powerful insights to grow your business

- Excellent time tracking and finance management

Cons

- Does not work for the complex financial needs of a large corporation

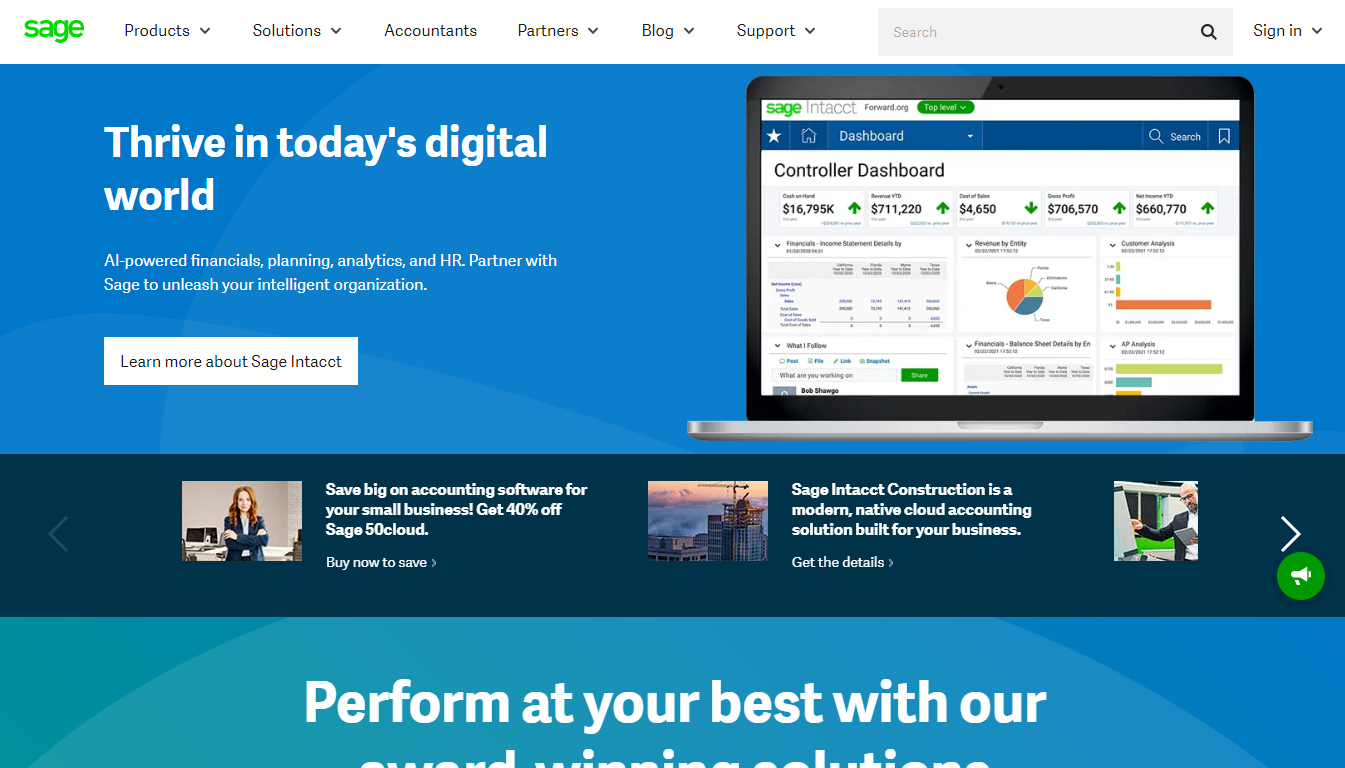

2. Sage: The Most Affordable Software for Small Business Accounting

Sage is a popular accounting software trusted by small businesses and large multinational companies, like Radisson, Food Corps, Avis, University of Maryland, etc. It offers excellent payment processing features and integrations that simplify business transactions, even for those on a global level.

Whatever your business size is, Sage will successfully meet your financial management needs with seamless integration and powerful core features. Sage has successfully helped more than 3 million customers nail their finance management game and grow their business revenue with its award-winning financial and accounting management.

A standout feature of Sage is that it offers a one-stop solution for all business needs; you can manage them all from a single platform. In addition to accounting features, it also houses features that cater to inventory management, supply chain management, HR services, and many more business operations.

Best Features

Here is what we love about Sage:

- Global Payments: Sage’s advanced payment processor makes even international transactions frictionless.

- Accounting App: Sage also offers an accounting app compatible with both Android and iOS to help you work on the go.

- Multi-faceted: Sage caters to multiple business operational needs. Managing different departments of your business becomes easier with this platform.

- Stock Management: Sage manages your inventory levels and product orders with effective stock management.

Pricing

In addition to Sage’s free trial, you can choose any one of these two paid plans:

- Sage Accounting Start: $10/month for basic accounting needs

- Sage Accounting: $7.5/month for advanced accounting needs

To help small businesses thrive, Sage offers a 70% discount on the first six months of their “Sage Accounting” plan.

Pros

- Offers multiple business services

- Simplifies international payments

- Allows you to manage company stock

- Helps you track expenses

Cons

- Inadequate customer support

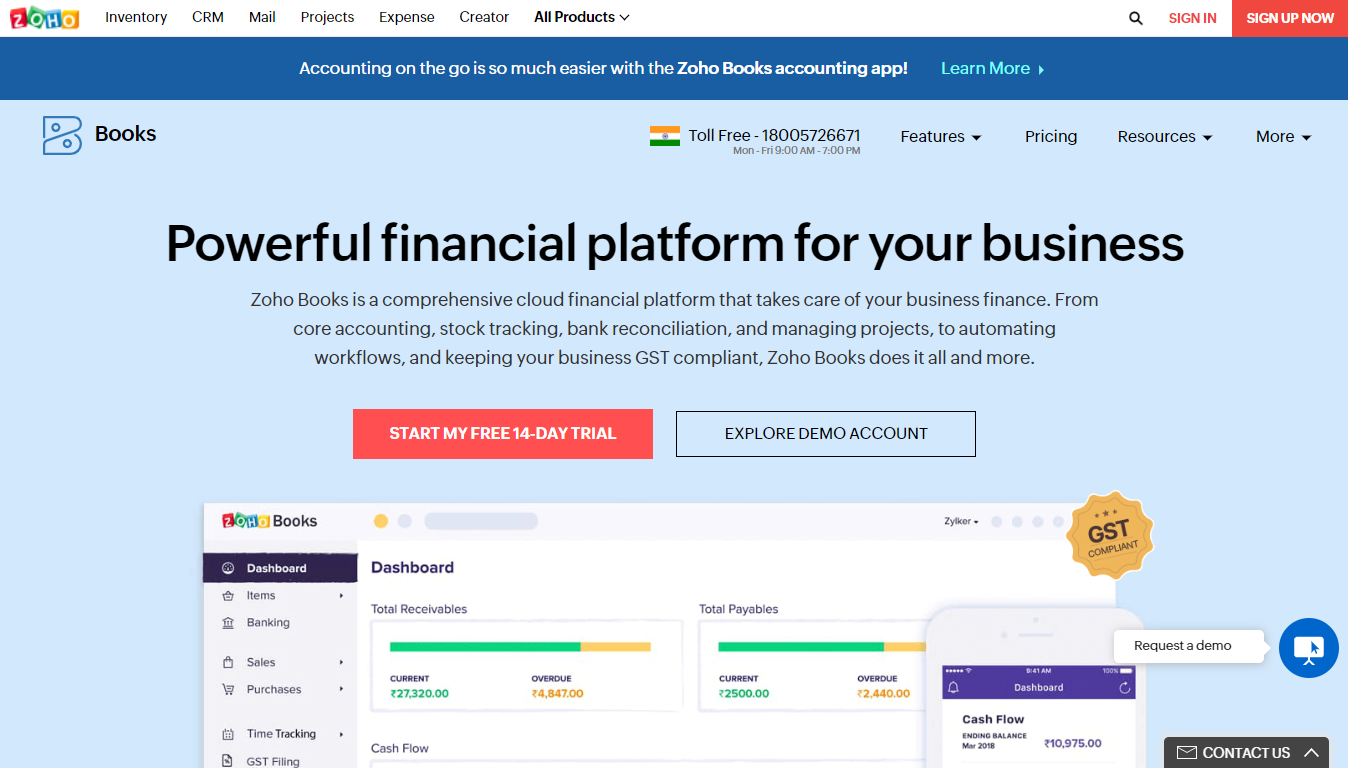

3. Zoho Books: An Up-and-Coming Solution for Modern UK Businesses

Zoho Books is a must-try if you are looking for powerful accounting software with the added benefit of accounting automation. It offers some of the best core and advanced accounting features, including bank reconciliation, tax compliance, stock tracking, and day-to-day financial management.

To make keeping track of your finances and records easier, Zoho Books also offers a unique audit trail feature that allows you to track every change made to your account.

The biggest benefit of partnering with Zoho Books is its wide network of business software and automation tools. With a network of more than 40+ Zoho apps, each catering to a particular business need, integrating all your business tools into one software becomes easy as your company grows.

Best Features

Here is what we love about Zoho Books, a small business accounting software for mac:

- Timesheets for Project Management: Zoho Books does not just help you with business transactions but also keeps track of every billable minute, so you never confuse any numbers.

- End-to-end Financial Support: From negotiating deals to raising sales orders and invoices, Zoho Books helps you with every financial need of your organization.

- Payment Processor: Zoho Books is not merely a finance management application; it also doubles up as a payment processor and offers secure and swift transactions.

- Mobile Application: If you want to manage your finances on the go, you can use Zoho Book’s responsive mobile applications compatible with both Android and iOS.

Pricing

Zoho Books comes with a 14-day free trial, after which you can choose any of these paid plans:

- Free: $0 and only for one user

- Standard: $15/month and allows up to 3 users

- Professional: $40/month and allows up to 5 users

- Premium: $60/month and allows up to 10 users

Pros

- Available in 12 countries

- End-to-end finance management

- Doubles up as a payment processor

- Easy to manage vendor, company as well as employee finances

Cons

- Does not track fixed assets

4. Xero: Accounting Software with the Best Customer Support

If you want simple and easy-to-use software to manage your account online, try Xero. Over 3 million users trust Xero with their business numbers; the tool has slowly garnered a massive customer base with its comprehensive range of financing features that includes day-to-day payments and transactions as well as advanced-level invoicing and banking.

One of the most impressive features of this safe and secure accounting software is that you get 24×7 support from the Xero team. Irrespective of the problem you run into — financial or technical — the Xero team is always on their toes to help.

Best Features

Here is what we love about Xero, a payroll tax accounting software for small businesses:

- Bill Payment: Xero doesn’t just help with managing client payments and invoices, but you can also use it to pay your own business bills.

- Cancel Anytime: Xero plans are highly flexible; cancel anytime you want without any additional cancellation fee.

- Bank Reconciliation: Automate bank reconciliation and let Xero ensure that your bank has recorded all your payments and transactions.

- Payroll Integration: You can also use Xero to pay off your employees directly or via your bank or integrate it with the payroll application.

Pricing

After the free trial ends, here are the paid plans you can choose from:

- Starter: $22/month, best for solopreneurs or freelancers

- Standard: $35/month, best for small businesses

- Premium: $47/month, best for large organizations

Pros

- Integrates with payroll apps

- 3 million+ happy customers

- 24×7 customer support

- Easy plan cancellation at any time

Cons

- Limited expense claims

5. QuickBooks: Best Accounting Software for Inventory Management

QuickBooks is one of the best accounting software for small businesses. It not only helps you manage your transactions and payments but also gives you a real-time overview of your business profits and performance.

The best part about using QuickBooks is that it has a simple interface and functionality that makes it accessible even to non-tech users with no expertise in finance management.

With more than 4.5 million happy customers, QuickBooks is slowly adding to its functionality with excellent finance management features like quick invoicing, payment reminders, cash flow overview, etc.

A super easy cloud-based financial management and accounting software, QuickBooks is perfect for businesses that want to skyrocket their profits and simplify record-keeping with minimal expense.

Best Features

Here is what we love about QuickBooks:

- Transaction Management: QuickBooks makes managing and tracking your finances easy by allowing you to download your daily transactions and auto-categorize and reconcile in a single click.

- Inventory Management: QuickBooks is one of the few accounting software that also integrates inventory management. Keep track of your upcoming projects and place limits on purchase orders accordingly.

- Reporting: QuickBooks offers a 360-degree view of your company finances. Be it business performance or overdue invoices, QuickBooks reporting shows everything.

- Cloud Accounting: QuickBooks manages your data through cloud accounting, so you can access it wherever you go from QuickBooks’ 100% secure servers.

Pricing

In addition to the free 30-day trial, the paid plans offered by QuickBooks include:

- Self-employed: $10/month for self-employed individuals or freelancers

- Simple Start: $15/month for small teams

- Essentials: $35/month for small businesses

- Plus: $50/month for bigger teams

Pros

- Easy to integrate with other apps

- Offers seamless inventory management

- Detailed account reporting

- Responsive mobile application

Cons

- Lack of industry-specific features

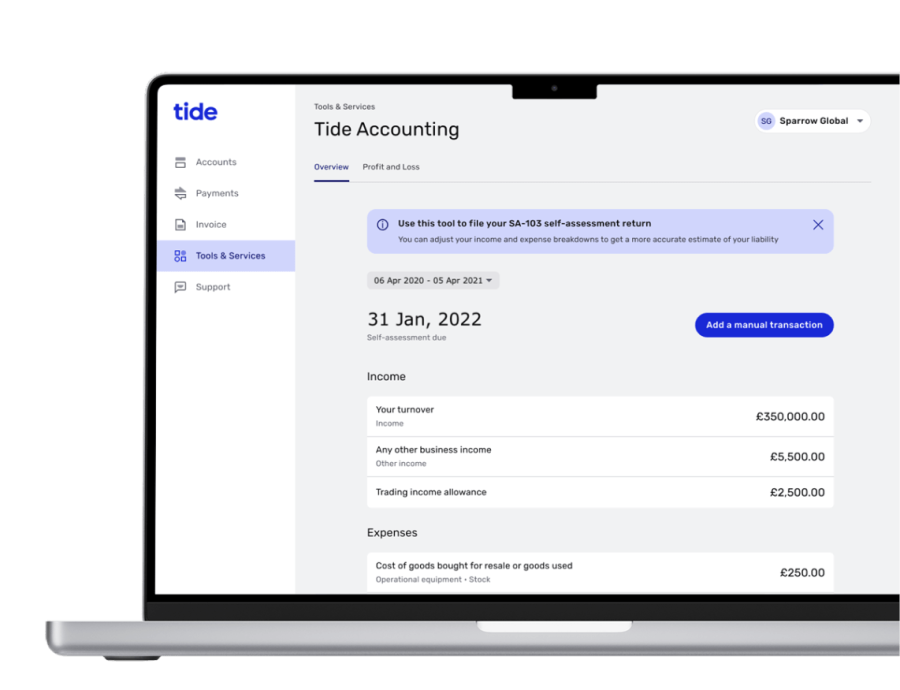

6. Tide: Popular Accounting Software for Cashflow Insights and Loans

Tide has developed a one-stop platform for all the accounting needs of a small-scale business. To provide exceptional value, Tide partners with several companies like Drovo, Auderli, and RAC that share the same mission to offer great discounts and bonuses for its members.

For example, if you have a new business, you can save £100 on any of the SeedLegals plans or one-off services so you can have your legal and admin documents streamlined, get customized contracts made, or set a share options scheme with the assistance of SeedLegals.

It has a handy free plan to get started. You get a card when you open a business account with them, which again, can be done for free. You can create and send invoices for no charge at all, and there are a number of free invoice templates to choose from as well.

One thing that small businesses often struggle with is funding – Tide makes borrowing as easy as it can be. It has a range of partners, including the British Business Bank, and you can compare and pick the business loan that best suits your needs without affecting your credit score.

Best Features

Here is what we love about Tide:

- Cash Flow Forecasting: You can stay a step ahead and plan your finances in advance with Tide’s cash flow forecasting feature that predicts the incoming and outgoing of cash 30 days in advance and shows you your predicted cash balance 30 days down the line.

- Expense Cards: This feature allows you to streamline your expenses and cut down on admin expenses. You can add as many as 50 people to an account and set spending limits for each user to ensure that the budget is being adhered to. Further, there’s a segregation feature for monitoring the expenses and filtering them by category or persons.

- Easy Loans: With Tide, you can effortlessly compare and apply for loans within 5 minutes from its partner banks. All you need is your bank statement from the previous year and some basic information about your business.

- Accounting Software Integrations: Tide’s in-built accounting software is a simple one, but it makes up for that by offering you the ability to import accounting services from high-rated providers like Xero, Sage, and Quickbooks. Plus, the setting up process only takes a few minutes.

Pricing

Besides a free forever plan, Tide offers the following three paid plans:

- Plus: £9.99 + VAT — per month

- Pro: £18.99 + VAT — per month

- Cashback: £49.99 + VAT — per month

Pros

- Competitive charges and fees

- The app and browser versions are easy to use

- Very simple to apply for and get loans

- Budget-friendly

Cons

- Can’t pay via cash or cheque

7. Bonsai: Quality Accounting Tool for Small UK Businesses

Bonsai is a phenomenal all-in-one accounting (and tax) solution for small businesses and self-employed individuals — in fact, over 500k businesses put their trust in this tool.

As a small business owner, keeping on top of everything can be a real nightmare, and forgetting minor details like a business expense can cause damage to a business that simply can’t afford a messy tax return or a lost file or payment.

Bonsai solves this by automating tasks like your expense tracking and keeping all of your documents, clients, projects, tasks, and everything else — all under one roof.

Best Features

Here is what we love about Bonsai:

- Templates: Bonsai is all about saving you time, and with ample free accounting-based templates, all you need to do is choose, and customize.

- Automation: Powerful automation like automatic expense tracking, late payment reminders, tax estimations, and income reporting, save you time and improve the accuracy of your books.

- Management: Forget integrations, with Bonsai you can track all your projects and tasks within the app, and this includes time-tracking too with automated timesheets.

Pricing

On top of the 14-day free trial, Bonsai also offers these 3 plans:

- Starter: $17/month

- Professional: $32/month

- Business: $52/month

Plus, there’s a 14-day money-back guarantee on offer with all the paid plans.

Pros

- Intuitive, modern interface

- Simple to use, even for the least tech-savvy

- Phenomenal for easy invoice tracking

- Great for keeping a small business organized

- Plans offer great feature-to-price value

Cons

- Training material could be improved

- Template customization is limited

8. Free Agent: Best Accounting Software for Invoicing

Free Agent will be your best bet if you are looking for online accounting software specifically designed to cater to the needs of freelancers, self-employed users, and small businesses.

One of the best features of Free Agent is its easy-to-use recurring invoicing for regular clients. All you have to do is set up a recurring invoice and let Free Agent automatically send them the bill at your chosen date. The software will also send them automated reminders so you can keep the late-paying clients in check without coming off as too rude.

It also automates bank reconciliation. Once you connect it with your chosen bank, it will import transactions to your bank feed and keep a record of successful transactions.

Best Features

Here is what we love about Free Agent, an online accounting software for small business:

- Estimates: Create quick estimates with professional templates powered by Free Agent to impress new clients.

- Expense Management: Keep track of all your expenses by simply uploading a picture of your bills and receipts to your Free Agent account.

- Project Management: Run all your projects smoothly by recording your expenses, invoices, bills, and pending payments all in one dashboard.

- Time Tracking: Record all your billable minutes and get the right value for your business efforts with Free Agent’s reliable time tracking feature.

Pricing

One of the best features of Free Agent is its flat pricing. After the free 30-day trial, you start for $10/month for the first 6 months, increasing to $20/month from the 7th month.

Pros

- Pre-designed estimate templates

- Easy expense management

- Controlled project management

- Time tracking for billable hours

Cons

- Its universal pricing increases after the first 6 months

9. Accounting Seed: Most Flexible Small Business Accounting Software

Accounting Seed is designed to transform the way you run your business finances to make your company more profitable, productive, and scalable. The platform’s robust set of finance management features will benefit your company in many ways.

For example, unlike other accounting tools, Accounting Seed understands that every business and company structure is different. That’s why it offers customizable workflows that sync with your personal business framework.

It also offers seamless team collaboration and increases visibility for your stakeholders to nurture the relationship you share with your business investors.

Best Features

Here is what we love about Accounting Seed:

- Vendor Management: Do not just cater to your clients; make sure your vendors get paid on time and continue to give 100% effort to your business.

- Customizable Workflows: Run your business finances the way you like them with Accounting Seed‘s customizable workflows.

- Easy Connections: Connecting Accounting Seed with your bank and other business tools is extremely simple. Get detailed reports on daily transactions and generate leads from integrated apps within seconds.

- Secure: Accounting Seed offers one of the most secure and reliable APIs backed by the globally renowned CMS platform Salesforce.

Pricing

Accounting Seed isn’t transparent about its pricing and does not display it on its website. If you want to know about their plans, you have to request the same via a contact form.

Pros

- Native to Salesforce

- Secure & reliable APIs

- Easy project management

- Easy vendor management

Cons

- Pricing revealed only on request

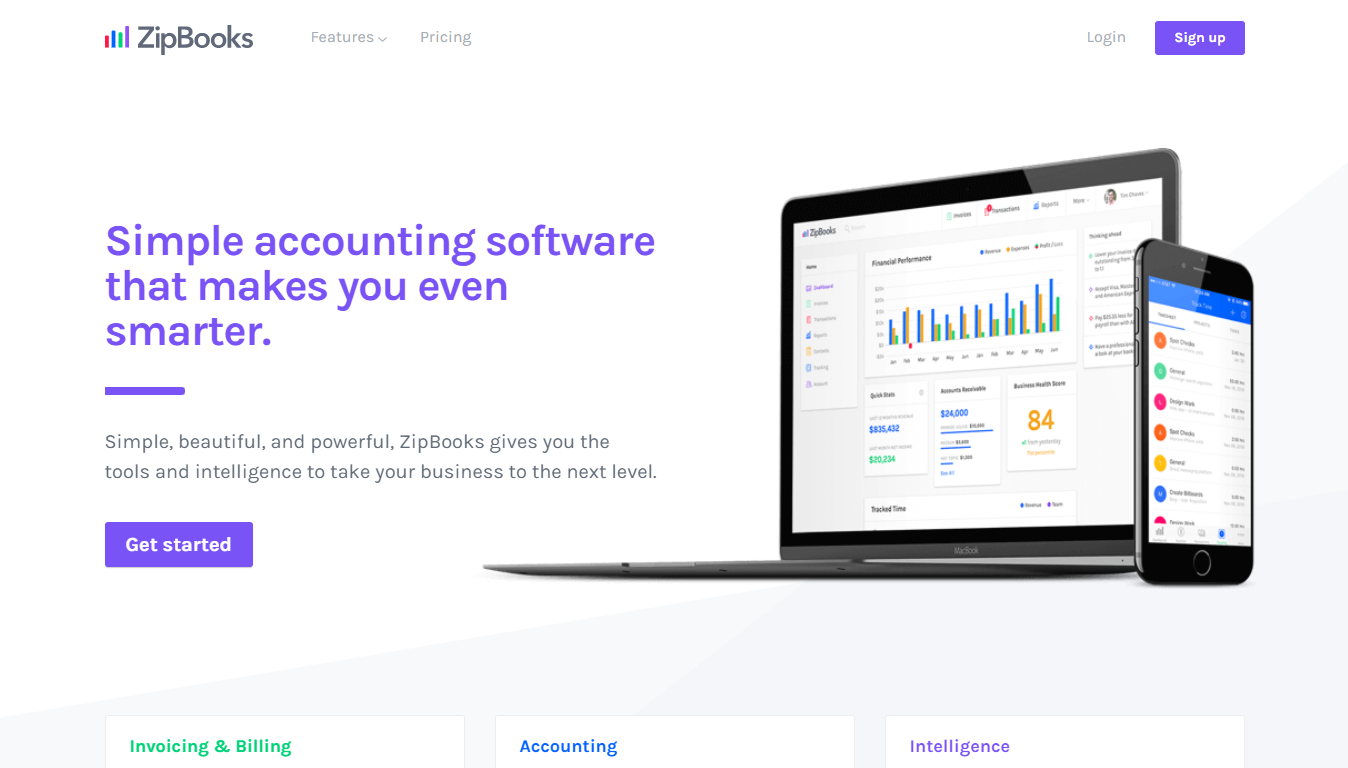

10. Zip Books: Best Accounting Software for Team Collaboration

When it comes to small businesses, not everyone can afford a paid accounting software when starting out. Say you need a free accounting software with almost every basic feature to effectively cover your accounting needs. In that case, try Zip Books.

The free plan of Zip Books allows you to send unlimited invoices and offers advanced features like vendor and customer management and basic account reporting.

Along with regular bank-to-bank transactions, Zip Books also accepts digital payments with applications like Paypal and Square, simplifying international payments.

As you move on to the paid plans, you will also be able to invite your team to collaborate on your business finances and connect multiple bank accounts to the same profile.

Best Features

Here is what we love about Zip Books:

- Invoice Reminders: Zip Books will send automated invoice payment reminders to your clients.

- Organizing Records: Zip Books keeps your transactions organized with smart tags like location, project, or any customizable tag of your choice.

- Record Locking: Once you are done with the bookkeeping responsibilities of a particular project, securely lock them to prevent any further changes.

- Document Sharing: Users can also share sensitive documents and financial information through the secure servers of Zip Books without any risk.

Pricing

- Starter: $0 for one user

- Smarter: $15/month for 5 users

- Sophisticated: $35/month for unlimited users

- Accountant: Custom pricing plan

Pros

- Easy document sharing

- Generous free plans

- Compatible with digital payments

- Offers excellent team collaboration

Cons

- Limited integrations

11. Wave: Best Free Small Business Accounting Software

As mentioned earlier, one of the biggest issues small businesses face is recruiting adequate staff to look after their bookkeeping. If you are looking for a free accounting software for small businesses that gives you automation benefits and reduces the workload on your employees, try Wave.

Creating invoices with Wave is extremely easy and, most importantly, free of cost. You can create professional-looking invoices and load them with advanced features like automatic payments and recurring billing.

Wave also allows you to seamlessly integrate with other payroll management and payment processing applications, making it a perfect automated package for 360-degree finance management.

Perhaps the most significant benefit of using Wave is that it’s 100% free, and there are no hidden charges.

Best Features

Here is what we love about Wave, the best free software for small business accounting:

- Organized Dashboard: Wave offers an organized dashboard that gives a glimpse into your expenses, invoices, and payments all in one place.

- Secure: The security protocols of Wave are unmatchable. All the bank connections are in read-only mode, and the servers are physically and electronically encrypted.

- Credit Card Payments: Quit relying on bank transactions alone, as you can now get paid faster with credit cards on Wave.

- Reminders: Wave automatically sends overdue invoice reminders to clients running late on payments.

Pricing

Wave is completely free to use. You can use all its accounting features with no hidden or additional cost.

Pros

- 100% free

- Accountant-friendly features

- Highly secure servers

- Several available integrations

Cons

- Additional features like payroll services come at an extra cost

What Are The Benefits of an Accounting Software If You’re A Small Business in the UK?

Most business owners operating on digitized platforms start with spreadsheets. However, as they begin to scale their operations, they eventually switch to advanced accounting software.

After all, managing something as sensitive as accounting calls for accuracy; under no circumstance can you afford human errors to mess up your calculations — no wonder why forward-thinking business owners embrace sophisticated accounting tools sooner rather than later.

These tools can seamlessly record financial transactions, segregate and categorize them based on any criteria you set, and help you with billing. Moreover, comprehensive tools come with payroll management features.

Businesses can also use this software to pay bills, run standard reports, and integrate their accounting system with other departments.

Let’s take a deeper look into the strategic benefits of using accounting software:

1. Access to Real-Time Information Saves Time

With comprehensive accounting software at your disposal, your accounting department can get real-time data to process. The system is on the cloud, meaning professionals working in different branches of your organization can access them at the same time. This fosters better collaboration that helps in making intelligible decisions.

Moreover, automating your accounting department would save valuable time for your staff. Eventually, you can channel this time to carry out more productive activities.

2. Minimize Errors

Human errors are inevitable when it comes to dealing with complex invoices and receipts. With an accounting tool, you can streamline the system and detect possible errors. These tools enable users to organize and sync data. You can also reprint, review, and re-send the same if any issue crops up.

With an online tool for accounting, you can import all sorts of transactions from banks to avoid missing out on anything. A faulty or missed entry into the manual system, although apparently insignificant, can lead to faulty decisions.

3. Integrate Invoicing and Bookkeeping

An integrated approach to merging your invoicing, bookkeeping, and spending would help you keep track of your finances. The enhanced system significantly eases up your task of tracking invoices, recording the same, and even creating and sending invoices.

Indeed, your staff will find the process breezy, as there’s no need to switch tools while they work on accounting. Ultimately, the integrated system would also facilitate calculations for filing your tax returns.

4. Instant Invoicing

Early payment matters when you’re trying to grow your organization. A dedicated accounting tool will enable small businesses to send their invoices instantly to clients. It would be easy to customize invoices and print the same with a sophisticated tool.

This implies that your invoice would have the logo and name of your organization. This way, you can make it look more authentic and legitimate.

Moreover, all you need is a smartphone to email these invoices to your clients, making the entire invoicing process much faster and more convenient.

5. Get Detailed Insights

Once you set up your accounting software properly, it will be a lot easier to track your transactions based on locations, projects, classes, or departments. This would make your accounting department more transparent.

Also, account managers would have a transparent view of where you get your income from and the heads where you spend them. These specifications from the reports will enable business owners like yourself to make tactical decisions.

How to Choose a Small Business Accounting Software?

Choosing the right accounting software happens to be a key decision for small businesses. Here are seven criteria you should be looking at when you get one of these tools for your accounts department:

1. Consider Your Requirements

The choice of your accounting tool would directly impact your revenue management. Look at what your accounting department needs based on the challenges they face and their skills. While certain industries require specific features in the accounting software they pick, others can settle with generic ones.

For instance, restaurants and retailers might need features in their accounting software that are different from what enterprises in the manufacturing sector require.

2. Go For Cloud Applications

To ensure seamless accessibility of your accounting information, you need to get systems that readily sync with the cloud. This way, an authorized employee working with your organization can access the data remotely.

Besides, there’s zero chance of losing your data that manual systems are susceptible to. Whether you have a smartphone, a tablet, or a PC, you can control the data from any location.

Moreover, syncing your accounting tool with the cloud system would facilitate information exchange with other departments like payroll management.

3. Explore Advanced Features

You might find it challenging to narrow down the choices of your accounting software unless you are specific about advanced features. At the same time, the tool should be flexible enough to accommodate add-on features if needed. Also, there’s no point in paying for features that your team would hardly need.

Small businesses generally opt for the following features in their accounting tools:

- Sales tracking

- Inventory management

- Tax reporting for business

- Payroll management

- Budgeting

- Estimating costs

- Merchant account support

- Managing customer contacts

As for the add-on features, you might want to integrate your eCommerce tool with the accounting software or accept online payments. Weigh the scope of integrating such features later on if the need arises.

4. Consider Unique Situations

While shopping for your accounting software, consider unique situations to determine whether the tool would be the right fit for your organization.

- Check aspects like scalability and whether the tool would grow as your business expands over the years; switching to a different tool every few months would be a hassle.

- Find out whether your bank supports the tool so that you can download your transaction details and sync the information with the accounting department. Otherwise, it can be challenging to track possible information mismatches.

- Consider whether you need the tool on one system or multiple computers. It’s logical to go for an accounting tool that multiple users can access simultaneously for better coordination.

- You might have to restrict access to your accounting tool for some users. Also, you might need a tool that provides exclusive access to data to some employees, but not the reports. This degree of customization is necessary to make your accounting department foolproof.

It’s logical to go for a tool that offers a free trial so that you can get a first-hand experience of its usability. Accordingly, you can decide whether you should settle for that particular tool’s paid version.

5. Consider Budget And Support Costs

Small businesses often face budgetary constraints while purchasing premium tools. It’d be wise to narrow down tools within your budget and meet most, if not all, of your needs.

Currently, reputed developers offer advanced accounting tools at manageable costs. For instance, small businesses can go for Xero or QuickBooks instead of investing in expensive tools like Oracle or NetSuite.

The size of your business, its scale of operations, and the number of employees largely determine your budget.

Also, you need to factor in the support costs. For some tools, you can get phone or email-based support in exchange for a small fee. Note that this, too, depends on the complexity of the software.

6. Seamless Integrations

Small businesses often work with limited employees. It’s a popular tactic to integrate the accounting tool with other software to ease up the workload. Therefore, the accounting software you pick should provide easy integration with other systems.

Say you are using a POS, ERP, or CRM system. In that case, integrating data would be that much more crucial. And even if you aren’t presently using these tools, you might have plans to adopt such sophisticated systems later on.

7. Consult Your Accountant

Consult your accountant and team to get a sense of what they need. This way, you can create a wishlist of essential features that must be present in the accounting software you pick.

Moreover, your account manager might have certain preferences with regard to the choice of software. They can help you make an educated decision after considering your organization’s needs. Besides, you can provide your accountant with relevant inputs on the departments you need to sync.

Unless you make an intelligible decision, you might have to move on to a more sophisticated tool later on, which wouldn’t be convenient for your team, so it makes sense to rope in the professionals who would be using the tool at the outset and make your decision accordingly.

FAQs

Do you need to download the software for it to work?

Can you access the accounting software through a mobile app?

Do you need bookkeeping knowledge to use accounting software?

Can you give access to your team to your accounting software?

Can accounting software help you with taxes?

Are accounting tools safe?

Do you need to be tech-savvy to use accounting software?

Conclusion: What is the Best Small Business Accounting Software in the UK?

Having discussed nine equally adept accounting software for small businesses, we are of the opinion that Zoho Books is the best of them all.

Besides automating your accounting, FreshBooks will provide you with features like stock tracking, bank reconciliation, seamless integration, end-to-end financial support, and whatnot. Not to forget, it also has a mobile application compatible with both iOS and Android to allow you to manage your finances on the go.

Here’s a reminder of our top picks for the best small UK business accounting software in 2024:

- FreshBooks – The Best Accounting Software for Small UK Business in 2024 | Put It to the Test With a 30-Day Unlimited Free Trial

- Sage – The Most Affordable Software for Small Business Accounting

- Zoho Books – An Up-and-Coming Solution for Modern UK Businesses

- Xero – Accounting Software with the Best Customer Support

- QuickBooks – The Best Accounting Software for Inventory Management

- Tide – Popular Accounting Software for Cashflow Insights and Loans

- Bonsai – Quality Accounting Tool for Small UK Businesses

- Free Agent – The Best Accounting Software for Invoicing

- Accounting Seed – The Most Flexible Small Business Accounting Software

- Zip Books – The Best Accounting Software for Team Collaboration

- Wave – The Best Free Accounting Software for Small Businesses