Fueled by rapid growth across key metrics, the mobile app market staged a notable recovery in the first half of 2023, according to the latest data from data.ai.

Consumers spent record amounts of time on their mobile devices, racking up over 2.5 trillion hours on Android phones during the first six months of the year, the report indicates. That marked a 4% increase from the second half of 2022 and an impressive 16% year-over-year jump.

Time spent surged most dramatically in developing markets like India, China, Indonesia, and Mexico. India saw a massive 26% rise since H1 2021 as consumers there continue to rapidly adopt mobile devices. However, many of these markets showed signs of saturation as total app downloads have been flat over the past two years.

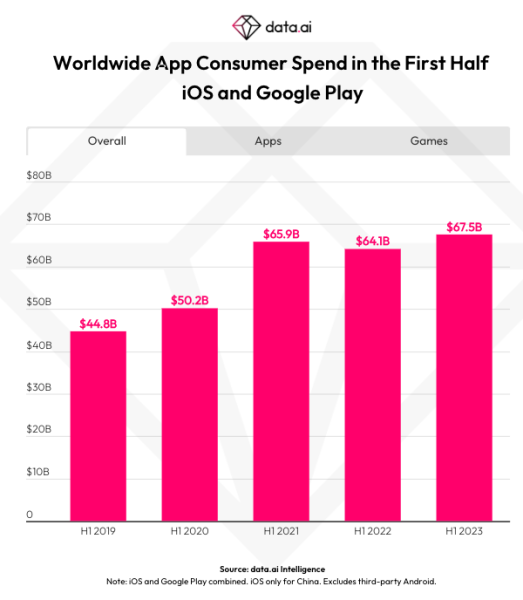

Defying industry headwinds that hurt the market in late 2022, consumer spending on mobile apps returned to growth in early 2023 across multiple regions. The U.S., South Korea, U.K., Mexico, Brazil, France, Turkey, Indonesia, and South Korea all witnessed spending rebounds.

Social and AI Apps Keep Getting More Popular by the Day in the Non-Gaming Space

The rise of conversational AI apps and educational apps from Chinese publishers boosted many markets in H1 2023. Apps like TikTok, CapCut, and Temu from ByteDance and Pinduoduo saw meteoric rises, while BeReal grew in Europe after surging in the U.S. in 2022.

Familiar names like Bumble, Tinder, Disney+, LinkedIn, and games from miHoYo and Scopely topped spending growth due to their popularity and positive momentum. Meanwhile, long-time favorites like Candy Crush Saga, Coin Master, and FIFA Soccer extended their dominance and revenue-generation capacity.

The utilization of new technologies demonstrates the mobile market’s agility. ChatGPT and AI technologies wildly increased in popularity towards the middle of 2023, prompting responses from established mobile players like Alphabet (GOOG) with Bard and newcomers alike to create rival apps.

While market leaders still reigned supreme, many up-and-coming apps carved out major growth opportunities for themselves. Honkai: Star Rail from miHoYo- which earned $230 million in its first 30 days – joined established hits like Candy Crush Saga and Coin Master as breakout successes.

Mobile Apps Shake Off Economic Woes as Consumer Spending Keeps Increasing

The Apple App Store continues to be the most successful marketplace in terms of attracting consumer spending. During the first half of the year, consumers spent $43.5 billion on iOS mobile apps. This resulted in a 6% year-on-year jump for the Apple-owned mobile marketplace.

Meanwhile, Google Play apps managed to attract $24 billion worldwide resulting in a 4% year-on-year increase.

The record growth exhibited across key metrics points to a resurgent year for the mobile market after economic headwinds stunted growth in late 2022. The recovery has been powered primarily by developing markets in Asia and Latin America where mobile adoption continues to skyrocket. If these trends persist, mobile apps stand poised for another record-breaking year.

The market’s recovery was a product of several factors: soaring engagement across regions, a rebound in consumer spending after declining in 2022, breakout successes from newcomers and mobile mainstays alike, and the agility demonstrated by mobile players in adopting new technologies. The foundation appears set for the mobile app industry to build upon the momentum achieved throughout the first half of 2023.