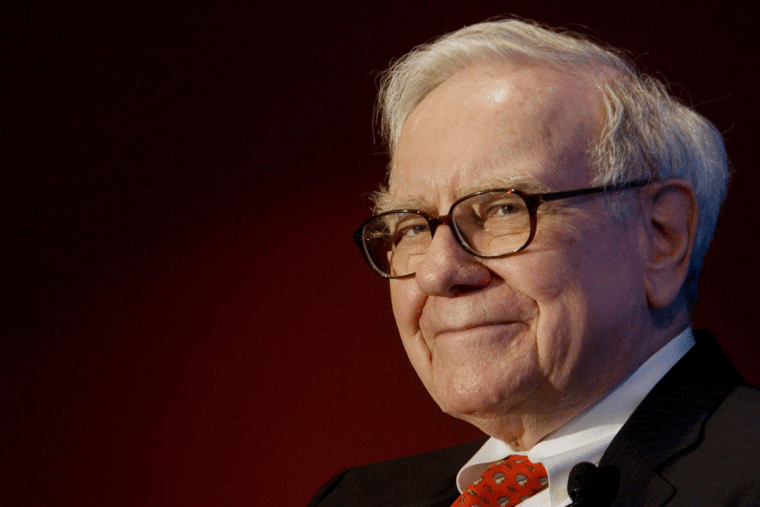

At Berkshire Hathaway’s annual meeting held yesterday, chairman Warren Buffett compared AI to an “atom bomb” while his deputy Charlie Munger said he was “skeptical of some of the hype in AI.”

Known for their wits, both Buffett and Munger comment on contemporary topics during the annual day.

Every year, thousands of Berkshire stockholders and Buffett fans attend the event which is also known as “Woodstock for Capitalists.”

Questions on AI naturally cropped up during the event this year as generative AI is making waves across the globe and some of the companies in Berkshire Hathaway’s portfolio including Amazon are also investing in the business.

Responding to a question on AI’s impact on markets as well as society, Munger said, “Well, if you went into BYD’s factories in China, you would see robotics going at an unbelievable rate. So, we’re going to see a lot more robotics in the world.”

Munger however cautioned “I am personally skeptical of some of the hype that is going into artificial intelligence.”

Incidentally, earlier this year, Munger said that BYD was his best investment ever. However, while he talked about BYD using AI for manufacturing, Tesla CEO Elon Musk has a different take and during the company’s investor day in March, he said that he doesn’t see any manufacturing utility for AI.

That said, Musk is reportedly hiring for his AI venture and is planning to launch his own company – TruthGPT.

- Read our guide on the best AI stocks

Musk is also quite vocal about the need for AI regulations and lobbied with lawmakers for the same.

Warren Buffett on AI

Buffett meanwhile is impressed with AI and said it “can do amazing things.” In a lighter vein, the billionaire said, “But it couldn’t tell jokes. Well, Bill (Gates) told me that ahead of time, prepared me, and it just isn’t there.”

Buffett meanwhile is also apprehensive of AI and said, “When something can do all kinds of things, I get a little bit worried.”

The Oracle of Omaha compared AI to the atom bomb and said, “Because I know we won’t be able to un-invent it and, you know, we did invent, for very, very good reason, the atom bomb in World War II.”

Notably, Buffett has a strong opinion about Bitcoin as well and once labeled it as “rat poison squared.”

However, fellow billionaires Paul Tudor Jones and Stanley Druckenmiller admitted to investing in Bitcoin in the past.

Bitcoin prices have soared in 2023 after last year’s slump.

- Read our guide on buying bitcoins

Coming back to Berkshire’s annual meeting, apart from AI, Buffett commented on several of the stocks that the company owns.

Buffett Says iPhone is an “Extraordinary Product”

He especially praised Apple and called iPhone an “extraordinary product.” Notably, Apple is the largest holding in Berkshire’s portfolio of publicly-traded companies.

According to Buffett, “Our criteria for Apple was different than the other businesses we own —It just happens to be better business than any we own.”

iPhone sales have held off relatively well despite the overall slump in smartphone sales which fell 14% YoY in Q1 2023.

Apple’s Q1 2023 smartphone shipments were 59 million as compared to 58 million in the corresponding quarter last year. In percentage terms, its shipments fell the least among major producers.

Meanwhile, Munger and Buffett’s comments on AI have renewed the clamor for regulatory oversight of the technology.

Last week, Vice President Kamala Harris met heads of Microsoft, Alphabet, and OpenAI. The White House said the meeting was to “underscore that companies have a fundamental responsibility to make sure their products are safe and secure before they are deployed or made public.”

Related stock news and analysis

- Best AI Crypto Tokens & Projects to Invest in 2023

- Another TikTok Controversy: Report Says It Tracked Users Watching Gay Content

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops