Snap (NYSE: SNAP), which is the parent company of Snapchat, is trading sharply lower in US premarket price action today after the company disappointed markets with its Q2 earnings report and Q3 guidance. However, the report has a silver lining, and its premium subscription service Snapchat+ has surpassed 4 million users while the user base swelled by 14%.

The company posted revenues of $1.1 billion in the second quarter of 2023 which was 4% lower than the corresponding quarter last year. Its net loss came in at $377 million which was 10% lower YoY.

This is the sixth consecutive instance when Snap stock is crashing after reporting its quarterly earnings.

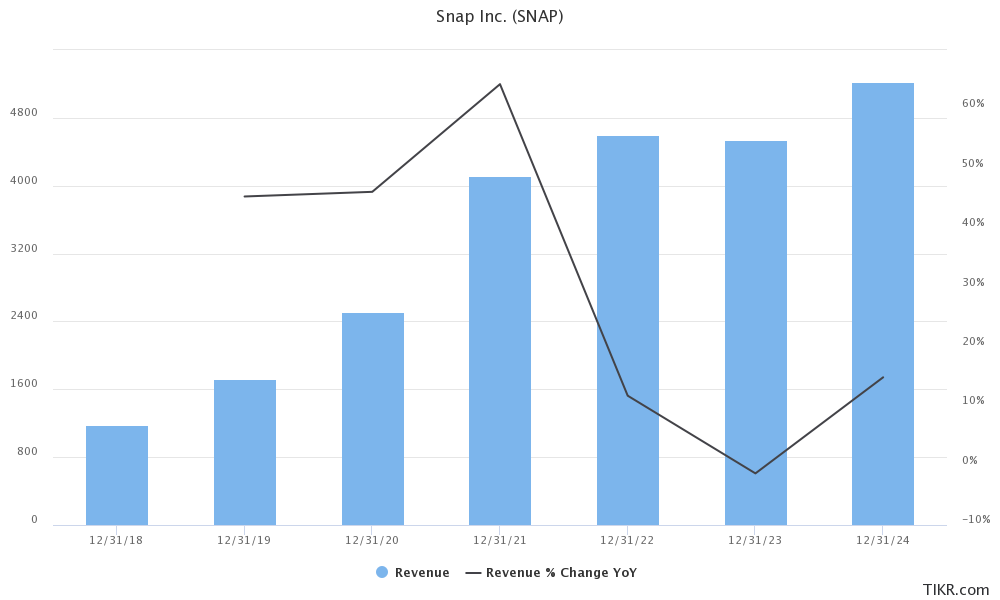

Snap’s revenues have fallen on a yearly basis for two consecutive quarters and the slowdown for the social media company has been deepening.

For instance, its revenues rose above 40% in 2018, 2019, and 2020. In 2021, its revenues rose 64.2% amid the tech boom. However, the company’s revenue growth was a mere 12% last year. Analysts expect the company’s sales to fall 1.3% in 2023.

Snap’s Revenue Growth has Turned Negative

Notably, while Snap’s revenue growth has turned negative, Facebook-parent Meta Platforms reported a slight increase in its Q1 revenues and forecast a small rise in Q2 revenues as well.

Meta Platforms’ revenues however fell 2% YoY last year which was the first instance ever when the Mark Zuckerberg-led company posted a yearly fall in revenues.

Media investment group GroupM predicts in its new report that global ad spending would rise 5.9% in 2023 while digital ad spending would rise 8.4% which would be the slowest pace since the 2009 financial crisis.

Meanwhile, while the growth of Facebook subscribers has nearly plateaued, Snap continues to add more users to the platform.

Snapchat Reported an Increase in its User Base

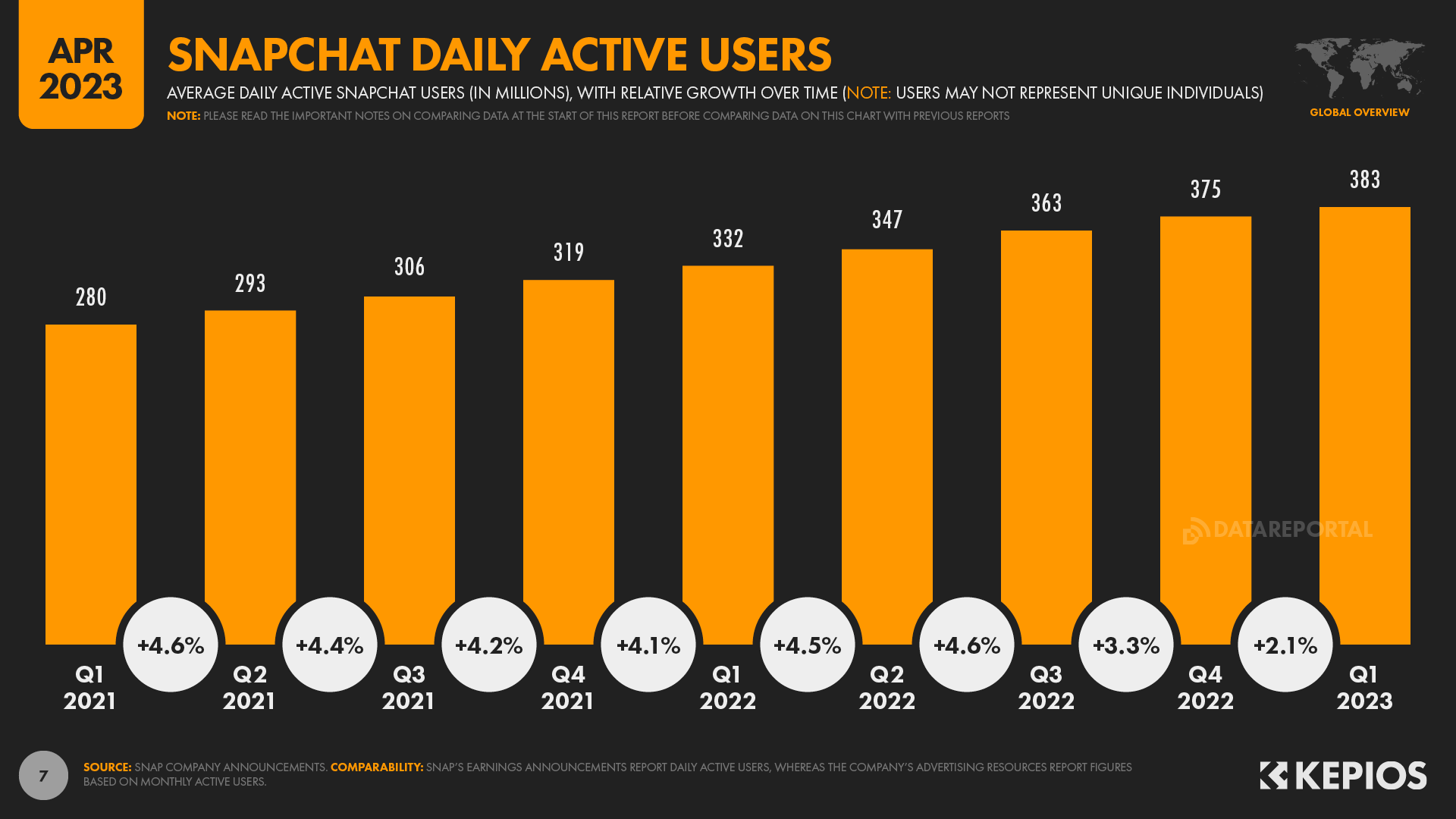

Snapchat’s daily active user (DAU) count increased by 14% in the second quarter and reached 397 million. The company said that its DAUs increased in North America, Europe, as well as the Rest of the World.

The engagement numbers on Snapchat also increased, and in its earnings release, Snap said, “Total time spent watching Spotlight content more than tripled year-over-year, and Spotlight reached more than 400 million monthly active users on average in Q2, an increase of 51% year-over-year.

Also, it said that it now has over 4 million subscribers for its premium Snapchat+ service which is priced at $3.99 per month.

Social media companies have been turning to paid subscriptions amid a slowdown in the ad market. Also, they are pivoting to AI to increase ad effectiveness and improve user experience.

Interestingly, while Snapchat is seeing good traction in its paid subscription business, Twitter’s Blue subscription wasn’t as successful as the company thought.

The Elon Musk-owned company has shifted back the focus to ad revenues and hired Linda Yaccarino a former chairman of global advertising and partnerships at NBCUniversal as the CEO.

Why Has Snapchat User Growth Been Strong

While Snapchat’s revenues fell in the first quarter also, its DAU increased 15% YoY. The company has taken several measures to revive its fortunes and has expanded its revenue-sharing program for creators.

Snapchat stock, $SNAP, tanks 16% after earnings in yet another disappointing quarter.

This stock can never catch a break and falls double digits after almost every earnings report. pic.twitter.com/njHXCc7PjL

— The Kobeissi Letter (@KobeissiLetter) July 25, 2023

It also launched AR Enterprise Services (ARES) which helps retail companies use augmented reality and lets users try out products from the comfort of their homes.

In its Q2 2023 shareholder letter, Snap said, “We continued to work on deepening engagement with our content platform by investing in four key areas: Stories, Spotlight, Creators, and Media Partners.”

Snapchat has taken several measures to improve user engagement and said that is looking for new ways to inspire Snapchat users to share content with their friends.

It gave the example of Communities that enables students with a verified .edu email address to add to a shared Campus Story and build friendships with other classmates.

It said, “In Q2, Snapchatters who signed up to be in a high school or college community more than doubled quarter-over-quarter, and Community Snaps were viewed more than 27 million times per day, on average.”

Snap is also working with media partners to localize content and in the second quarter, it added new publisher deals while renewing some of the other key deals.

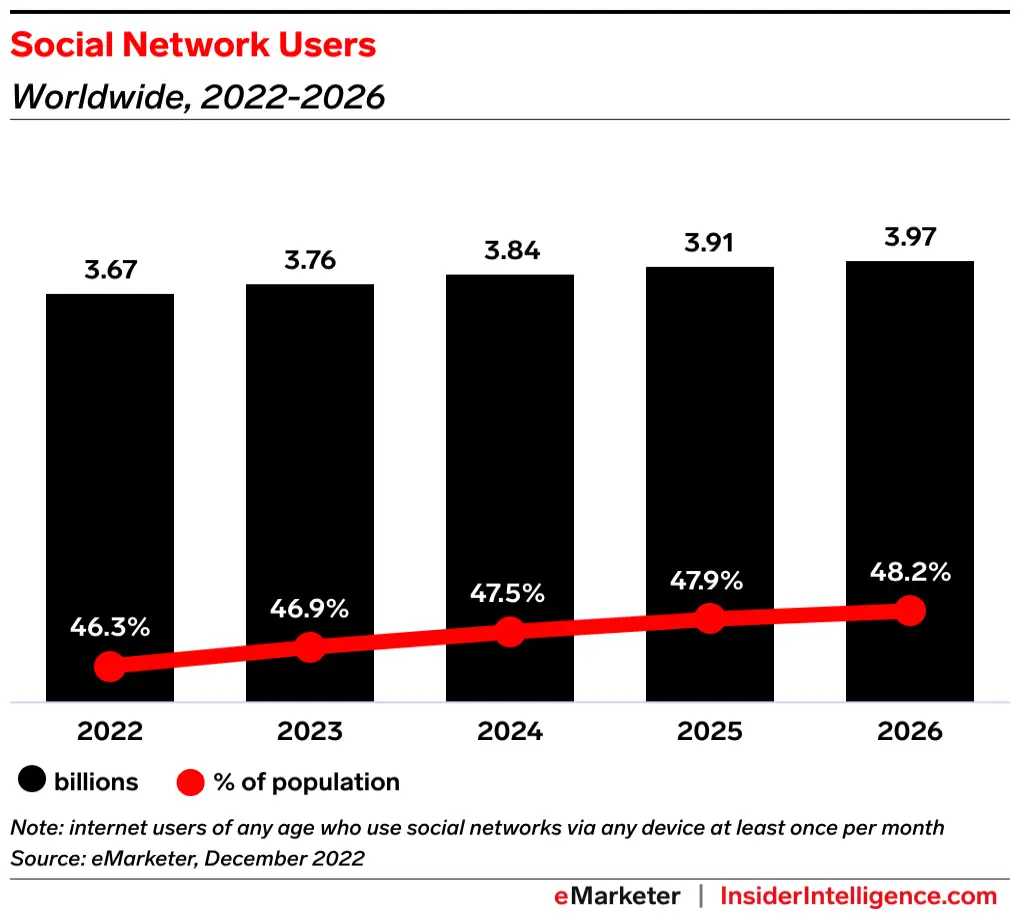

Also, Snap’s penetration levels are still much below bigger rivals like Instagram and TikTok. According to Insider Intelligence, there were 3.67 billion social media users in 2022 which it expects to rise to 3.97 billion by 2026.

Snap has Pivoted to AI to Improve Its Ad Revenues

While Facebook has admitted to peak penetration in key markets, Snapchat still has room to grow. According to Datareportal, only about 8.2% of the world’s population currently uses Snapchat.

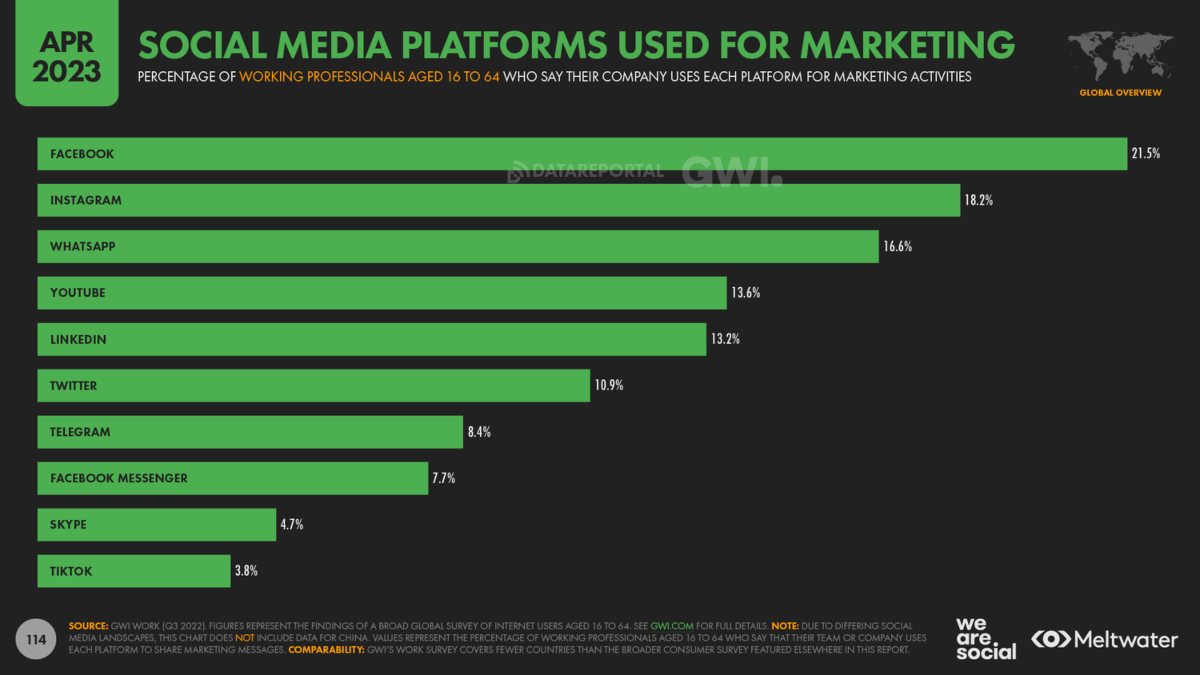

Notably, Snapchat does not even feature among the top 10 companies in terms of social media marketing, and the top three slots are held by Facebook, Instagram, and WhatsApp which are all part of Meta Platforms.

Snap was among the first social media companies to pivot to AI and has expanded its My AI chatbot to all users. In its investor letter, it said that since the launch of My AI, 150 million people have sent over 10 billion messages and stressed the statistics that make My AI among the most used AI chatbots.

AI has been the buzzword in the US corporate world and according to FactSet, 110 S&P 500 companies used the word “AI” in their Q1 2023 earnings call – which is over thrice the ten-year average and the highest level since 2010.

YTD Returns…

C3 AI +319%

NVIDIA +191%

Super Micro Computer +191%

Palantir +159%

Samsara +144%

Meta Platforms +136%

DraftKings +125%

Carnival Corp +102%

Tesla +108%

SoFi+106%

MongoDB +102%

Royal Caribbean +97%

AMD +93%

Spotify +92%

Shopify +91%

Elf Beauty +90%

Exact Sciences…— Quartr (@Quartr_App) June 15, 2023

AI stocks have also outperformed in 2023 and both Nvidia and C3.ai have tripled amid the euphoria towards AI.

Snapchat believes that its business model is also somewhat different from other social media platforms like Twitter and Facebook and unlike these platforms where users literally compete for likes and comments, Snapchat helps build relationships between friends and families.

Meanwhile, despite the strong growth in DAUs and paid subscribers, markets have given a thumbs down to Snap’s Q2 earnings on tepid guidance for the third quarter. Investors would now look forward to Meta’s Q2 earnings which are scheduled for later today and would provide more insights into the global digital ad market.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops