The best UK accounting software is loaded with a wide range of advanced features that make running your business a breeze — from automatically recording every transaction to ensure accurate bookkeeping to unlimited invoices and phenomenal reporting tools, these accounting solutions are a must-have for businesses of all sizes.

However, with ample options, finding one best suited for your business isn’t easy.

We’ve scoured the market to find the top 10 best accounting software in the UK. QuickBooks was an easy top pick — It excels in ease of use, features, and cost and should meet the needs of most UK small businesses.

That said, FreshBooks is best for invoice creation, and Sage has handy paid add-ons like payroll, so read on to learn more about our top 10 accounting tools.

Best Accounting Software UK 2024 | Top 10 List

With careful consideration of factors like ease of use, reputation (and user feedback), pricing, feature-to-value ratio, and more — we’re confident that these are the best accounting software in the UK:

- Intuit QuickBooks — Overall, the Best Accounting Software UK in 2024 | Test it Now Free for a Full 30 Days

- Oracle NetSuite — The Go-To UK Accounting Tool for Large Firms

- FreshBooks — Best for Solid Invoice Creation Tools | Take Advantage of the 30-Day Trial Now

- Sage Accounting — Perfect for Payment Tracking | Try it Free for a Month

- Xero — Best Accounting Software in the UK for Businesses of all Sizes | Offers a 30-Day Trial

- Tide — Best for On-the-Go Invoicing and Cash Flow Insights | Offers a Free Plan

- Zoho Books — Superb for Time Tracking | Has a 2-Week Free Trial You Can Use

- Crunch — Best for Sole Traders in the UK | Use the 7-Day Free Version Before You Buy

- FreeAgent — Best for Small Businesses | Also Has a Month-Long Free Trial

- Bonsai — Popular Accounting Software for Freelancers

How we Chose the Best Accounting Software:

- Evaluated features, user feedback, and pricing for a comprehensive comparison.

- Focused on ease of use, reputation, and the feature-to-value ratio.

- Aimed to find versatile solutions for different business sizes and needs in the UK.

Compare Quotes from the Best UK Accounting Tools

Want to know which service would suit you best but don’t have the time to compare them all? Use the widget below to find out which provider is right for you.

Best Accounting Software UK | Reviewed

Eager to learn more about what each of these can do for your business? Read on as we explore each one in more depth — from their key features through to their pricing and pros and cons. Here, you’ll learn all you need to know to make an informed decision.

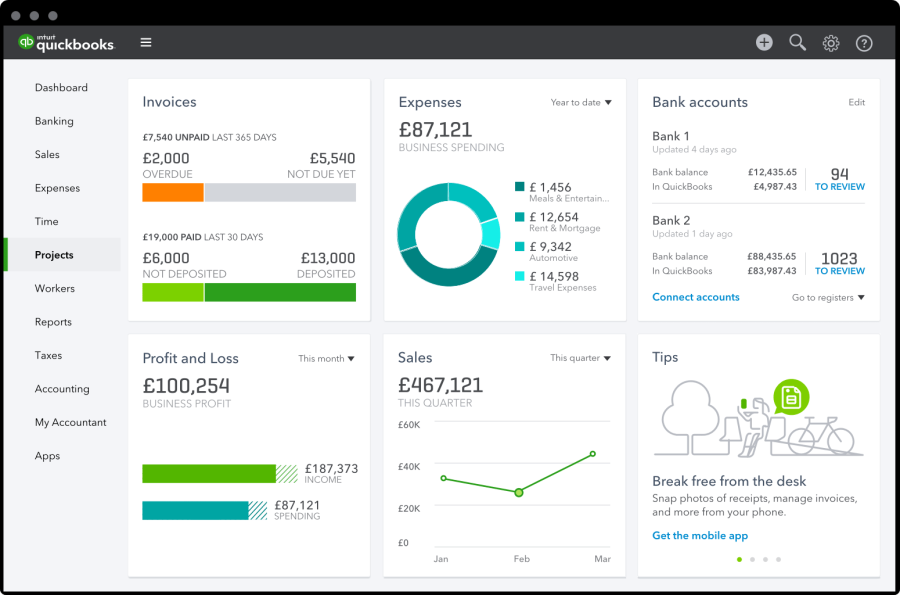

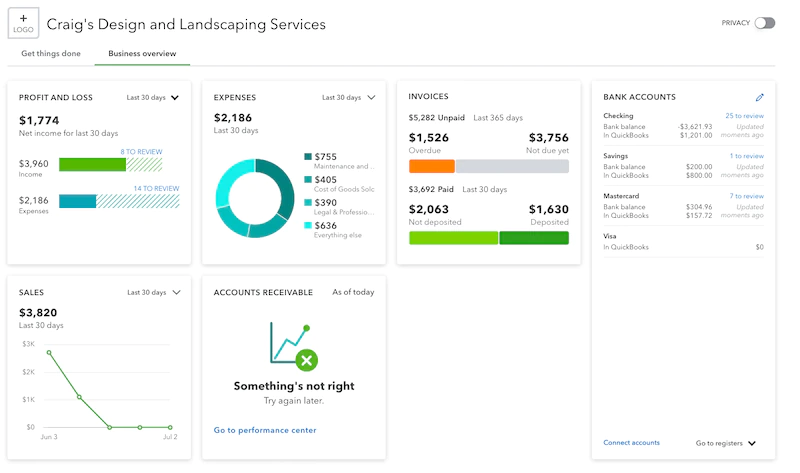

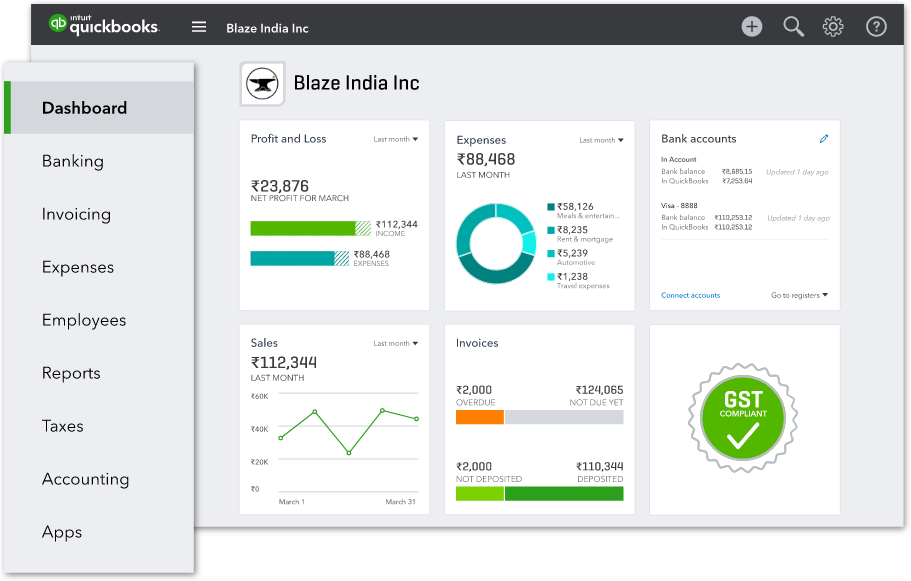

1. Intuit QuickBooks — Overall, the Best Accounting Software UK in 2024

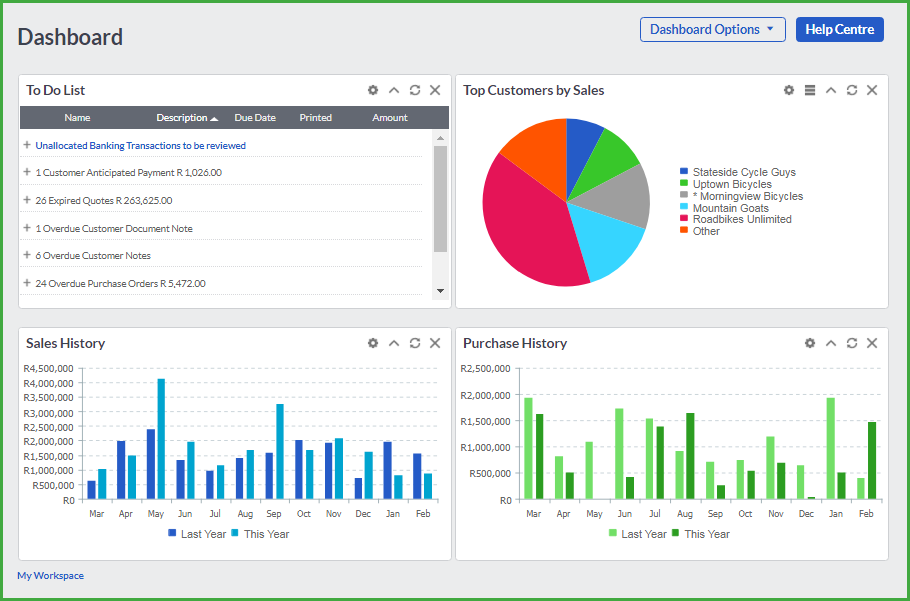

Intuit QuickBooks is one of the market’s most popular accounting software programs used by businesses and individuals to manage their finances. It’s effortless to use, which makes keeping track of your income, expenses, and taxes an absolute breeze.

You’d be hard-pressed to find a better tool to manage your accounting needs — and with its low cost, ease of use, and incredible functionality, it’s no wonder small businesses across the globe put their trust in QuickBooks.

Although you’re not limited in terms of features, QuickBooks gives you the option to connect with a range of other apps, including point-of-sales solutions. Plus, a big bonus is that it’s cloud-based and it’s regularly updated.

Special Features:

- Automation — QuickBooks can automate many tasks for you, such as invoicing, tracking payments, and creating reports. This can save you time and help you stay organized.

- Reports and Analytics — You can generate various reports to track your finances — allowing you to know how much you’re making and what you’re spending to accurately pinpoint where your money is going.

- Electronic invoicing — You can send invoices to clients through email, track them, and collect online payments and electronic signatures using the system.

Pricing:

- Self-Employed — £10 per month

- Simple Start — £14 per month (1 user)

- Essentials — £24 per month (3 users)

- Plus — £34 per month (5 users)

- Advanced — £70 per month (25 users)

Considering what’s on offer with this impressive accounting tool, the pricing is an absolute bargain — try it now free with the 30-day trial and see why QuickBooks is a go-to solution for so many businesses.

Pros:

- The platform is cloud-based

- It’s incredibly easy to use

- You can create customizable invoices

Cons:

- Limited users for growing businesses

2. Oracle NetSuite — The Go-To UK Accounting Tool for Large Firms

Oracle NetSuite is a popular UK accounting tool for large firms looking for an all-in-one solution to manage their accounting — and loads more, including HR, customer management, eCommerce, and inventory and order management.

With that said, you can opt to buy just the accounting suite or the full deal for a centralized business management solution.

With Oracle NetSuite, you’ll have all the accounting tools you need to save time, prevent errors in your books, and, most importantly, ensure compliance in everything your firm does. It simplifies, automates, and provides everything you’d need for a large or blooming business.

Besides the key features outlined below, NetSuite’s accounting tools also include the automation of accounts payable and receivable processes and even fixed asset management (from creation to disposal), amongst ample more.

Special Features:

- General Ledger — With NetSuite, you’ll have solid audit trails, and you’ll be able to customize things like the account type, transactions, and reports to meet your needs

- Cash Management — Control, manage and monitor your cash flows, bank accounts, liquidity, and more from one location

- Tax — With NetSuite, you can save time and reduce manual work and the potential for errors as it lets you easily manage local and global tax and multiple tax schedules. Plus, each tax rate is automatically added to every transaction

Pricing:

Unlike most, Oracle NetSuite’s pricing is based on your business’s particular needs, and therefore it varies considerably. With that said, we recommend requesting a quote to determine how in line the pricing of the tool is with what you’re after.

If you’d like to try it, there’s a free demo tour on their website that you can check out. Eliminate the guesswork and get a solution designed to help you manage your business’ financials.

Pros:

- Offers seamless payroll

- Offers flexible reporting capabilities

- Streamlines and automates many time-consuming tasks

- Cloud-based, so it’s accessible from anywhere

Cons:

- Lacks a free trial and training documents

- It isn’t ideal for all industries or smaller businesses

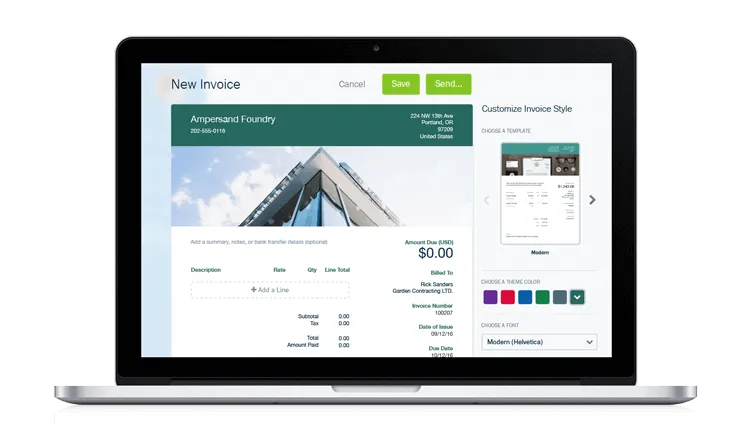

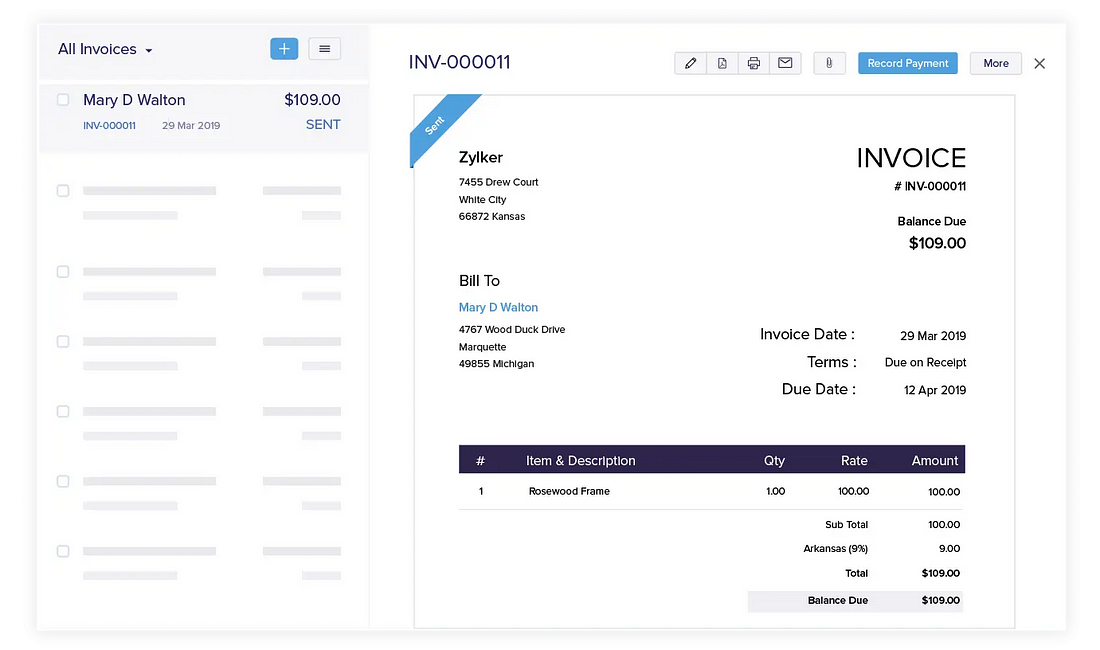

3. FreshBooks — Best for Solid Invoice Creation Tools

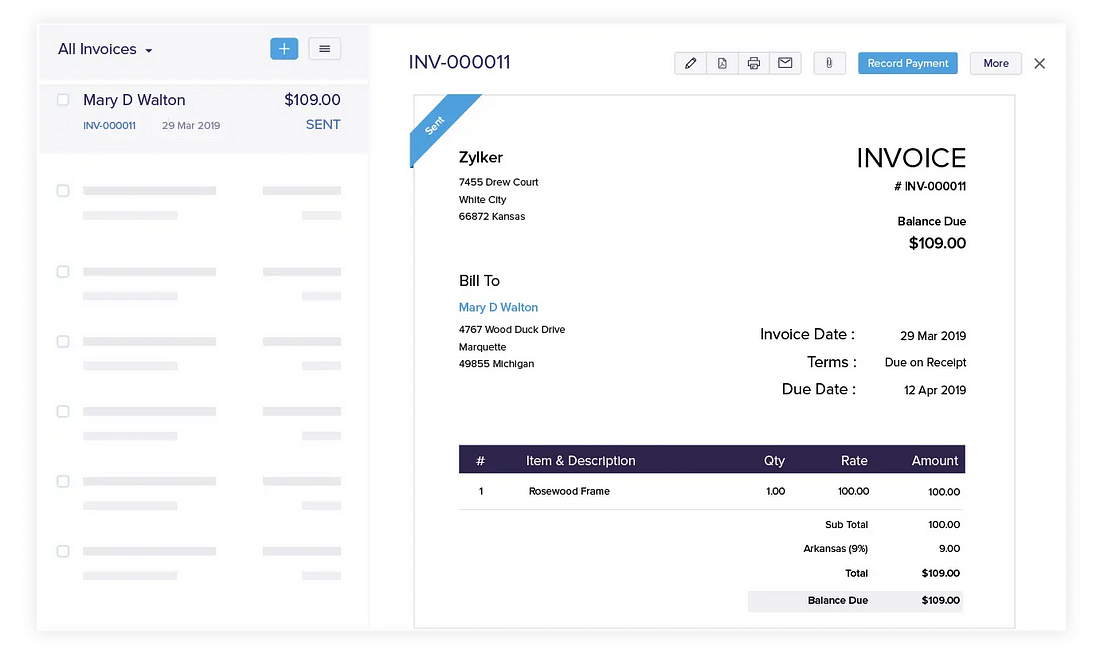

If you’re looking for a full-featured invoicing program that’s easy to use, FreshBooks is the best option. Although all accounting software programs offer invoicing options, FreshBooks is exceptionally user-friendly, which is why we rated it as the best accounting software for invoicing.

The interface is simple to navigate, and with just a few clicks, you can add billable time and costs, personalize the design of the invoice, and set up recurring invoices, automated payment reminders, and late fines.

Special Features:

- Customizable Invoice — You can change the font and colour and add your company logo to create a completely customized invoice.

- Automatic Late Fees — If you have clients who are habitually late in paying their invoices, you can set up FreshBooks to automatically charge them a late fee.

- Recurring Invoices — You can create recurring invoices so that you don’t have to spend time creating the same invoice every month.

Pricing:

- Lite — £11 per month (with 5 billable clients)

- Plus — £19 per month (50 billable clients)

- Premium — £30 per month (unlimited clients)

Pros:

- It’s straightforward to use

- You can create highly customized invoices

- Offers affordable pricing plans

Cons:

- Limited mobile functionality

4. Sage Business Cloud Accounting — Perfect for Payment Tracking

Sage Business Cloud Accounting is a low-cost accounting program with a lot of power. You can produce and send invoices, track payments, and reconcile bank entries automatically with the entry-level plan.

Great for freelancers, Sage also offers a custom invoice template to make your invoices look professional. With this software, you can also manage your inventory, track project time and expenses, and generate detailed reports.

Special Features:

- Personalized Invoicing — You can create and send invoices that look professional with Sage’s customizable templates.

- Automatic Bank Reconciliation — Keep track of your bank entries and reconcile them automatically with the entry-level plan.

- Detailed Reports — Get detailed reports on your inventory, project time and expenses, and more.

Pricing:

- Accounting Start — £12 per month (1 user)

- Accounting Standard — £26 per month (multiple users)

- Accounting Plus — £33 per month (unlimited users)

Pros:

- Offers low-cost plans

- It has powerful features

- Includes customizable invoice templates

- Manages inventory, time tracking, and expenses

Cons:

- The UI isn’t as modern as others

- Doesn’t offer integrated payroll

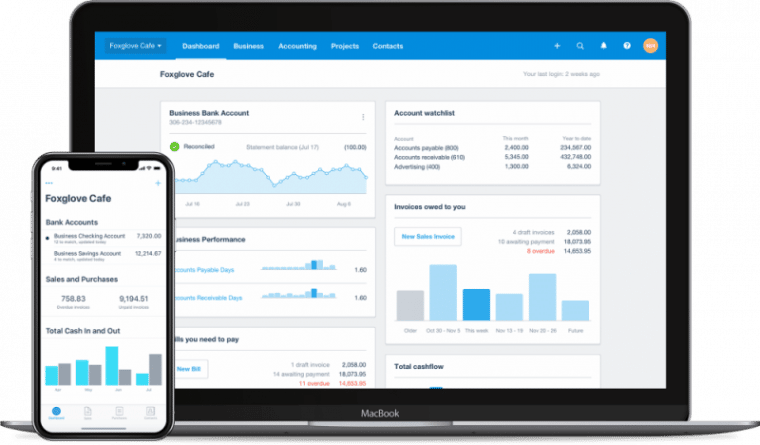

5. Xero — Best Accounting Software in the UK for Businesses of All Sizes

Unlike accounting software that charges based on the number of users, Xero’s subscription options allow unlimited users. As a result, you can add more employees to your account at no additional expense as your company expands.

Most functions, including estimations, inventory monitoring, and recurring invoicing, are included in all plans. You can also upgrade your subscription to include payroll and credit card processing features.

Xero offers a 30-day free trial so that you can test out all the features before you decide to subscribe. You don’t need to provide a credit card number, and there’s no obligation to continue using the software.

Special Features:

- Pay Bills — The software will automatically import your bills from your email or online banking so that you can see your expenses in one place. You can also schedule payments for future dates to ensure that you always stay on top of your bills.

- Record Expenses — Keep track of your business expenses by claiming them in Xero. The software makes it easy to add new expenses as you go and will automatically categorize them for you.

- Track Projects — If you’re running a project-based business, Xero can help you keep track of your expenses and income. The software lets you create different projects and then tracks the associated revenue and expenses.

Pricing:

- Starter — £14 per month — Best for sole traders

- Standard — £28 per month — Most suitable for growing small businesses

- Premium — £36 per month — Ideal for established companies

Pros:

- Allows for unlimited users

- Inventory management

- Auto bill and receipt capture

Cons:

- No phone support

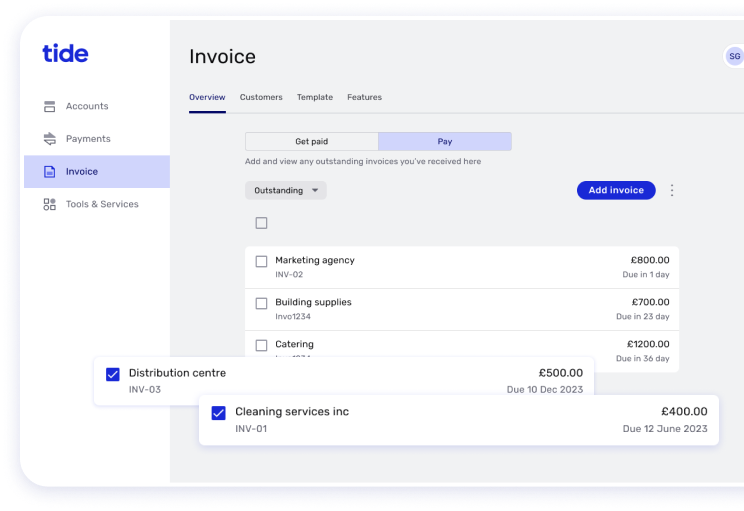

6. Tide — Best for On-the-Go Invoicing and Cash Flow Insights

Tide offers effortless and transparent services at an affordable price. It’s a great choice for small businesses and companies that usually don’t have an enormous number of transactions in cash or cheque.

It comes with a lot of smart features that allow you to manage your account, invoices, and credits in a simple and straightforward manner. Among the greatest USPs of Tide is that you can open a business account on the platform and register your company without paying a single penny.

With its mission to support small businesses, Tide gives a lot of perks like free subscriptions and discounts to its users through its partnership with other companies like Drovo, Auderli, RAC, and more. Also, it keeps adding new perks from time to time, so you might want to go through its offering list if you’re planning to get a Tide account.

Special Features:

- Advanced Invoicing — Tide has a lot of invoice templates to choose from. You can generate and send the invoices using the Tide app, match your received payments with the invoices you sent out, and even get the ‘automatic invoice chasing’ feature to avoid wasting time following up with your clients.

- Cash Flow Forecasting — You will receive automated 30-day cash flow forecasts, along with tips to improve your cash flow. This is great for planning any budget, as you get the predicted account balance 30 days ahead. Additionally, you can also monitor your credit score.

- Expense Card — An expense card makes expenditure management super easy. You can add up to 50 people per account, get real-time access to the expenditure records, set spending limits on individuals according to their job roles, and segregate the transactions by person or spend category.

Pricing:

- Free plan

- Plus — £9.99 + VAT — per month

- Pro — £18.99 + VAT — per month

- Cashback — £49.99 + VAT — per month

Pros:

- A handy free plan

- Free membership and discount with partner companies

- Very reliable and secure

- Superb invoicing from the mobile app itself

Cons:

- Benefits of a traditional bank account not available

7. Zoho Books — Superb for Time Tracking

Zoho Books has superb functionality, making it a fantastic option for businesses of all sizes. It even has some more complex capabilities, like project billing and time tracking. Plus, it offers connectors, allowing you to add functionality as your company expands.

Zoho Books integrates with other Zoho programs — including one of the best CRM software solutions. You can also connect with other programs, such as PayPal and Xero. And although the tool offers simplicity for small businesses, you certainly won’t be sacrificing features or functionality.

Special Features:

- CRM Integrations — Zoho Books integrates with Zoho CRM, giving you a complete overview of your customers and their interactions across both programs.

- Recurring Invoices — Automate the creation of invoices and bills with recurring templates.

- Expense Tracking — Keep track of your expenses by recording them as they occur or attaching receipts to transactions.

Pricing:

- Free — 1 user and 1 accountant

- Standard — £12 per month — (3 users)

- Professional — £24 per month — (5 users)

- Premium — £30 per month — (10 users)

- Elite — £99 per month (cash flow forecasting)

- Ultimate — £199 per month (15 users)

Pros:

- Great functionality on the free plan

- Includes all essential features for small businesses

- More complex capabilities, like project billing and time tracking

Cons:

- Steep learning curve

8. Crunch — Best for Sole Traders in the UK

Crunch is a user-friendly accounting software tool that’s best for freelancers and sole traders, although the company recently expanded its offerings to cater to small businesses. With this tool, you can create and manage invoices while dealing with all the regulatory and tax pieces that go with running a one-person business.

With Crunch, sole traders can also calculate VAT, record all deposits and withdrawals from their business, and figure out how much they owe HMRC at the end of the year. Plus, the software makes it easy to run an annual Self Assessment.

Although Crunch doesn’t have a vast range of features, it does offer a few handy ones. For example, the software can automatically reconcile bank statements and call attention to any discrepancies before they lead to a call from HMRC.

The software also includes a payroll function that lets sole traders pay themselves and determine any necessary payroll taxes along the way.

Special Features:

- VAT Calculation — Crunch calculates VAT on every invoice, ensuring that businesses comply with tax requirements.

- Unlimited Support — You get unlimited accountancy support with all paid plans.

- Payroll — Crunch can run payroll for a sole trader or freelancer, keeping business and personal income separate.

Pricing:

- Free — 1 user and 1 accountant

- Sole Trader Pro — £24.50 per month

- Limited Company Pro — £41.50 per month

- Limited Company Premium — £121.50 per month

Pros:

- It’s very easy to use

- Run an annual Self Assessment

- Automatic bank statement reconciliation

Cons:

- There are few bookkeeping features on offer

9. FreeAgent — Best for Small Businesses

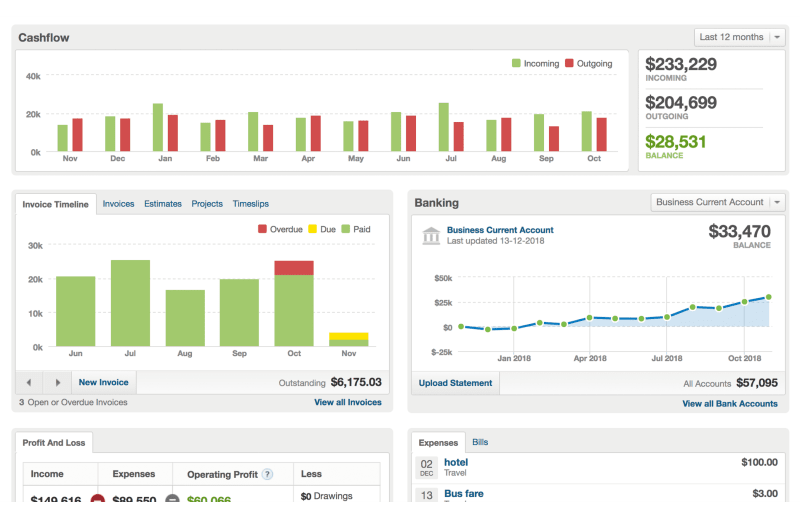

FreeAgent was designed for small businesses and traders. The software integrates with various third-party apps, such as Google Drive and Dropbox, which makes data entry a breeze. You can also attach documents to transactions for further clarification.

FreeAgent’s Radar sends you personalized alerts on your company’s performance. Your insights are tailored to your company and you’ll be alerted on everything from late payments to possible cash flow difficulties.

Special Features:

- Radar — This lets you keep an eye on your business, combining intelligent insights, targeted trend-spotting, and customized suggestions in one location.

- Time Tracking — As an essential part of any business, this allows you to track your time on each task, project, or client and then bill them accordingly.

- Sales Tax — When selling products or services, you must keep track of the sales tax you owe. FreeAgent can help you do that.

Pricing:

- Universal — £14.50 per month for the first 6 months, then £29 per month thereafter

Pros:

- Offers a 30-day trial

- Transparent pricing

- Affordable pricing for small businesses

- Loaded with valuable features

Cons:

- Limited dashboard customization

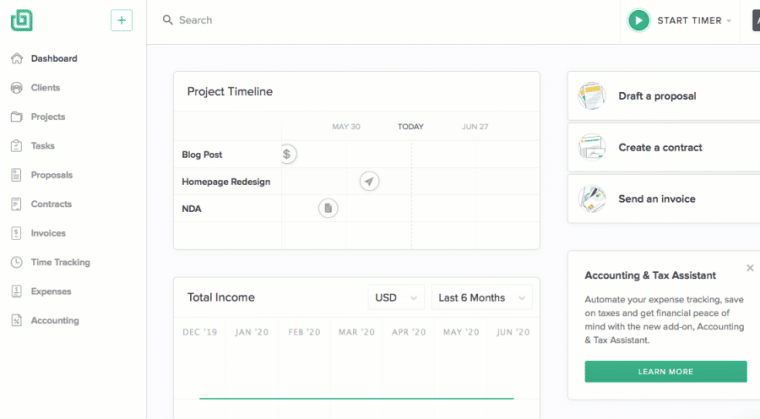

10. Bonsai — Popular Accounting Software for Freelancers

Bonsai boasts over 500k customers — many of which fit the title of self-employed and freelancing. As an all-in-one solution, Bonsai is a solid accounting tool that doubles over as a fantastic tax solution, too.

From client, task, and project management to handling all your documents in one place, Bonsai does it all to help keep your business organized and your books accurate.

Special Features:

- Automation — Automatically track every expense, your income, tax estimates, and invoices (including payment reminders), for complete efficiency

- Templates — From contract templates to proposals, invoices, agreements, and quotes — simply customize, save, and reuse to speed up your processes and save time

- Management — Offers time and task-tracking tools to automate your timesheets and help you stay organized with your day-to-day projects

- Tax — Bonsai Tax will automatically identify deductible expenses and estimate your quarterly taxes so that you can rest easy when tax season comes around

Pricing:

Here are the plans on offer with Bonsai:

- Starter: $17/month

- Professional: $32/month

- Business: $52/month

Monthly billing, on the other hand, starts at $24/month.

Pros:

- Provides time-saving automations

- Adored for its invoicing and tracking

- The interface is incredibly user-friendly

- Offers great value for money

Cons:

- Additional training resources required

- It could use more customization

Best Free Accounting Software UK

Even the best free accounting software is usually incredibly limited in terms of functionality, but it can give you insight into the platform and whether it’s right for your business.

Although, because of the limits, we’d advise you to opt for free trials, as it gives you a better understanding of the software’s true capabilities. Nevertheless, these are top-rated and are known for being the best free accounting software in the UK:

1. QuickBooks — Best Free Accounting Software UK

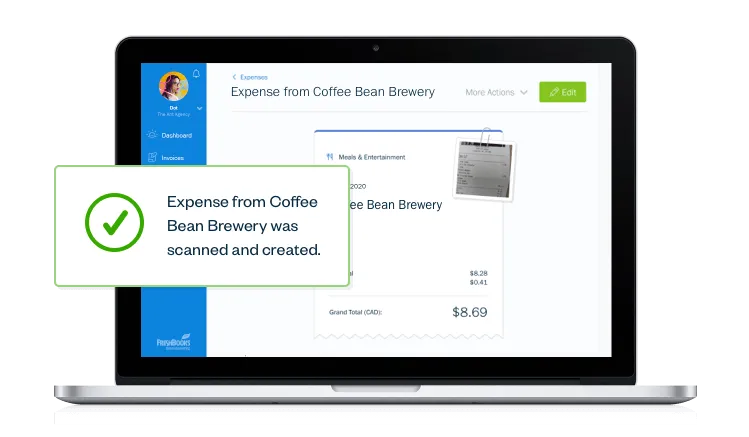

QuickBooks is one of the best free accounting software options for businesses in the UK. It offers everything from invoicing and VAT to expenses and payroll in one convenient solution.

Paper receipts are also a thing of the past, as you can extract the info from a photo. Plus, with QuickBooks, you can track mileage, saving you hours on tax time.

Special Features:

- Robust integrations

- Built-in reports

- Mileage tracking

Paid Plans:

- Self-Employed — £10 per month

- Simple Start — £14 per month (1 user)

- Essentials — £24 per month (3 users)

- Plus — £34 per month (5 users)

- Advanced — £70 per month (25 users)

There’s also a 30-day free trial on offer with all of QuickBooks’ plans.

Pros:

- An unlimited number of clients supported

- Intuitive user interface

- Mobile app

Cons:

- Inability to revert to a previous version

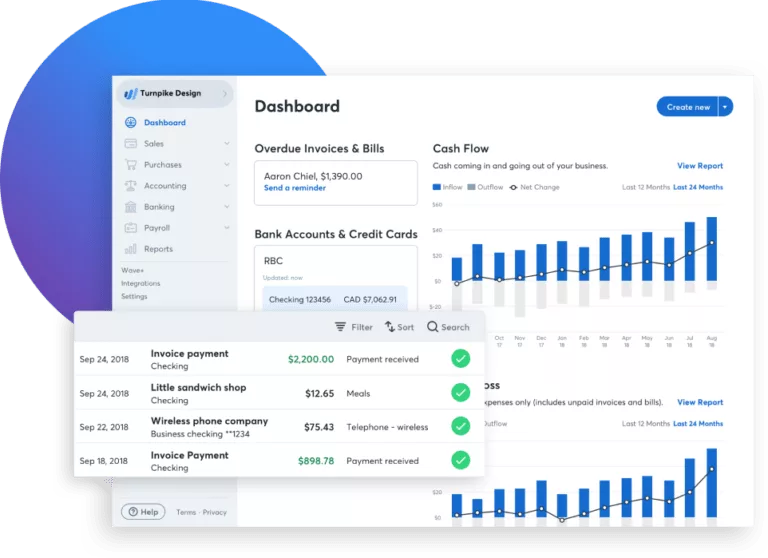

2. Wave — Best for Invoicing

Wave offers excellent features, including invoicing, tracking expenses, and creating reports. It also has a built-in payment processing system that allows you to accept customer payments online.

Special Features:

- Customizable Invoices

- Expense Tracking

- Invoice Payment Reminders

Pros:

- Wave is free to use

- Integrates with a number of popular payment processors

Cons:

- Limited features as it’s free

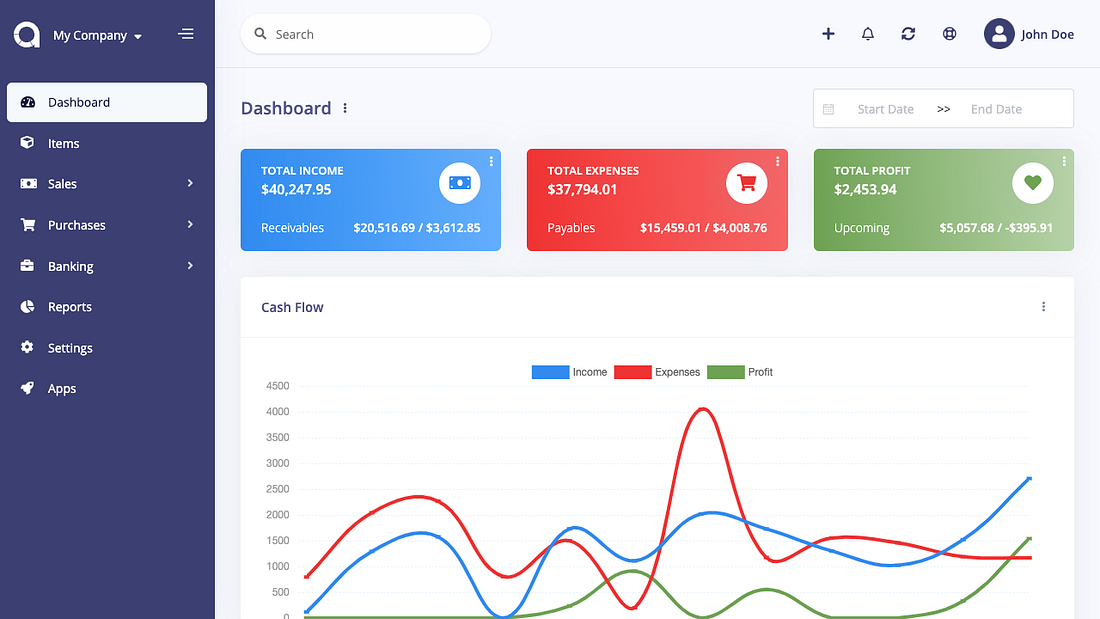

3. Akaunting — Best Free Software for Vendor Management

Akaunting is a free, open-source accounting software tool that supports double-entry bookkeeping, invoicing, time tracking, and more.

Plus, it also integrates with several other business tools, making it an ideal option for businesses looking to manage all aspects of their operations in one place.

Special Features:

- Multi-Company

- Client Portal

- Customer Summary

Pricing:

- Free Cloud — Good for freelancers

- Premium Cloud — $36.00 per month (approx. £31) — Good for SMEs and established businesses

Pros:

- Completely free

- Easy to use

Cons:

- Limited functionality compared to paid options

Best Self-Employed Accounting Software UK

Finding the best accounting software to help manage your finances is vital if you’re self-employed — here’s a list of options you’ll find best suited to your needs:

1. Xero — Best Accounting Software for Self-Employed UK

Xero is a fantastic option for self-employed individuals — on the starter plan, you can send 20 invoices and pay up to 5 bills a month, schedule payments, capture bills, and submit VAT returns to HMRC.

Plus, you can connect your bank account to sync all your activity and connect to external tools like PayPal, and some of the best CRM apps like HubSpot.

Special Features:

- Pay Bills

- Claim Expenses

- Track Projects

Pricing:

- Starter — £14 per month — Best for sole traders

- Standard — £28 per month — Most suitable for growing small businesses

- Premium — £36 per month — Ideal for established companies

There’s a 30-day free trial that you can use to test Xero before committing to one of the paid plans.

Pros:

- Unlimited users

- Inventory management

- Auto bill and receipt capture

Cons:

- No phone support

2. OneUp — Best UK Self-Employed Accounting Software for CRM Integration

OneUp is an ideal solution for small sales teams, as it offers accounting software that includes one of the best free CRM software solutions, plus invoicing.

Many self-employed company owners who are constantly on the go will also appreciate that OneUp is a mobile-first solution, making tracking and managing your finances seamless.

Special Features:

- Invoice Management

- Bank Automation

- Integrated CRM

Pricing:

- Self — $9/user/month (approx. £8 per month)

- Pro — $19 per month (approx. £17 per month) (2 users)

- Plus — $29 per month (approx. £25 per month (3 users)

- Team — $69 per month (approx. £60 per month) (7 users)

- Unlimited — $169 per month (approx. £147 per month)

Pros:

- Incredibly easy to use

- Superb mobile functionality

Cons:

- Limited customization

3. Zoho Books — Best For Micro-Businesses

Although Zoho Books doesn’t have an option specific to self-employed individuals, it offers an affordable solution for small businesses looking for quality functionality and fantastic integration support.

Special Features:

- Customizable Invoice

- Automatic Late Fees

- Recurring Invoices

Pricing:

- Free — 1 user and 1 accountant

- Standard — £12 per month — (3 users)

- Professional — £24 per month — (5 users)

- Premium — £30 per month — (10 users)

- Elite — £99 per month (cash-flow forecasting)

- Ultimate — £199 per month (15 users)

Pros:

- Ease of use

- Customizable invoices

- Affordable pricing scheme

Cons:

- Limited mobile functionality

What Are the Benefits of Using Accounting Software in the UK?

The most obvious benefit of using accounting software is that it automates many of the tasks involved in bookkeeping and financial reporting — this can save your business time and money and eliminate the risk of human error. In addition, accounting software can help businesses:

- Track their financial health over time

- Make strategic decisions about pricing and product development

- Stay compliant with financial regulations

- Keep your books organized and accurate for tax season

And so much more. Overall, accounting software offers invaluable benefits — it saves time and money and allows you to manage your finances efficiently.

How to Choose the Best Accounting Software for Your Business

When choosing an accounting software package, be sure to consider the following:

1. Your Company’s Needs

Perhaps the most important criterion for selecting accounting software is ensuring that it meets your company’s specific needs.

Your needs will vary depending on your industry and the size of your business, so double-check that your chosen software fits your specific requirements.

2. Your Budget

Accounting software can be expensive, but various options are available at different price points, giving you the freedom to find software that best suits your budget without sacrificing the features most important to your business.

3. Support

To ensure you have access to assistance if you encounter any problems, you’ll want to double-check the support provided on your chosen plan and the documentation on the website.

4. Automation

Automating financial transactions can save time and improve accuracy. However, not all accounting software offers automation features. Some, for example, only allow you to automate part of the process. Others automate the entire process, from entering data to creating financial statements.

5. Ease of Use

Although most of the accounting software tools reviewed in this post are user-friendly, some have higher learning curves than others. You may want to test the free trial first to ensure the software’s interface is simple to navigate.

How Does Accounting Software Work?

You know what accounting software is and some of the best options on the market — but how does it actually work?

When you first install accounting software, you’ll need to set up your company’s chart of accounts. This is a list of all the different accounts your business will use to track its financial activity. The program will then ask you to input your opening balances for each account.

Once set up, your financial transactions will sync automatically, including updating the data on reports and charts — giving you real-time insight into your business’s financial health.

What’s the Difference Between Online Booking Software and Accounting Software?

The main difference between accounting software and online booking software is that accounting software is designed to help you manage your finances. It can help you keep track of your income and expenses, as well as your assets and liabilities.

On the other hand, online booking software can help you keep track of bookings, cancellations, how much money you’re making from your business, and more — but it doesn’t offer the level of financial tracking and management that accounting software does.

UK Accounting Software FAQs

What is the best accounting software for small businesses?

What are the benefits of using accounting software?

How much does accounting software cost?

What features should I look for in accounting software?

What is the best accounting software for contractors?

What is the best accounting software for rental properties?

What is the best online accounting software?

What is the best small business accounting software for Mac users?

Conclusion — What’s the Best Accounting Software in the UK for 2024?

Accounting software is a must-have for businesses of all sizes to efficiently manage their finances and track expenses. Our top 10 approved picks are:

- Intuit QuickBooks — Overall, the Best Accounting Software UK in 2024 | Test it Now Free for a Full 30 Days

- Oracle NetSuite — The Go-To UK Accounting Tool for Large Firms

- FreshBooks — Best for Solid Invoice Creation Tools | Take Advantage of the 30-Day Trial Now

- Sage Accounting — Perfect for Payment Tracking | Try it Free for a Month

- Xero — Best Accounting Software in the UK for Businesses of all Sizes | Offers a 30-Day Trial

- Tide — Best for On-the-Go Invoicing and Cash Flow Insights | Offers a Free Plan

- Zoho Books — Superb for Time Tracking | Has a 2-Week Free Trial You Can Use

- Crunch — Best for Sole Traders in the UK | Use the 7-Day Free Version Before You Buy

- FreeAgent — Best for Small Businesses | Also Has a Month-Long Free Trial

- Bonsai — Popular Accounting Software for Freelancers

Although there are many worthy options, there’s no doubt that QuickBooks is the best of the bunch. Besides being incredibly easy to use, QuickBooks is customizable and comes loaded with the functionality you’d be looking for in the best UK accounting software.