The UK’s Competition and Markets Authority (CMA) has cleared Amazon’s (NYSE: AMZN) acquisition of iRobot. While the Roomba makers’ stock soared over 21% on Friday after the news came out, privacy experts are sounding an alarm.

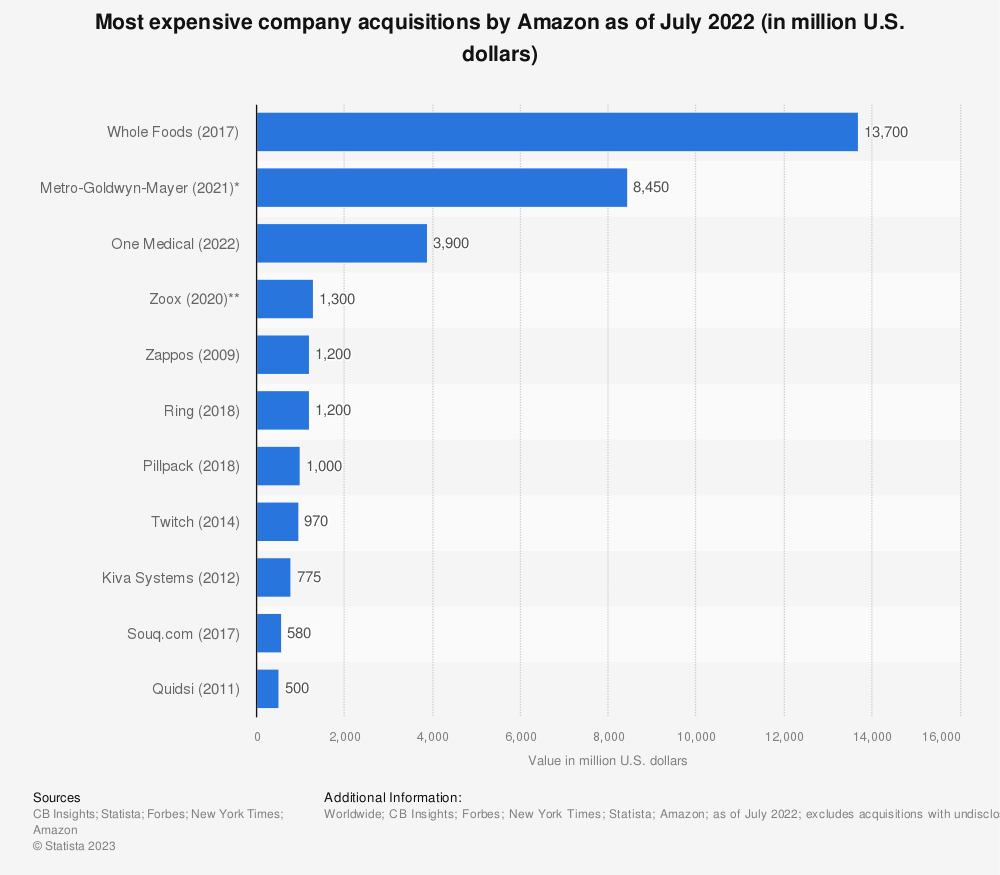

Amazon was on an acquisition spree last year and announced the acquisition of iRobot for $1.7 billion. It also announced the acquisition of One Medical for $3.9 billion – the biggest deal under Andy Jassy who took over as the CEO in 2021.

Amazon’s iRobot acquisition faced regulatory oversight in the US, UK, as well as the EU. The UK has gone ahead and approved the acquisition as the CMA found that the deal “would not lead to competition concerns in the UK.”

Colin Raftery, senior director of mergers at the CMA said, “It’s important to ensure tech firms that already benefit from powerful positions aren’t able to use those positions to undermine competitors at the expense of UK consumers and businesses.”

Raftery added, “After a thorough investigation, we’re satisfied that the deal would have no impact on competition in the UK.”

The US Federal Trade Commission is also investigating the transaction – so is the European Commission which would decide by July 6 whether to start the second phase of probe into the deal.

We have cleared Amazon’s $1.7bn purchase of iRobot.

Our full text decision on why we cleared the merger will be published in due course.

Find out more: https://t.co/obWsNSjLnu pic.twitter.com/Juls5VgI5d

— Competition & Markets Authority (@CMAgovUK) June 16, 2023

Regulators globally have increased their scrutiny of tech mergers and acquisitions amid fears of monopoly as well as the concentration of data with a select few Big Tech companies.

CMA for instance blocked Microsoft’s acquisition of Activision-Blizzard as well as Meta Platforms’ purchase of Giphy.

Privacy Experts are Worried after the UK Clears Amazon’s iRobot Acquisition

While the CMA cleared Amazon’s acquisition of iRobot, privacy experts are worried. Max Von Thun, a Brussels-based director at the Open Markets Institute termed the approval a “mistake” and stressed, “Far more serious concerns are raised by the sensitive data Amazon would acquire with this takeover, which inexplicably do not appear to have featured in the CMA’s review.”

Notably, the Roomba vacuum cleaner comes with sensors that map the house. Amazon already has loads of data about its users’ thanks to its e-commerce platform, Prime, as well as connected devices like Alexa.

The One Medical deal gives $amzn access to more data.

One Medical has 15 years’ worth of medical and health-system data that Amazon could tap

The data can be powerful in health care — for predicting costs, targeting interventions and developing products and treatments

— Nelson Hsieh (@nelson_hsieh7) July 22, 2022

Many fear that if Amazon acquires One Medical, it would also get access to the medical data of users.

According to Evan Greer, director of the nonprofit digital rights organization Fight for the Future, “People tend to think of Amazon as an online seller company, but really Amazon is a surveillance company. That is the core of its business model, and that’s what drives its monopoly power and profit.”

The concerns are not entirely misplaced and Ring, which Amazon acquired in 2018, admitted to sharing customer information with law enforcement agencies multiple times without a warrant.

Big Tech Faces Scrutiny Across the World

Big Tech companies are facing global scrutiny over privacy as well as antitrust concerns. As for Amazon, while the UK clearing the iRobot acquisition is a step in the right direction, the deal still needs the blessings of Brussels and Washington.

Also, Amazon is facing several other investigations and the FTC is also contemplating filing a lawsuit against the company. There have been calls to break up Big Tech companies like Amazon.

The scrutiny might not have come at a worse time for Amazon as its revenue growth fell to an all-time low of 9% last year.

Amazon stock has underperformed tech peers over the last two years as it was almost flat in 2021 even as the S&P 500 soared almost 27%.

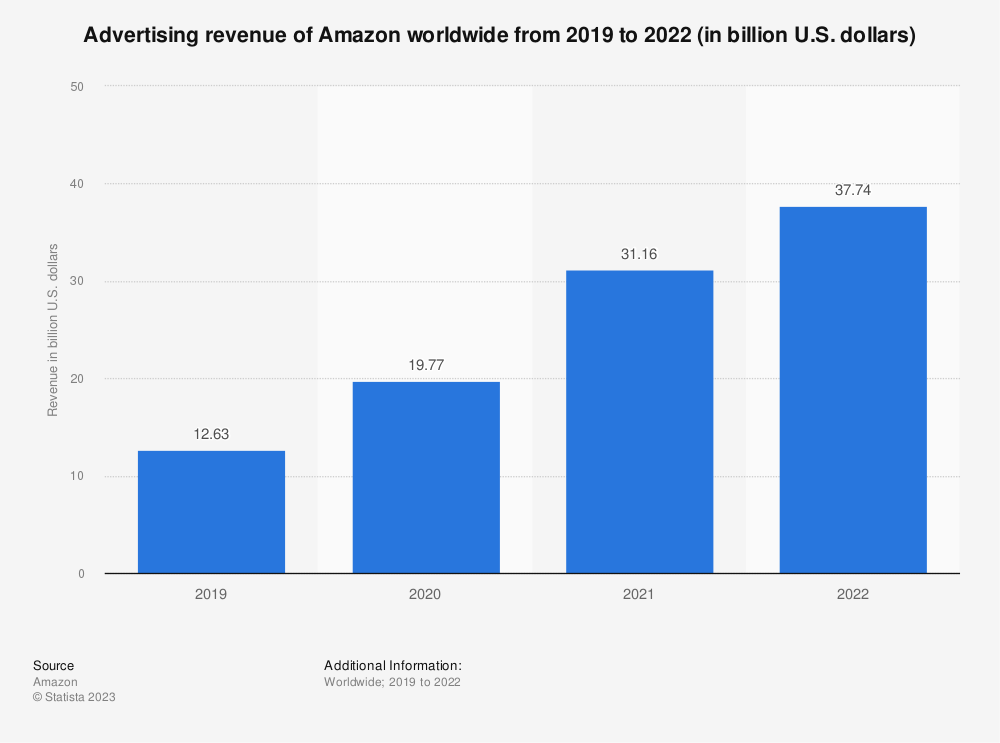

Amazon Advertising revenues Have Soared

Meanwhile, while Amazon’s e-commerce and AWS segments are witnessing a terrible growth slowdown, advertising has been among the strongest growth areas. The company’s advertising segment reported revenues of $9.5 billion in the first quarter of 2023 – a YoY rise of 21%.

It’s already the third largest ad seller in the US after Google and Facebook. Amazon’s privacy policy states that “We also use personal information to display interest-based ads for features, products, and services that might interest you.”

As Amazon gains access to even more user data post-acquisition of iRobot and One Medical, it might be able to target users with even more personalized ads – something which privacy experts seem to be worried about.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops