Tech companies as well as carmakers see a massive opportunity in autonomous driving. The optimism is not unfounded as one in every 10 cars is expected to be self-driving by 2030.

According to MarketsandMarkets, the global market for self-driving cars is expected to more than triple between 2021 and 2030 and reach 62.4 million units.

Separately, according to a McKinsey report, autonomous driving could create revenues of between $300 billion-$400 billion by the middle of the next decade.

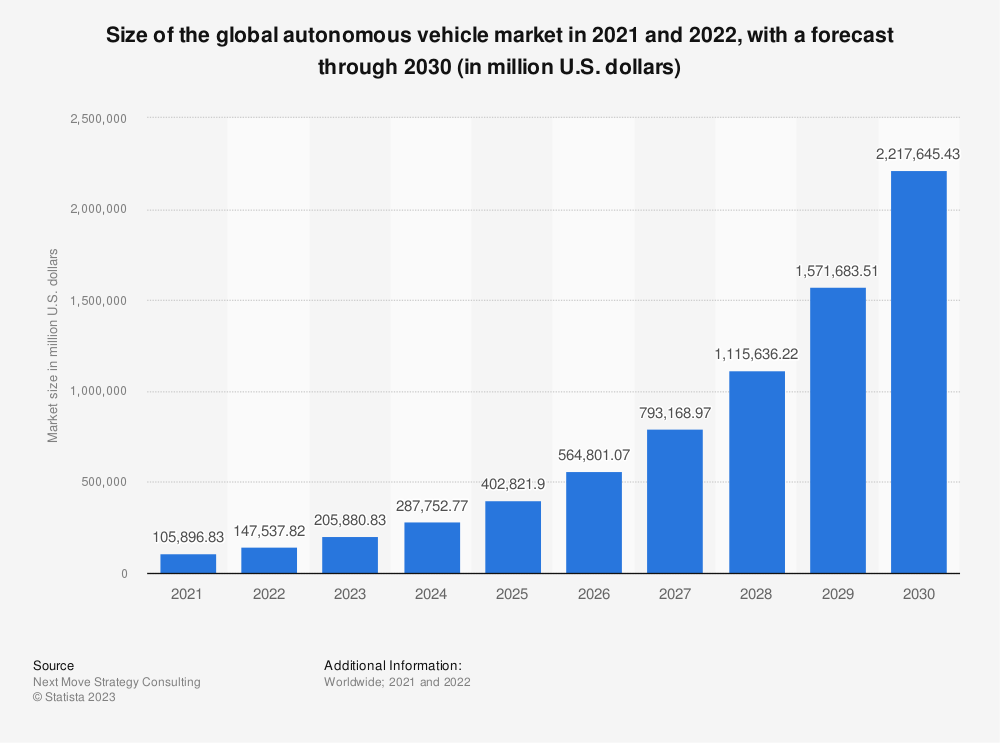

Next Move Strategy Consulting estimates that the market size of the autonomous driving industry would hit $2.3 trillion by 2030.

Notably, last week, speaking at the Paris VivaTech innovation conference, Tesla’s CEO Elon Musk said that the company’s valuation is linked to its autonomous driving.

Tesla is the world’s most valued automaker with a market cap exceding $850 billion – which is over thrice of Toyota Motors, the world’s largest automaker.

Musk Believes Self-Driving Accounts for the Bulk of Tesla’s Valuation

The billionaire said, “The potential for autonomy is that the value of autonomy is so high, that even if you have a discount, a percentage probability of autonomy happening, that is so incredibly valuable.”

Notably, Tesla offers Autopilot driving assistance as well as its advanced version the full self-driving (FSD).

In 2022, Tesla raised the FSD price by $5,000 to $15,000 and Musk has said that the price would eventually rise to $100,000.

Last year, the company extended FSD to all Tesla car owners in North America despite apprehensions among several quarters including over the very name “full-self driving” which suggests that it is L4 autonomous.

This year, Dawn Project released a 30-second commercial calling out Tesla for what it said was “deceptive marketing.”

Over the last many years, Musk has been promising full autonomy in Tesla cars but the software is still not L4. Musk meanwhile believes that Tesla leads competitors by a wide margin when it comes to autonomous cars.

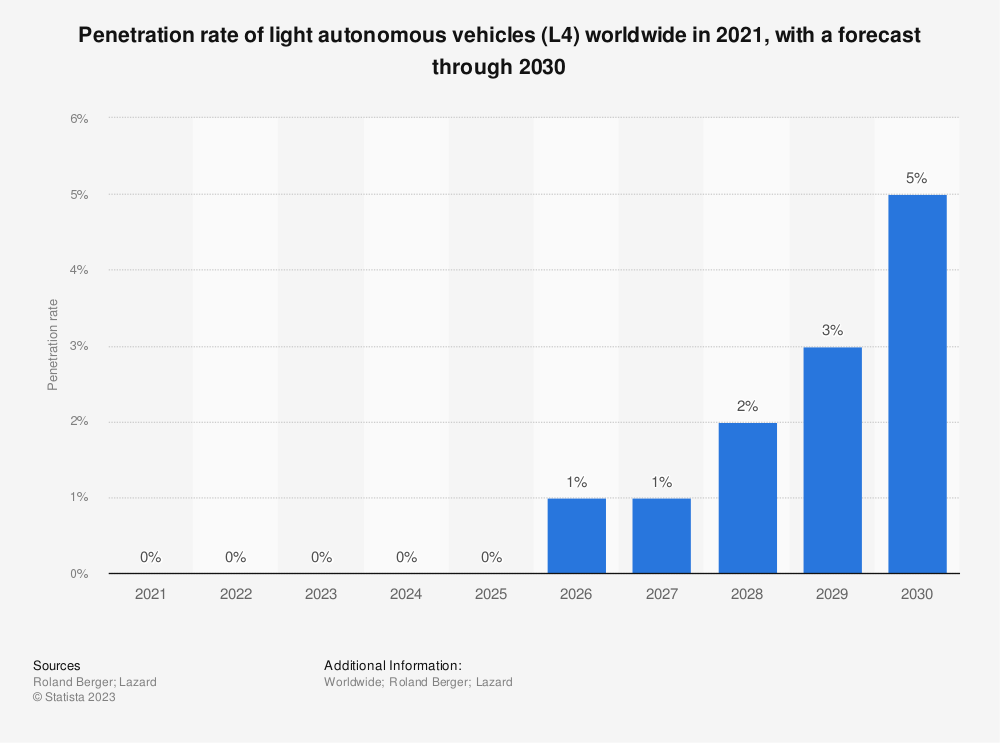

Penetration of L4 Autonomous Cars is Expected to Rise to 5% by 2030

The Tesla CEO is also open to willing its self-driving tech with other automakers. Notably, the penetration of L4 autonomous cars is expected to rise to 1% in 2026 and further to 5% by 2030.

Earlier this year, Waymo, which is backed by Alphabet began testing fully driverless cars in Los Angeles.

The company started testing fully driverless cars in San Francisco last year only and now has the approval to drive autonomous cars in two California cities.

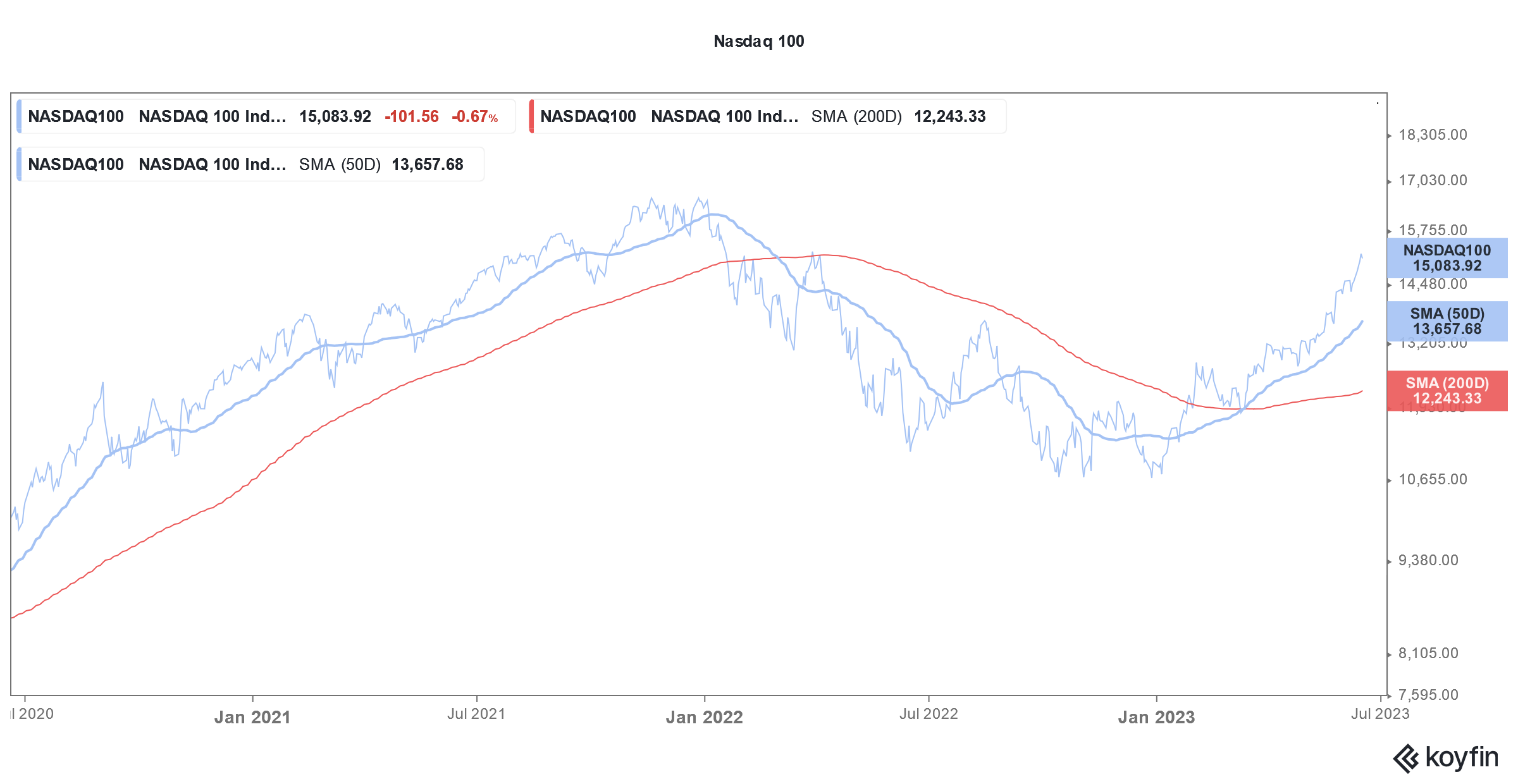

Alphabet is among the companies that are investing in generative AI. The euphoria towards AI has helped the Nasdaq 100 add over $4 trillion to its market cap and the index has gained almost 40% so far in 2023.

In China, Xpeng Motors has received permission to roll out its self-driving technology in Beijing – the company has already rolled out its self-driving tech in Shenzhen, Guangzhou, and Shanghai.

It aspires to roll out its self-driving tech in all major Chinese cities by the end of 2024.

Self-Driving Companies are Losing Billions of Dollars

Meanwhile, while markets are optimistic about the outlook for autonomous cars – companies in the sector are losing billions of dollars every year.

According to a report from Automotive News, investors have poured a whopping $160 billion towards self-driving companies over the last dozen years.

Cruise, which is backed by General Motors, lost $500 million in Q2 2022 and $900 million in the first half of 2022. Its accumulated losses surpassed $5 billion last year while the daily losses averaged around $5 million.

#GM has lost nearly $5 billion since 2018 trying to build a robotaxi business in SFO, and now as the automaker's Cruise unit starts charging for rides, the losses are accelerating.

GM said on Tuesday it lost $500 million on Cruise during the 2nd quarter – more than $5M a day pic.twitter.com/JlSI17sDzK— Berlinergy (@Berlinergy) July 26, 2022

Last year, Ford wrote off its entire investment in autonomous driving startup Argo AI – which eventually wound up its operations.

The company also announced that it would not focus on L4 autonomous systems. Ford’s CEO Jim Farley said that while companies have spent a cumulative $100 billion towards level 4 autonomous vehicles, no company has been able to define a profitable business model.

Ford’s CFO John Lawler said that the company believes that it does not need to create fully autonomous technology on its own.

That said, partnerships could be the way forward in autonomous driving. Tesla has already partnered with Ford, General Motors, and Rivian to share its Supercharging network.

In the coming years, it might also license its self-driving tech in what could be yet another win-win for Tesla and other automakers.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops