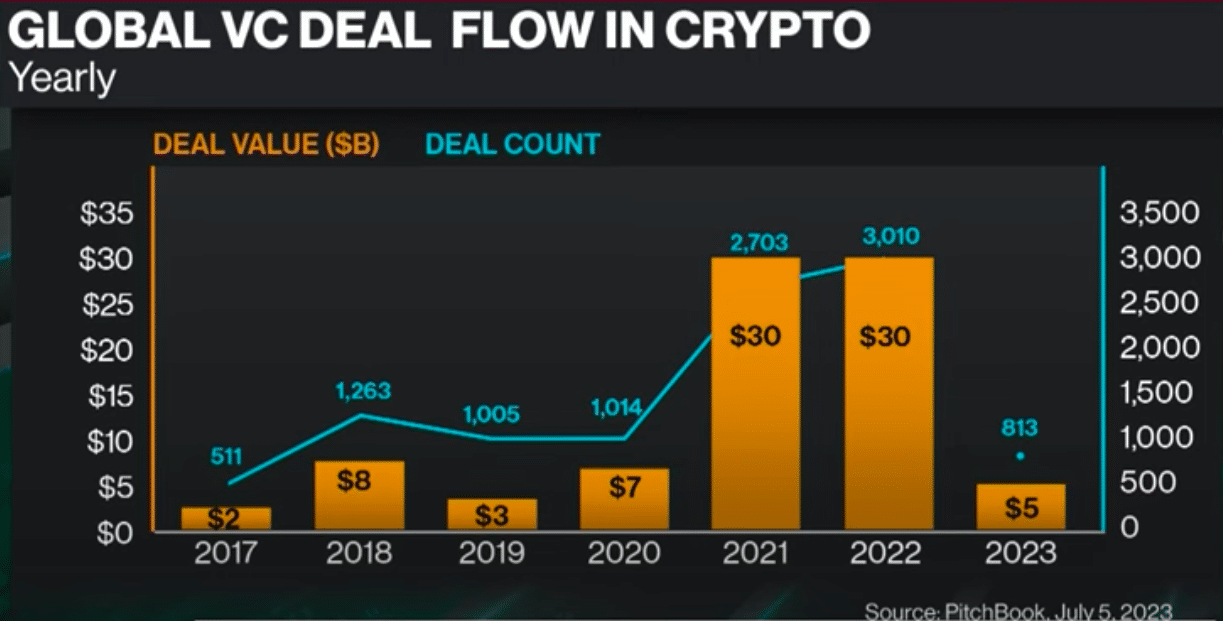

Funding for crypto startups is experiencing a significant downturn as venture capitalists (VCs) shift their focus toward artificial intelligence (AI). Silicon Valley investors, who were once bullish on crypto, are now racing to invest in AI companies.

In the second quarter of this year, VCs allocated less capital to crypto and digital asset companies than at any other point since 2020, according to data from PitchBook.

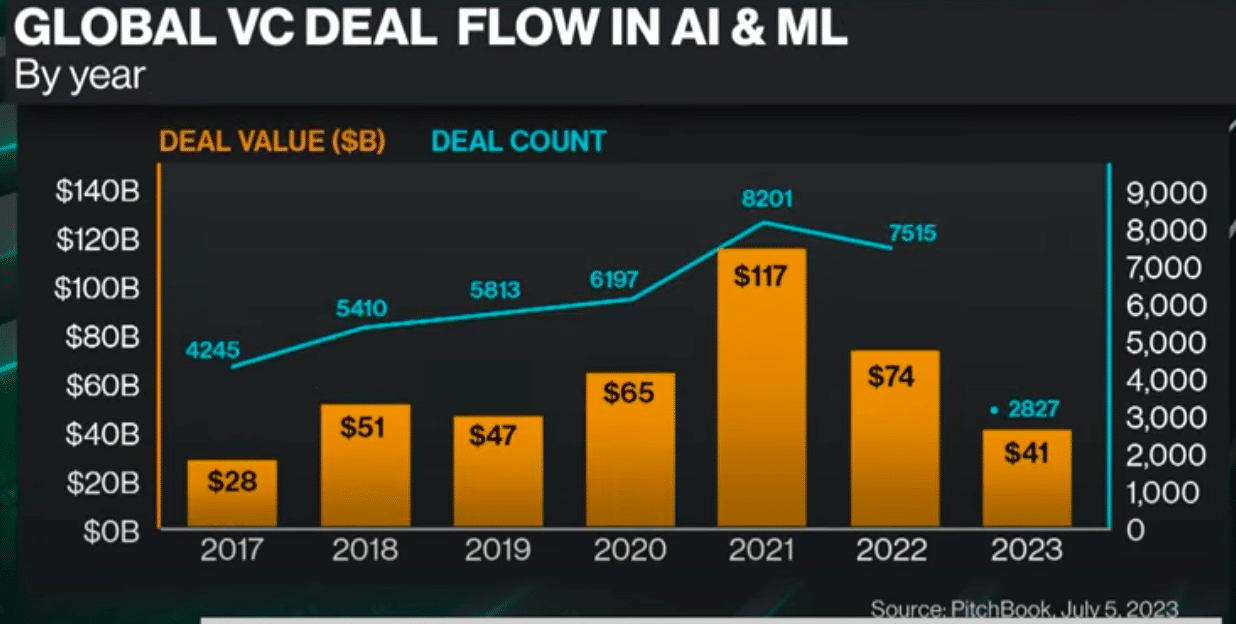

In contrast, the total global value of investments in AI during the same period surpassed that of crypto, even during its peak.

Investors’ Changing Focus

The shift reflects the increasing interest in AI, driven by its numerous use cases, as well as the negative impact of scandals, regulations, and falling crypto prices. Investors like Joe Zhao, managing partner at Millennia Capital, are now leaving digital assets behind and focusing on AI, stating that “AI is offering so many more use cases than blockchain.”

According to Bloomberg reports, even prominent crypto VC firms are emphasizing their interest in AI over crypto. Paradigm, the high-profile crypto VC firm founded by Coinbase Global Inc. co-founder Fred Ehrsam and former Sequoia Capital partner Matt Huang, removed crypto mentions from its website and highlighted its AI focus instead, as reported by the Block.

However, Huang later acknowledged this as a mistake and directed users to a revised version of the company’s homepage, which prominently featured the word “CRYPTO” in neon green and black banners. Despite these shifts, there are still investors who see potential in both AI and digital assets.

In an interview with Bloomberg, Robert Le, a crypto analyst at PitchBook, believes that there is considerable interest in the intersection of AI and crypto, and cited two startups, Tools for Humanity and Gensyn, which raised significant funding rounds in Q2 and operate in both industries.

Crypto VC Funding Outlook

The decline in crypto funding does not mean that all hope is lost. Le predicts that the situation will improve in the coming months as investors take the time to thoroughly evaluate opportunities in the crypto space.

VC funds specializing in crypto raised a substantial amount of capital in 2021 and 2022, and they are now in the process of deploying that capital over the next two to four years. While the diligence cycles for investments have slowed down, Le anticipates an uptick in the second half of 2023, which will bottom out sometime in the summer. He said:

“Part of the slowdown is that the diligence cycles just slow down. So you look at 2021 and 2022, some of those deals were happening in a one-week or two week timeframe and that’s not much due to that. Exactly right. And so now investors are taking the time, meeting the teams, meeting the founders, understanding the business model, understanding their product, product-market fit, and then they’re going to deploy capital.”

He highlights that the significant amount of funding raised for crypto in recent years indicates ongoing interest and commitment from many VC firms.

Continued Investor Interest in Specific Areas in Crypto

Although global VC funding for crypto has experienced a significant decline, there are still specific areas within the industry that continue to attract investor interest. Infrastructure, including underlying blockchains and scaling solutions, remains an area of focus.

Additionally, there is growing institutional interest in crypto, leading to opportunities in providing services that facilitate the entry of traditional financial institutions into the crypto space. Another area of interest is decentralized physical infrastructure networks, which aim to facilitate token-based services for real-world infrastructure, such as decentralized servers or mobile networks.

While the decline in crypto funding is evident globally, there are regional variations. Crypto markets in Europe, Dubai, Hong Kong, and Singapore are showing more strength compared to the US, where regulatory challenges have impacted the industry.

However, Andreessen Horowitz, a prominent VC firm that recently raised a $4.5 billion crypto fund, announced the opening of an office in London due to the crypto-friendly environment in the UK. The firm remains committed to investing in crypto startups and expects continued investment activity both in the US and abroad.

VC Funding as a Catalyst for Crypto Rebound

When asked about the rebound of crypto, Le mentioned that funding would play a significant role as startups now require financial support to facilitate their growth and expansion. Regarding when investors would feel comfortable enough to provide funding, the crypto analysis said:

“As investors are looking at what projects are building the strongest products out there and what are the underlying business models and how they are getting product market fit.”

He added that those projects that meet these criteria are expected to secure the necessary funding, with signs of this expected towards the end of this year.

Predicting the exact timing of the rebound is challenging, but there is optimism that by early 2025, there will be an influx of capital and an increase in the number of founders entering the space to build upon it.

Overall, the decline in VC funding for crypto startups reflects the shifting focus of investors toward AI and the challenges faced by the crypto industry due to scandals, regulations, and falling prices. However, there are still opportunities for investment in specific areas of the crypto space.

VC firms with mandates to support the industry are expected to continue their backing. The future rebound of the crypto industry will depend on the confidence and comfort of investors in the projects and their underlying business models.

Related Articles

- While Everyone Else Focuses on TikTok’s Impact on the West, Mozilla Is Investigating Its Effects on Elections in the Global South

- Senators Reintroduce Comprehensive Crypto Regulation Bill – Here’s How it Would Change Crypto

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops

- Pipe-Backed Fintech CapStack Raises $6m to Derisk Bank Portfolios