Early signs point to a more muted Black Friday this year as inflation takes a toll on consumer budgets, leading shoppers to wait out for the best bargains during the kickoff to the vital holiday season.

Retail analysts say that weak October sales, high debt loads, and declining savings point to consumers feeling strained. This is pushing them to prioritize discounts and practical items over impulsive purchases.

According to data from Adobe Analytics, online spending on Thanksgiving Day rose only 5.5% year-over-year to $5.6 billion. While still seeing growth, this marks a slowdown from more robust e-commerce gains in 2021 and 2020. Adobe predicts that this pattern will continue, with online Black Friday sales up just 5.7% to $9.6 billion.

Adobe emphasized that shoppers are mostly zeroing in on electronics, toys, and apparel promotions. On average, they expect to see discounts of up to 30% for electronics and 35% for toys, both higher than what retailers offered a year ago.

Cautious Approach Among US Shoppers, Europeans Turn to Online Offerings

These cautious signs were echoed across storefronts as millions of deal-focused American shoppers turned out for Black Friday openings. Macy’s CEO Jeff Gennette observed stronger early morning crowds versus last year but said that it remains difficult to predict the overall holiday momentum.

At a Walmart (WMT) in Connecticut, the parking lot was only half full by 6 am compared to prior years when lines stretched around the building. Shoppers say that they are intentionally taking targeted approaches, resisting impulse purchases as inflation has squeezed their budgets and forced them to prioritize.

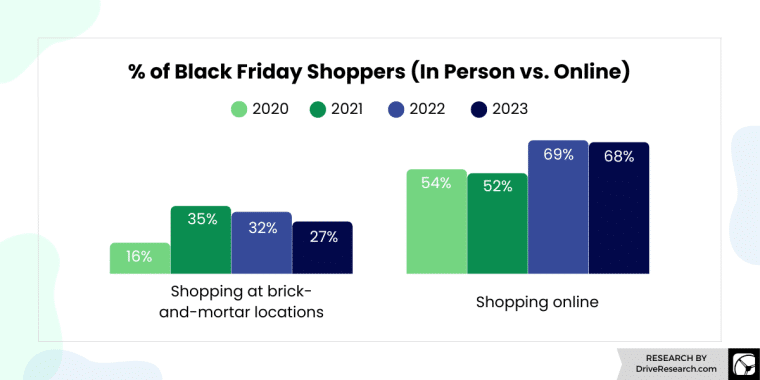

Data indicates that e-commerce gained a higher share of Black Friday sales once again, now accounting for roughly 40% of all purchases. Mobile sales also hit a record, reflecting how convenience is influencing purchasing decisions more than ever.

Meanwhile, in Europe, consumers gravitated towards discounted apparel along with electronics and smart home devices. Adobe recorded a sharp increase in online traffic in France and the UK as shoppers began hunting for deals early across top multinational e-tailers.

TD Cowen Reduces Year-on-Year Sales Growth Forecast for Black Friday

With inflation still relatively high at 3.2% in the US, household finances remain a bit stretched and have steered shoppers toward bargains on this Black Friday. Retailers responded by unleashing a blitz of promotions, with average sitewide discounts of up to 10%. Product-level markdowns are also deeper across categories like toys, laptops, clothing, and kitchen appliances.

Most analysts believe that weak consumer metrics will require that retailers keep pushing forward aggressive promotions through Christmas to spur hesitant spending.

TD Cowen exemplifies this view, recently downgrading its projected US holiday sales growth rate to 2-3% year-over-year due to expectations of flattish store traffic overall. Meanwhile, the National Retail Federation’s holiday forecast hovers at 3-4% sales growth.

This overall sentiment of extending deals throughout the entire holiday season was voiced by Lowe’s CEO, Marvin Ellison, who told CNBC: “We’re going to have a sustained drumbeat of great offers for the entire holiday season, starting this week”.

Meanwhile, CEO Corie Barry from BestBuy commented: “Since we are preparing for a customer who is very deal-focused, we expect shopping patterns will look even more similar to historical holiday periods than they did last year with customers’ shopping activity concentrated on Black Friday week, Cyber Monday and the last two weeks of December”.

Every Day is Black Friday?

Whereas Black Friday once monopolized deal headlines as the centerpiece bargains bonanza, its relevance has eroded over the years. The rise of e-commerce and “Every Day Low Prices” models have sparked a dilutive effect. The holiday’s rival Cyber Monday also emerged and then holiday promotions began hitting as early as October.

This season followed that pattern, with retailers becoming anxious to prompt consumers to spend early to get the best deals. Macy’s, for example, placed Black Friday-level deals on kitchen appliances plus beauty gift sets within the first week of November. It then added further category-wide cuts on toys, fragrances, and jewelry in the week prior to the main event.

Such early price slashing aims to evenly spread out deal-hunting shoppers, avoiding risky over-concentrations during Black Friday itself. However, it may also foster the expectation of perpetual discounts among deal-focused consumers who are becoming less and less willing to buy at ‘normal’ prices.

Navigating promotional timing and depth has been turned into a delicate balancing act. Retailers must spark short-term enthusiasm without conditioning sentiment that ultimately deflates their pricing power over the longer term.

Retailers Invest Heavily in Marketing to Prepare Buyers for Deep Discounts

Facing thriftier shoppers, retail chains emphasized their value credentials to open the all-important holiday season. Companies like Best Buy, Lowe’s, and Kohls’ advertised Black Friday price cuts through national advertising, digital communications, and in-store displays.

Some also rolled out novel promotions to generate engagement. Best Buy’s mobile app hosted limited-time ‘Deal Drops’ on coveted items like newly released game consoles. Meanwhile, Home Depot and Lowes competed through lowest price guarantees if customers find an appliance or tool cheaper elsewhere.

Behind the scenes, retailers worked with suppliers to fund deeper manufacturer rebates used to bring down retail prices. The cost burden helped secure impressive headline discounts in categories like TVs, laptops, and toys.

While profit margins suffer significantly on these heavily discounted items, retailers aim to make up dollars through higher attachment of full-price companion purchases and elevated transaction volumes.

Europe Braces for Muted Holiday Shopping Season as Well

Across the Atlantic, expectations similarly call for more frugal Christmas spending amidst the cost of living crisis that is currently squeezing European wallets. Accentuating the gloominess, UK retail transactions stayed completely flat last week.

Eurozone inflation stood at 2.9% last month, prompting households to stick firmly to holiday budgets. In a PwC survey, 65% of shoppers in France, Italy, and Spain said that they expect to buy gifts online to hunt for deals.

Accordingly, Black Friday provided the ideal kickoff for motivating cautious commerce. Online retail giants like Amazon and Alibaba’s AliExpress ran banner promotions and greater discounts versus last year throughout November. Retail experts say that digital sales will continue to gain market share over physical stores.

While the Black Friday retail movement originated in the US, the event has now firmly made its way across Europe as a cultural phenomenon. However, based on this year’s strained economic climate, analysts say that retailers must keep discounts coming to have the chance of salvaging lackluster sales forecasts.