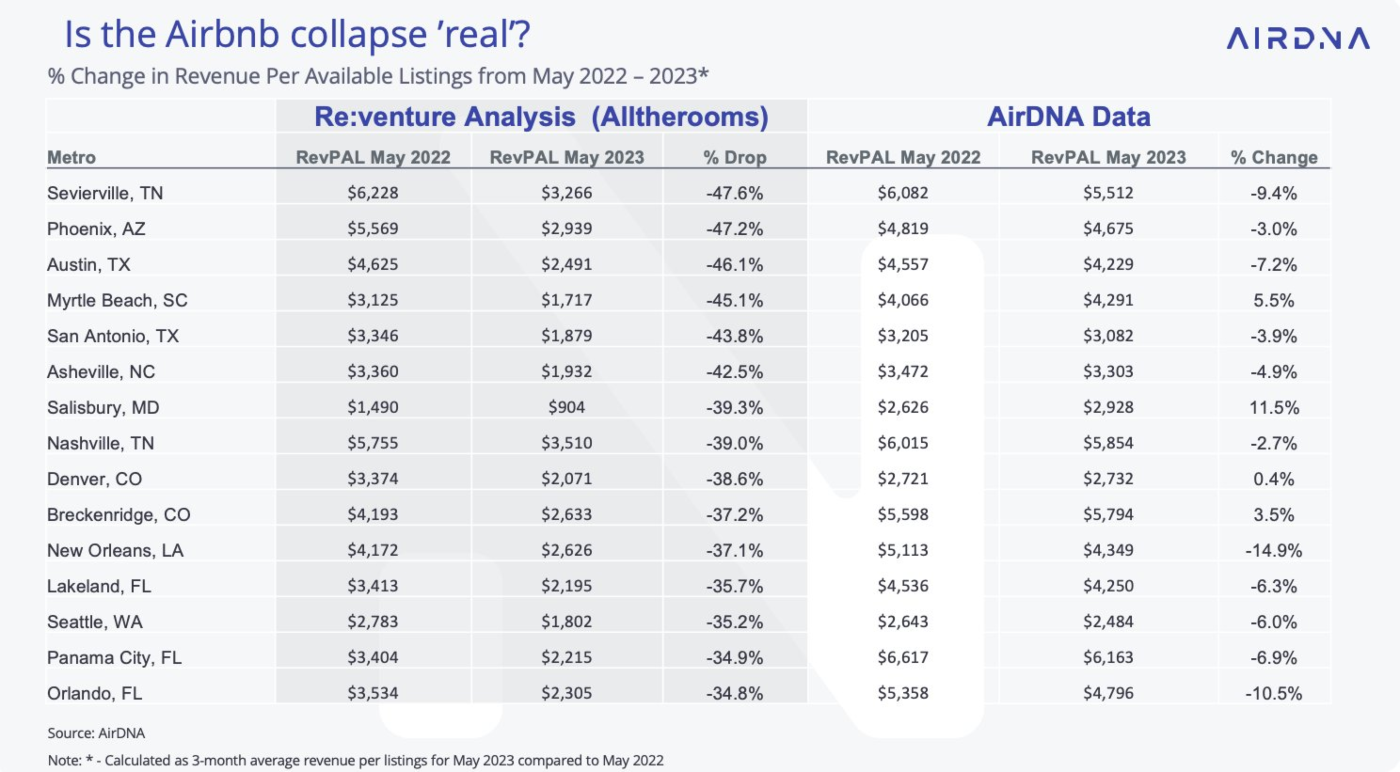

A report from AllTheRooms which has now gone viral claims that the revenue per available listing (RevPAL) on Airbnb has fallen by almost 50% in some US cities. Airbnb has ridiculed the report and said that the decline is in the low single digits.

Data from AllTheRooms has been shared by multiple Twitter handles – including Reventure Consulting CEO Nick Gerli.

Gerli also runs a YouTube channel advising people on real estate.

The data shows that RevPAL in Sevierville, Tennessee, fell 47.6% YoY in May. Phoenix, Austin, San Antonio, and Myrtle Beach also witnessed over 40% YoY drop in the metric, based on the three-month average revenue.

Gerli sees the trend as worrisome and a precursor to forced selling from Airbnb owners later this year.

Airbnb has meanwhile called the report factually incorrect and said the fall in RevPAR in the markets listed by AllTheRooms is on an average 3.6% and not 40.3% as claimed in the report.

Jamie Lane, Airbnb’s Chief Economist and SVP of Analytics shared the data from AirDNA – an alternate data provider to substantiate his claims.

So far, AllTheRooms hasn’t responded to media requests for comments.

Sam Randall, an Airbnb spokesperson said that AllTheRooms data is inconsistent with its data.

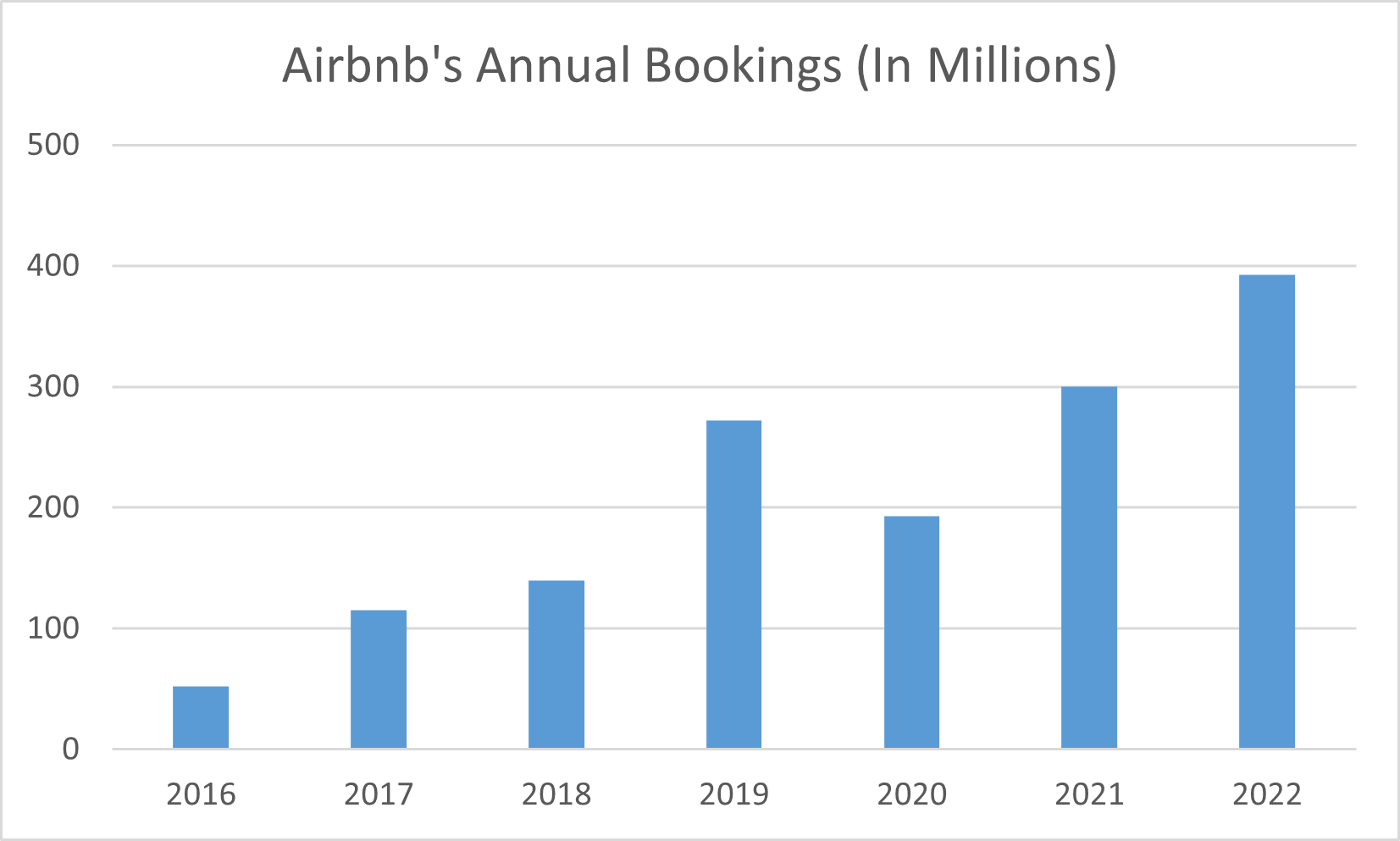

Randall added, “As we said during our first-quarter earnings, more guests are traveling on Airbnb than ever before, with nights and experiences booked growing 19% in the first quarter of 2023 compared to a year ago.”

Airbnb Denies that RevPAR Fell Drastically in May

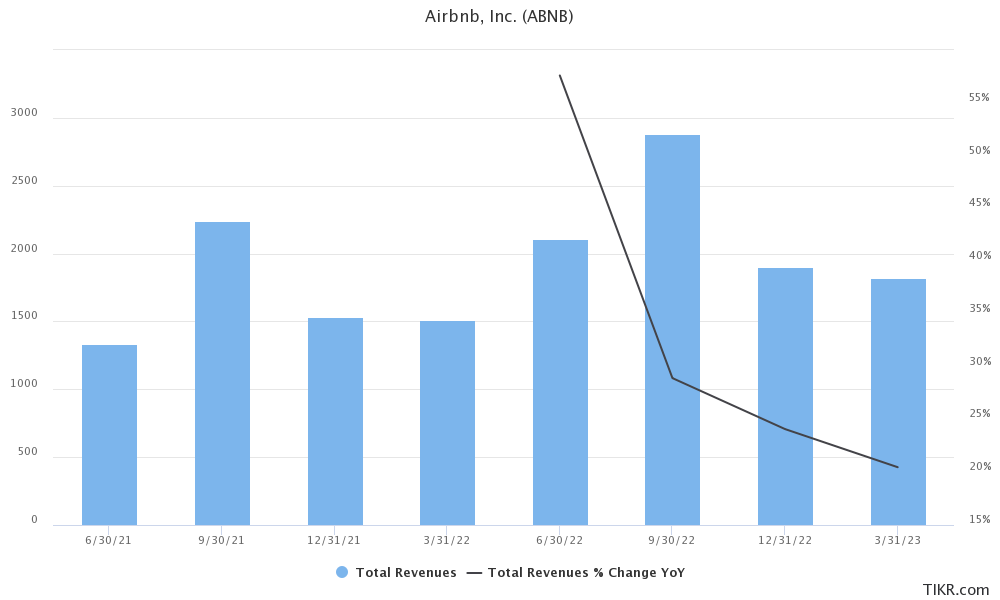

Since Airbnb is a listed company, we get a lot of disclosures from the company and it is expected to release its Q2 2023 earnings in August.

Looking at the Q1 2023 earnings report which was released in May, Airbnb reported a 20% YoY rise in revenues and had its first-ever profitable quarter based on GAAP.

The company’s gross booking values rose 19% YoY to $20.4 billion in the quarter. Its revenues and free cash flows were also a fresh record – highlighting the continued rebound in travel demand.

Total active listings on the platform rose 18% in the first quarter.

Meanwhile, Airbnb was circumspect on the second quarter outlook and said it expects revenues to rise between 12%-16% in the quarter and talked about the tougher comps as travel spending was quite strong in Q2 2022 after the slump in the previous quarter amid the Omicron wave of the COVID-19 pandemic.

Airbnb Expects Lower Average Daily Rates in 2023

During the earnings call, Airbnb CEO Brian Chesky said that North America is the most price-sensitive market currently and the demand for lower-priced rooms is quite robust.

Today's TSOH update – "Airbnb: ADR's and Affordability"

CEO Brian Chesky: "Affordability and great value are key reasons people use Airbnb, and we have to continue to make sure we have that." pic.twitter.com/66N694q9K9

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) May 22, 2023

The company expects its average daily rate (ADR) to fall mid-single digit in 2023, which seems consistent with the data from AirDNA.

Meanwhile, Airbnb’s annual users swelled to 200 million in 2020. The annual listings on the platform also rose to 6.6 million last year – from a mere 0.3 million in 2013.

The company has over 4 million hosts globally on the platform and users made 393 million bookings on the platform in 2022.

The company is also pivoting to AI and was among the first to have a ChatGPT plugin. AI stocks have rallied this year with C3.ai more than tripling YTD.

As for the fall in Airbnb’s RevPAR, we’ll probably get more clarity when the company releases its quarterly earnings.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops