Amid the global pivot to electric vehicles (EVs), countries in the Middle East that get the majority of their revenues from fossil fuel exports, are also looking to subsidize the EV industry in the region and Chinese automakers especially see an opportunity in the oil-rich region.

Chinese EV companies including BYD, NIO, and Xpeng Motors have expanded in Europe. However, they haven’t been much successful in the region.

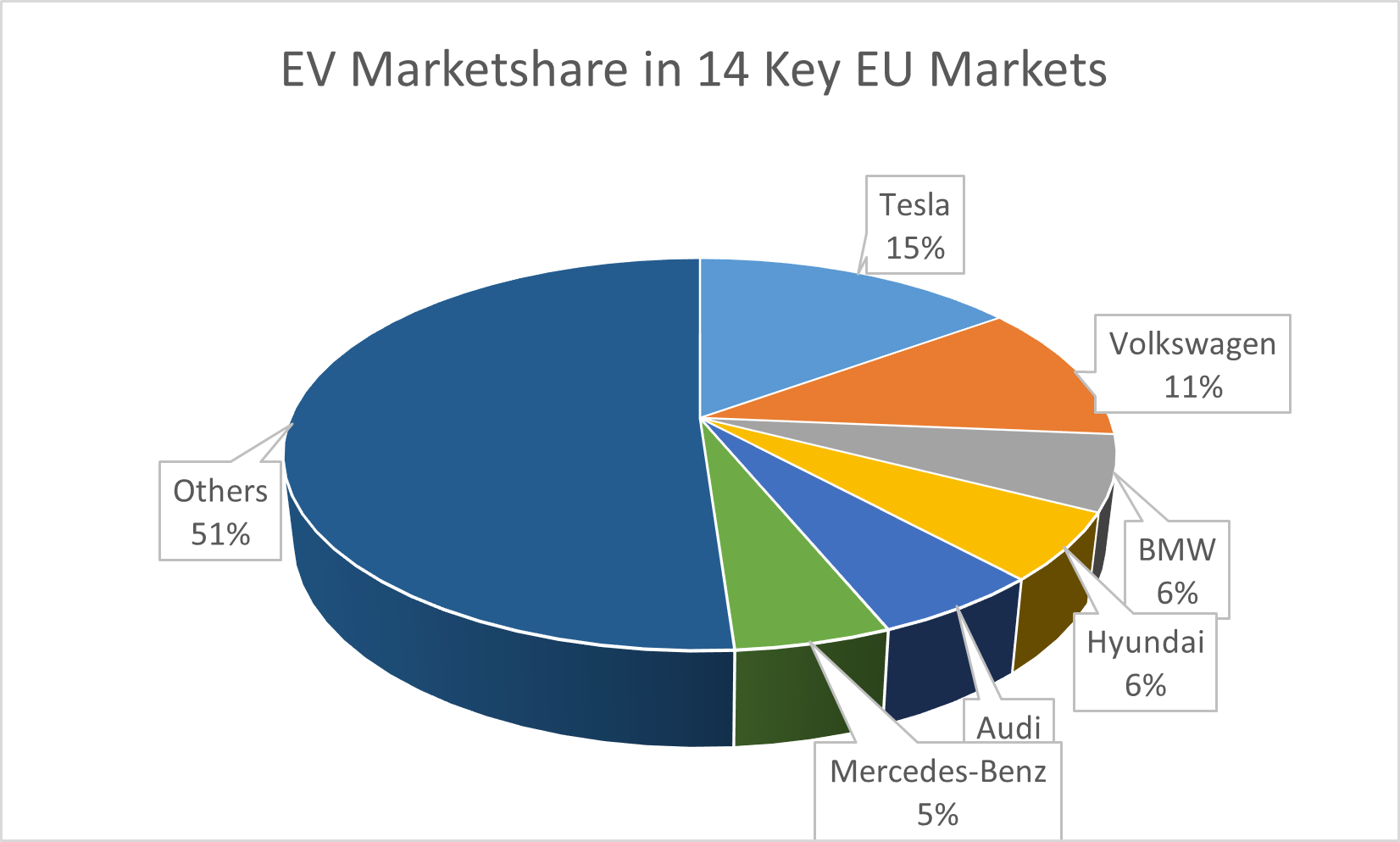

BYD, which sold a record 253,046 vehicles in June and has emerged as the largest seller of new energy vehicles (NEVs) globally, had a mere 0.3% market share in 14 major European markets last year and sold just 4,239 vehicles in the region last year.

The performance of NIO and Xpeng – which started selling cars in Europe in 2021 – has been even dismal and they respectively sold 1,224 and 715 cars in 14 major EU markets last year and had a market share of only 0.1%.

Chinese EV Companies Are Expanding in the Middle East

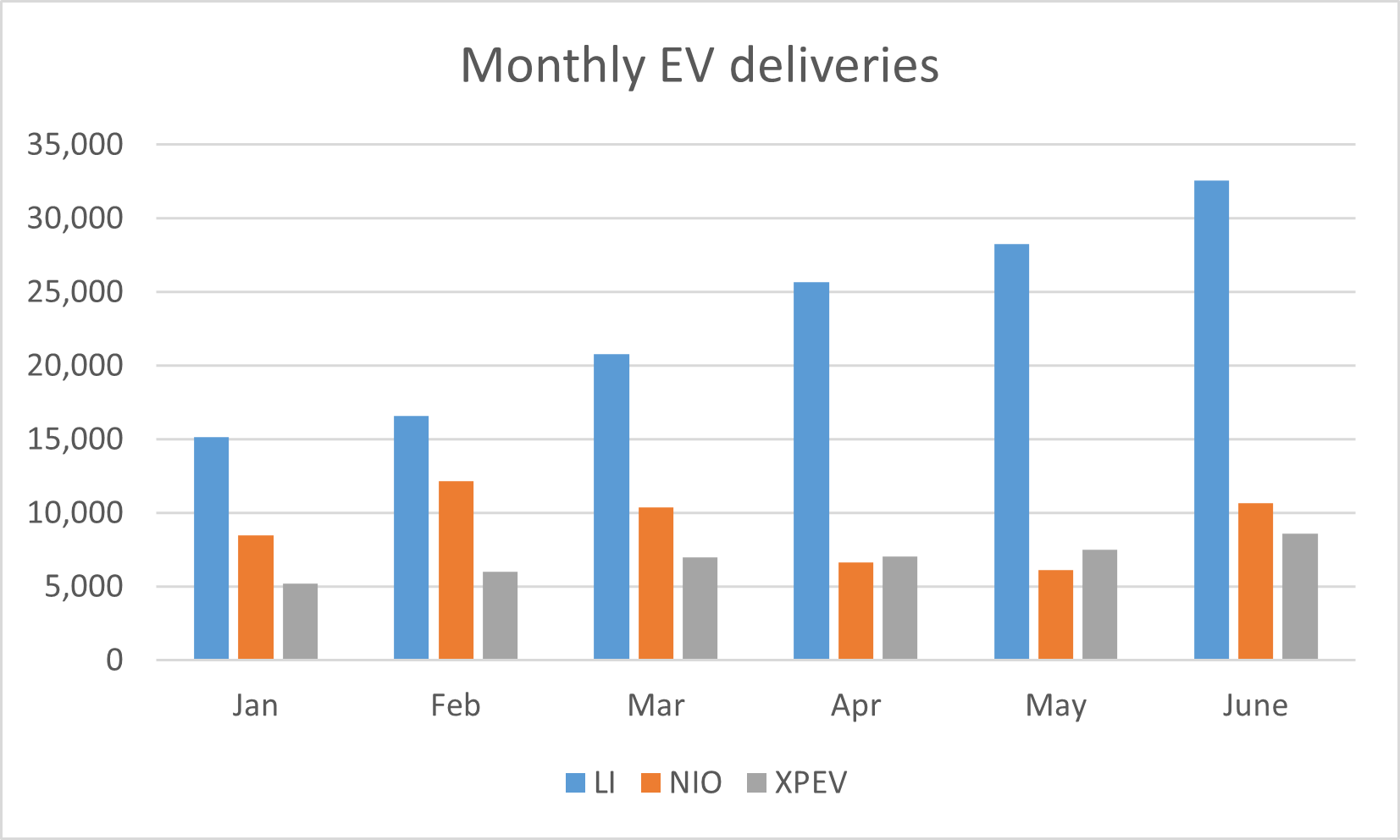

Incidentally, while BYD has emerged as a force to reckon with, NIO and Xpeng Motors are struggling to increase their production and deliveries.

Xpeng Motors’ monthly deliveries have been below 10,000 for six consecutive months. NIO too managed to deliver only 23,520 cars in the second quarter of the year which was barely above the low end of its guidance.

In contrast, Li Auto delivered 32,575 cars in June – which was more than what NIO delivered in the entire second quarter.

Meanwhile, as they struggle to make a mark in the European automotive market, Chinese EV companies sense an opportunity in Middle Eastern countries like UAE which are now investing in green energy and embracing zero-emission cars with open hands.

Also, there is growing bonhomie between Middle Eastern countries like Saudi Arabia and China even as Chinese companies face increasing scrutiny in the US.

Toyota is significantly expanding battery manufacturing in the United States thanks to the Inflation Reduction Act.

The law’s manufacturing incentives will help bend the clean energy cost curve down, which will have far-reaching benefits. https://t.co/CikWbAf5vZ

— Ashley Schapitl (@AshleySchapitl) July 4, 2023

Notably, after the passage of the Inflation Reduction Act of 2022, only those EV models would get the tax credit in the US which are assembled in North America. Also, the batteries and critical battery minerals have to necessarily be sourced from “friendly countries” – with China of course not meeting the mark.

Oil Rich Middle East Kingdoms are Investing in EV Companies

In an apparent bid to diversify their revenues, oil-rich countries in the Middle East are investing in EV companies.

Last month, CYVN Holdings L.L.C., which is an investment vehicle majority owned by the Abu Dhabi Government announced a $738.5 million investment in NIO.

NIO said that CYVN “agreed to cooperate to jointly pursue opportunities in NIO’s international business following the closing of the Investment Transaction.”

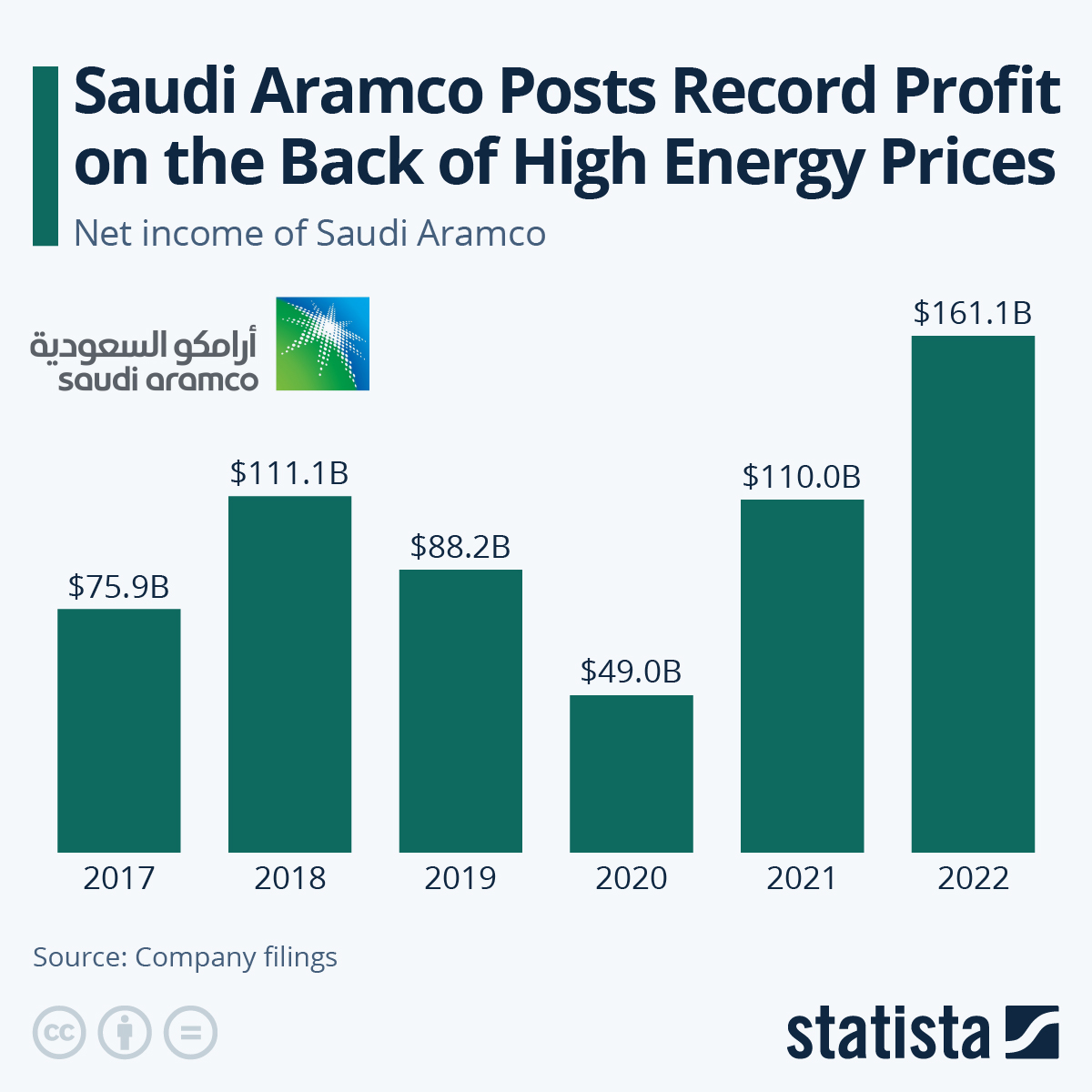

Saudi Arabia has been at the forefront of the EV transition even as the country is home to Aramco – the world’s biggest oil company.

In 2022, Aramco posted a net income of $161.1 billion which is the highest ever by a publicly traded company.

To put that number in perspective, Apple, which is the most valuable company globally, posted a net profit of just under $100 billion in its fiscal year 2022 which ended in September 2022. Microsoft’s net income was $72.7 billion in its fiscal year 2022 which ended in June.

Saudi Arabia is the Largest Investor in Lucid Motors

Public Investment Fund (PIF), which is Saudi Arabia’s sovereign wealth fund holds a nearly 69% stake in US-based EV startup Lucid Motors.

The country has poured billions of dollars into the loss-making venture, including a cumulative $2.7 billion since November 2022.

Saudi Arabia has the option to order upto 100,000 vehicles from Lucid and the company is looking to set up its next plant in the country.

In November 2022, Saudi Arabia signed an agreement with Taiwan-based contract manufacturer Foxconn. As part of the agreement, PIF and Foxconn would form a joint venture under the name Ceer, which would sell EVs under the same brand.

Notably, Ceer would be the first EV brand in Saudi Arabia and would sell both sedans and SUVs in Saudi Arabia and the MENA region.

Foxconn would make the electric architecture for the cars. The cars would be made in Saudi Arabia and the deliveries are expected in 2025.

With the global economy slowly pivoting to a low-carbon future, it’s no surprise that countries like UAE and Saudi Arabia are looking to subsidize EV production in their countries.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops