Nvidia (NYSE: NVDA) stock is up almost 24% in US premarket price action today after the company shattered earnings estimates for the first quarter of the fiscal year 2024 and forecast record revenues for the current quarter amid higher chip demand for generative AI.

Nvidia reported revenues of $7.19 billion in the quarter that ended in April – a YoY rise of 19%. Wall Street analysts were expecting the metric at $6.52 billion while the company had forecast revenues of $6.50 billion during the fiscal fourth-quarter earnings call.

Its adjusted EPS of $1.09 also surpassed analysts’ estimate of 99 cents. However, what triggered the massive rally in NVDA stock was the company’s guidance as well as commentary on how AI would help increase its sales.

Nvidia forecast revenues of $11 billion for the fiscal second quarter which is way above the $7.15 billion that analysts were expecting.

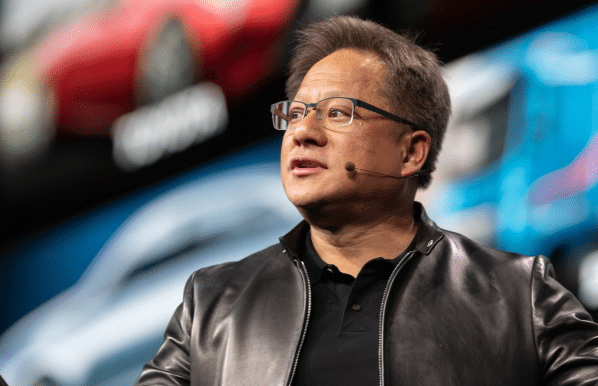

In his prepared remarks, Nvidia CEO Jensen Huang said, “The computer industry is going through two simultaneous transitions — accelerated computing and generative AI.”

He added, “A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.”

Notably, with a YTD gain of over 113%, Nvidia is already the best-performing S&P 500 stock this year and looks set to extend its lead further – looking at the splendid rally in premarkets.

Nvidia Stock Rises after It Forecasts Record Revenues on Generative AI Push

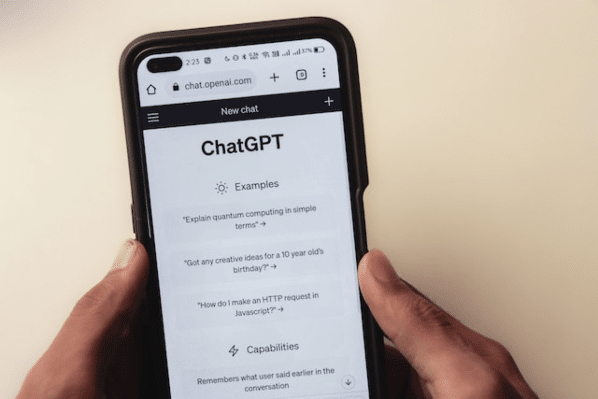

Generative AI is making waves globally and Nvidia is among the stocks that are a play on AI. Listed as well as unlisted AI companies are attracting good interest from investors and C3.ai – which is among the rare listed pure-play AI names – is up 150% YTD.

Sensing the opportunity in generative AI, Roundhill Investments launched the Generative AI & Technology ETF (NYSE: CHAT) last week.

Meanwhile, during the earnings call, Nvidia CFO Colette Kress said that generative AI is “driving exponential growth in compute requirements and a fast transition to NVIDIA accelerated computing.”

Kress added, “Generative AI drove significant upside in demand for our products, creating opportunities and broad-based global growth across our markets.”

Generative AI is Fuelling the Demand for Chips

Nvidia forecast record revenues for the fiscal second quarter amid strong demand for AI chips. Kress said, “This demand has extended our data center visibility out a few quarters and we have procured substantially higher supply for the second-half of the year.”

Huang termed the current pivot to AI as the “iPhone moment” – a reference to how Apple transformed the industry with its iPhones.

“All the technology came together and helped everybody realize what an amazing product that can be and what capabilities it can have,” summed up Huang while responding to an analyst question.

Meanwhile, Huang also admitted to competition for AI chips from both established as well as startup companies.

All said, the generative AI push is helping companies like Nvidia whose high-end chips are necessary for the technology.

Nvidia is working with companies like Microsoft, Amazon, and Google for generative AI. Markets have been supportive of the AI pivot and NVDA’s market cap is now approaching $1 trillion.

NVIDIA gained $200 billion during the last 90 minutes of after-hours trading.#Bitcoin‘s entire market cap is $530 billion.

NVIDIA (a single stock) gained 40% of all the value of all the #Bitcoin over dinner.

Lesson 1: price is set at the margins.

Lesson 2: $30k #BTC is cheap.— Luke Broyles (@luke_broyles) May 24, 2023

While most other tech companies are trading below their all-time highs and the Nasdaq 100 is still over 20% below its 2021 highs, Nvidia looks set to hit a new all-time high today as markets give a thumbs up to its fiscal first quarter earnings and record revenue guidance.

Related stock news and analysis

- Best AI Crypto Tokens & Projects to Invest in 2023

- Nvidia is Making AI Supercomputers the Size of a Regular Server

- SoftBank Questions Rationale as S&P Lowers Its Credit Rating to BB

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops