Want to invest in Bitcoin UK? Is now the right time? Bitcoin is currently priced at just under $38k. Early August 2021 was the last time the Bitcoin price was this high. And then within ten weeks it rose by 70% hitting almost $66k by late October. Is Bitcoin starting to pump again, ready to spike in value once more over the coming months?

Below we make the competing views around Bitcoin simple to understand. What’s more, we show you how to invest in Bitcoin UK.

How to Invest in Bitcoin UK – Quick Guide

- Step 1: Open a Binance account

Head to the Binance website. Fill out a few personal details. Get verified by supplying photo ID and address ID. - Step 2: Deposit

Use a suitable payment method to add funds to the account. - Step 3: Search for Bitcoin on Binance

Just search ‘BTC’ in the top navigation bar. - Step 4: Invest in Bitcoin UK

Enter the amount of tokens you wish to purchase on the order box, and confirm the transaction.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Where to Invest in Bitcoin in the UK

To get your Bitcoin investment strategy underway, you need to find the best Bitcoin broker UK or exchange to take your business. We review 4 brokers and exchanges to suit crypto-hungry investors of all experience levels.

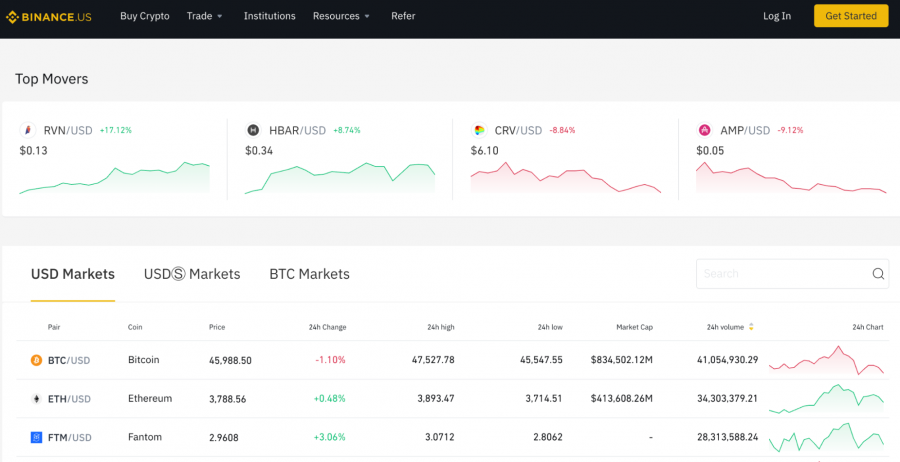

1. Binance – Trusted Bitcoin Exchange for Advanced Crypto Investing

Binance is an exchange that boasts the largest volume of crypto trading in the world. The upside of Binance is that it offers some of the lowest fees around, at 0.1% commission on investing in Bitcoin UK. The downsides are that the tool-filled site can be mind-boggling for beginners and, what’s more, Binance is not regulated in the UK.

Binance is an exchange that boasts the largest volume of crypto trading in the world. The upside of Binance is that it offers some of the lowest fees around, at 0.1% commission on investing in Bitcoin UK. The downsides are that the tool-filled site can be mind-boggling for beginners and, what’s more, Binance is not regulated in the UK.

With Binance, you can use fiat currency in your account or credit card to buy Bitcoin. If you are feeling a little more advanced, you can use Binance’s Peer-2-Peer trading system and trade Bitcoin with other investors.

Generally Binance is packed with advanced trading options. This can be empowering for advanced traders but overwhelming for the beginner. The Binance smartphone app is set up to make things simple if you prefer: you can switch from the normal interface to Binance Lite. The smartphone app has received a good average score of 4.7/5 from 96k reviews on the App Store and 4.3/5 from 570k reviews on Google Play. A common complaint from reviewers, however, is that Binance’s verification protocols are sketchy.

Binance offers a free crypto wallet, the Binance Trust Wallet, as well as crypto staking options.

Cons

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Mode – Popular Bitcoin Trading App with Bitcoin Rewards

With Mode, you don’t have to worry about how to invest in Bitcoin UK. That is because Mode rewards you for your loyalty with free Bitcoin. In one handy smartphone app, Mode provides a digital wallet that gives you Bitcoin when you spend with partner outlets — as well as allowing you to buy Bitcoin yourself at a commission of 0.99%. This 0.99% fee is a competitive offering given the integrated utility as well as incentives offered by Mode.

The Bitcoin you hold with Mode not only benefits from any rise in Bitcoin price, but you can earn interest on your Bitcoin at a rate of 5% APY. Interest is paid and compounded weekly. You can withdraw Bitcoin for a fee of 0.0005 BTC with a minimum transaction value of $10.

Mode is all about convenience. The app means you can flash your phone to pay at 31 partner outlets using either your Mode balance or your UK bank account (16 UK banks covered). You verify your payment with a few taps using Face or Touch ID technology. You then receive Bitcoin directly to your Mode account as a loyalty incentive, and you can even send and receive Bitcoin amongst friends on the Mode network.

Earning Bitcoin passively is a great way to go about investing in Bitcoin UK. That’s because you don’t need to worry about timing the market, or losing money, as you do with conventional investing. And, when it comes to security, Mode is no slouch. Your Bitcoin is stored with crypto custodian BitGo. Most of Mode’s Bitcoin is held with BitGo in cold storage, which means the storage is not connected to the internet and therefore safer from Bitcoin thieves. BitGo is insured by Lloyds of London up to US $100m.

One teething problem that faces all fintech digital wallets is users being frozen out of their account on suspicion of fraudulent activity. Judging by its Trustpilot reviews, Mode is no exception to this trend. In attempting to keep user funds safe, fintech firms are often over-zealous and freeze accounts just to make sure nothing is being stolen. Better safe than sorry.

Mode came to market in the form of an IPO on the London Stock Exchange in October, 2020. You can invest in Mode using the ticker symbol MODE. It is the only LSE-listed firm to hold both an FCA Electronic Money Institution License as well as crypto asset registration.

Cons

3. CEX – Leading Exchange With Over 70+ Cryptos

A strength of the exchange is the wide variety of deposit methods for GBP, including credit card, SWIFT, wire transfer, Skrill and Epay. Also, GB investors can deposit using credit card at a discounted commission of 1.49% rather than the standard 2.99%. Note that other brokers, permit credit card deposit for free. Disappointing here too is the absence of PayPal deposit and withdrawal, which many GB Bitcoin investors prefer.

When it comes to trading fees, CEX follows a sliding maker-taker scale like Binance. If you buy less than $10k of Bitcoin, for example, you will pay a taker fee of 0.25%. As with all brokers and exchanges, spread fees apply on Bitcoin prices.

Generally CEX offers an impressive suite of products, with a free crypto wallet, a mobile app, a debit card with reward package, crypto staking and even loan options.

Cons

4. Coinbase – Trusted Bitcoin Exchange Listed on NASDAQ

- Size: Coinbase was the first exchange ever to come to market with an April 2021 IPO on the NASDAQ. As such, Coinbase has a high profile and boasts 73m verified users internationally. This giant following is reassuring for newcomers to investing in Bitcoin.

- Security: famously, 98% of Coinbase customer funds are stored offline. ‘We distribute Bitcoin geographically in safe deposit boxes and vaults around the world.’ Affirms Coinbase. Back to pen and paper then! It certainly guarantees against cyber-fraud.

- Scope: Coinbase offers a selection of 50+ crypto, including Bitcoin.

To start investing with Coinbase, you get signed up, link your bank account, and trade Bitcoin using the currency in your account. You can buy Bitcoin with a credit card instantly – but watch out for the hefty 3.99% fee on credit card purchases.

When it comes to trading fees, Coinbase offers a dual structure. This combines flat fees and commissions. Coinbase users have long complained that this fee system is both expensive and confusing. The good news is that Coinbase CEO E. Choi signalled last year that a ‘compression’ of the fee structure is on the cards.

Coinbase offers a smartphone app that replicates the desktop Bitcoin investing service. The Coinbase app has been well-received, receiving an average rating of 4.7/5 from 1.6m reviewers on the App Store and 4.3/5 from 632k reviewers on Google Play.

Many Brits looking to invest in Bitcoin UK appreciate the convenience of PayPal. So it is a bit of a blow for UK Bitcoin investors that you can only use Paypal for withdrawals with Coinbase.

All in all, Coinbase offers a well-established service with many advantages. But it is an exchange rather than a broker, and thus not regulated by the UK’s FCA. Coinbase’s fees can be off-putting too.

Cons

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

What is the Best Way to Invest in Bitcoin?

Let’s review how to invest in Bitcoin UK. There are two main methods of Bitcoin investment – buying the coin as a crypto, and buying into stocks that have a relationship to Bitcoin.

Buying Bitcoin

- You can buy Bitcoin instantly with a credit card with exchanges like Coinbase, Binance and CEX. But watch out for credit card commissions.

- With a broker, you can deposit funds into your account and buy and sell Bitcoin at locked-in prices.

- You can invest in the price of Bitcoin against other crypto and fiat currencies using what are known as crypto and currency pairs.

- If you are feeling adventurous, you can seek out a Decentralised Exchange (DEX) and trade Bitcoin with other investors in a less regulated environment.

- You can trade Bitcoin directly with other investors too with Peer-2-Peer trading (offered by Binance and other providers). But this can be risky, because you are trusting individuals you do not know.

Investing in Bitcoin Stocks

Blockchain ETFs (Exchange Traded Funds) allow you to invest in the stock of companies involved in Bitcoin-related technologies and business.

Bitcoin Exchange Traded Funds (ETFs) are just coming onto the market. Bitcoin ETFs like the Pro Shares Bitcoin Strategy ETF (available with Capital.com) allow you to invest in Bitcoin futures.

Should I Invest in Bitcoin?

Follow the Big Players

Financial markets aside, Bitcoin continues to be taken up in the real world as a valid currency for the future. An entire country, El Salvador, has allowed Bitcoin to be used as legal tender since September 2021. Giant payment providers PayPal, Mastercard and Visa have all said that they will support Bitcoin payments; and Apple and Amazon are rumoured to be getting involved too.

Follow the Banks

When it first came on the scene, Bitcoin was seen as an enemy to the big banks as it offered a decentralised way of doing transactions that cut the banks out. But the banks are now getting involved. 85% of institutional investors surveyed in 2021 said that they planned to begin, or increase, investment in Bitcoin over the next two years.

Hedge against Inflation

Over the long-term, Bitcoin is widely seen to offer a hedge against price inflation. That is because the supply of Bitcoin is limited, so it cannot reduce in price owing to oversupply. Cash does suffer from this problem, because governments sometimes print more money, thus increasing the supply of cash and making it worth relatively less. Currently, inflation in the US is at a 40-year high, thanks in part to pandemic pressures.

Bitcoin’s usefulness as a hedge against inflation depends, of course, on whether its price maintains an upward trajectory. Since its launch, Bitcoin’s annual return has averaged 230%.

Buy the Dip

Bitcoin recently reached a point at which its 50-day moving average crossed below its 200-day moving average. This means, in real terms, that Bitcoin’s price has been doing worse recently than it has over the longer-term. One theory of technical charting calls this point ‘the Death Cross’ and says that this means Bitcoin could slip into a long-term decline in price. But technical analysis like this has been proved wrong time and time again. The reality is that Bitcoin is currently priced lower than it has been for 6 months. So, if it is ever to rise in value again, which is likely, now might be a sensible time to buy when it is relatively cheap.

Spread your Risk

If you want to invest in Bitcoin UK and make sure you do not miss out on opportunities, you can minimise your risk in many ways. The best way to reduce the risk of your Bitcoin investment is to balance it with investments in other assets. Make sure no more than 1%-5% of your investment portfolio is dedicated to Bitcoin or crypto in general. For those with a high risk tolerance, buying BTC to play in the best Bitcoin casinos UK is a popular option.

Choosing a Bitcoin Wallet for Investing

A Bitcoin wallet is a piece of digital software that means you can invest in Bitcoin UK and then store your Bitcoin, send it elsewhere or use your coin to earn rewards with crypto staking.

Bitcoin wallets are generally called crypto wallets, because you can store many types of crypto in them. Your Bitcoin wallet has a unique digital address, which acts as a mailing address on the blockchain. ‘Cold’ wallets spend most of their time not connected to the internet; this makes them safer from cyber-fraud. ‘Hot’ wallets are always connected to the internet.

Bitcoin Investment Strategies

The best way to invest in Bitcoin UK depends on your risk appetite.

- For investors with a high-risk appetite, there is the option to devote over 5% of your investment portfolio to Bitcoin alone. (In the UK, it is not permitted to enter leveraged trades with crypto – otherwise this would be the way to go for huge Bitcoin rewards at great risk).

- For medium-risk investors, investing in Bitcoin with a more experienced trader making the decisions might suit.

- For low-risk investors, investing in a crypto fund that features Bitcoin along with other crypto is the safest option.

How to Invest in Bitcoin & Make Money – Example

Between November 2020 and November 2021, Bitcoin rose in value by 300%. If the same rate of growth picks up again and you were to make a $1000 Bitcoin investment UK right now, with Bitcoin priced at just under $40k, you could be looking at having $3000 worth of Bitcoin this time next year.

Many investors ponder how to invest in Bitcoin and make money: the answer is always ultimately to make the investment. But, of course, with any crypto it is only sensible to invest money you can afford to lose, thanks to the price volatility of the sector.

When is the Best Time to Invest in Bitcoin?

All cryptos are volatile. Their prices go up and down with a speed no other asset class can match. That makes crypto riskier than other investments, but it also means the potential gains are sky-high. Nobody can predict the future of any asset price, let alone crypto. But what we do know for certain is that when Bitcoin surged to $64k in April 2021, it became the best-performing asset class of the decade with an annualised average return of 230%. If that average return continues, the best time to invest in Bitcoin is right now, particularly as it was only this cheap (sub-$40k) 6 months ago.

How to Invest in Bitcoin UK – Tutorial

Step 1: Choose a Crypto Exchange

Firstly, investors must select a suitable crypto trading platform. One of the top brokers is Coinbase – which is used by millions around the world.

Step 2: Create an Account

Head over to the Coinbase website or mobile app, and fill in the necessary information.

Step 3: Verify Your Identity

Before trading with Coinbase, investors will be required to verify their identity. Upload a copy of your passport/driver’s license.

Step 4: Deposit your Funds

Select a suitable payment method, and make a deposit on Coinbase.

Step 5: Search and Buy Bitcoin

Investors can type ‘Bitcoin’ on the Coinbase search bar and hit ‘Enter’. Now, enter the purchase amount and confirm the transaction.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Bitcoin ETF Token – Top Presale Alternative to Bitcoin Investment

Bitcoin will remain the king of cryptocurrencies for the foreseeable future. It is typically the first token that large institutions will purchase when entering the market, and the same applies to smaller investors. It is also the largest by overall market capitalization as well as the original cryptocurrency.

However, it might not offer the upside in comparison to some of the more modern coins, such as Bitcoin ETF Token ($BTCETF). We liked this ERC-20 token as an alternative because it is linked to the Bitcoin markets (mainly through BTC ETF approval) while still providing the many benefits of presale investment.

In its early stages, it stands to appreciate more in comparison to Bitcoin, which has already experienced its major growth stages. $BTCETF, in contrast, is priced at $0.005 and is set to rise to $0.0068 by the final stage, stage 10. It could also be a 10x coin, according to some analysts, and BTC is unlikely to 10x like a presale token.

In addition, the presale campaign offers yields above 5,500% as well as a 25% token burning policy. Of the 2.1 billion supply, 525 million will be burned through a burn tax on each transaction. The 5% burn tax is reduced by 1% at specific roadmap milestones, such as BTC ETF approval and the launch of the first BTC ETF for trading.

Presale investments often offer much more upside but do come with increased risk – this presale has a lot of incentives but it relies on Bitcoin ETF approval. So it might be a good idea to diversify assets with some BTC and some $BTCETF. However, it did conduct a robust smart contract audit, and only one low-risk issue was found.

For more details, investors should read the Bitcoin ETF Token Whitepaper, and also join the Telegram channel for essential updates relating to BTC ETF approval.

Conclusion

To invest in Bitcoin UK, Coinbase is our top pick because of its fees, features and global user base.

An alternative would be Bitcoin ETF Token, which offers more upside potential but is tied to the fate of Bitcoin ETF approval by the SEC. It might be a great coin to hold if the approval were to occur, possibly appreciating by far more than Bitcoin or Bitcoin ETFs.

Crypto assets are highly volatile and unregulated in most EU countries, Australia, and the UK. No consumer protection. Tax on profits may apply. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.