Mastercard is using artificial intelligence to give banks insights that help spot and stop payment scams before money is taken from victims’ accounts. The company’s Consumer Fraud Risk (CFR) solution examines data from millions of transactions to find patterns that suggest a payment might be going to a scammer.

Growing scam rates have undermined consumer trust, but Mastercard is working to fix that. By using its overview of account-to-account payments and AI tools, it can assist banks in spotting which transfers may be used for scams. In the U.K., the initial market for this software, nine banks, including Lloyds, NatWest, and Monzo, are already implementing Mastercard’s solution.

Scammers use “mule” accounts to disguise fraudulently obtained funds. Mastercard has tracked scam flows through these accounts for years, allowing it to close them down to bring down this essential puzzle piece of the business model. Now Mastercard analyzes factors like account names, payment values, transaction history, and links to known scam accounts to pinpoint suspect payments in real time.

Early Adopters Reports Millions in Savings with the Adoption of CFR

The UK-based TSB Bank, one of the solution’s early adopters, reported a substantial reduction in scam losses since adopting Mastercard’s tool. If all U.K. banks mirror TSB’s success, it could represent savings of over £100 million annually for these institutions.

Impersonation scams now cause 40% of U.K. bank fraud losses. Through a method called “authorized push payment (APP)” fraud victims are tricked into sending money to criminals posing as friends, businesses, or online sellers.

“Using the latest AI technology, we are helping banks identify and predict which payments are being made to fraudsters and stop them in real-time” said Mastercard President, Ajay Bhalla.

Also read: How to Buy Bitcoin With Prepaid Card in July 2023

Meanwhile, Paul Davis of TSB Fraud Prevention said monitoring tools are crucial: “Our partnership with Mastercard is providing the intelligence needed to identify fraudulent accounts and prevent payments ever reaching them.”

Banks using Consumer Fraud Risk show success, especially when combining it with customer behavior data to tailor fraud strategies. Purchase scams represent over half of U.K. scams and remain a challenge. In 2022, U.K. banks reported over 200,000 authorized push payment scams totaling £485 million in gross losses.

Mastercard Looked Ahead to the Power of AI with its Investment in Brighterion

In 2017, Mastercard invested in Brighterion, a software company that specializes in creating security solutions for anti-money laundering (AML), fraud prevention, and fraud risk mitigation for an undisclosed amount.

The investment seems to be paying off for the payments giant at a point when artificial intelligence has gone mainstream and corporations across the world are looking to tap into today’s powerful large language models (LLMs) for multiple purposes.

Brighterion is already an important part of Mastercard’s AI push as multiple solutions, including this new Consumer Fraud Risk product, are being powered by the technology created by this subsidiary.

Earlier this year, Mastercard signed an agreement with Network International, a major operator in the digital payments landscape in the EMEA region, to help it fight financial fraud via the technologies devised by Brighterion. Mastercard made a $300 million strategic investment in Network roughly four years ago to strengthen its presence in that particular geographical area.

Acquirers face challenges balancing fraud detection and false declines. New technologies like AI enable better transaction monitoring and fraud prevention. Mastercard’s Brighterion uses AI to assess payment risk and catch fraud in real time. AI-powered models analyze each transaction’s attributes within seconds to assign risk scores from 0 to 100.

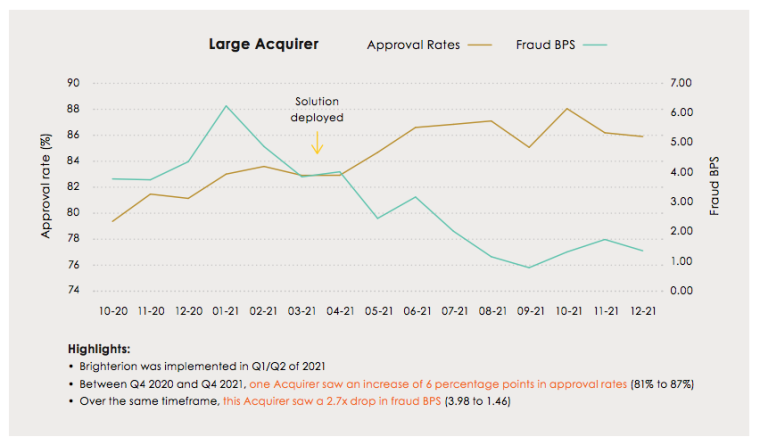

Models are linked to databases containing confirmed fraud cases, cardholder data, and transaction histories. This gives acquirers tools to make more informed decisions on approving or declining transactions. Large acquirers have seen success implementing Brighterion’s technology. One saw approval rates rise 6% while fraud basis points fell 2.7 times after implementation. The improvements reflect how AI and stronger monitoring benefit banks’ bottom lines.

Acquirers also use AI models to monitor merchant risk. Brighterion’s merchant monitoring model provides risk scores for each merchant to help prioritize fraud investigations. Worldpay adopted a comprehensive AI-based merchant monitoring solution combined with case management for investigating risky merchants. The efficiencies gained allowed Worldpay to reallocate staff to review more cases.

Having merchants listed by risk score made it easier for Worldpay to prioritize manual reviews, improving efficiency. Through portfolios with one top acquirer, Mastercard identified $6 million in annual savings by reducing exposure to fraudulent merchants.