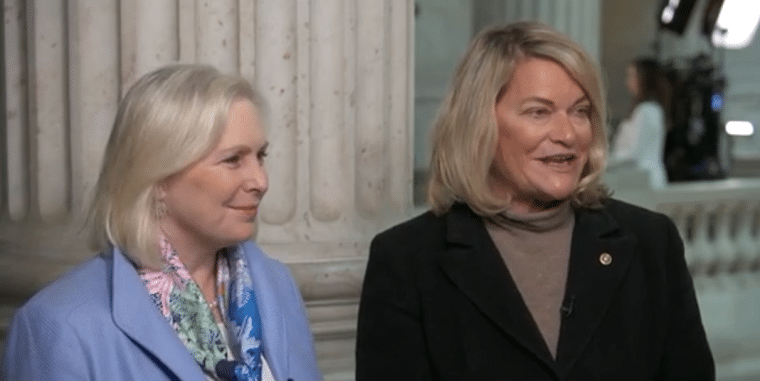

In an important step for crypto markets, U.S. Senators Cynthia Lummis and Kirsten Gillibrand are bringing back legislation aimed at creating a clear framework for crypto regulations. This action is a key move toward building a more organized and specific system of crypto rules in the United States.

The Responsible Financial Innovation Act, introduced in the Senate on June 7, 2022, is returning after nearly a year of being on hold. This bipartisan legislation from Republican Lummis and Democrat Gillibrand aims to define the roles of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in the cryptocurrency sector, while also improving consumer protection.

The crypto asset industry is here to stay.

Today, @SenGillibrand and I are reintroducing landmark legislation to create a federal regulatory framework that allows crypto businesses and investors to prosper here in America while protecting consumers from bad actors. pic.twitter.com/z2pr0evWt2

— Senator Cynthia Lummis (@SenLummis) July 12, 2023

Plugging the Leaks: Crashes and Crypto Regulations

The inception of the Lummis-Gillibrand bill took place against the backdrop of a devastating crypto market crash, which caused several high-profile companies to declare bankruptcy and the value of many tokens to plummet. The collapse of the crypto exchange FTX in November 2022 further highlighted the urgency for effective crypto regulations.

Lummis’ fact sheet indicated that the refreshed bill will include updates to the U.S. tax code, enabling the industry “to fund its own oversight,” and implement measures to prevent another FTX-like incident. In the wake of the collapse of TerraUSD in May 2022, the legislation will also require payment of stablecoins to be issued solely by depository institutions.

Additionally, the legislation offers a much-needed distinction between securities oversight and other crypto activities, providing explicit instructions for the SEC and CFTC. According to the proposed bill, assets that do not grant the investor a financial interest in a business should not be classified as securities, even if their value is influenced by “entrepreneurial and managerial efforts.”

Sen. Cynthia Lummis discusses bipartisan crypto regulation bill, focusing on consumer protection and SEC feedback. #CryptoRegulations pic.twitter.com/3RyxXOjd5m

— Crypto News Pulse (@CryptoNewzPulse) July 12, 2023

The majority of crypto tokens would fall under the jurisdiction of the CFTC as commodities, assigning the agency control over crypto trading. The bill suggests equal funding of $500 million each for the SEC and CFTC, enabling them to play equal roles in a newly proposed self-regulatory organization (SRO) for crypto.

A Third Party: Self-regulation Bodies

The proposed legislation also introduces the concept of a mediator entity, mirroring structures such as the National Futures Association or the Financial Industry Regulatory Authority in the securities sector.

This new entity, described as the “consumer protection and market integrity authority,” will oversee industry standards and impose penalties for violations, bolstering the framework of crypto regulations.

The legislation also necessitates that customers’ assets are entirely segregated and imposes new risk-management standards for crypto lending, including an outright ban on “rehypothecation,” a practice where crypto firms utilize customer assets to extend their credit.

The reintroduction of the Responsible Financial Innovation Act in the Senate arrives amidst growing criticism of U.S. regulators for the lack of clear directives that would enable firms to operate without the fear of enforcement actions. Conversely, the bill has received considerable acclaim for its bipartisan approach to address the politically charged aspects of the crypto space.

While the Act represents one approach, alternative legislative proposals are being examined in the House of Representatives, underlining the diverse strategies and potential challenges in defining the future of crypto regulations. Either way, as the crypto industry continues to evolve rapidly, the reintroduction of this legislation signifies a critical step in shaping a stable, comprehensive regulatory framework.

Related:

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards