All Tesla Model 3 variants are now eligible for the full $7,500 EV tax credit which would be a big boost for the company which has of late struggled to meet the 50% delivery growth that it set for itself.

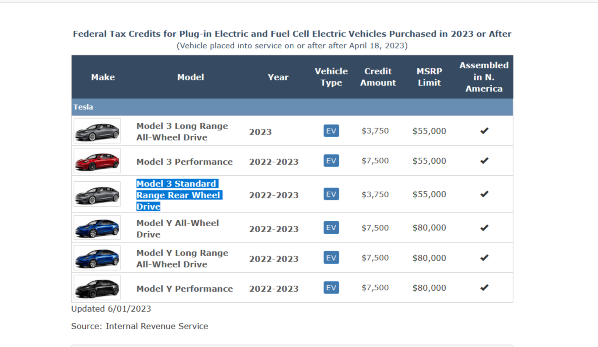

Previously the Model 3 Long Range All-Wheel Drive and Model 3 Standard Range Rear Wheel Drive were eligible for only $3,750 credit while the remaining Model 3 variants – as well as all the Model Y variants were eligible for the full $7,500 credit.

The Model S and Model X did not qualify for the tax credit at all as their price is above the maximum threshold set under the Inflation Reduction Act of 2022.

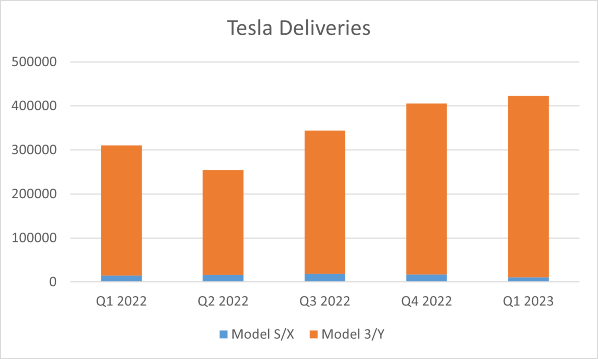

That said, together Model S/X accounted for only about 2.5% of Tesla’s sales in the first quarter of 2023 and their share has been falling gradually.

Most of Tesla sales now comprise Model 3/Y and the Model Y was the best-selling car globally in the first quarter of 2023 – becoming the first EV model to achieve that feat.

Amid the strong demand, the company upwardly revised Model Y prices twice over the last month – even as the price is still much lower than what it was at the beginning of the year.

Notably, Tesla did not raise the Model 3 price – a sign that the aging model’s demand is probably not as strong as the best-selling Model Y.

All Tesla Model 3 Variants are Eligible for the $7,500 EV Tax Credit

On its website, Tesla mentioned that all the Model 3 variants are now eligible for the full EV tax credit of $7,500 and its CEO Elon Musk also retweeted a tweet by Sawyer Merritt who’s the co-founder of apparel company Twin Birch and a Tesla investor.

However, the IRS website still mentions that Model Long Range All-Wheel Drive and Model 3 Standard Range Rear Wheel Drive qualify for only a $3,750 EV tax credit.

Tesla hasn’t specified how the two Model 3 variants are now eligible for the full EV tax credit.

The IRS unveiled the new set of rules in mid-April, under which the models would be eligible for a $3,750 EV tax credit if they source 50% battery components from North America and another $3,750 if they source critical minerals from the US or one of its free trade partners.

Also, the car has to be necessarily assembled in North America to meet the EV tax credit.

After the new rules were announced only models from US-based car companies were eligible for the $7,500 credit – but soon enough the IRS said that Volkswagen ID.4 is eligible for the full tax credit.

TSLA Stock Has Doubled in 2023

Tesla stock has doubled in 2023 and the rally gained momentum after Musk visited China last week.

The stock slumped to multi-month lows on the first trading day of 2023 but has since rebounded amid a buying spree from retail investors. Cathie Wood of ARK Invest also bought more Tesla shares this year.

Cathie Wood predicts the market for humanoid robots to grow to $1 trillion by 2030 & Tesla is well positioned to cash in. pic.twitter.com/p2wzX73X7e

— DogeDesigner (@cb_doge) May 27, 2023

Her 2026 base case target for TSLA stock is $2,000 with a bear case and bull case target price of $1,400 and $2,500 respectively.

Incidentally, her base case target price would imply a market cap of $5 trillion – which is quite close to Musk’s prediction of the company’s market cap surpassing the combined market caps of Apple and Saudi Aramco.

Previously, she predicted that the stock would rise to $1,500 by 2025 – a price level that Ron Baron – another Tesla bull sees more likely by the end of this decade.

All said all Model 3 variants qualifying for the full $7,500 EV tax credit would be a big boost for Tesla especially as the EV price war has escalated this year.

Foreign automakers are also scrambling to set up battery plants in the US in order to make their models eligible for the lucrative $7,500 credit.

Related stock news and analysis

- Greenest Cryptocurrencies to Invest In 2023

- Toyota Going All-In On EVs, Invests $2.1 Billion in US Battery Factory Expansion

- Could Li Auto Challenge BYD and Tesla’s Dominance in China’s EV Market?

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops