Shopping apps have fully seized control of the US retail market, fueled by consumers spending an ever-increasing amount of time in mobile e-commerce applications. Brick and mortar retailers are now reliant on mobile apps as the linchpin of their omnichannel strategies to provide personalized experiences and streamlined checkout.

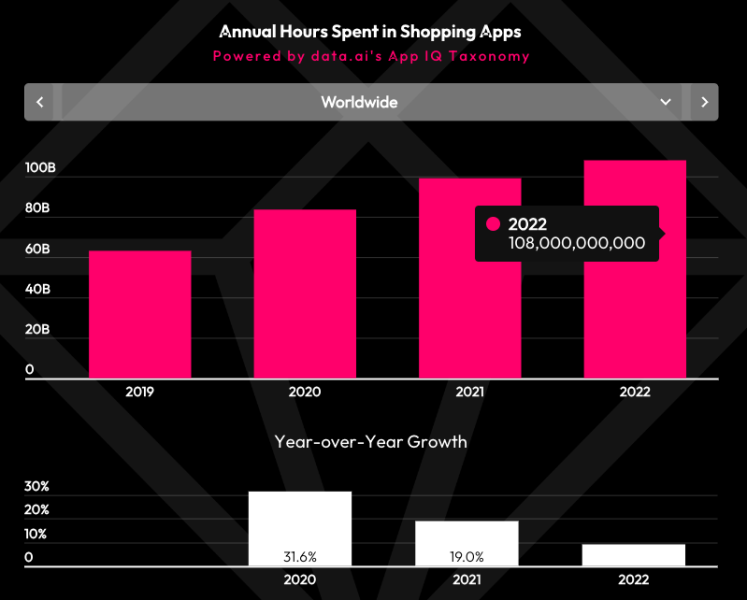

Americans spent nearly 110 billion hours in shopping apps in 2022, reflecting 9% annual growth, according to a report published recently by Data.ai. Rapid expansion occurred in emerging markets like India and Indonesia, as well as Latin American countries such as Brazil, Mexico, and Argentina.

The pandemic led to a huge rise in app downloads in 2020 since people were shopping less in stores. Now, high inflation is keeping app usage up as budget-minded shoppers use these mobile platforms to find the best deals. Discount and coupon apps experienced a 27% jump in downloads as shoppers looked to save money.

Despite this apparent continuation of the pandemic tailwind, the number of hours spent in mobile shopping apps is growing at a slower pace since 2020 when the metric surged by 31.6% and compared to 2021 when it kept advancing by 19%.

India’s Shopsy Ranked as Most Downloaded Mobile Shopping App in 2023

Globally, the Indian online mobile shopping marketplace Shopsy dominates the scoreboard in terms of breakout downloads in 2022. Meanwhile, in the United States, Temu, Upside, My Bath and Body Works, Fetch Rewards, and SHEIN were listed as the top five mobile shopping apps by breakout downloads, the data.ai report indicates.

Buy now, pay later (BNPL) mobile applications saw the most explosive user base growth globally according to the study as downloads increased by 47% last year followed by the coupons & rewards segment (27%) and e-commerce with a 22% year-on-year jump in downloads.

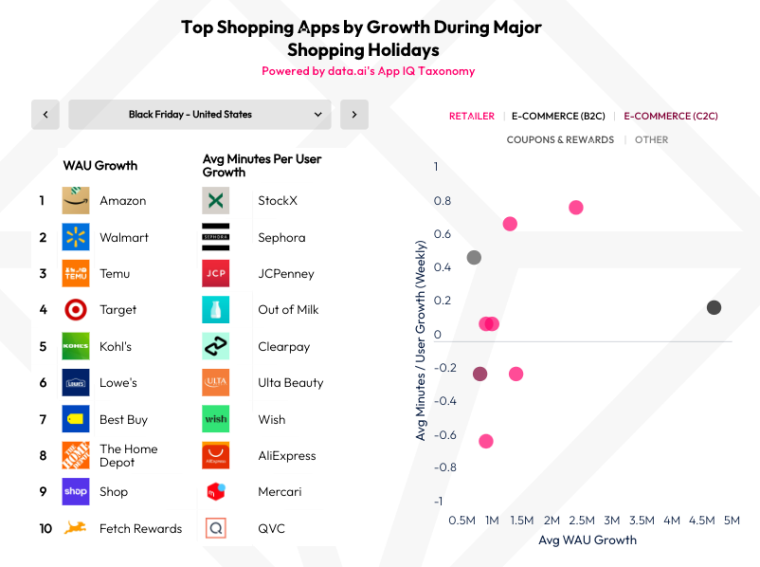

When it comes to specific shopping events, Black Friday sales proved the dominance of mobile in the US. During this week, the e-commerce titan Amazon (AMZN) gained 4.7 million new active users – more than Walmart and Target combined. Meanwhile, in China, Taobao Tejia’s app downloads soared over 400% during Singles Day, while Flipkart saw the largest gains in India during festive shopping periods.

Finally, in 2022, the mobile shopping apps that experienced the most rapid growth in terms of monthly active users (MAUs) were SHEIN, Fetch Rewards, Upside, Etsy (ETSY), and Affirm.

How Do Brick and Mortar Stores Compete with This Growing E-Shopping Trend?

For companies like The Home Depot, Kohls, Walmart, and CVS Pharmacy, competing with well-established e-commerce giants like Amazon is crucial to keep improving their top-line performance.

These corporations have been heavily investing in developing proprietary mobile shopping apps powered and have managed to stay dominant in their particular segments. For example, The Home Depot was among the fastest-growing mobile shopping apps in terms of MAUs in 2022 and so was Walmart (WMT).

Meanwhile, during Black Friday, retailers including the Walton’s family business, Target, Kohl’s, Lowes, and Best Buy all managed to increase their weekly active users (WAUs) by at least 900,000 by tapping on the power of their mobile apps.

Apple Search Ads seem to represent a huge untapped opportunity for brick and mortar retailers. Half of the top 15 shopping-related search keywords in the US are for physical stores, yet they have a relatively low “share of voice” in paid search results.

Grocery stores like Whole Foods and Kroger have utilized search ads more effectively by targeting keywords related to big retailers with grocery options. The goal is to, at least, protect their own brand keywords from competitors.

Prime Day is Coming and Americans are Getting Ready to Spend Billions

Amazon’s Prime Day 2023 event, slated for July 11-12, is poised to be its biggest yet with global app usage set to surpass 1 billion hours. Prime Day, along with competing sales from other retailers, presents a spike in shopping activity outside of Black Friday and Cyber Monday.

The US market is particularly important for both Amazon (AMZN) and retailers, accounting for 60% of Prime Day sales and over $11.9 billion in retail sales during Prime Day 2022 alone. However, Amazon now faces intense competition in the run-up to Prime Day 2023 from large retailers announcing their own sales events.

The mobile app will likely be the battleground as 81% of US consumers now use omnichannel shopping, up from 75% last year. To differentiate themselves, brick and mortar stores offer competitive benefits like fulfillment, assistance, and product trials.

Prime Day gives an early indication of consumer shopping habits ahead of the key holiday season. Areas of opportunity for US retailers in 2023 include electronics, value brands, splurge items like apparel/travel, and food deals.

Mixed economic signals make Prime Day insights especially valuable for benchmarking and understanding spending patterns before retailers head into the peak holiday period. Prime Day 2023 could reveal where and how much American consumers are willing to spend this year.