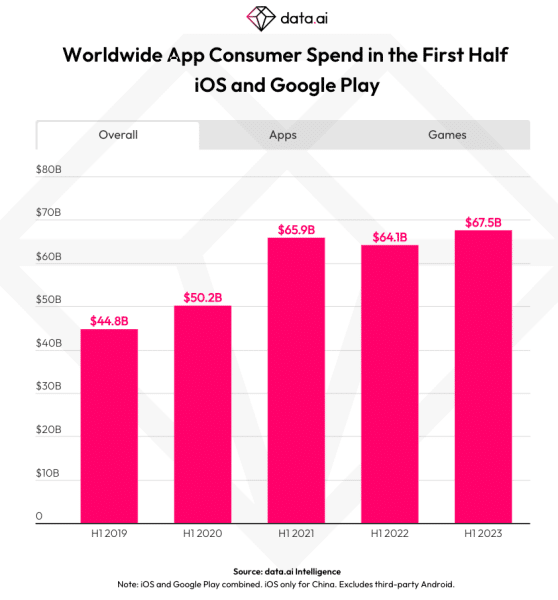

After experiencing its first drop in consumer spending last year, the mobile app market bounced back in the first half of 2023, according to a new report from data analytics firm data.ai. This recovery indicates that the decline in 2022 might have been a short-term adjustment instead of the beginning of a longer-lasting slowdown.

Global consumer spending in apps, measured by in-app purchases, rose 5.3% year-over-year in the first six months of the year to hit a record $67.5 billion, while overall app downloads increased 3.2% to 76.8 billion, the data.ai report reveals. The recovery was seen across both Apple’s iOS App Store and Google Play, showing that growth is not a single-platform phenomenon.

On iOS, consumer spending climbed 5.8% to reach $43.5 billion, with non-game apps like TikTok, Disney+, and YouTube showing especially strong growth of over 30% each. However, iOS users continue to spend on average nearly twice as much per download compared to Android.

On Google Play, consumer spending grew 4.3% to hit $24 billion. Categories such as productivity, business, and news apps saw the strongest growth in spending of over 25%.

In terms of downloads, Google Play maintained its lead with 58.7 billion in H1 2023, up 1.4% year-over-year. On iOS, installs jumped 10% to over 18 billion. Game apps remained the most popular in terms of both downloads and consumer spending but productivity apps showed the highest growth in both metrics.

TikTok is the First Mobile App to Reach $2 Billion in Revenue in a Semester

Match-3 game Gardenscapes also saw a resurgence, with consumer spending surging 94% to $94 million in May 2023, surpassing its previous peak in May 2020. The title moved up 11 spots in global spending rankings for H1 2023.

In terms of games, Subway Surfers and Free Fire remained the most downloaded titles, while Roblox (RBLX), Free Fire, and Candy Crush Saga topped the charts for monthly active users. However, FIFA Soccer entered the top 10 most played games for the first time, benefiting from the FIFA World Cup in late 2022.

In summary, the data shows that the mobile app market has rebounded strongly after facing some headwinds in 2022. The return to positive growth in consumer spending and steady increase in downloads indicate the fundamentals of the app economy remain strong and the disruption may have just been a temporary blip caused by macroeconomic factors. Looking ahead, industry experts expect the recovery to continue in the second half of the year barring any major unforeseen events.

US and China Spearhead Consumer Spending on iOS Mobile Apps in H1 2023

The United States, China, and Japan led the scoreboard on a regional basis in terms of consumer spending in mobile apps on the Apple App Store while South Korea substitutes China on that same front for Android.

Meanwhile, when it comes to downloads, India and Brazil are the largest markets for Google Play while China, the US, and Japan lead the scoreboard for iOS-powered devices.

Interestingly, Russia, a country known for its government-imposed limitations on certain areas of the internet, was among the top-growing latitudes in terms of app downloads on Google Play during this first semester of the year.

Also read: Google Decides to Allow Games with NFT Trading in the Play Store

According to a report from data.ai for 2022, app store spending accounts for a third of the total invested by individuals and businesses in this growing ecosystem. The remaining two-thirds come from advertising.

Last year, $500 billion were poured into mobile apps while $167 billion were spent by consumers on app stores. Purchases on the Apple App Store accounted for half of the total while Google Play amassed 27% of the pie.