The process of buying shares in the UK rarely takes more than a few minutes from start to finish. After opening a stock broker account and depositing funds, it’s just a case of placing an order to invest.

Those that are completely new to online investing will appreciate this article on how to buy shares in the UK, as we explore some popular trading platforms.

How to Buy Shares in the UK in 4 Easy Steps

The are four easy steps to buy shares in the UK listed below, while a more detailed step-by-step guide on how to buy shares is at the bottom of the article:

- Step 1 – Find Broker: Users must consider which platform they want to use to manage their shares, as each offers different features and fees.

- Step 2 – Create and Verify Account: The next step is to set up an account. You will need to enter and confirm basic information, including your email address and phone number, and submit a photo ID like a passport or driver’s license. Some platforms may also request proof of address and require you to fill out a questionnaire.

- Step 3 – Deposit funds: Next, users will need to deposit funds. Most platforms accepts debit card, bank transfer, PayPal, e-wallets, and other payment methods, although minimum deposits, fees, and the confirmation times can vary.

- Step 4 – Buy shares: After creating an account type in the name of your chosen share in the search box, find the ‘Buy’ (or similar) button and complete the transaction.

How to Buy Shares in the UK – Best Stock Trading Apps Reviewed

Below we outline some of the leading trading platforms on the market and look through their advantages and disadvantages.

Different customers will have different needs so we have outlined the best stock apps for beginners and for experts, as well look at the best mobile stock trading apps.

Most of the brokers we reviewed are regulated by the FCA and covered by the Financial Services Compensation Scheme (FSCS).

They offer different financial instruments, including stocks and shares, commodities, forex, indices and cryptocurrency.

1. Axi – Trade 50 Stocks with up to 5:1 Leverage

Besides omitting commission fees, Axi ensures traders incur minimal costs by offering competitive prices on share CFDs. To enable traders to maximize their profits, Axi provides leverage of up to 5:1. Apart from profiting from favorable trades, traders can also earn direct dividend payouts from share CFD trades.

Axi provides an MT4 platform that is ideal for professional traders to access advanced tools while still being easy for beginners to place trades. Trading on this platform is made simpler with the PsyQuotation tool, which helps traders minimize errors by delivering performance analytics. Axi also includes AutoChartist, which aids traders by scanning the market for opportunities based on tailored trade setups.

Beginner traders lacking technical analysis skills or the time to analyze markets can copy trades from professionals. Traders can search for professionals on the platform and attempt to mimic their results by using the CopyTrades feature. Axi also provides free educational material on how to buy shares and use the platform. An advanced trading course is available via the academy.

Traders preferring to trade pooled shares can opt for indices trading on Axi. The platform offers more than 30 indices and 30:1 leverage with $0 commission.

| Shares Available | 50+ stock CFDs |

| Fractional Shares? | Yes, via CFDs |

| Pricing System | 0% commission on all markets |

| Minimum Deposit | £0 |

81.6% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. IG – Leading Broker with more than 13,000 Shares and Funds

IG is an online broker that offers access to thousands of shares. When buying shares listed on the London Stock Exchange, UK investors will be required to pay a dealing fee of £8. This is required on both buy and sell orders. This fee is reduced to £3 when the user places more than three trades in a single month.

While this fee is competitive for large-scale investors, casual traders will find this expensive. After all, a share purchase of £100 at a commission of £3 would translate into a fee of 3%. US shares can also be purchased on the IG platform and the commission stands at £10 per trade.

This is reduced to £0 when three trades are placed in a single month. Another drawback of IG is that the platform requires a minimum deposit of £250.

| Shares Available | 13,000+ shares and funds |

| Fractional Shares? | No, not supported |

| Pricing System | £8 per trade, or £3 when three trades are placed in a month |

| Minimum Deposit | £250 |

3. AvaTrade – Top CFD Platform with MetaTrader 4 and MetaTrader 5

The next platform on the list is AvaTrade. This is another CFD trading platform that allows residents of the UK to trade shares without paying any commission. AvaTrade is also popular for offering tight spreads, which is the difference between the buy and sell price of the share being traded.

AvaTrade can offer UK retail clients leverage of up to 1:5. There is also the opportunity to profit from rising and falling pricing, as AvaTrade supports buy and sell orders. Moreover, AvaTrade is also home to other markets – which include forex, commodities, and indices.

AvaTrade also supports third-party platforms like MT4/5. Additionally, AvaTrade is one of the most regulated platforms in this space – with no less than 8 licenses under its belt. The minimum deposit to get started at AvaTrade is just £100. Debit and credit cards are supported, as is a bank transfer.

| Shares Available | 1,250+ markets |

| Fractional Shares? | Yes, via CFDs |

| Minimum Deposit | £100 |

| Deposit Fee |

£0 |

4. Alvexo – Leading Platform for Experienced Traders

Seasoned share traders might appreciate the Alvexo platform – which offers everything needed to outperform the markets in a sophisticated manner. The platform specializes in CFDs, which means that users will have access to short-selling facilities alongside leverage.

There are two trading platforms for skilled investors to choose from. First, there is MT4, which connects directly to the Alvexo platform via desktop software. Second, the Alvexo web trader can be accessed via a standard web browser. This comes with instant order execution, charting suites, technical indicators, and real-time asset prices.

We also like that Alvexo offers multiple account types. Those looking to deposit at least £10,000 will have access to spreads from 1.8 pips and use of Alvexo Plus for 180 days. The classic account, which requires a minimum account balance of £500, offers spreads from 2.9 pips. In addition to share CFDs, Alvexo also supports forex, commodities, and indices.

| Shares Available | 450+ markets |

| Commissions | 0% |

| Minimum Deposit | £0 |

| Deposit Fee |

£500 |

5. Hargreaves Lansdown – Highly Respected Broker established 40 Years Ago

Hargreaves Lansdown has a long-standing reputation in the UK investment space – especially with retail clients. This popular broker offers access to thousands of shares across both the London Stock Exchange and AIM. The platform is also home to funds and fixed-rate bonds.

Moreover, Hargreaves Lansdown is often the go-to place to open a stocks and shares ISA. However, the key drawback with Hargreaves Lansdown is that it charges high fees.

For instance, those looking to buy shares in the UK will pay a dealing fee of £11.95. In comparison, the same trade can be placed at other brokers without any commission.

Furthermore, funds are charged at 0.45% annually – unless over £250,000 is invested – and even then the fee drops to just 0.25%.

| Shares Available | Not stated |

| Commissions | £11.95 per trade |

| Minimum Deposit | £0 |

| Deposit Fee |

£0 |

6. Fineco Bank – Leading Financial Institution with 0% Commission on CFDs

Fineco Bank is an Italian financial institution that has since launched a share dealing platform in the UK. As such, UK retail clients can use the platform to invest in thousands of shares. This includes markets in the UK, US, Europe, and more.

The platform is heavily regulated and it is now used by over 1.3 million clients. When it comes to fees, Fineco Bank charges £2.95 per order on UK shares. There is a charge of £3.95 and $2.95 on European and US shares, respectively.

Moreover, there are no monthly account fees charged by this broker. Those wishing to trade share CFDs are also catered for at Fineco Bank. UK, US, and European share CFDs can be traded at 0% commission. Finally, Fineco Bank also offers a handy stock screener.

| Shares Available | 20,000 instruments across 26 global markets |

| Commissions | £2.95 on UK shares |

| Minimum Deposit | £0 |

| Deposit Fee |

£0 |

7. Trading 212 – Popular Trading Platform for Beginners

The final broker to research when learning where and how to buy shares in the UK is Trading 212. This platform offers UK residents access to more than 7,000 shares and ETFs.

This includes UK shares as well as those listed in the US, Germany, Spain, France, and the Netherlands.

The platform is authorized and regulated by the FCA, which ensures that traders can buy and sell shares in a licensed trading environment. Trading 212 does not charge any commissions to invest in shares, and the minimum trade requirement is just £1, making it a popular platform for beginners to use.

Supported payment methods here include Visa, MasterCard, Maestro, Apple, and Google Pay, and local bank transfers.

| Shares Available | 7,000 shares and ETFs |

| Commissions | 0% |

| Minimum Deposit | £0 |

| Deposit Fee |

£0 |

The Basics of Buying Shares

To buy shares in the UK, it is a requirement to choose one of the best stock brokers in the UK and open an account. Next, investors will need to make a deposit – which can often be done instantly with a debit or credit card.

After that, it’s just a case of searching for the company of choice and placing a buy order. In doing so, the investor will own a small portion of the firm. For instance, if the firm has 100,000 shares in circulation and the investor purchases 1,000 – they will own 1% of the company.

Investment returns will ultimately depend on the performance of the company as well as the broader economy. Nonetheless, if the investor can sell the shares for more than they originally paid, a profit will be made.

This is known as capital gains. It is also possible to make a profit through quarterly dividends. This happens when the company distributes some of its retained profits to shareholders. The amount received will depend on the size of the distribution and the number of shares owned.

Perhaps the most challenging part of learning how to buy stocks and shares in the UK is knowing which companies to invest in. While some UK investors will focus on shares listed on the London Stock Exchange, others will turn to markets in the US.

How do I Find Popular Shares to Watch?

As noted above, the tricky part when exploring how to buy stocks in the UK is knowing which companies to pick. Thousands of UK-listed shares can be bought online.

And, when factoring in the US and other international markets, this makes the decision-making process even more complex. Nonetheless, even beginners are advised to make their own investment decisions as opposed to buying shares based on third-party advice.

Look for Trending Markets

Some investors first analyze which markets are trending right now. For example, with the UK suffering from a cost of living crisis, investors will often turn to staple companies that sell products and services that are always in demand.

This might include a company like Tesco or GlaxoSmithKline. After all, demand for food and medicine will always remain solid irrespective of how the economy is performing.

Amid COVID, one of the hottest investment trends was in stay-at-home stocks. This refers to companies that benefited from global lockdown measures – such as Amazon and Facebook (now Meta Platforms).

Ultimately, to find popular shares to watch, the first thing that investors should focus on is companies that operate in trending markets.

Earnings Report

Every three months, public companies are required to release an earnings report. This details the fundamentals of the company – such as how much cash it holds and what revenues it generated in the period. The key idea here is to compare the earnings report to two different metrics.

Dividend Policy

Although not a minimum requirement, it is always useful when companies pay dividends. By being a shareholder in a dividend-paying company, investors will be entitled to a share of the distribution – which is typically every three months.

- Dividend shares can be invaluable during a bearish market, as the income can help counter some of the losses made from a share price decline.

- Those seeking consistent dividends might turn to UK-listed AstraZeneca.

- In the US, the likes of Coca-Cola and Johnson & Johnson have increased the size of their dividend for 60 consecutive years.

On the flip side, companies like Amazon and Google have never paid a dividend.

Popular Stocks to Watch Now in the UK

While we suggest that investors should pick their shares on a DIY basis, this might be challenging for first-timers.

Therefore, in the sections below, we discuss what shares to buy today – based on our market research and analysis.

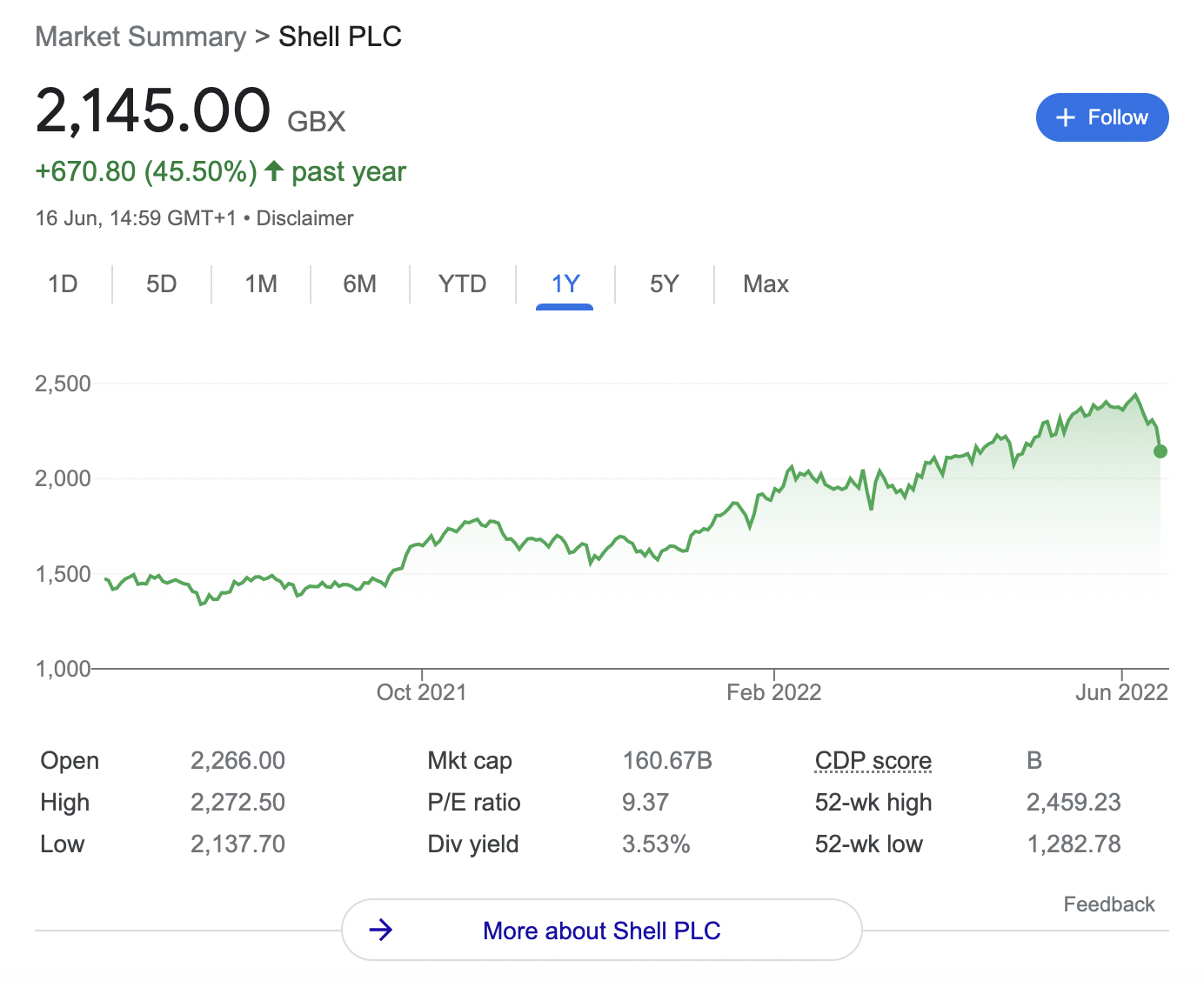

1. Shell

We mentioned earlier that one of the effective ways to find popular shares to watch is to explore what markets are trending. And right now, the oil industry is one of the popular markets to consider. After all, oil continues to trade at over $100 per barrel, so it makes sense that companies operating in this space are doing well.

Over the prior 12 months, Shell shares have increased by over 31%. This is especially notable considering that over the same period, the FTSE 100 has moved by less than a percentage point.

Furthermore, fellow UK oil counterpart BP, over the same 12-month period, has increased in value by just 11%. If that wasn’t enough, Shell is a dividend payer. Based on prices as of writing, Shell investors have access to a running dividend yield of over 3.5%. Just remember that Shell operates in a cyclical industry.

This means that if and when the global price of oil begins to decline, this will have a major impact on its share price.

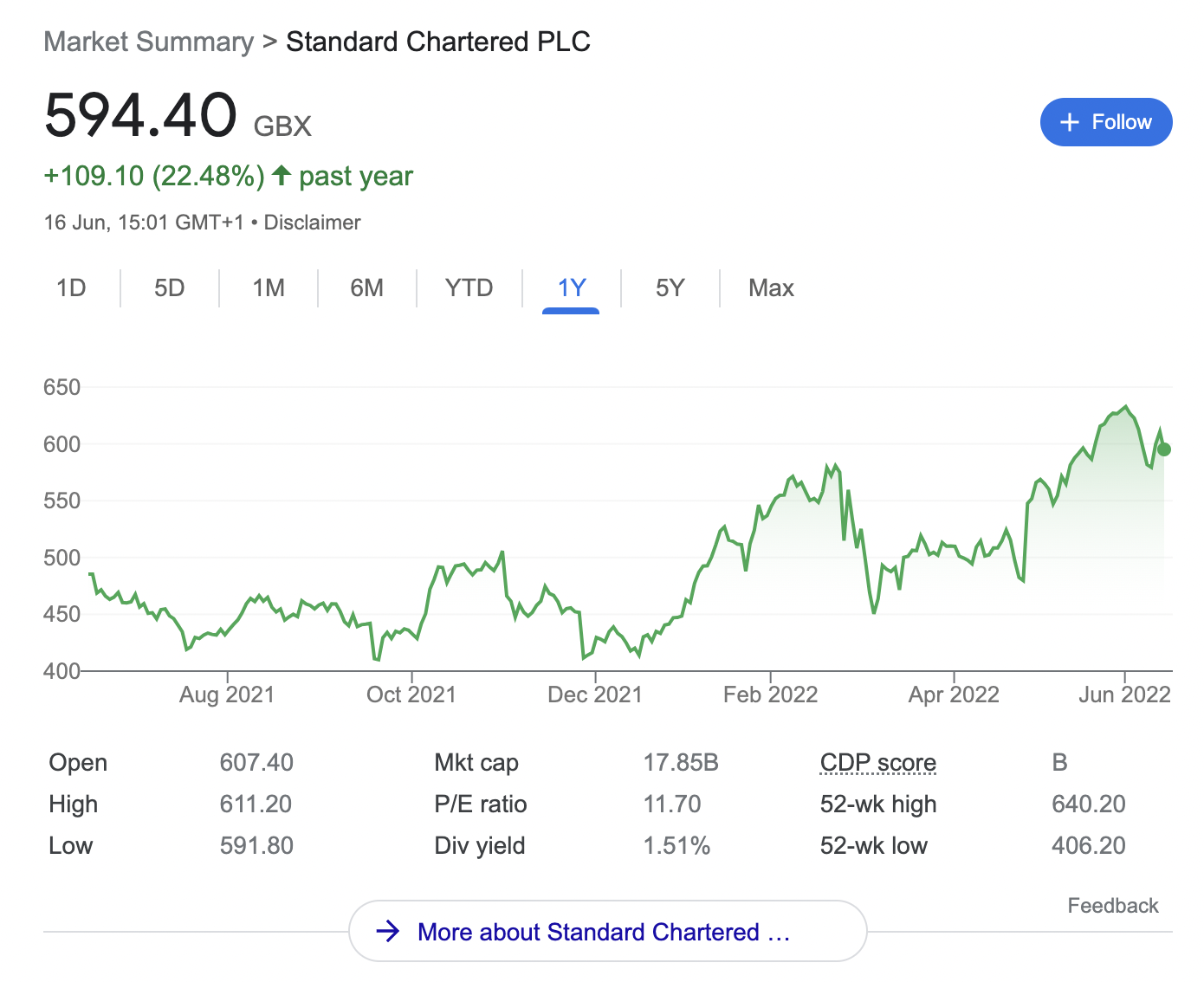

2. Standard Chartered

Standard Chartered is a major British financial institution that operates in over 70 countries around the globe. UK banking shares have struggled since the 2008 financial crisis.

As per its most recent earnings report, revenues at the bank were up 4.41% year-over-year to £4.09 billion. This translates into an increase of 7.69% in net income, up to £1.18 billion for the quarter. These notable quarterly results have had an impact on the Standard Chartered share price, with gains of 25% generated in the prior 12 months.

Just like Shell, Standard Chartered is a dividend-paying company. As of writing, a modest yield of just under 1.5% is available to shareholders.

3. Vodafone

The next company from our list of popular FTSE 100 shares to watch now is Vodafone. This telecommunications company operates globally, albeit, its share price has struggled in recent years. For instance, over the prior 12 months, Vodafone shares are down 16%.

The outlook appears even worse considering that the telecommunications firm has seen its share price drop by 46% over five years. On the flip side, Vodafone is expected to have a major say in the future of 5G technology – at least in the domestic marketplace.

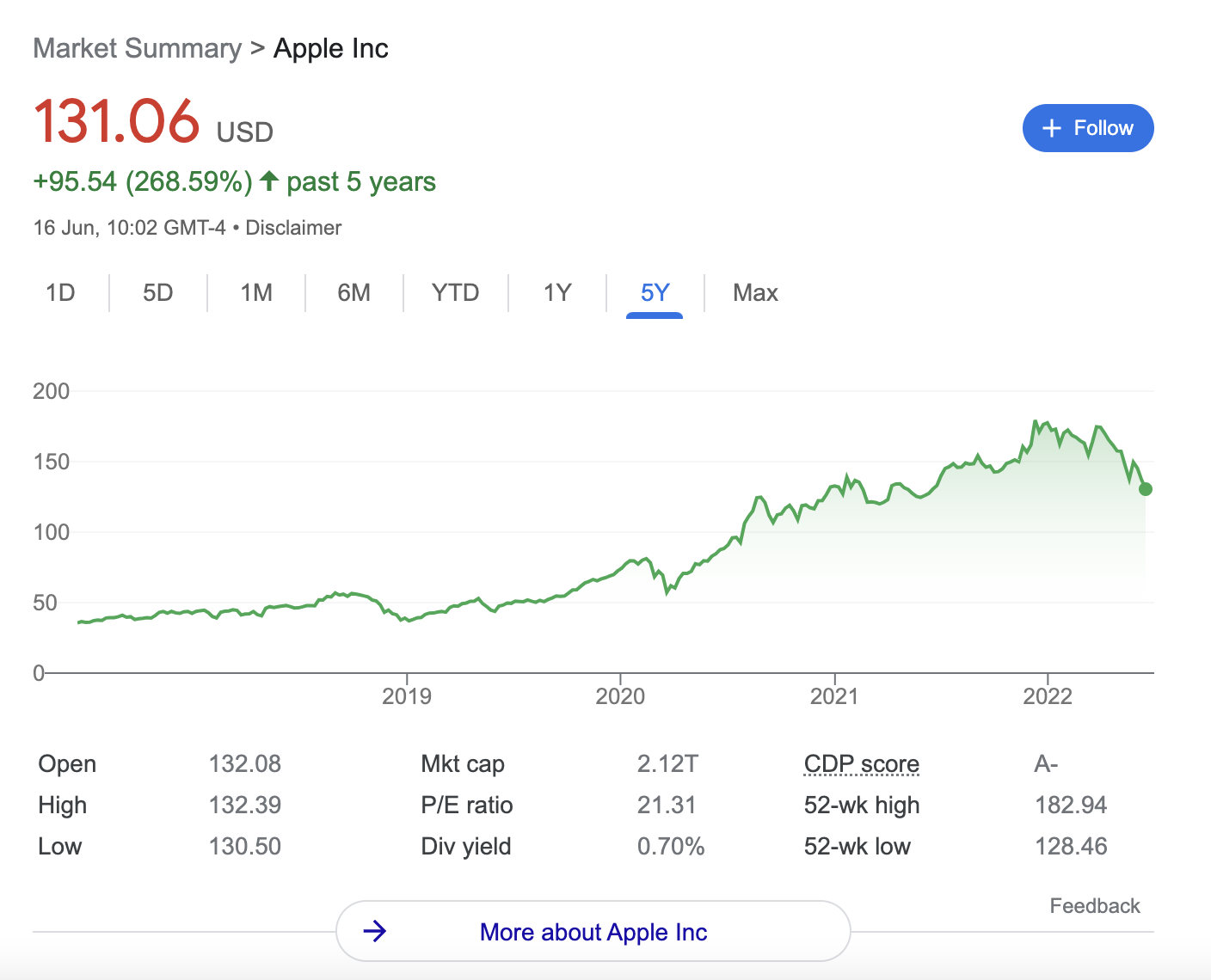

4. Apple

Those looking for international diversification could turn to the US – as this marketplace has outperformed the London Stock Exchange for many decades. One of the popular shares to watch in the US is Apple. This powerhouse is now one of the largest companies globally, thanks to its loyal customer base. Its trusted brand covers smartphones, tablets, laptops, and even streaming services. But why are so many investors interested in learning how to buy Apple shares in the UK?

The thing about Apple shares is that they can now be purchased at an entry price. The reason for this is that – as per the broader market downturn, Apple shares are down 25% in the first half of 2022. On the flip side, Apple shares are up 280% over the prior five years. During the same period, the FTSE 100 has gone down in value by over 4%.

As per its most recent earnings report, Apple shares increased revenue by 8.59% year-over-year to $97.28 billion. Net income was up 5.84% to $25.01 billion. Apple also has a significant amount of cash on its book – with the amount still hovering around the $200 billion figure. Finally, Apple shares pay a very small dividend, which, as of writing, offers a running yield of just 0.68%.

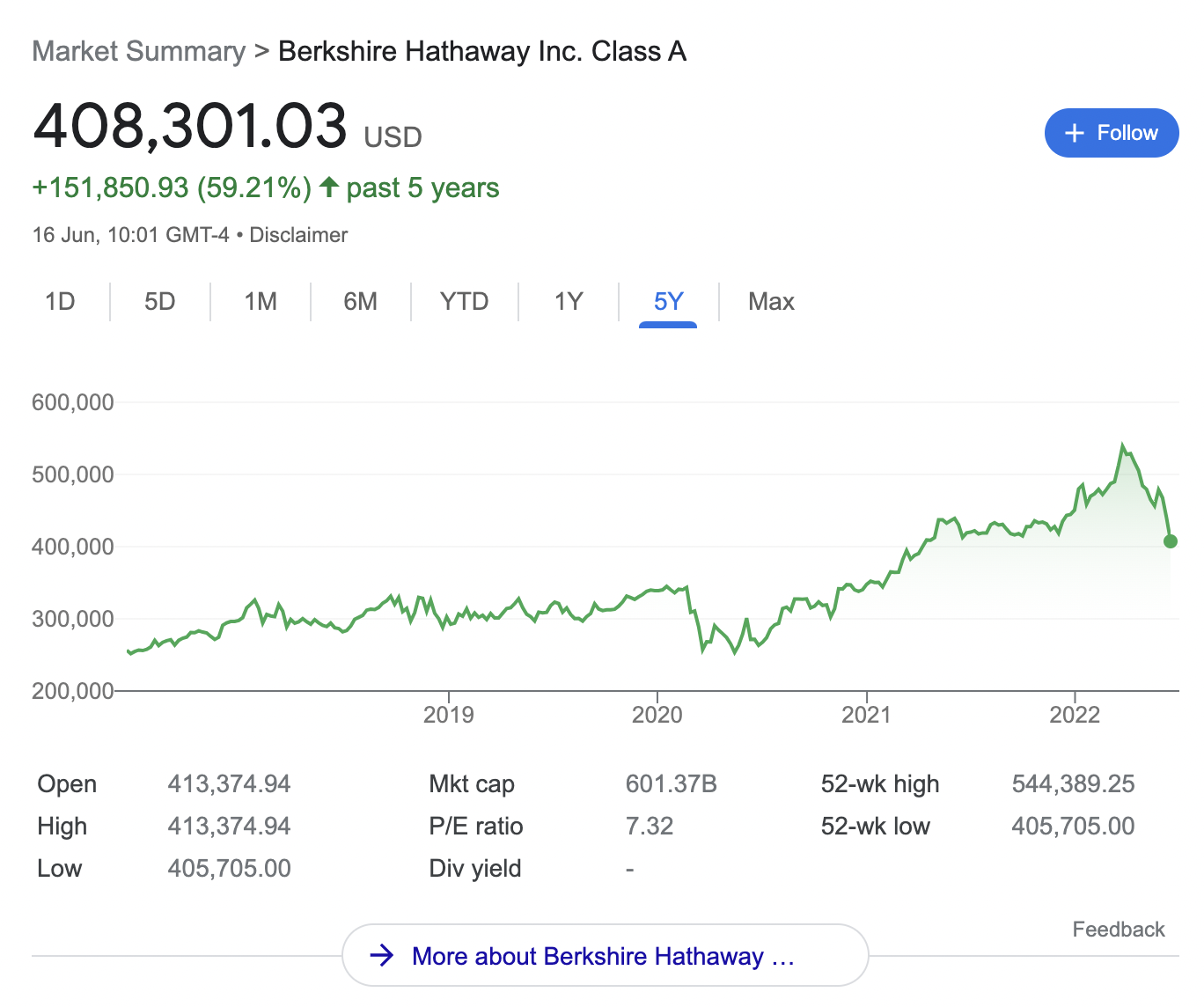

5. Berkshire Hathaway

Berkshire Hathaway is a US-based holding company controlled by investor legend Warren Buffett. NYSE, Berkshire Hathaway holds an investment portfolio that covers dozens of companies from a wide variety of industries and sectors. Interestingly, a single share in Berkshire Hathaway will cost hundreds of thousands of dollars.

However, by investing via a broker, it is possible to allocate smaller amounts. Nonetheless, some of the companies that Berkshire Hathaway investors have exposure to include Apple, Bank of America, Coca-Cola, American Express, and Amazon.

In terms of its performance, Berkshire Hathaway shares are down just under 2% over the prior year. However, across five years, the shares are up 63%. Although Berkshire Hathaway owns shares in companies that pay dividends, the firm reinvests the funds to buy new stocks.

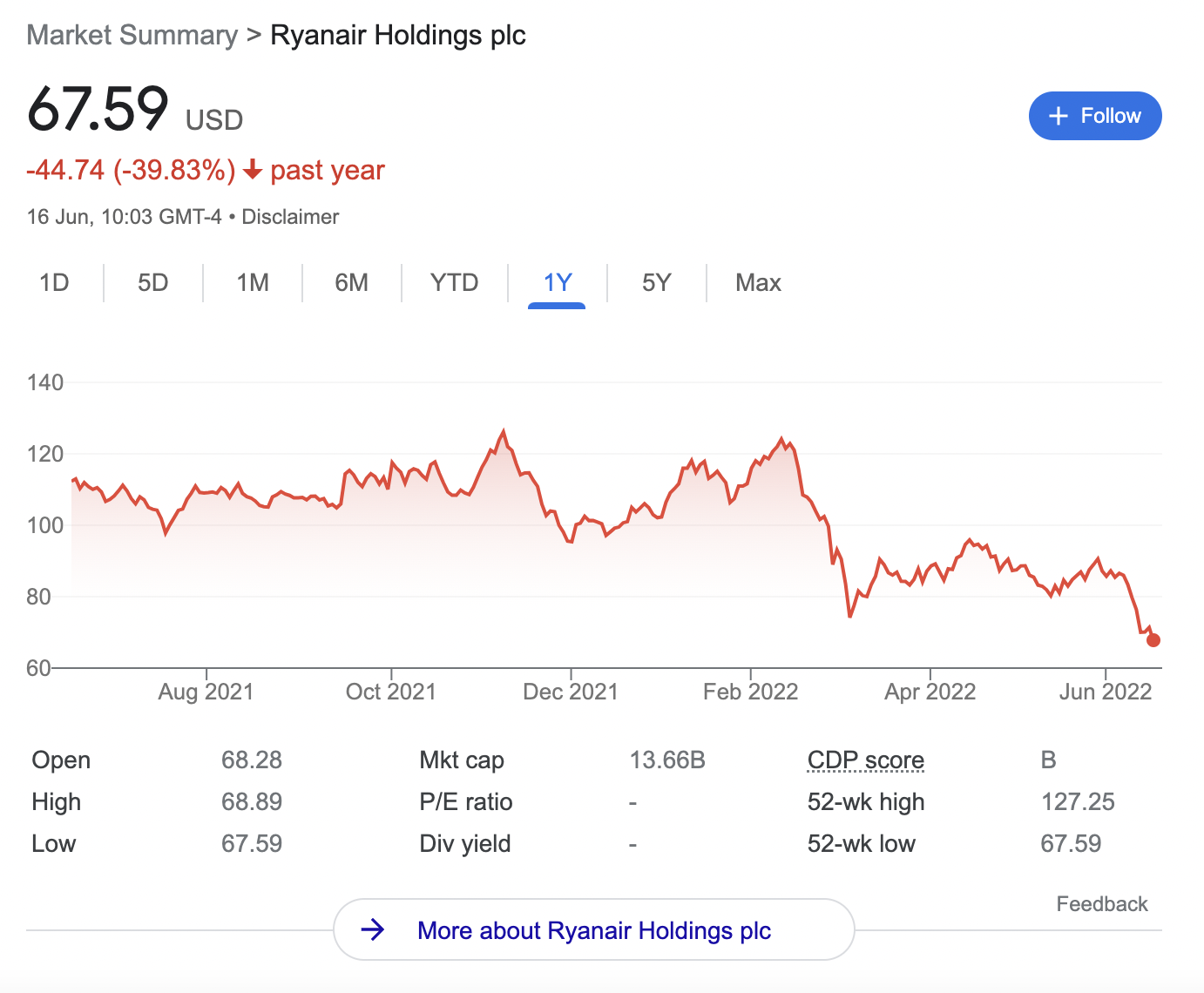

6. Ryanair

Ryanair is the largest airline in Europe, with its fleet of 470 carriers flying to over 200 destinations in 40 countries. Naturally, Ryanair, like all airlines, suffered from global travel restrictions as per COVID.

After all, before COVID being declared a pandemic, Ryanair shares were in a strong upward trend. Nonetheless, over the prior 12 months, Ryanair shares are down 36%.

While Ryanair opted to delist from the London Stock Exchange – citing Brexit as the key motivator, the shares are also listed on the NASDAQ.

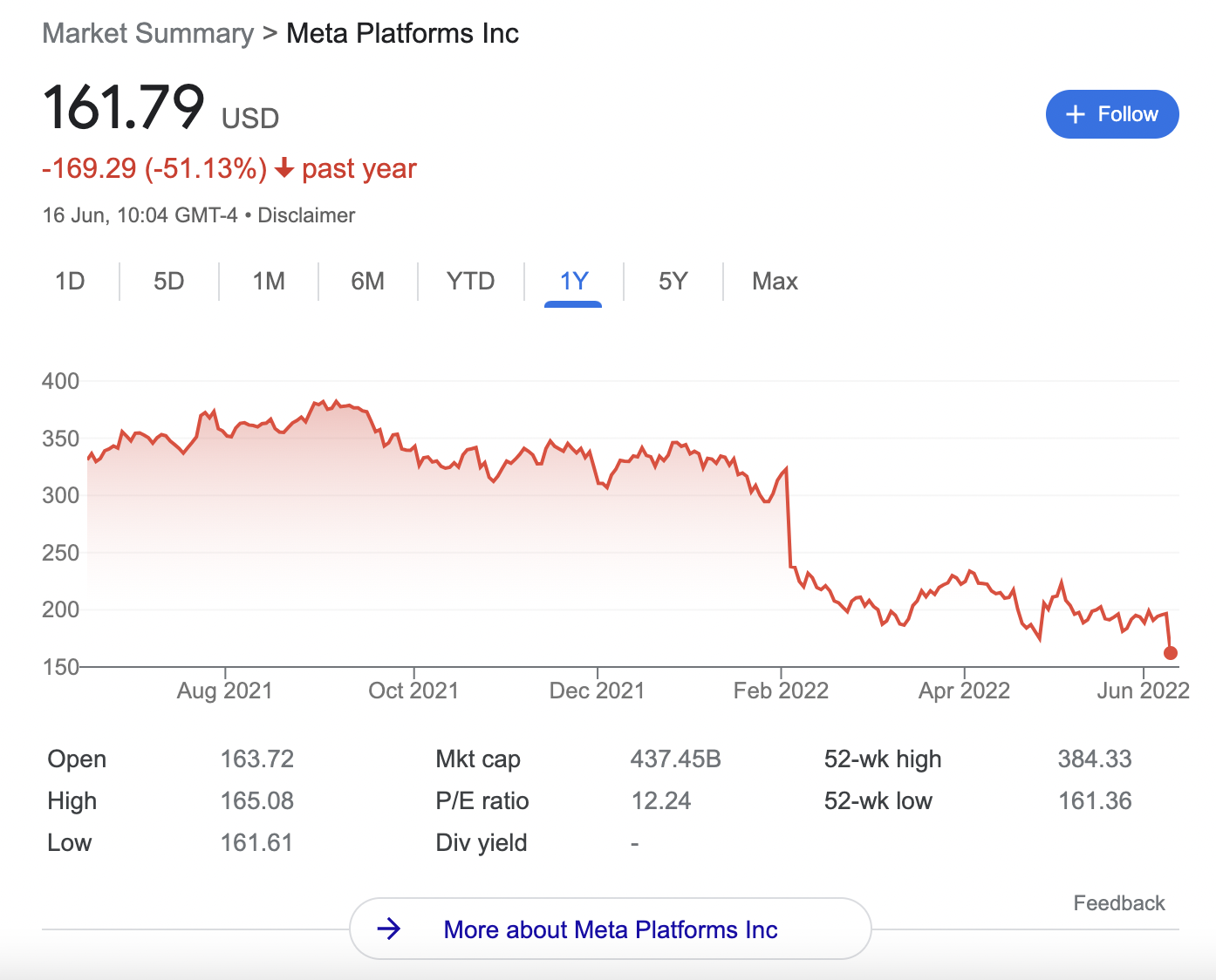

7. Meta Platforms

Meta Platforms is the parent company of some of the largest social media platforms globally. This is inclusive of Facebook, Instagram, and WhatsApp. The firm also owns dozens of other subsidiaries, which include the virtual reality brand Oculus. Although Meta Platforms reported strong quarterly revenues, its shares continue to decline in value.

In fact, over the prior 12 months, Meta Platforms shares are down nearly 50%. However, considering that several billion people use at least one of the firm’s social media platforms every day, Meta Platforms is home to a significant customer base – especially when it comes to advertising revenues.

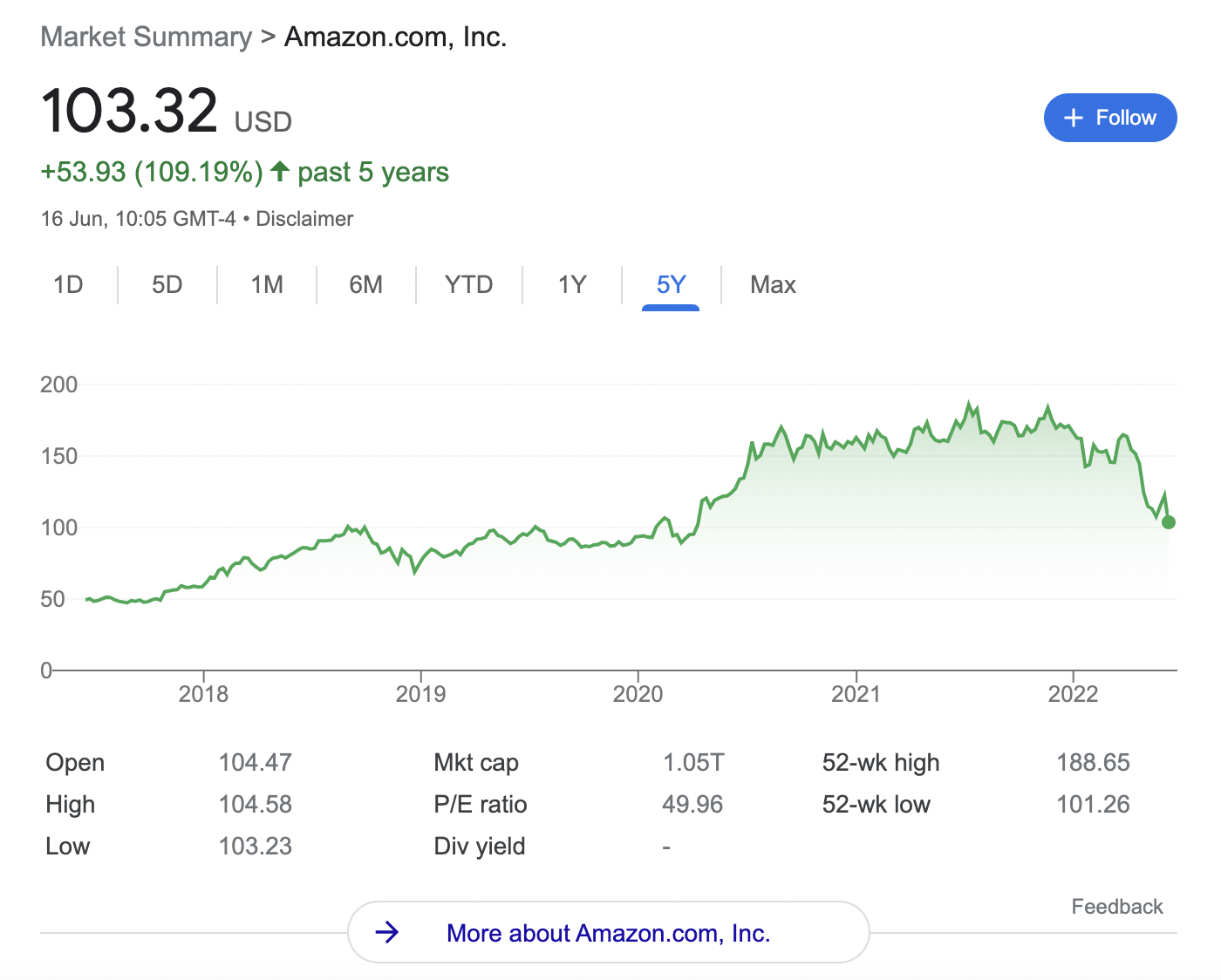

8. Amazon

Like most tech companies, Amazon is yet another stock that has seen its share price decline in recent months. In fact, over one year, Amazon shares have declined by nearly 37%. Considering how dominant this powerhouse is in many of the markets it operates in.

After all, not only is Amazon a major leader in the e-commerce and retail spaces, but also cloud computing and streaming services. The firm is also working hard on emerging technologies like artificial intelligence and drone deliveries. Wondering how to buy Amazon shares in the UK? Read our in-depth guide on how to invest in AMZN stock today.

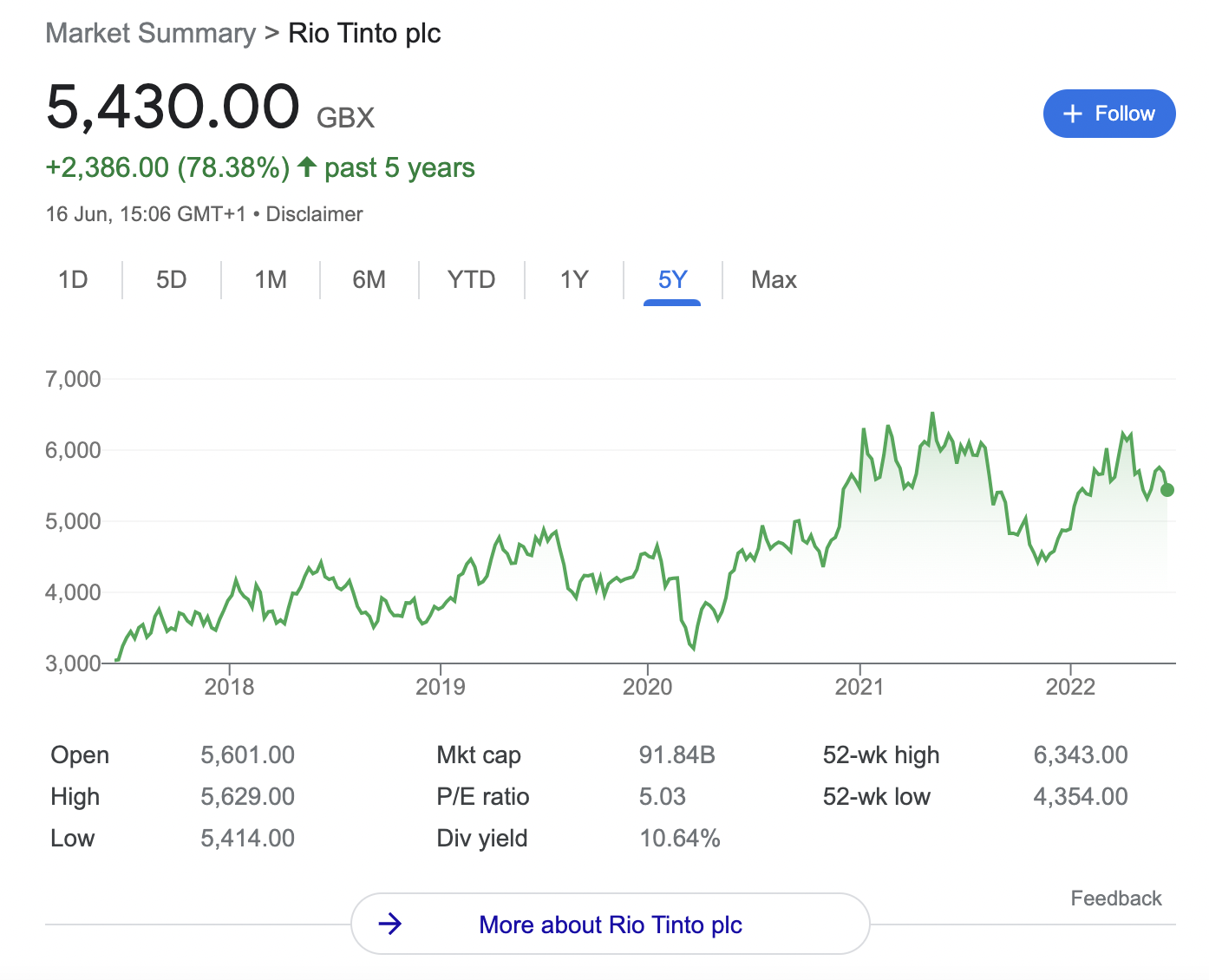

9. Rio Tinto

This firm is a major mining company that is involved in a wide variety of commodities. This includes uranium, iron ore, copper, diamonds, raw materials, and more.

Over the prior five years of trading, Rio Tinto shares are up 80%. Once again, this smashes through the FTSE 100 average for the same period. We also like the huge running dividend yield of over 10% that Rio Tinto is offering as of writing. Another reason that we like Rio Tinto is that it is currently carrying a P/E ratio of just over 5 times.

10. Chevron

Chevron is the second oil company to make our list of popular shares to watch today. This firm, just like Shell, has benefited tremendously from rising oil prices over the prior 12 months, with its shares increasing by nearly 50%. In addition to this, Chevron is offering a running dividend yield of over 3.4%.

This is especially the case considering that as per its most recent earnings report, revenues were up 68% year-over-year to $52.31 billion. Free cash flow levels were up massively too, with a year-over-year increase of 74% to $6.47 billion.

How to Buy Penny Stocks in the UK

In theory, all UK shares are penny stocks. The reason for this is that UK shares are traded in pennies as opposed to pounds. With that said, the consensus is that penny stocks carry a share price of less than £1 – or 100p.

Moreover, when researching where to buy penny stocks in the UK, consider the following:

- Penny stocks are typically traded on OTC (Over-the-Counter) markets, which means that UK retail clients will need to find a specialist broker that has access to the respective marker.

- Furthermore, penny stocks often carry a very small market capitalization. This means that the share price will be a lot more volatile.

- And of course, penny stocks trading on the OTC markets do not have to release as much public information as those listed on the London Stock Exchange.

- Therefore, this opens the doors to manipulation and inside trading.

Are Shares Taxed in the UK?

UK tax on shares can appear confusing at first glance.

The main takeaway is that:

- When selling shares for a higher price than originally paid, the proceeds will be liable for capital gains tax.

- However, UK residents get an annual capital gains tax allowance of £12,300

- This means that any capital gains made in 2022/23 below £12,300 will not be liable for tax

- Share dividends are taxed too. UK residents get an annual allowance of £2,000.

- After the dividends allowance is used, those on a basic and higher rate will pay 8.75% and 33.75 respectively. Additional rate bands will pay 39.35%.

In addition to the above, buying shares on the London Stock Exchange will attract a stamp duty tax of 0.5%. Some brokers will waiver this tax – be sure to consult with a qualified advisor for guidance on tax.

How to Buy Shares in the UK – Step-by-Step Guide

This guide below will show you how to buy shares in the UK using a broker.

Step 1 – Select Broker

This step is arguably the most important as different brokers will offer different features, trading options, and fees. Our list above has offered brief reviews on eight leading platforms.

Step 2 – Create Account and Get Verified

All those sites listed above are available to create an account via their websites or with dedicated mobile apps – they are free and available on iOS or Android.

Whichever broker you choose to go with, they will have a similar sign-up process that involves completing Know Your Customer (KYC) verification.

Users will need to create an account with a username, email address, phone number, and password. Some brokers may also require users to complete a questionnaire.

The next step is then to verify their identity – this includes confirming the email address and phone number, as well as providing a photo ID such as a passport or driver’s license. Some platforms may also need users to offer proof of address.

Step 3 – Deposit Funds

Once the account has been verified, the investor can deposit funds into it.

Brokers allow users to deposit in several ways, including with a debit card, bank transfer, PayPal, or via an e-wallet such as Google Pay or Apple Pay.

However, users should note that different brokers have different fees and minimum deposit amounts, while different methods can take varying times to process.

Step 4 – Find the Share and Execute a Trade

Once funds are deposited, the user may begin trading – they can find shares simply by searching in the search bar, which is usually prominent on the homepage.

Find the relevant share, press the ‘Trade’ button and then select either ‘Buy’ or ‘Sell’ – depending on whether the investor wants to go long (expects the price to go up) or short (expects the price to go down).

Enter the purchase amount and then complete the transaction. The shares will then be stored in the wallet or portfolio section of the account.

Step 5 – How to Sell

To sell a share on, navigate to the wallet/portfolio and then select the relevant share you wish to sell from your list of assets.

After confirming the sell order, brokers will action that instantly if the market is open. If it is not, the sale will be executed immediately after the market reopens.

Conclusion

In summary, this beginner’s guide has explained the nuts and bolts of how to buy and sell shares in the UK. We have also covered popular shares to watch right now and what factors need to be considered before an investment is made.

We have outlined a number of the best places to buy shares in the UK, with each offering varying features, share options, and fees.