AI, or generative AI to be precise has been making waves globally. However, a Yahoo Finance/Ipsos survey shows that only 20% of investors are either very likely or somewhat likely to use an AI financial advisor.

Nearly two-thirds of the investors say that they are somewhat or very unlikely to use an AI financial advisor. The survey, which was conducted on 1,276 Americans further showed that 45% of investors don’t trust AI for financial advice.

The results look somewhat dampening for US financial giants who have otherwise been considering a pivot to AI.

We all know that AI is here to stay? Can you imagine #AI giving you personal advice?

Yes, you heard it right.

JPMorgan Chase is developing a ChatGPT-like software service that leans on a disruptive form

of artificial intelligence to select investments for customers, as per… pic.twitter.com/2f5KbhZ72k— Moneycontrol (@moneycontrolcom) June 12, 2023

JPMorgan Chase, which is the largest US bank, is reportedly looking to launch a ChatGPT-like AI service for investment advice. Incidentally, the bank is among the companies which have restricted employees from using generative AI platforms like ChatGPT.

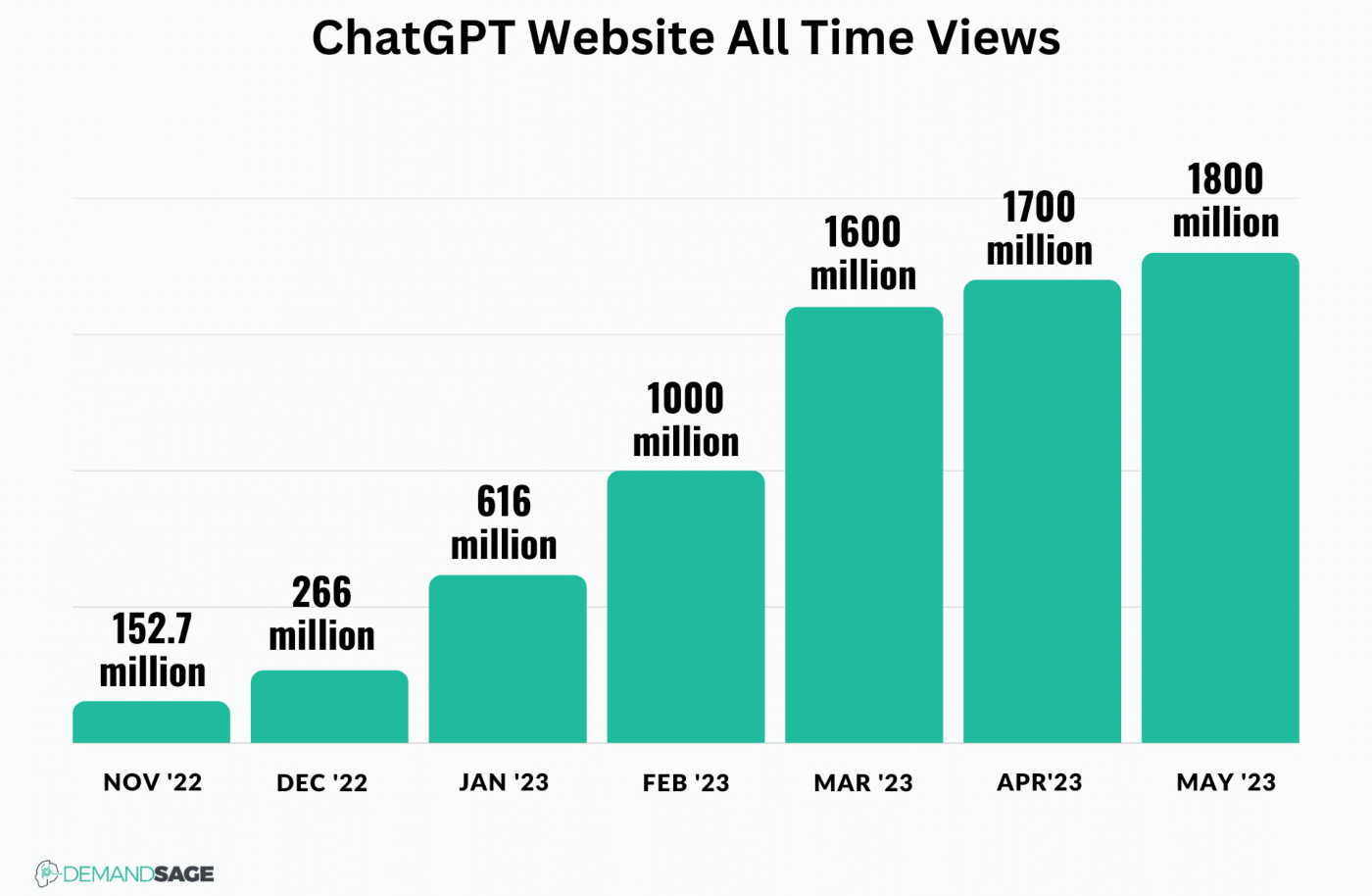

ChatGPT took the tech world by surprise and became the fastest-growing app to reach 100 million users within two months and its all-time views crossed 1.8 billion last month.

The valuation of ChatGPT’s parent company OpenAI has also exploded and it was last valued at upto $29 billion in the May funding round.

Microsoft is among the companies that have invested in OpenAI, and has committed an estimated $10 billion to the company spread across multiple years.

Meanwhile, coming back to the survey, while the majority of the investors don’t look comfortable with the prospect of AI managing their money – they might unknowingly be using AI while making financial decisions.

According to Q.ai Market Trend Analyst Jason Mountford, “So far, [AI] has mainly been in the background, with few investors likely to realize that AI is involved in the management of their money.”

Investors are Twice as Likely to Use AI But are Wary of AI Financial Advisors

An interesting finding from the survey was that while the majority of the investors are wary of AI, they are more likely to use AI as compared to non-investors.

The survey showed that 20% of investors have used AI over the last year – while the corresponding figure for non-investors is only 11%.

Notably, AI as an investment theme is quite popular among investors as is visible in the rally in AI stocks. C3.ai, which is among the rare pure-play listed AI stock is up almost 290% for the year, while Nvidia whose chips are crucial for building AI models has gained 186% for the year.

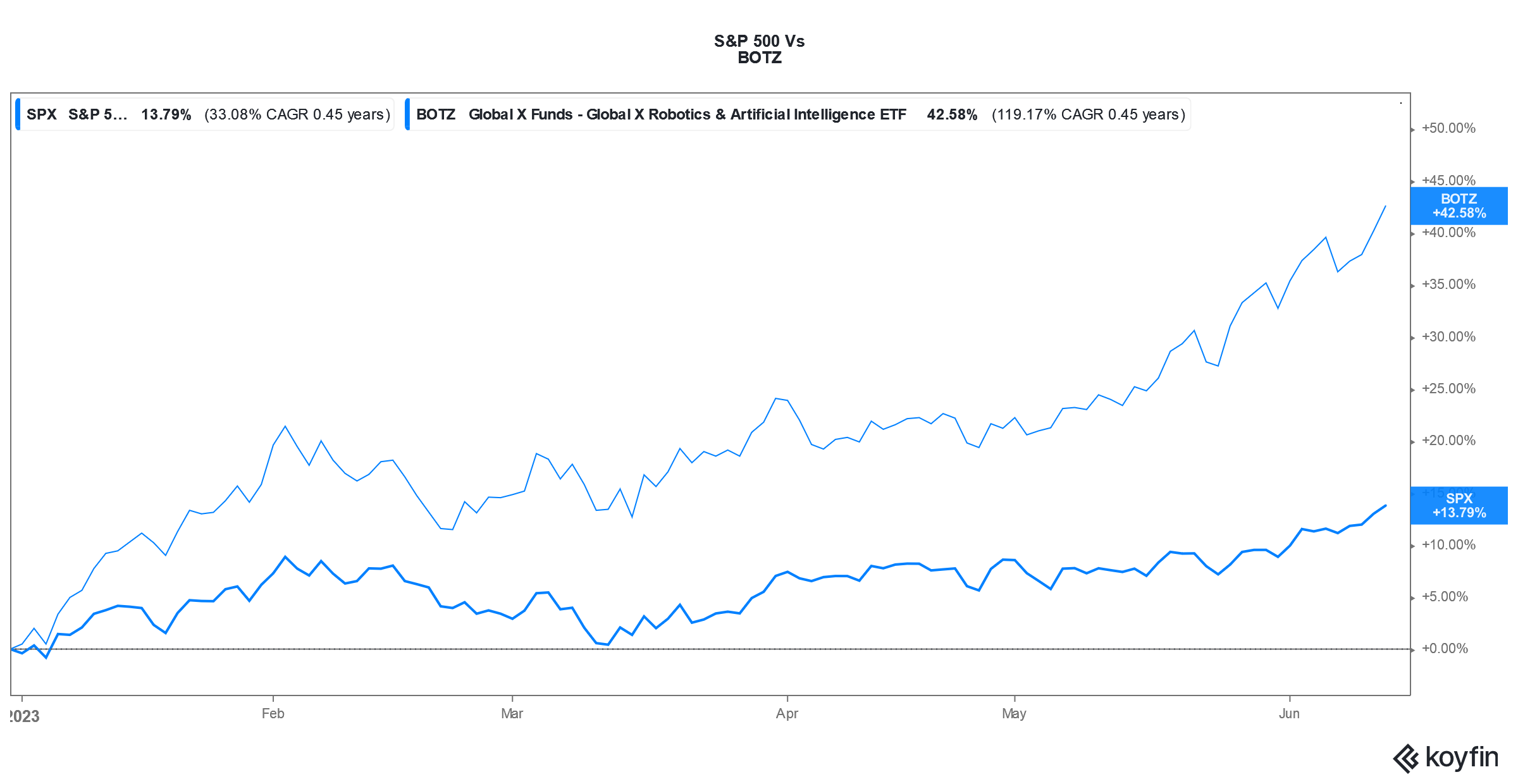

The S&P 500 has gained just about 13.8% which is a third of what the Global X Robotics and Artificial Intelligence ETF has risen over the period.

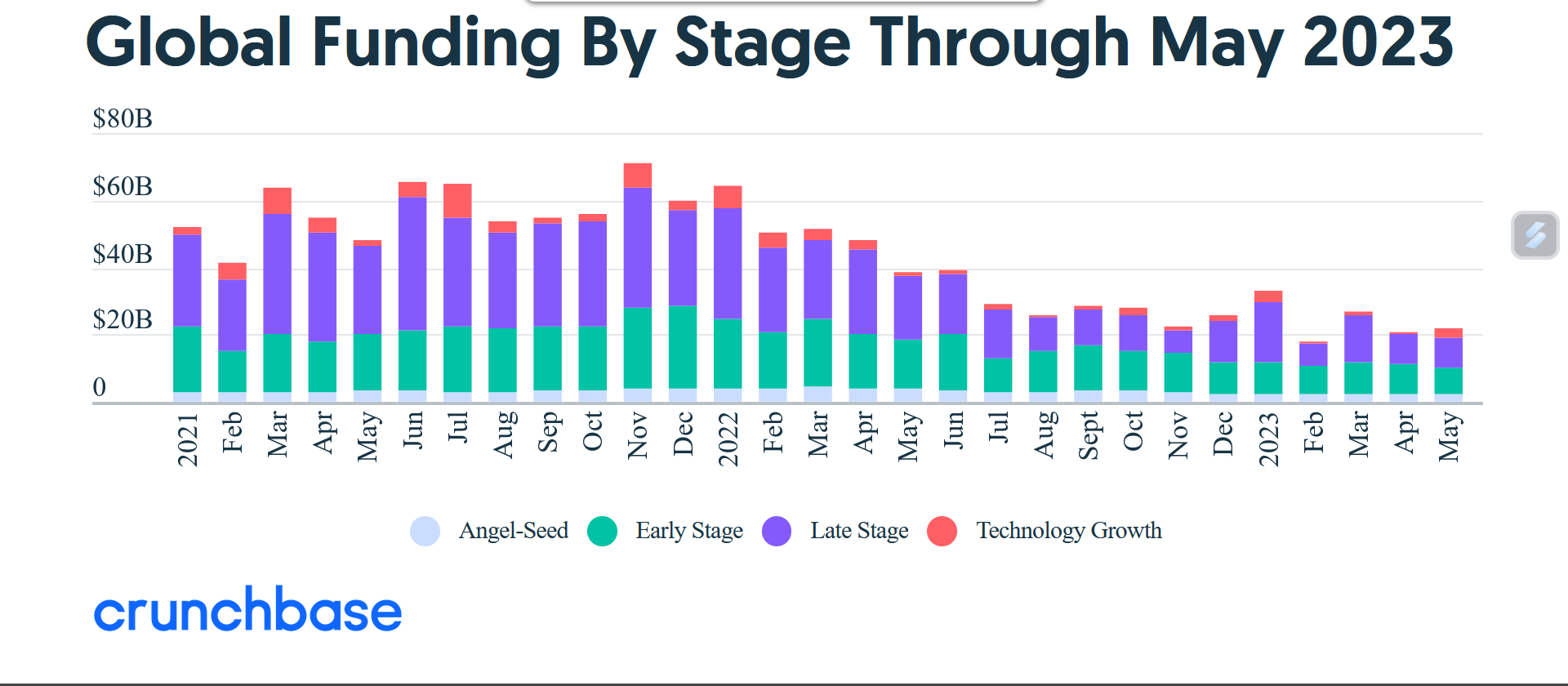

AI has been a bright spot in the startup space as well. While Global Venture Capital (VC) funding fell 44% YoY to $22 billion in May according to Crunchbase, AI funding fared relatively better and eight of the 38 unicorns this year are AI companies.

Young Americans are More Likely to Use Artificial Intelligence

Meanwhile, the propensity to use AI financial advisors also varied by demographics and the survey showed that 20% of Gen Z adults were somewhat or very likely to use an AI-based financial advisor – which is over twice what baby boomers and older adults.

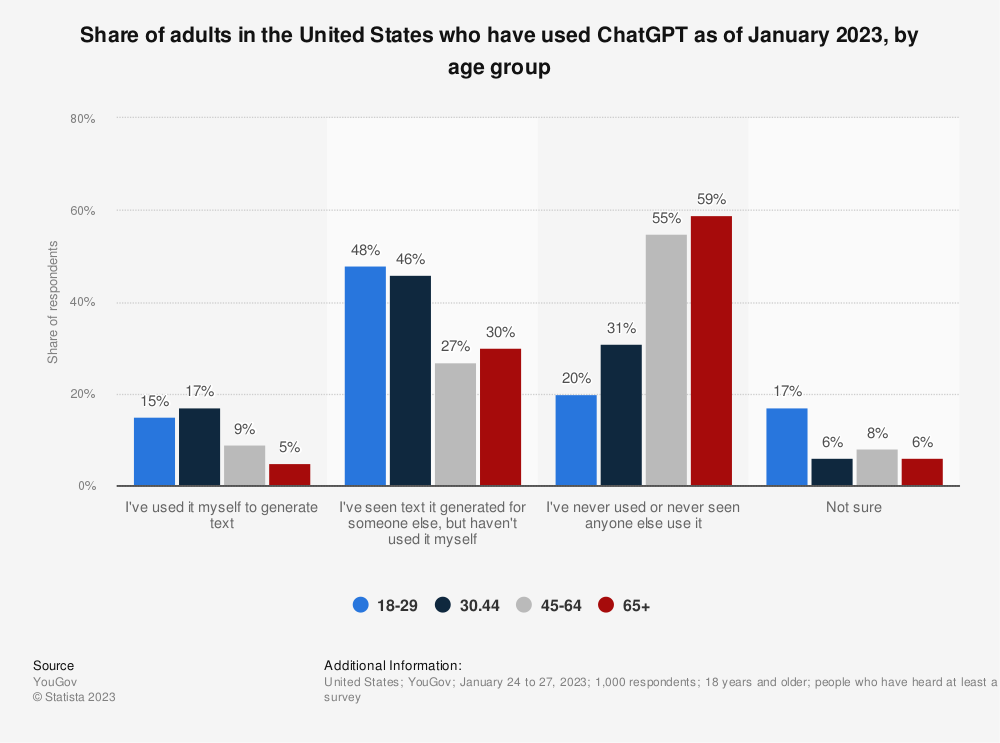

The results are not surprising as a January survey showed that while 17% of respondents aged between 30 to 44 years old claimed to have used ChatGPT to generate text themselves, 59% of those older than 65 years old said that they have neither used AI themselves nor seen anyone else using it either.

Related Stock News and Analysis

- Best AI Crypto Tokens & Projects to Invest in 2023

- No One’s Job Is Safe – 97% of Business Owners Expect ChatGPT to Help Their Business

- Meta Platforms Tops the Charts as 58.1% of Companies Use Social Media Marketing

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops