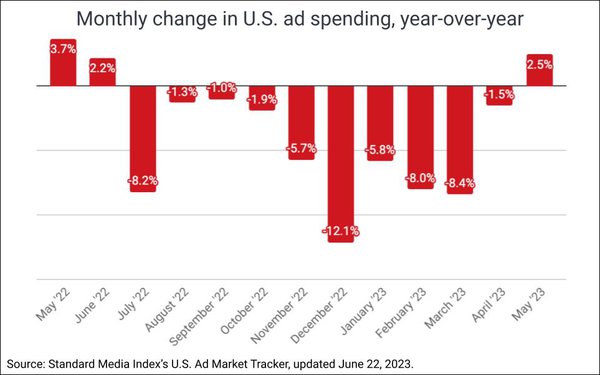

The US advertising market has finally broken its nearly year-long slump, with Standard Media’s US Ad Market Tracker showing growth for the first time in 11 months.

The index rose by 2.5% in May, marking the best May since Standard Media Index began tracking the market, as reported by Insider Intelligence.

This growth is a positive sign that the US advertising market may be emerging from a recession that began in July 2022, most likely due to rising interest rates.

Ad spending declined steeply during the first quarter of the year, with outlays falling by 12.1% in December, 5.8% in January, 8% in February, and 8.4% in March.

April saw a slight upturn, with spending dipping by just 1.4%. Furthermore, May’s growth of 2.5% indicates that the advertising industry is picking up.

While May’s expansion came equally from larger and smaller ad categories, digital media continued to represent an increasing share of total media spending, rising to 60% in May 2023 from 56% in May 2022, 51% in May 2021, and 47% in May 2020.

Despite the positive news, however, ad spend growth is not expected to return to pre-pandemic rates anytime soon.

March forecasts predict single-digit worldwide ad spend growth of 5.8% in 2023, and recent downgrades from groups such as Dentsu argue that ad spend growth is an illusion driven by inflation.

What Caused the Uptick in US Ad Spending in May?

Part of this spending boost can be attributed to seasonal factors, with summer advertising spending and events like Pride Month and Juneteenth driving activity.

However, other factors are also at play, such as the popularity of ad-supported video-on-demand (AVOD) services.

As reported, ad-supported video-on-demand (AVOD) platforms are expected to gain 13.3 million US viewers, including 4.3 million from free premium platforms, this year, bringing their total to 157.1 million.

In contrast, subscription over-the-top (OTT) services will gain just 4.3 million viewers to reach 222.2 million.

“AVOD is the one to watch as streaming services focus on profitability through new ad plans, which are paying off for Netflix, and new ad formats, like those of the newly rebranded Max,” a report by market research firm eMarketer said.

This has led to major services such as Disney+ and Netflix launching advertising subscription tiers, which have piqued brand interest.

Netflix has been among the early streaming companies to introduce cheaper, ad-supported tiers to attract customers and offset losses.

Last month, the company disclosed that its ad-supported streaming tier, launched last November, has reached nearly five million monthly active users.

I thought it was a poor strategic move, but @netflix ad-supported tier has attracted almost 5 million global monthly active users six months after it first launched.

Note: active users are not the same as subscribers, but nonetheless seems pretty impressive.— Horacio Rousseau (@horaciorousseau) May 29, 2023

Neftflix’s basic ad-supported plan is currently priced at $7 per month and represents a reduced-cost alternative to Netflix’s standard offerings that start at $10 per month.

Digital Ad Spending is Expected to Increase in the US

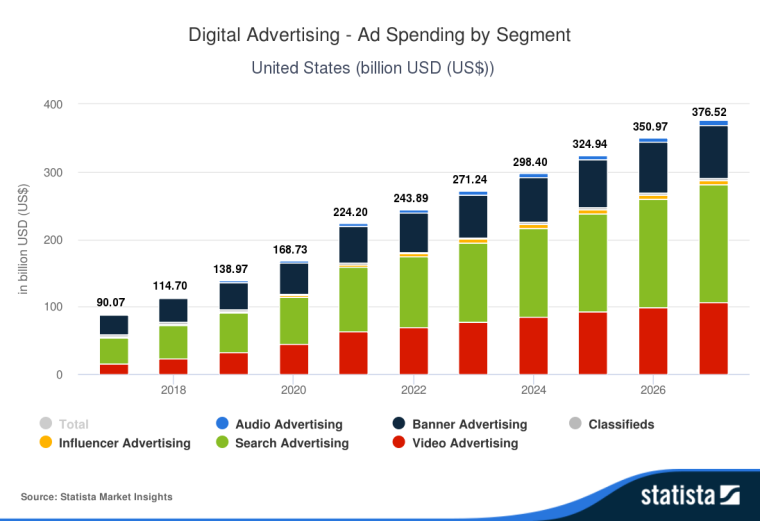

The digital ad market in the United States is expected to see significant growth over the next few years, with spending projected to surpass $400 billion for the first time.

The expected increase in US digital ad spending is part of a global trend, fueled in part by the growing number of internet users worldwide.

According to data from Statista, digital ad spending in the US is forecast to reach $271.2 billion in 2023, representing an 11.2% increase from the previous year.

The trend is set to continue with experts predicting spending will grow to $325 billion in 2025 and reach $376.5 billion in 2027, meaning that the digital ad market will continue to expand at an average annual rate of 8.6% from 2023 to 2027.

While the anticipated growth in US digital ad spending over the next few years is impressive, it pales in comparison to the growth rates seen in previous years.

From 2019 to 2023, the average annual growth rate was over double at 18.6%.

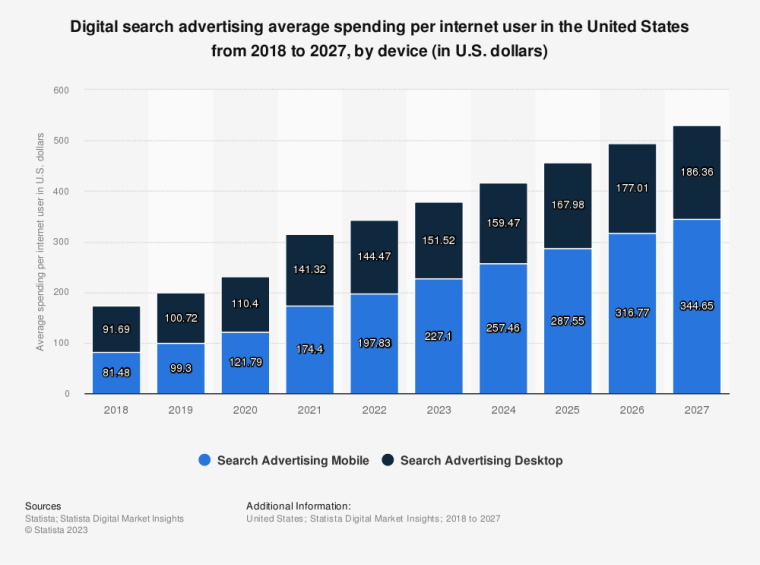

Per capita digital ad spending is also on the rise in the US, with expenditures projected to surpass $378 per internet user in 2023, representing a more than 11% increase from the previous year.

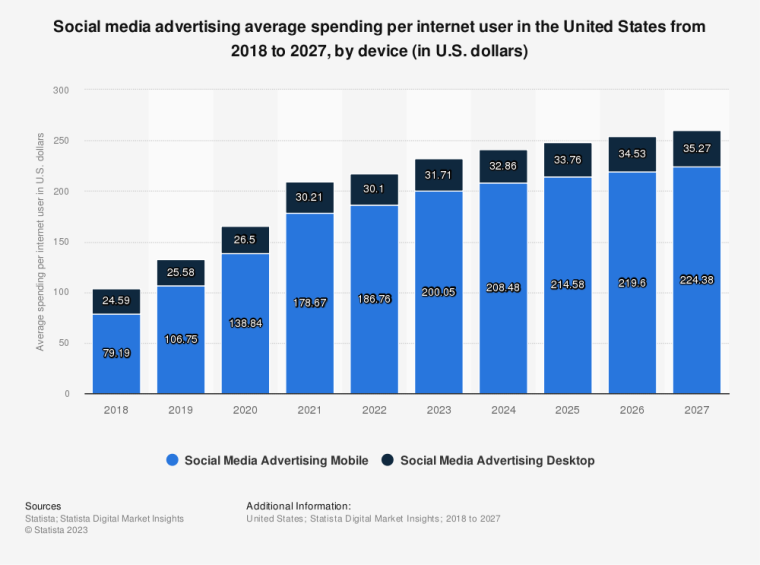

In this regard, the social media advertising average per internet user is expected to rake in the highest value, projected to amount to $231 per internet user in 2023, representing a 6% increase from the previous year.

This figure is expected to continue increasing every year, with spending predicted to surpass $250 per person by 2027.

The retail industry is leading the way when it comes to digital ad spending in the US, with market analysts predicting a 23.5% increase in spending in 2022, followed by the travel and telecom sectors, which are both seeing significant growth in digital ad spending.

Read More:

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops