Wireless home broadband is fast becoming the in thing in the telecoms industry. It stands out for offering consumers an affordable, yet quick self-installation option. When exploring possibilities in the tech industry, it is sensible for investors to assess two stocks.

As consumer search for faster yet affordable wireless home broadband services, would lead you to two companies, T-Mobile US (ticker: TMUS) and Verizon (VZ). The communications firms have been digressing to capitalize on the fast-growing fixed wireless in a bid to offer their customers the latest home broadband service alongside their mobile services.

In other words, T-Mobile US and Verizon are exploring new ways to benefit from conventional defensive qualities of telecoms stocks, at the same time, taking advantage of the market from their cable competitors

What Is Fixed Wireless Home Broadband?

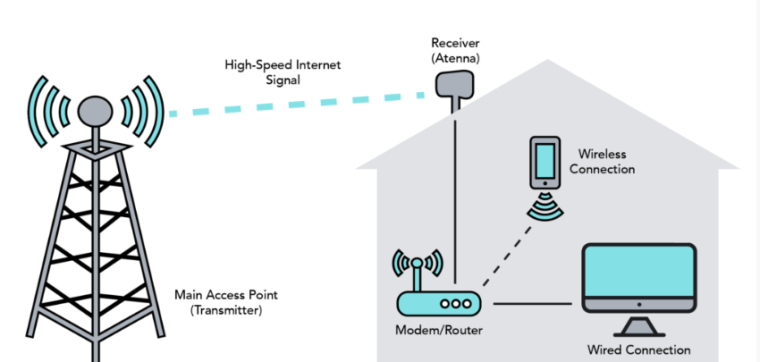

The main difference between fixed wireless internet and cable internet is in the way it is transmitted to the end user. The former (fixed wireless broadband) utilizes radio frequencies instead of cables to connect homes to the internet.

This method of internet connection is gaining popularity at a great speed globally, its main selling point being the price. It is much cheaper to onboard new users as installation costs are relatively lower compared to cable internet.

As expected for every product, it has some drawbacks including its maximum achievable speeds, which are currently lower than those attained via fiber. According to the latest consumer data in the telecoms industry by the Leichtman Research Group, 90% of the 3.5 million net additional broadband subscriptions in the United States were fixed wireless in 2022 alone.

The rate of adoption among households is remarkable, considering there were 730,000 fixed wireless connections in 2021, which quickly accelerated to 3.1 million in 2022.

T-Mobile US is one of the three industry leaders in the fixed wireless home broadband segment in the US. The company is projecting between 7 and 8 million fixed wireless broadband subscribers by 2025, which would be a massive step from its 2.6 million at the end of last year.

The company’s stock has been gaining traction, reflecting the strides being made in fixed wireless technology. Precisely, TMUS is up 15% in 12 months to trade at $142.03 – pre-market price on Friday, March 24, 2023.

Stocks in the telecoms industry generally performed well over the last year despite the insistent push by the Federal Reserve to hike interest rates to slow economic growth and consequently inflation.

Stocks in the S&P 500 recorded an 11% decline over the same period. According to Barron’s, TMUS is currently trading roughly 18x the projected stock earnings in the 12 months and according to FactSet, this is below its 5-year average of approximately 31x.

Verizon (VZ) figures are just as impressive, as the company is preparing to have signed up to 5 million subscribers to its fixed wireless broadband service by the end of 2025, up from 1.45 million subscribers reported at the end of 2022.

However, its stock has been on a downtrend over the last 12 months, down 27%. Verizon attributed the loss to a decline in subscribers for its mobile consumer segment. For now, VZ is trading 7.8x its anticipated earnings in the period, as observed by FactSet.

A glance at other industry players like AT&T shows that other firms are prioritizing fiber broadband while tapping the fixed wireless internet service as supplementary. AT&T does not disclose its fixed wireless consumer base figures, although its stock is up 5.1% in the last 12 months.

“In a lot of densely populated areas, with fixed wireless, there’s not enough spectrum to serve customers in the longer term. We believe that fiber is the best medium to serve those customers,” Gordan Mansfield, AT&T’s vice president for global technology planning, said in an interview at the Mobile World Congress in Barcelona.

Competition Is Far Much Higher In The Fixed Wireless Home Broadband Segment

Despite the growth achieved by T-Mobile and Verizon, competition is much tougher now, especially from other cable companies like Comcast (CMCSA) and Charter Communications (CHTR).

A cost comparison check in the US shows that fixed wireless is relatively cheaper than using a fiber connection. Currently, T-Mobile charges its fixed wireless home internet customers a flat fee of $50 a month, without the option of a yearly contract.

On the other hand, the average cost of a high-speed internet service in the US was $74.99 per month based on data provided by Consumer Reports in 2022.

“Some of those [fixed wireless] offers look pretty attractive and that’s what’s putting pressure, particularly on the cable industry in the U.S.,” Kester Mann, the director of consumer-and-connectivity at CCS Insight, a consultancy firm said.

The shift from cable to fixed wireless broadband, however, introduces some concerns that investors must seek to address. For instance, is the segment’s capacity closing in on its ceiling based on key variables like the number of customers it can pull from cable internet providers and what the technology itself can handle?

It has already been established that wireless networks have limitations on the amount of data they can process while not compromising on speed.

A report prepared by analysts at UBS recently said the fixed wireless network is fast approaching its peak rate of additions. However, numbers are unlikely to drop significantly in the period between now and 2024 “at the earliest.”

In that case, T-Mobile and Verizon are likely to continue benefiting from their fixed wireless internet services for some time before the growth curve starts to drop. Furthermore, the peak rate could be delayed due to the potential advances in technology, thereby extending the headroom.

By utilizing the millimeter-wave spectrum, which is a range of extremely high radio frequencies, wireless connections can reach speeds comparable to fiber-optic cable over limited distances.

The demand for fixed wireless technology may encourage providers to deploy fixed wireless broadband equipment in densely populated locations—urban areas.

So far, T-Mobile and Verizon’s attention to the fixed wireless internet service means they have the fast-mover advantage for their popular mobile bundles and home broadband. This does not mean cable companies are sitting on the sidelines watching, they are supplementing their fiber internet services with fixed wireless home broadband.

However, T-Mobile and Verizon have already done the heavy lifting – laying down the network infrastructure and do not need to rely on partners. As their subscription numbers grow, they will not spend much on expanding their fiber connections.

Related Articles:

- Microsoft Signs Deal With Startup CarbonCapture to Store More of its CO2 Underground

- What Funding Winter? Character.AI Becomes Unicorn after $150 Million Fund Raise

- Canva Web-Based Design Platform Gets an AI Makeover That Threatens to Eclipse Adobe

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops