If you’re based in the UK and looking for a credit/debit card that allows you to spend your cryptocurrency holdings online, in-store, or at an ATM – this guide has you covered.

Within it, we compare the five best crypto cards available to UK residents – with a specific focus on the issuer (e.g. Visa), transaction and ATM withdrawal fees, supported coins, and the reputation of the respective provider.

Best Crypto Cards UK List

For a quick glance at the five best crypto cards in the UK right now – consider the options outlined below:

- eToro – Overall Best Crypto Card in the UK

- Crypto.com – All-in-One Crypto Ecosystem With Visa-Backed Cards

- BlockFi – Top Bitcoin Credit Card UK for Cashback Rewards

- Nexo – Great Crypto Card UK for Travelling to Europe

- Celsius – Multifaceted Crypto Card With Cashback and Interest

For a full overview of the above crypto cards – read on.

Best Crypto Credit Cards Reviewed

As we explain in more detail later in this guide, the best crypto cards in the UK allow you to spend your digital currencies in the real world at competitive fees.

As long as the card is issued by Visa or MasterCard – you’ll be able to use it online, in-store, and even to withdraw cash at ATMs.

In the sections below, you will find reviews of the five best crypto cards in the UK for 2024.

1. eToro – Overall Best Crypto Card in the UK

eToro is a leading broker in the UK and has more than 25 million global users. It supports thousands of markets across stocks, ETFs, indices, commodities, and cryptocurrencies.

eToro is a leading broker in the UK and has more than 25 million global users. It supports thousands of markets across stocks, ETFs, indices, commodities, and cryptocurrencies.

Before we get to that, we should note that the eToro card is issued by Visa – which means that you can use it pretty much anywhere. Not only does this cover ATM withdrawals, but online and in-store purchases. A feature of the eToro crypto card is that it comes alongside a UK bank account. This means that you will have the ability to deposit funds into your unique sort code and account number.

The eToro Money account comes without deposit fees – so you can add funds to your crypto card without being charged. And, if at any point you wish to make a withdrawal from your eToro account, you can do this via a bank transfer. Another benefit of the eToro crypto card is that it comes alongside a mobile crypto app for both iOS and Android phones. This allows you to keep tabs on your spending as well as make deposits and withdrawals at the click of a button.

This top-rated card connects to your main eToro brokerage account. And as such, you will have access to 70+ cryptocurrency markets. The minimum crypto purchase at eToro is just $10 – or about £8. You will also have access to copy trading tools and the ability to invest in professionally managed crypto portfolios.

2. Crypto.com – All-in-One Crypto Ecosystem With Visa-Backed Cards

Crypto.com is best described as an all-in-one crypto ecosystem, not least because it offers a large suite of digital asset products and services. For instance, once you’ve opened an account with this platform, you will have access to loans, crypto savings accounts, exchange services, and a crypto wallet app. And, in addition to this, Crypto.com also offers one of the best crypto cards in the UK.

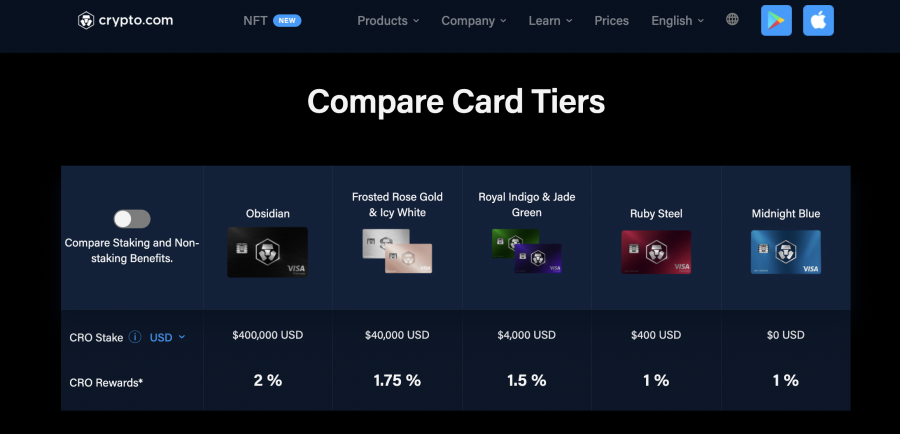

Crypto.com Visa cards allow you to spend your crypto holdings online, in-store, or at an ATM. In terms of fees and core benefits, this will depend on one key factor – whether or not you wish to hold an allocation of CRO tokens, which is the native digital asset of the Crypto.com platform. For example, if you decide that you are not interested in staking CRO, then you will be offered the Midnight Blue edition of the provider’s crypto card.

This comes with a CRO token cashback of 1% on transactions and $200 (about £150) worth of free ATM withdrawals per month. On the other hand, in staking CRO tokens, not only will your cashback rate increase to 2%, but you could get up to $1,000 in free monthly ATM withdrawals. Either way, our Crypto.com card review found that when you exceed your monthly allowance, withdrawals cost 2%. To apply for the Crypto.com card, you will first need to open an account and upload a copy of your ID.

3. BlockFi – One of the Best Crypto Credit Cards for Cashback Rewards

Traditional credit cards in the UK will often come with lucrative rewards that are paid on eligible transactions – subsequently allowing you to build points that can later be turned into cash or other benefits. In the case of crypto cards, BlockFi is one of the best options for those seeking cashback rewards. In a nutshell, BlockFi cardholders can earn 1.5% on all purchases.

And, most importantly, BlockFi notes that there are no monthly limits in place – meaning that the more you use your crypto card, the more you will receive in rewards. In terms of how the rewards are distributed, BlockFi offers cashback in the form of Bitcoin. This will appeal to those of you that wish to increase your Bitcoin holdings over the course of time. We should also note that for new customers, BlockFi offers enhanced cashback rewards via an introductory promotion.

This stands at 3.5% cashback in Bitcoin on all purchases for the first three months – capped at $100 in rewards. Moreover, if you spend more than $50,000 (about £37,000) over the course of the year, anything above this figure will earn 2% in Bitcoin cashback. Another major benefit of applying for the BlockFi crypto card is that there are no annual fees, and all FX charges are waivered. And, as the card is linked to your main BlockFi account – you can earn interest on unspent crypto holdings.

4. Nexo – One of the Best Bitcoin Debit Cards for Travelling to Europe

No two crypto cards are the same in the UK – so while one provider might be suitable for local ATM withdrawals, another could be better for traveling abroad. And, if you’re specifically looking for the best crypto debit card for visiting Europe – we like the look of Nexo. This popular platform offers a range of crypto-centric products – such as loans, savings accounts, and exchange services.

The Nexo debit card itself is issued by MasterCard, so you will have no issues spending funds online, in-store, or at your nearest ATM. In terms of using your Nexo card in mainland Europe, no FX fees are charged up to the first €20,000 per month. And, it’s also possible to get up to €10,000 worth of fee-free monthly ATM withdrawals. With that said, we should note that card transactions processed in the EU will attract a fee of 1.49%.

This does, however, cover the cost involved in swapping your crypto holdings into euros in real-time. Another core feature of the Nexo crypto card is that you can connect your account to Apple Pay and Google Pay. This will allow you to make seamless purchases on your smartphone without needing to enter your card details. And, should you wish to add an additional layer of security on online purchases, Nexo also offers free virtual cards for one-time transactions.

5. Celsius – Multifaceted Crypto Card With Cashback and Interest

Next up on our list of the best crypto debit cards in the UK is that of Celsius. In applying for a card with this provider, you will have access to a one-stop-shop for multiple financial services – all of which are related to crypto. For example, crypto interest accounts allow you to earn a yield on idle digital asset holdings – with APYs of up to 17.8% on offer.

You can even earn 11.18% annually by keeping some TrueGBP tokens in your Celsius account – which is a stablecoin pegged to the pound sterling. Additional features offered by Celsius include crypto loans and exchange services. In terms of the Celsius crypto card itself, the platform notes that there are no fees related to opening an account, late payments, foreign exchange, or ATM withdrawals. Moreover, you have the opportunity to fund your Celsius account with fiat money, cryptocurrencies, or stablecoins.

Best Bitcoin Cards Comparison

As you might have gathered from our comprehensive reviews, there are a lot of variables to consider when choosing the best crypto card in the UK for your requirements.

With this in mind, we have summarized our key findings below via a simplified comparison table:

| Supported Coins | Fees | Rewards | Card Issuer | |

| eToro | 70+ | 0.5% GBP deposits, 1% on crypto purchases | Auto staking on eligible coins | Visa |

| Crypto.com | 250+ | 2% after monthly ATM limit reached, FX charge 0.5% | Up to 8% in CRO | Visa |

| Blockfi | 15+ | No annual or FX fees | Unlimited 1.49% cashback | Visa |

| Nexo | 32+ | 1.49% on EUR transactions | Earn APY on holdings | MasterCard |

| Celsius | 50+ | No annual, FX, or ATM fees | Not stated | Not stated (waiting list) |

Take note, the above metrics were correct as of writing and are therefore subject to change at any given time.

How do Crypto Cards Work?

In a nutshell, crypto cards allow you to spend your digital asset holdings in the real world. That is to say, just like a conventional Visa or MasterCard issued by your bank – the best crypto debit cards allow you to buy products and services online.

You can also use your crypto card to make in-store purchases and even withdraw cash from an ATM. And as such, crypto cards form the crucial bridge between everyday spending and the blockchain arena.

In terms of how the process works, your crypto card will be connected to a third-party platform. The platform that you opt for will typically offer exchange and storage services. This means that in order to spend funds with your crypto, the tokens need to be deposited with the respective provider.

In fact, the respective online/physical store or ATM won’t even know that you are using a crypto debit card, as the transaction is processed in the local currency.

Crypto Debit Cards vs Crypto Credit Cards

You might have noticed that in this guide, the terms crypto credit card and debit card are often used interchangeably. However, we should note that all providers in this space only offer crypto-backed debit cards, as opposed to credit cards.

This is because you can only spend funds up to the amount you have available in your account. For example, if you have £500 worth of Bitcoin stored at your chosen provider, you can only use the crypto card to buy or withdraw £500 worth of goods or cash.

Perhaps further down the line, crypto credit cards will come into the mix – whereby you have an agreed monthly limit that needs to be repaid with interest. However, for the time being, only crypto debit cards are supported.

Benefits of Crypto Credit Cards

If you’re wondering why crypto debit cards are so popular in the UK, check out the list of benefits discussed below.

Buy Goods and Services With Crypto

The first benefit to consider is that the best crypto cards in the UK are either issued by Visa or MasterCard. This means that you can buy goods and services online just like you would with a bank-issued debit card.

As such, this prevents the need to exchange crypto for cash to be able to purchase something that you required. Moreover, the best crypto cards in the UK can also be used in physical locations.

Be it the supermarket, petrol station, or your local restaurant – anywhere that Visa or MasterCard is accepted – you can use your crypto card.

Convert Crypto to Cash Instantly

Another major benefit that the best crypto cards in the UK offer is the ability to instantly convert digital tokens into cash. This is because, once again, you can use your crypto card at any ATM that accepts Visa or MasterCard.

As such, this prevents the need to send your crypto to a third-party exchange, swap the tokens for cash, and withdraw the funds to a UK bank account. Instead, you can simply head to your nearest ATM and make a withdrawal.

Cashback Rewards

Just like traditional issuers offer, the best crypto debit cards in the UK offer a variety of cashback rewards. In most cases, you will earn a percentage of eligible purchases back in crypto.

For example, let’s suppose that your chosen crypto debit provider offers 2% cashback in Bitcoin on all purchases. In spending £500 on your card, you would receive the equivalent of £10 in BTC tokens.

This can be a superb way to slowly build up your cryptocurrency portfolio, as every time you use your card, you will increase the number of tokens that you own.

Interest

Some of the card providers discussed on this page also double up as a crypto lending platform. This means that for as long as your crypto assets are held at the respective platform, you can earn interest on the funds.

This is a great way to earn passive income on digital assets that otherwise do not organically yield dividend-related payments. In other words, you can connect your chosen crypto debit card to a savings account that generates interest.

Bank Account Details

A feature offered by eToro is that you will also be offered local bank account details. This means that through your unique account number and sort code, you can deposit cash into your eToro account

When you eventually get around to cashing out, you can use this to withdraw your funds back to your usual bank account.

Great for Travelling

Some of the top-rated providers that we came across allow you to use your crypto debit card abroad at highly competitive foreign exchange fees.

Some waiver FX fees altogether. Either way, this means that crypto debit cards can be a great way to spend money when you go on holiday. The alternative to this is to use your standard UK debit card – which can come with super-high FX charges.

How to Choose the Right Crypto Credit Card for You

Choosing the best crypto card in the UK can be a challenging task, not least because no two providers are the same. For example, while one crypto card might come with low transaction fees, ATM withdrawal limits might be on the low side.

As such, the best thing to do is think about what your main priorities are, before researching the many crypto cards available to UK residents.

To help clear the mist with the research process, below we explain the main things to look for when choosing a crypto debit card.

Issuer and Usage

The first metric to consider when selecting the best crypto debit card in the UK is the respective issuer. As mentioned earlier, if the card is issued by either Visa or MasterCard, you should have no issues using it online, in-store, or at ATMs.

Moreover, it is also important to understand whether there are any restrictions on specific card usage. For instance, we came across a number of providers that allow you to use the crypto card online and in-store, but not at ATMs.

Fees

When comparing the best crypto cards in the UK, you will often find that fees and limits go hand in hand. In other words, you might get a certain amount of free ATM withdrawals per month, before needing to pay a fee for anything above this figure.

You should also check to see what fees apply when you use your crypto card online or in-store. However, some providers will charge a transaction fee irrespective of whether the card is used domestically or abroad. Moreover, you might find that some crypto card providers in the UK charge an application fee – so this is another thing to look for.

FX Charges

If you plan to use your crypto debit card abroad, then it’s crucial that you check what FX fees will apply.

For instance, we mentioned earlier that although Nexo advertises zero-FX fees of up to €20,000 per month, you still need to pay a 1.49% charge every time you use the card in Europe.

Card Limits

As per anti-money laundering regulations, certain limits will apply when you apply for a crypto card in the UK. These limits can, however, vary considerably between providers.

Some of the main limits to look out for include:

- ATM withdrawals

- Online and in-store spending

- Card loading

- Single transaction value

In many cases, limits will be displayed in terms of daily, monthly, and annual usage. Ultimately, just make sure that the limits offered by your chosen crypto debit card are sufficient for your lifestyle.

Qualification

You might find that certain terms and conditions are stated by crypto card providers with respect to the application process. In most cases, you will need to be a UK resident aged 18 or over.

And, in order to active your crypto card, the provider will need to collect some personal information from you – alongside a copy of your passport or driver’s license.

You might also need to provide proof of address – such as a recently issued bank account statement or utility bill.

Supported Coins

Another important metric to look for in your search for the best crypto cards in the UK is the range of digital currencies supported.

After all, most of your crypto portfolio is held in XRP and Ethereum – but the card does not support these tokens, then you will need to look elsewhere.

Rewards

It’s also a good idea to check whether or not your chosen crypto card comes with cashback rewards. As we covered earlier, some providers will give you a percentage of each transaction back in the form of crypto.

However, be sure to read the terms and conditions thoroughly, as you might find that transaction fees far outweigh the benefits of receiving rewards.

Regulation

Most of the crypto cards that we came across in the UK are offered by providers without sufficient levels of regulatory protection.

As such, this could put your capital at risk. To ensure your money and crypto funds are kept safe at all times, consider a regulated provider.

Brokerage Services

We prefer crypto cards in the UK that are backed by platforms that also brokerage services.

For example, the likes of eToro, Crypto.com, and Nexo all allow you to buy crypto with fiat money. This also makes it a seamless process when if you decide that you wish to sell your crypto holdings back to cash.

How to Qualify for and Use a Crypto Card

This section of our guide will show you how to qualify for the eToro crypto card.

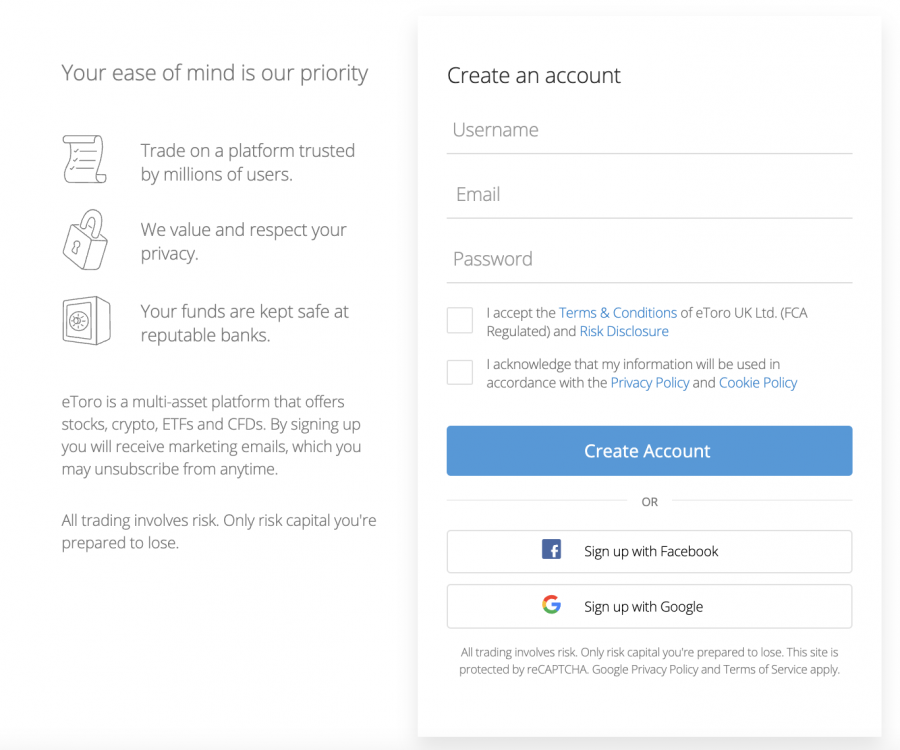

Step 1: Open an eToro Account

The very first step will require you to open a verified account.

This will initially require some personal information alongside your email address and mobile number. After confirming your mobile number, you will then be asked to upload some ID.

This can be a passport or driver’s license – both of which will be validated automatically.

Step 2: Apply for eToro Money Account

The account that you just opened is relevant to the brokerage arm of eToro – which allows you to buy and sell crypto, stocks, ETFs, and more.

However, in order to apply for the provider’s crypto card, you need to register for an eToro Money account. The two accounts are connected, so it’s simply a case of opting in.

Step 3: Receive Crypto Card

Once you have opted in for an eToro Money account, the provider will send your crypto card to your registered address.

Step 4: Deposit Funds

In order to use your eToro crypto card, you need access to some digital tokens. And, to buy crypto at eToro, you will first need to make a deposit. GBP deposits come with 0.5% fees and a minimum deposit amount of $10 (£8).

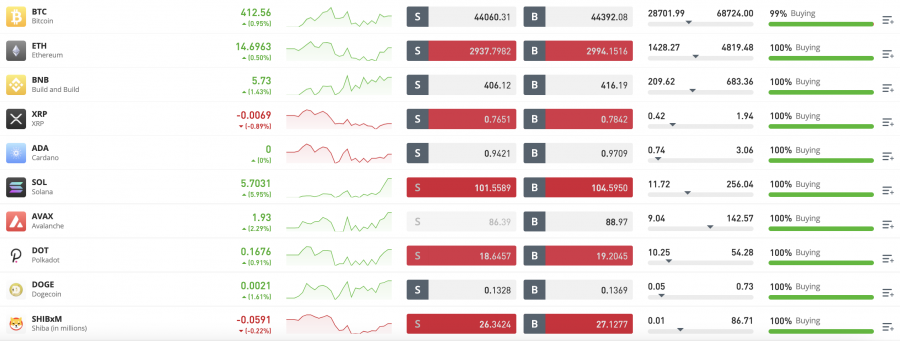

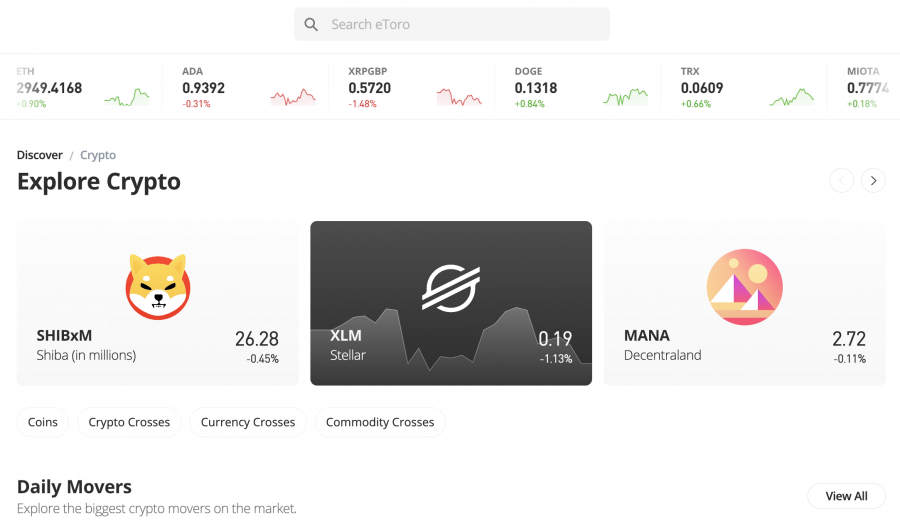

Step 5: Buy Crypto

Now that you have funds in your eToro account, you can proceed to buy Bitcoin and 70 other cryptos.

To fast-track, the process, use the search bar at the top of the page and enter the name of the crypto you want to buy. Alternatively, click on ‘Discover’ to see what crypto assets the broker offers.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Conclusion

In choosing the best crypto card for your requirements – consider exploring core factors surrounding fees and limits, supported tokens, FX charges, and the reputation of the respective issuer.

Crypto assets are highly volatile and unregulated in most EU countries, Australia, and the UK. No consumer protection. Tax on profits may apply. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.