UK investors of all shapes and sizes now have access to a wide range of crypto exchanges. This means that from the comfort of home – you can buy and sell digital assets like Bitcoin and Dogecoin at the click of a button.

In this guide, we list and review the best crypto exchanges UK investors are accepted at right now – in terms of safety, fees, supported coins, and more.

The Best Crypto Exchanges UK for 2024

The best crypto exchanges in the UK – as per our in-depth research, can be found below.

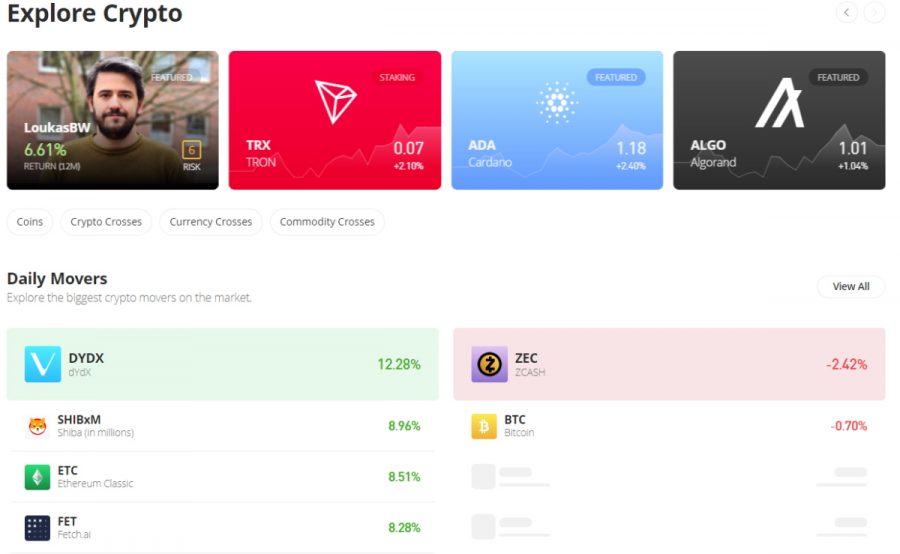

- eToro – Overall Best Crypto Exchange UK

- OKX – Powerful Crypto Exchange with Minimal Fees

- AQRU – Leading Crypto Exchange with Crypto Savings Account

- Bitstamp – Long-Running Crypto Exchange with Low Trading Fees

- Crypto.com – Top Crypto Exchange with User-Friendly Mobile App

- Margex – Best Exchange to Buy Crypto on Margin

- Huobi – Great Crypto Exchange for Earning Interest

- Binance – Best Crypto Trading Platform UK for Low Commissions

- Coinbase – One of the Best Bitcoin Exchanges for Beginners

- Uphold – Trade More Than 115 Cryptocurrencies

- CEX – UK-Based Crypto Exchange Established in 2013

- Coinjar – Simple Exchange to Buy Crypto in the UK

- Luno – Popular Cryptocurrency Exchange App

Read on to find out which of the above UK crypto exchanges are right for your requirements.

Top Bitcoin Exchanges in the UK Reviewed

When researching crypto exchanges that align with your personal needs – you need to consider which markets the provider supports, how much you will be charged to trade, and whether or not the platform is safe.

To locate the best crypto exchange in the United Kingdom for your investment goals – consider the nine platforms reviewed below.

1. eToro – Overall Best Crypto Exchange UK for 2024

The overall best crypto exchange in the UK right now is eToro. After you have made a deposit you can then buy and sell 70+ cryptocurrencies – including Bitcoin, Ethereum, Cardano, Fantom and more.

You can also invest in trending meme coins as eToro has listed Dogecoin and buy Shiba Inu, as well as metaverse coins.

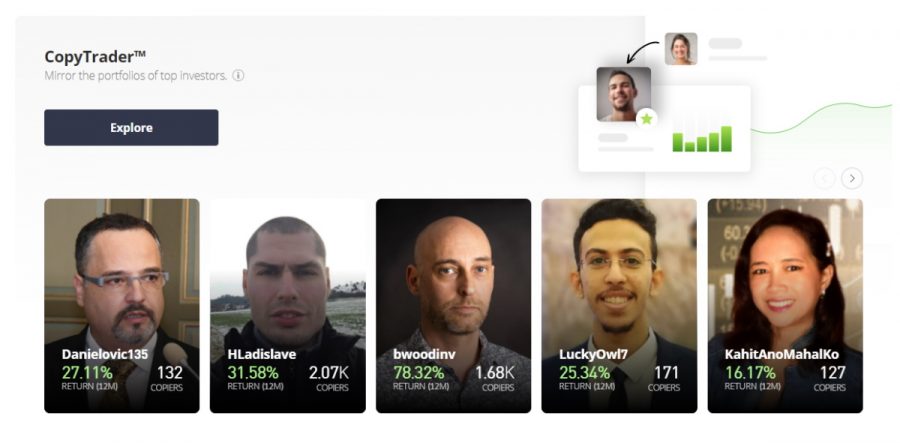

eToro also offers passive investment tools – there is a professionally managed Smart Portfolio that gives you access to a diversified basket of digital assets. Alternatively, if you want to actively trade cryptocurrencies there is a Copy Trading tool. As the name suggests, this allows you to copy other traders.

If you’re looking to invest in financial products other than cryptocurrencies, eToro also allows you to buy thousands of UK and international stocks and ETFs. You can also trade forex, commodities, indices, and more. Read our eToro review UK for more details.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 70+ | Tight spreads | 1% | $10 |

What we like

- Supports copy trading

- Offers wide range of payment methods

- 70+ cryptos supported

- 25 million global users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2. OKX– Powerful Crypto Exchange with Minimal Fees

Following its early 2022 rebrand, OKX (previously OKEx), has quickly risen the ranks to become one of the best crypto exchanges in the UK. Thanks to its educational material and range of advanced trading features, OKX is a great option for any investor regardless of experience.

As any top exchange should, OKX makes every effort to look after its customers and their funds. On top of holding 95% of client funds offline in cold storage, OKX takes security an extra step further by using semi-offline wallets to hold the remainder of its assets. Considering OKX is one of the few exchanges yet to be hacked, it seems this security-focused approach is paying off.

One of the main draws to OKX is the platform’s low fees. With just 0.1% taker and 0.08% maker fees, OKX is far cheaper than many alternatives on the market. With that said, OKX doesn’t disclose its deposit fees so investors are recommended to double-check their payment method of choice before purchasing.

Anyone that chooses to invest with OKX can also use their crypto as collateral for a fiat loan. As this allows people to temporarily use their crypto for purchases without worrying about capital gains taxes, it’s a big bonus for UK-based investors.

OKX is an excellent exchange. In addition to the platform’s educational resources and crypto-backed loans, it’s got a ton of features designed to make trading easier and more efficient. Combined, all of these factors make OKX one of the best crypto exchanges in the UK.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 140 | 0.1% Taker 0.08% Maker | 0.1% | $10 |

What we like

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

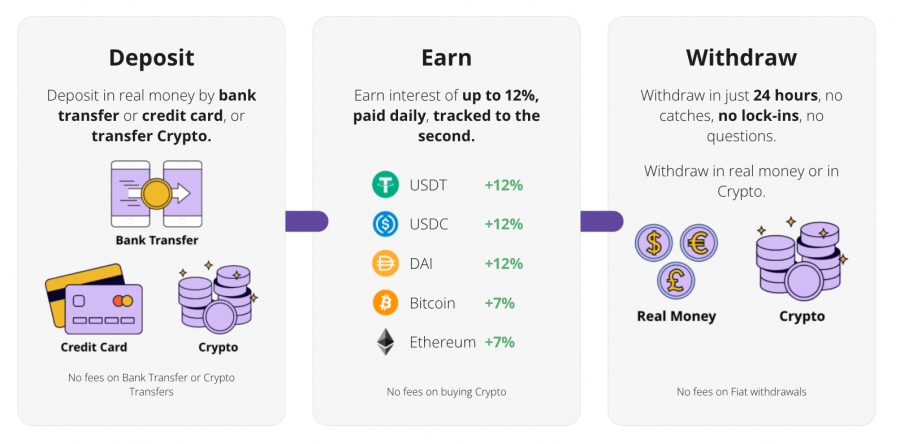

3. AQRU – Leading Crypto Exchange with Crypto Savings Account

Users can fund their AQRU account in BTC, ETH, USDT, USDC, or DAI and instantly begin generating interest on their holdings. AQRU offers up to 12% interest per year on stablecoin deposits and 7% on BTC or ETH deposits – far higher than what you’d get in a traditional savings account. Notably, interest is paid daily, and there are no lock-up periods to contend with.

If you wish to purchase crypto through the AQRU platform, the process is facilitated by the leading payments gateway MoonPay. AQRU doesn’t charge any fees for its yield-generation services, although there may be some third-party fees if you opt to buy cryptocurrency via MoonPay. Finally, AQRU even has a referral bonus scheme where you can receive 75 USDT for yourself and a friend if they sign up using your link.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 5 | Faciliated via MoonPay | No fee (third-party fee may apply) | No minimum |

What we like

- Can purchase crypto via MoonPay

- Up to 12% interest on crypto deposits

- Supports five different digital currencies

- No lock-up periods

- Free FIAT deposits

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

4. Bitstamp – Long-Running Crypto Exchange with Low Trading Fees

Bitstamp charges a flat 0.5% fee when you place a crypto trade, which falls to only 0.25% if you exceed $10,000 in trading volume per month. Alternatively, users can buy crypto instantly using a credit or debit card, although this will cost 5% per transaction. In terms of safety, Bitstamp holds 98% of customer holdings offline and provides asset protection through BitGo insurance.

When trading with Bitstamp, you can trade on either of the two web-based platforms or the mobile app, all offering a user-friendly and safe experience. The app itself is incredibly well designed, featuring biometric authentication and the ability to send and receive crypto instantly.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 50+ | 0.5% per trade | 0.5% | No minimum |

What we like

- No minimum deposit

- Low trading fees

- Long-running reputation

- Free deposits via Faster Payments (FP)

- Biometric authentication on app

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

5. Crypto.com – Top Crypto Exchange with User-Friendly Mobile App

Another of the best crypto exchanges in the UK to consider is Crypto.com. Crypto.com has burst onto the scene during the past year and now has over 10 million users globally. The platform caters to beginners and advanced traders alike, offering a web-based exchange and a handy mobile app. Crypto.com’s exchange allows users to buy and sell cryptocurrencies with a 0.4% maker/taker fee – which can be reduced if you opt to pay fees in CRO.

The Crypto.com app is very well-designed, with clear tabs along the bottom for all major sections. Users can track specific assets and even stake CRO, with 34.6% APY offered.

Through their Crypto Earn feature you can earn interest on 50 cryptocurrencies at up to 14.5% APY, including stablecoins such as USDT and USDC at up to 10% APY.

Notably, Crypto.com allows users to buy crypto via the app using a credit or debit card – removing the need to deposit. This feature is free for the first 30 days, although it will accrue a 2.99% fee after that.

Aside from the trading app, Crypto.com also offers a free crypto wallet app, which is non-custodial and supports over 100 different coins. The wallet app even allows users to send crypto to other Crypto.com wallets at various speeds, providing scope to save on network fees. Finally, Crypto.com even has a dedicated ‘University’ section, complete with an array of educational articles targeted at beginners.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 250 | Maker-taker fees | From 0.4% | $20 |

What we like

- Only 0.4% maker/taker fee

- Fee-free card purchases for first 30 days

- Free crypto wallet app

- Over 150 cryptos to trade

- Dedicated educational section

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

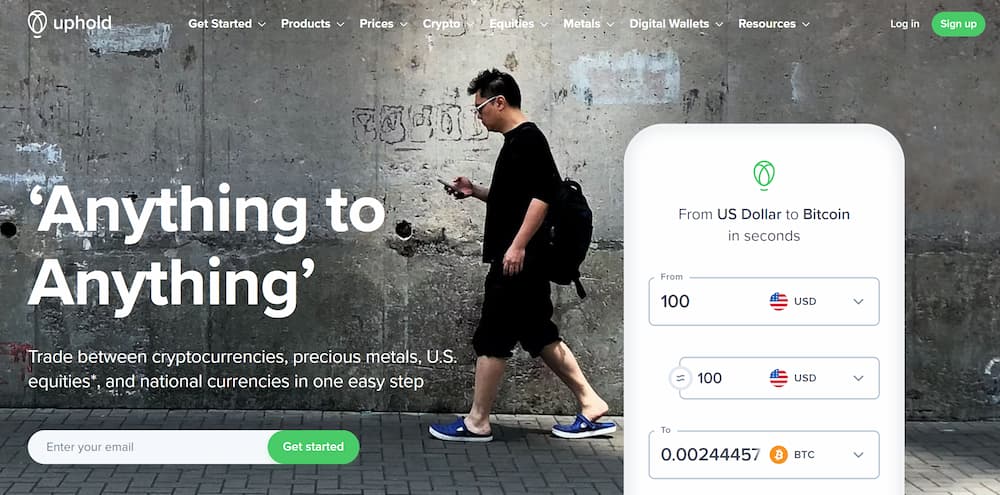

6. Uphold – Trade More Than 115 Cryptocurrencies

Uphold doesn’t charge a commission for crypto trades, but it does charge a variable spread. The spread varies by cryptocurrency and depends on market conditions, but is usually between 0.8% and 1.2% for popular cryptocurrencies. You can see the current spread for any digital currency when you preview an order and decide whether or not to trade.

Uphold does a few things differently from other cryptocurrency exchanges. For one, it prides itself on transparency. Users can check how much cash Uphold has in reserves at any time to protect against market downturns and customer withdrawals. In addition, the platform routinely undergoes third-party security audits to make sure that its system is safe against hacks.

Uphold also has more than just cryptocurrency available to trade. This brokerage platform offers stock and commodities trading, so it’s a good all-in-one option for traders who want to trade a wide variety of assets.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 115 | Spreads | 0.8%-1.2% | $10 |

What we like

- 115 cryptocurrencies to trade

- Supports stock and commodity trading

- Preview the spread before every trade

- Transparent financial reserves

- Third-party security audits

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

7. Margex – Best Exchange to Buy Crypto on Margin

When you open a margin trade with Margex, you can choose your leverage and explicitly see the price level at which your trade will be liquidated. You can also see your maximum risk, enabling you to make smarter trading decisions.

Margex offers an advanced crypto trading platform that’s packed with tools for technical Bitcoin trading. You’ll find dozens of technical indicators, customizable charts and drawing tools, price alerts, limit and stop loss orders, and much more. Margex also displays the Bitcoin order book and recent trades so you can stay one step ahead of the market.

Margex charges competitive fees for Bitcoin trading. You’ll pay 0.019% when you create liquidity and 0.060% when you remove it from the market.You can go long or short and trade with as little as $1 at a time.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 8 | Maker-taker fees | From 0.019% | $10 |

What we like

- Extremely low maker/taker fees

- Trade with up to 100X leverage

- Advanced technical trading platform

- Minimum trade size is just $1

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

8. Huobi – Great Crypto Exchange for Earning Interest

With that being said, Huobi offers a lot more than just a crypto savings account. On the contrary, the crypto exchange is home to hundreds of markets. This covers a broad range of digital assets – from large-cap projects and ERC-20 tokens to DeFi coins. When it comes to fees, Huobi will charge you 0.20% at both ends of your trade.

This is competitive – and your commission will be reduced further should you increase your 30-day trading volumes or hold the Huobi Token. Perhaps the main issue with Huobi is that the platform does not clearly state what it charges to use a Visa or Mastercard to buy crypto in the UK.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 400 | Commission | 0.2% Base Fee | $100 |

What we like

- Low trading fees

- Supports credit/debit card purchases

- Free crypto deposits

- Useful crypto wallet app

- Huge range of tradeable assets

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

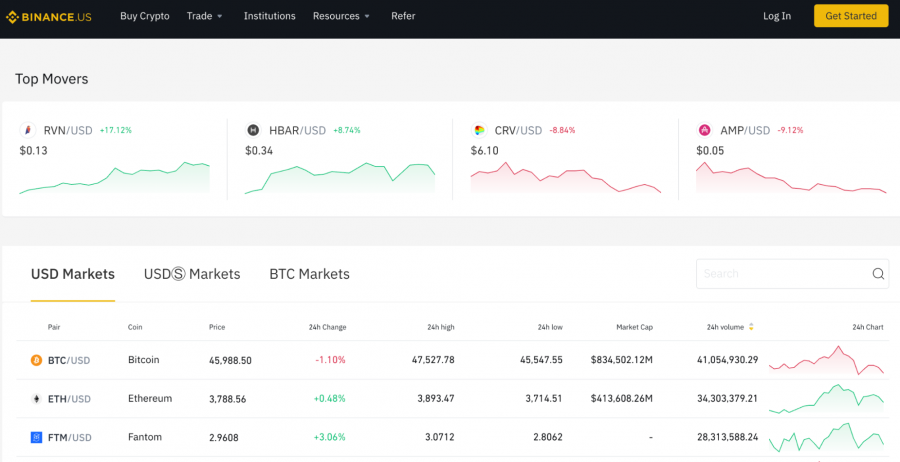

9. Binance – Best Crypto Trading Platform UK for Low Commissions

Next up on our list of the best crypto exchanges in the UK is Binance. Moreover, although you can still buy crypto in the UK with a debit card, you will need to go through a third-party – which is expensive.

On the other hand, Binance is the world’s most popular exchange – dwarfing its competitors in terms of markets, trading volume, and registered account users. In fact, the platform is now used by over 100 million people globally. Once you have funded your Binance account, you can trade more than 1,000+ digital asset pairs at a commission of just 0.10%.

If you’re an active trader or you own some BNB tokens, Binance will reduce your trading commission further. Binance comes packed with lots of advanced trading tools and charting features – which will suit experienced investors that wish to perform technical analysis. You can also set up custom orders – and even elect to receive pricing alerts via the Binance app.

Another core feature at this popular Bitcoin exchange is that it offers crypto savings accounts. You simply need to deposit some tokens and in return – you’ll earn interest. Ultimately, the key issue with Binance is that many question how long the platform can continue to operate without the correct regulatory framework in place – especially in the UK.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 500+ | Maker-taker fees for P2P transactions fees | 0.35% maker fee & 0% taker fee | $3 via Faster Payments |

What we like

- Competitive instant buy fees

- Supports a wide array of digital assets

- Offers a popular NFT marketplace, crypto staking and other features

- Zero account management fees

- Account opening process is simple and fast

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

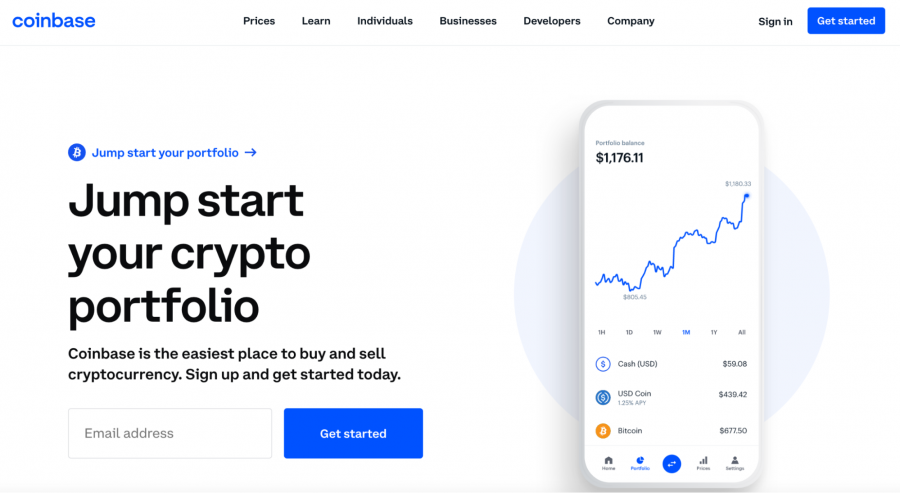

10. Coinbase – One of the Best Bitcoin Exchanges for Beginners

Newbies will like Coinbase – not least because it is home to one of the best crypto exchanges for beginners You can also access Coinbase via a native mobile app that is compatible with iOS and Android. Both the web and app version of Coinbase allows you to buy dozens of cryptocurrencies instantly with a debit or credit card.

Unlike eToro – which charges 0.5% on card payments, Coinbase has a standard transaction fee of 3.99%. You can also transfer funds from your UK bank account for free – and once the money arrives, pay a standard commission of 1.49%. Both options are, however, considered expensive when compared to other crypto exchanges in the UK.

Nevertheless, some investors are happy to pay a higher fee to benefit from Coinbase’s user-friendliness and enhanced security features. Regarding the latter, you’ll find that this UK Bitcoin exchange keeps 98% of client funds in cold wallets and it is mandatory to set up two-factor authentication. When logging into your account from a new IP address – you need to confirm this via email.

Additional features at Coinbase that are worth noting include a highly comprehensive research facility that offers lots of educational guides. Coinbase also offers a fully-fledged cryptocurrency wallet that you can download to your phone. Not only does the wallet give you full control of your private keys – but you can directly exchange tokens without leaving the app.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 100+ | Spreads, fixed fees, commissions | From 0.40% maker fee and 0.60% taker fee. 1.49% per slide. | $50 |

What we like

- User-friendly interface

- Offers access to a wide range of cryptos

- Secure crypto wallet app

- No inactivity fees to worry about

- Responsive customer support

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

The Best UK Crypto Exchanges Compared

Below you will find a comparison table of the best crypto exchanges in the UK – in terms of the number of supported coins, fees, and wallet functionality.

| Number of Coins | Debit Card Fee | Fee to Buy BTC | Proprietary Wallet | |

| eToro | 70+ | 0.5% | 1% | Yes |

| OKX | 140 | Set by MoonPay | No direct fee (third-party fees may apply) | No |

| AQRU | 5 | Not Stated | 0.1% | No |

| Bitstamp | 50+ | 5% | 0.5% on exchange; 5% via card | No |

| Crypto.com | 150+ | 2.99% (free for first 30 days) | 0.4% | Yes |

| Uphold | 115 | 3.99% | 0.8%-1.2% | Yes |

| Margex | 8 | None | 0.060% | No |

| Huobi | 400+ | Not Stated | 0.20% | Yes |

| Coinbase | 100+ | 3.99% | 1.49% | Yes |

| Binance | 1,000+ Markets | Up to 10% | 0.10% | Yes |

| Mode | 1 | Free Bank Transfer Only | 0.99% | No |

| CEX | 70+ | 2.99% | 0.25% | Yes |

| Coinjar | 7+ ERC-20 Tokens | 2% | 1% | Yes |

| Luno | 6 | N/A in UK | 0.10% | Yes |

| Kraken | 50+ | 3.75% | 0.26% | Yes |

What is a Crypto Exchange?

Crypto exchanges allow you to buy, sell, and trade digital currencies. The exchange that you choose to open an account with will effectively sit between you and other market participants. In turn, crypto exchanges collect commissions from the traders that use their platform.

- Although crypto exchanges primarily facilitate buy and sell orders between registered users, many providers in this industry have since expanded into other areas.

- For example, some crypto exchanges allow you to buy digital assets directly with a debit or credit card.

- This effectively means that some exchanges also offer brokerage services.

Moreover, the best crypto exchanges in the UK will also offer cypto investment tools – such as the Copy Trading feature at eToro. This allows you to trade crypto assets passively – as you will mirror the orders of an expert trader.

Copy Trading does not amount to investment advice. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How do Bitcoin Exchanges Work?

As noted above, Bitcoin exchanges facilitate trades between buyers and sellers. This is no different from a traditional stock trading site – which allows market participants to buy and sell shares in the open marketplace.

The specific process of using a Bitcoin exchange in the UK is as follows:

- First, you will need to open an account with your chosen exchange – by entering some personal information

- Next, before you can start trading cryptocurrencies, you will need to fund your newly opened account.

- Once your account is funded, it’s then a case of choosing a cryptocurrency pair to trade. For example, the most traded pair in this space is BTC/USD.

- Finally, you will then need to place an order at your chosen exchange. This simply tells the exchange whether you think the cryptocurrency will rise or fall in value, and how much you wish to stake on the trade.

The above process is much the same at all of the UK crypto exchanges that we reviewed today.

How to Choose the Best Crypto Trading Platform UK for You

It goes without saying that it can be a headache to choose the best crypto exchange in the UK for your needs. The overarching reason for this is that UK residents now have so much choice.

During the research process, you might want to consider the core factors outlined below.

Tradable Cryptos

While the best UK crypto trading platforms in this space will offer a huge selection of digital currencies, providers like Mode only support one token – Bitcoin. This is perfectly fine if you are solely looking to add BTC tokens to your crypto portfolio.

However, shrewd cryptocurrency investors will never put all of their eggs into one basket. After all, this will leave them overexposed to just one digital asset. Instead, it’s best to diversify across plenty of different cryptocurrencies.

Fees

When attempting to assess fees at a UK crypto exchange, the process can be complex. This is because fees can vary depending on the market you are trading, the account type you have opened, and the amount traded in the prior month.

With that said, many exchanges will offer a simple commission system that remains constant. For instance, if you trade digital currencies at Coinbase, you will pay a standard fee of 1.49% per slide. At eToro, you pay the spread – which is 1% for all crypto transactions.

However, you then have crypto exchanges like Binance and Huobi – both of which utilize a maker-taker system. Moreover, the commission is reduced when certain trading milestones have been met – so again, this makes things confusing.

Wallet

Whether or not you require a crypto wallet will ultimately depend on your chosen exchange and your personal preferences.

For example, some crypto investors do not feel comfortable leaving their digital tokens stored in an exchange. Rather, they want control over their private keys.

With that said, if you’re a complete newbie and don’t understand how private keys work – then you likely won’t want to take responsibility for your own wallet.

Tools & Features

Crypto exchanges will vary by some distance when it comes to tools and features. At one end of the spectrum, Mode offers virtually nothing in the way of trading tools. Instead, the app simply allows you to buy and sell Bitcoin.

You then have the likes of Binance, which offers a highly advanced trading platform that comes packed with charting tools, technical indicators, custom order types, and more.

Payment Methods

Not only do you need to ensure your chosen exchange supports your preferred deposit and withdrawal method – but you need to be aware of what fees apply.

We found that the best crypto exchanges in the UK allow you to deposit funds instantly with a debit or credit card at competitive fees.

- For example, although this payment method is supported by Coinbase and Gemini, these exchanges charge 3.99% and 3.49% respectively.

- CEX and Coinjar are slightly more competitive at 2.99% and 2%.

- eToro charges 0.5%.

Over at Mode, you won’t be able to deposit funds with either a debit or credit card. You can, however, transfer funds via a UK bank transfer for free.

Customer Service

It is hoped that you will not require the services of a customer support agent when trading at a crypto exchange. However, there might come a time when you need some assistance with your account.

The best crypto exchanges that we reviewed today offer a live chat feature – which means that you can speak with a human agent pretty much instantly.

However, we also came across exchanges that only offer a support ticket system – which means you might need to wait up to 48 hours before receiving a reply.

Mobile App

More and more investors in the UK are preferring to trade crypto via a mobile app – as opposed to using a laptop or computer. This affords you more in the way of flexibility, as you can place trades on the move – as well as check the value of your investments at the click of a button. For example, if the market price of Ripple suddenly dropped and you decided to buy XRP to make the most of the bearish downtrend, you could do so effectively via a dedicated mobile crypto app.

However, not all of the crypto trading apps that we came across today offer a suitable user experience. On the contrary, oftentimes, it was difficult to navigate around the respective app. As such, if you are looking for a crypto exchange app – make sure it’s user-friendly.

Tax on Withdrawing Funds from Crypto Exchanges in the UK

Assuming you have benefitted from some favourable price movements and have generated a profit on your investment, you may then wish to withdraw these profits to spend in the real world. This is where taxation comes in, which can appear complicated at first – especially to beginner investors. Luckily, the tax laws within the UK aren’t as complex as other countries, although there are a few significant points to note.

Firstly, there is no specific ‘cryptocurrency tax’ in the UK. Thus, cryptocurrency withdrawals will instead be subject to Capital Gains Tax, which is also the approach in equity markets. However, depending on how you use your crypto holdings, you may be subject to Income Tax instead. Let’s look at these two tax types:

- Capital Gains Tax – This is charged when you sell your crypto for FIAT currency. Therefore, this type of tax is the most likely to apply to crypto traders making withdrawals from crypto exchanges. Notably, Capital Gains Tax only applies when you have made a profit – so if your investment ends at breakeven or you make a loss, then there is no tax to pay.

- Income Tax – Income tax may apply when performing certain DeFi transactions – for example, staking your crypto or adding it to a liquidity pool. The specifics on this area of taxation concerning crypto trading are still quite hazy, so it’s best to discuss with a professional if you are unsure.

The specific rates charged for Capital Gains Tax are noted on the UK Government website. If you are within the basic Income Tax band, you’ll pay 10% on any profits that you make. On the other hand, you’ll pay 20% on any gains if you are above this band.

Finally, the information presented above is simply an overview of the tax landscape within the UK as it applies to crypto trading. If you are unsure of anything or wish to gain a more detailed understanding, it’s best to talk to a tax professional.

The best spread betting platforms in the UK are considered to be a good alternative to traditional investing as all profits are untaxed.

How to Use a Crypto Exchange in the UK

In this final section of our guide on the best crypto exchanges in the UK – we are going to show you how to get started with an account and subsequently place your first trade on eToro.

Step 1: Open an Account

To trade crypto at eToro, you first need to register a free account on etoro.com. Enter your personal information as requested, alongside your email address and mobile number.

Make sure that your mobile number is correct – as eToro will send you a verification number via a text message. You will also need to verify your email address.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Step 2: KYC

Now that you have an eToro account, you can proceed to deposit up to €2,000 without needing to immediately upload any ID.

However, withdrawals will be restricted until you do this – so it’s worth quickly uploading a copy of your passport or driver’s license immediately.

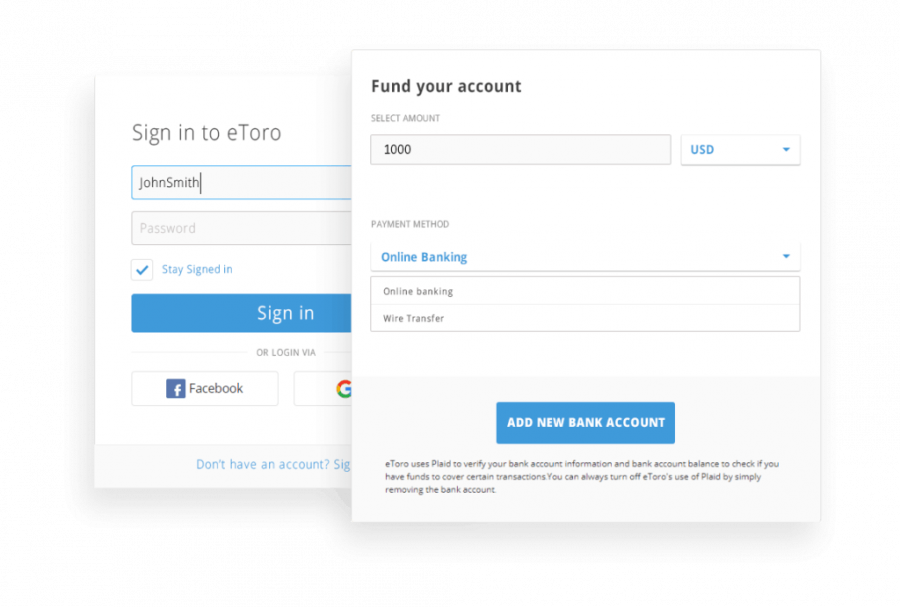

Step 3: Deposit Funds

eToro supports instant deposits via debit card, UK bank transfers are also accepted but can take up to 48 hours to process.

In terms of the minimum deposit required, UK clients can get started with $10.

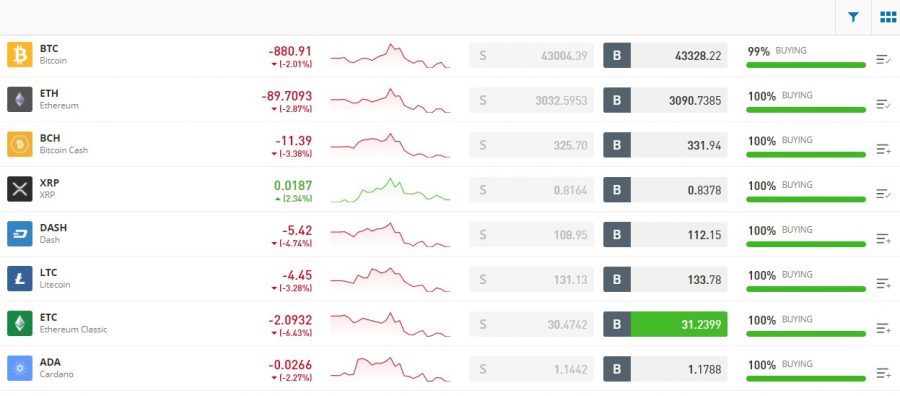

Step 4: Search for Crypto to Buy

You should now have a funded eToro account. The next step is to search for the cryptocurrency that you are interested in buying.

You can do this via the search bar. Once you see your desired digital currency appear – click on the ‘Trade’ button. You can also browse what digital assets are available on eToro by clicking on ‘Discover’, followed by ‘Crypto’.

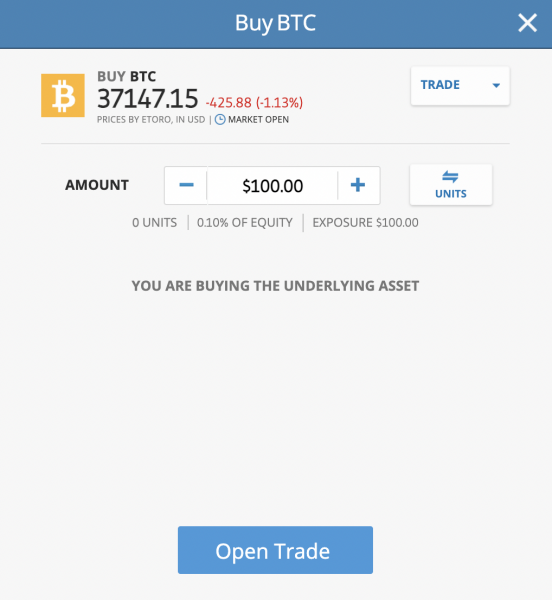

Step 5: Buy Crypto

The final part of the investment process at eToro is to enter the amount of money that you wish to risk on your chosen cryptocurrency.

First, this needs to be stated in US dollars – which isn’t an issue as your deposit was converted to USD at the point of the transaction.

Second, you can invest any amount from just $10 – regardless of how much the digital token is trading for.

In our example above, we are looking to invest in Bitcoin. To complete your crypto investment at eToro – click on the Open Trade’ button.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Conclusion

By reading this in-depth guide from start to finish – you now know how to choose the best crypto exchange for your trading goals. To recap, the key metrics to focus on include fees, payments, and more.

Ultimately, we found that eToro is the overall best crypto exchange in the UK. It has more than 25 million users and offers stocks, CFDs, commodities and other financial assets as well as crypto.

You need $10 to get started with your first crypto purchase, all crypto trades come with a 1% fee.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

FAQs on UK Crypto Exchanges

Where can I buy crypto in the UK?

Which crypto exchange is best in the UK?

What is the best Bitcoin trading platform in the UK?

What is the most trusted Bitcoin exchange?

What is the cheapest crypto exchange?