Sono Group (NYSE: SEV), which went public in November 2021, has terminated its electric car project and would instead focus on solar tech technology. Multiple startup EV (electric vehicle) companies are having trouble executing their business plans.

Sono Motors was developing the Sion SEV (solar electric vehicle) which had integrated solar panels. The company intended to make a mass-market model priced at $25,000 and at the time of the IPO, it had some 16,000 reservations.

The reservations had since soared to 45,000 which is even higher than that of Lucid Motors. Lucid incidentally reported a fall in reservations for two consecutive quarters and would no longer provide the reservation numbers.

In a business update yesterday, Sono Motors announced “that it decided to pivot its business model to exclusively retrofitting and integrating its solar technology onto third party vehicles, and to terminate its Sion passenger car program.”

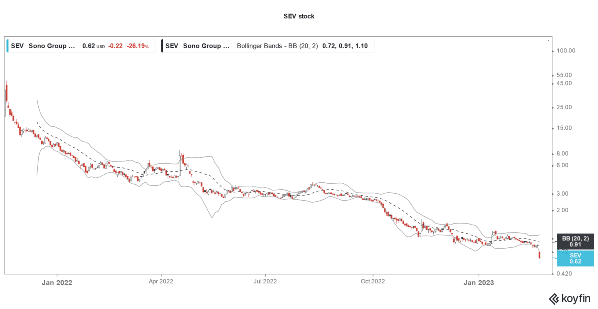

The decision is effective immediately. The stock fell over 26% yesterday and hit its all-time low of 60 cents. When the company went public in 2021, it priced the IPO at $15 which was at the midpoint of its range.

The stock however soared on the listing day. It was quite usual for startup EV companies to soar on their listing in 2020 and 2021. Even Rivian stock soared on the listing day and eventually, its market cap surpassed $150 billion.

While the US IPO market was dead last year, analysts expect the market to eventually rebound. There is a list of some of the upcoming IPOs.

Sono Motors Kills Its EV Program

In its release, Sono Motors said, “Termination of the Sion program reflects a decision to focus on a capital-light business model – an estimated 90% of the funding needs for 2023 were generated by the Sion program – in light of depressed capital market conditions.”

Notably, startup EV companies are battling with massive cash burn. Several EV companies like Nikola, Lucid Motors, Li Auto, and NIO have raised capital over the last year.

With markets turning apprehensive about startup EV companies, many are facing trouble in raising more capital. The cash burn of startup EV companies might not come down anytime soon amid the price war.

Startup EV Companies Face the Heat

Meanwhile, Sono Motors is not the first startup EV company facing the heat and almost all the companies are facing trouble even as the scale might vary. For instance, Lordstown Motors sold its manufacturing plant to Foxconn which now makes cars under contract manufacturing.

Electric Last Mile Solutions went bankrupt and eventually, Mullen bought the company’s assets.

Arrival has also restructured the business to lower the cash burn. Among the bigger names, Lucid Motors expects to produce between 10,000-14,000 cars in 2023 which is below its production capacity.

Tesla too missed its 2022 delivery guidance. The stock crashed 65% in 2022 but rebounded in 2023. There is a guide on how to buy Tesla stock.

Overall, things haven’t been rosy for EV companies, especially the newly listed names, as markets now question them on execution.

The honeymoon period for startup EV companies is over which is reflected in their valuations, that appear a lot more grounded now. At the peak, Rivian’s market cap was higher than that of Volkswagen, the world’s second-largest automaker.

Tesla’s market cap was also ahead of all leading automakers put together. While many like Ashwath Damodaran find the stock still overvalued, Tesla has proved its manufacturing prowess, something which almost all the startup EV companies are struggling with.

Sono Motors to Work on Licensing Its Solar technology

Coming back to Sono Motors, the company is now pivoting to a new business model which is capital light.

In its release, Sono Motors said, “The Company will now scale up its technology, starting with the introduction of the next generation of its mass-market-ready retrofit solution for cleaner public transportation — the ‘Solar Bus Kit’ — planned for the second quarter of 2023.

It added, “Talks with potential investors will now exclusively focus on solar technology.”

Related stock news and analysis

- 10 Most Eco-Friendly Crypto Coins 2023

- How to Buy Lucid Motors Stock in 2023

- Key Earnings and Indicators to Watch Next Week as US Stocks Crash

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards