The traditional advice to buy-and-hold stocks has undeniable benefits, but markets routinely experience larger drawdowns than expected, posing risks for many investors. And increasingly volatile equity markets can make it difficult for even long-term investors to maintain progress toward financial goals.

While financial experts recommend staying invested, many investors understand that reducing exposure during periods of high risk can be prudent. However, rule-based systems claiming to mitigate downside risk may lack agility and rely too heavily on past market assumptions.

Qraft aims to address this problem with an ETF harnessing artificial intelligence to protect portfolios from downside risk. The Qraft AI-Enhanced Large Cap Dynamic Beta and Income fund seeks to adjust equity and cash allocations based on imminent market risk.

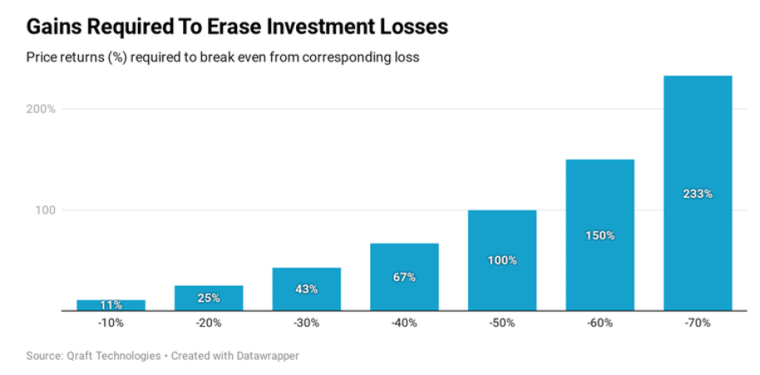

Large drawdowns often require outsized gains to recover losses. For example, a 30% loss requires a 43% gain to recover. Intra-year stock market drops of over 10% occurred 50% of the time from 2002 to 2021 on the S&P 500 index.

Here’s How Qraft Uses AI to Reduce Downside Risks

Qraft’s artificial intelligence model utilizes machine learning, analyzing and inferring from massive data sets without explicit programming.

The AI model absorbs over 70 macroeconomic and market indicators in real time. It “nowcasts” immediate market risk and adjusts the ETF’s equity-cash allocation accordingly. The goal is to provide defensive positions ahead of drawdowns and rapidly reenter markets when risks decrease.

Also read: 10 Best Crypto ETFs to Invest in 2023 – Business 2 Community

The fund provides a simplified way for investors to benefit from the AI-driven allocation without manually implementing cash levels. The fund aims to reduce drawdowns, volatility, and generate better risk-adjusted returns than broad indices.

The strategy fits into core portfolios, particularly for those with shorter horizons or asymmetric risk aversion requiring higher returns without increasing drawdown risk.

Qraft believes that artificial intelligence can provide more timely insights into imminent market risk and potential drawdowns. Traditional rule-based models for assessing risk rely on past data and assumptions that may no longer apply in today’s dynamic markets.

AI technology like machine learning enables algorithms to analyze massive data sets and adapt continuously without needing to be explicitly programmed. The indicators used by Qraft’s AI model allow it to potentially detect signs of rising market risk and impending drawdowns sooner than human analysts or traditional models.

Supercomputers also provide the computing power required to evaluate the immense amount of data from a variety of sources in a multi-dimensional manner. Qraft’s AI algorithms can parse signals from noise within the data, analyzing indicators and relationships between data points from multiple perspectives.

This analytical capability aims to give Qraft’s model a better grasp on current market conditions to help managers navigate dynamic environments.

More Information About Qraft Technologies

Founded in 2016 by Marcus Kim, Qraft aims to use AI to revolutionize the asset management industry by relying on technology rather than sole human wisdom to design and execute portfolio allocation strategies that follow multiple goals.

As beating the market has become a nearly impossible endeavor for humans, machines may have what it takes to analyze vast amounts of data and provide timely insights that help portfolio managers make accurate decisions that can deliver positive results.

Qraft has four active exchange-traded funds (ETFs) – the Qraft AI-Enhanced US Large Cap ETF (QRFT), Qraft AI-Enhanced U.S. Large Cap Momentum ETF (AMOM), Qraft AI-Enhanced U.S. Next Value ETF (NVQ), and the QRAFT AI-Pilot U.S. Large Cap Dynamic Beta and Income (AIDB).

This latter fund is the one that Qraft will test this AI-powered downside protection feature on. It currently manages approximately $500,000 in assets for customers and charges an expense ratio of 0.75%.

Overall, Qraft manages approximately $20 million in assets for investors, making it a relatively small asset management company. The firm’s first two funds were launched in 2019.

Also read: