Tax preparation giants including H&R Block shared sensitive personal and financial information of millions of taxpayers with tech companies Meta and Google without customers’ consent, according to a congressional probe.

The bipartisan investigation report by Senators Elizabeth Warren, Ron Wyden, and others found that H&R Block, TaxAct, and TaxSlayer collected data through tracking pixels provided by the two tech giant’s ad tools and sent them customer information.

The data collected included taxpayers’ names, income, refund amounts, dependents, and filing status along with details about the sections of the tax preparation websites customers accessed.

The congressional investigation found the information sharing was worse than initially reported last year by The Markup and may have violated privacy laws. The lawmakers have called on federal agencies to investigate and prosecute any illegal activity.

Ad Companies Confirm this Practice but Shift the Blame to Tax Companies

In a letter to the IRS, Federal Trade Commission, Treasury, and Justice Department, the senators said the “findings reveal a shocking breach of taxpayer privacy by tax prep companies and by Big Tech firms.”

The three tax preparation companies provided little oversight of the data collection and in some cases did not even know what information was being accessed, according to the report.

Meta Platforms (META) acknowledged using the data to target ads and train its AI systems. Meanwhile, Google said that site owners, not them, control what information is collected.

In statements, TaxAct, and TaxSlayer did not directly address the findings cited by lawmakers but said customer privacy is a priority. H&R Block said it has taken steps to prevent information sharing.

The investigation comes as the IRS is planning a free online tax filing system for 2024 that could compete with private tax preparation companies. Those companies have spent millions lobbying against government-run tax filing services.

The lawmakers say the information sharing highlights “the urgent need for the IRS to develop its own online tax filing system.” They have called on federal agencies to crack down on any illegal activity and pursue “any company or individuals who violated the law.”

The findings suggest a legal risk for both the tech giants and the three tax preparation firms involved, which experts say could face billions in fines or criminal penalties if the government decides to pursue legal action.

For taxpayers, this reported data-sharing means that sensitive financial details that are meant to be protected were apparently accessed by giant for-profit tech companies without their knowledge or consent. As tax season officially begins this week, Americans now must question who else may have had access to their most private financial details.

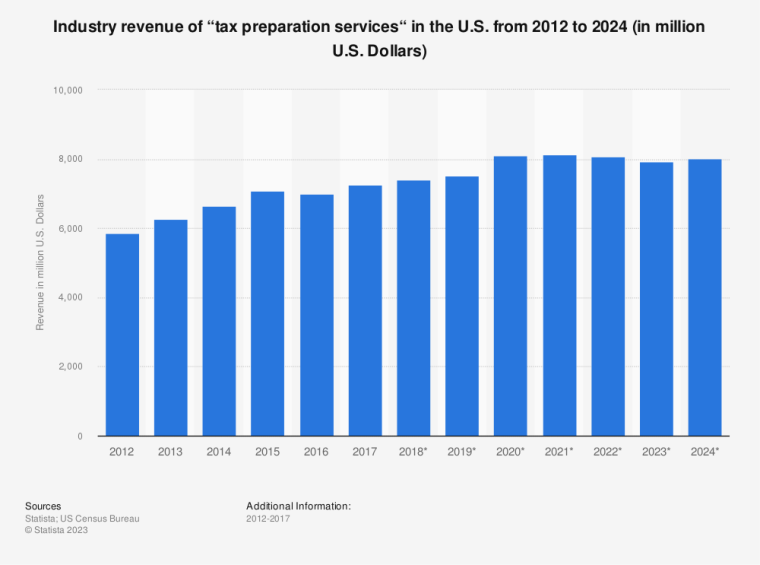

Tax Preparation Services is a Multi-Billion Dollar Industry in the US

Tax preparation services in the United States produced revenues of over $8 billion in 2023 according to estimates from Statista. These businesses help both individuals and organizations collect and sort all relevant financial information required to file their taxes every year.

To this end, they have access to sensitive information including income, employment status, addresses, contact numbers, household details, and even detailed statements containing lists of properties owned by the customer to perform their services.

A report from the website Gitnux indicates that 53% of Americans currently utilize the services of these firms to prepare their taxes every year. H&R Block and Intuit, the software developer behind TurboTax and QuickBooks, reportedly dominate the market with a 42% combined market share.

The average cost of preparing taxes in the United States is $200 for individuals. These services are primarily used to avoid penalties for faulty tax returns, claim any applicable refunds, and ensure access to federal social benefits, among other things.