Venture capital firms across the globe saw a steep drop in the amount of funding they managed to attract to their vehicles during the first quarter of 2023 according to the most recent report from Pitchbook.

The data collected from the provider of capital market data indicated that VCs raised 38% less during the 12 months ended on 31 March than they did during the same period a year ago.

In addition, the number of funds that raised money during this period experienced a steep drop as well, moving from 2,824 in Q1 2022 to just 1,382 during the first three months of this year.

Meanwhile, on a quarterly basis, VC funds globally raised 72% less than they did in Q1 2022, bringing in just $29.5 billion.

PitchBook Says That Raising Capital May Be More Difficult but Money is Still Flowing

Several factors are contributing to the slowdown in fundraising. Limited partners are being cautious with their capital due to uncertainty in terms of exit opportunities and lower expected returns.

High valuation levels from 2021 financings are challenging given the slumping stock market. Some funds have also slowed their deployment of capital and pushed out their next fundraising rounds.

The report notes some geographical shifts, with funds in Asia raising over half of global venture capital funds in Q1. This was driven by large funds from China affiliated with regional governments or state-owned enterprises, which made up 68% of funds raised in Asia. Meanwhile, North America secured 53% of the total fund count, indicating a more diverse fundraising ecosystem.

Also read: Best Upcoming IPOs to Watch in 2023

“In conversations with GPs, the mood around fundraising has been melancholic, even amongst established fund managers”, commented Hilary Wiek, Senior Strategist for PitchBook.

Wiek highlighted that the time it is taking these funds to raise capital has stood “remarkably stable” despite the headwinds that the private capital markets are experiencing at the moment.

In fact, the length of the funding cycle for both average and bottom-quartile private capital funds has actually dropped from around 13 and 5 months respectively in 2022 to 12 and 4 months respectively during the first quarter of this year.

Overall, Wiek does not believe that the data indicates a full-blown dry-up of the private capital market as the one seen back in 2008-2009 during the subprime crisis. Instead, she highlights that the environment is just “difficult”.

Also read: Next Cryptocurrency to Explode in May 2023

“In essence, there does appear to be some support for the feelings that fundraising has been difficult recently, but it is hyperbole to state that fundraising has ground to a halt, as hundreds of funds have managed to close on billions of dollars of commitments”, the researcher asserts.

Dry Powder Now Accounts for Over 15% of VCs Assets Under Management

Another interesting metric reported by PitchBook is dry powder, which is the amount of money that has not yet been deployed by venture capitalists yet due to unfavorable market conditions.

In this regard, the firm’s research indicates that, by the end of September 2022, VCs had nearly $500 billion sitting on the sidelines. The majority of these funds were reportedly raised between 2020 and 2022.

Meanwhile, VC’s assets under management (AUM) globally stood at around $3.3 trillion, meaning that around 15% of those assets are not being allocated to companies. This represents a 400 basis points increase approximately compared to the previous year.

Also read: OpenAI CEO Sam Altman’s Worldcoin Startup Lands $115 Million Series C

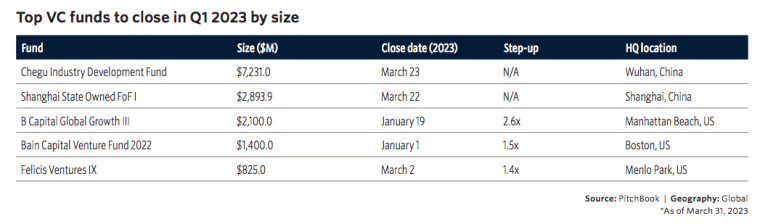

Two Chinese funds lead the scoreboard in terms of size – the Chegu Industry Development Fund and the Shanghai State Owned FoF I fund – with assets under management of $7.2 and $2.9 billion respectively.

Meanwhile, the next three largest funds making it to the top five globally are based in the United States, starting with the B Capital Global Growth III fund with $2.1 billion in assets, followed by the Bain Capital Venture Fund 2022 and the Felicis Ventures IX fund with AUMs of $1.4 billion and $825 million respectively.

Other Related Articles: