Hackers and scammers have long plagued the crypto industry, and the battle to trace and recover lost funds has become increasingly challenging. However, there is a glimmer of hope as a recent report indicates that losses from crypto scams have more than halved in the second quarter of 2023 compared to the previous quarter, although they still amounted to over $200 million.

Positive Trend As Losses from Crypto Scams Shrink

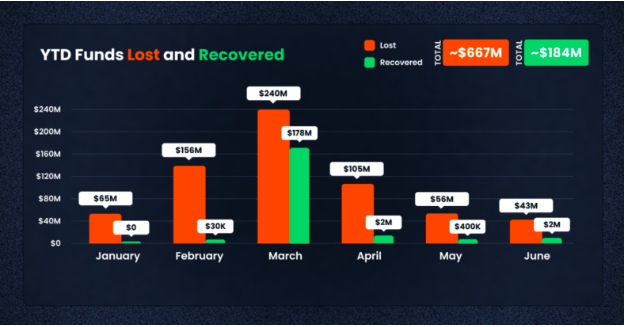

According to a report by De.Fi, a web3 “super app” and antivirus solution, supported by data from the REKT database, the industry managed to recover only $4.9 million of the $204.3 million lost to hacks, scams, and rug pulls in Q2 2023.

While this recovery amount is lower than the $6.9 million recovered in Q2 2022, the positive aspect is that losses in the second quarter were 55% narrower than in Q1 2023, where the industry suffered a staggering $462.3 million loss to hacks and scams.

The report highlighted that the first quarter’s losses were significantly influenced by the Euler Finance flash loan attack, which accounted for 42.4% of the total losses. In contrast, the second quarter saw 110 recorded cases of scams, exploits, or unintended losses.

The three most significant cases were the Atomic Wallet breach, resulting in a loss of $35 million, Fintoch’s alleged Ponzi scheme, which amounted to $31.6 million, and the vulnerability exploit in MEV Boost’s software that led to a loss of $26.1 million. These three cases alone contributed to a combined loss of $92.8 million, nearly half of the total losses in the second quarter.

It appears the team behind the ponzi @DFintoch has likely exit scammed with 31.6m USDT on BSC after the funds were bridged to multiple addresses on Tron/Ethereum and

people reported being unable to withdrawFintoch advertised 1% daily ROI & claimed to be owned by Morgan Stanley pic.twitter.com/UD3KKfkG97

— ZachXBT (@zachxbt) May 23, 2023

Rug pulls and exploits were major contributors to the losses, with rug pulls accounting for $55.3 million and exploits for $47.3 million in Q2. The report emphasized that risks and bad actors continue to be prevalent in equal measure within the industry.

Ethereum and BNB Smart Chain Became Major Targets

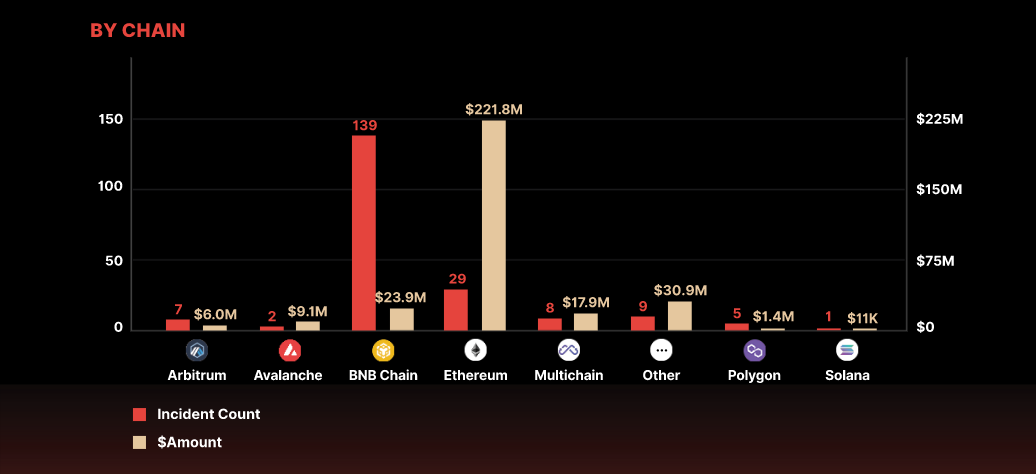

It was noted that BNB Smart Chain (previously known as Binance Smart Chain) and Ethereum were the two major blockchains heavily targeted by fraudulent activities. BNB Smart Chain, created by crypto exchange Binance, experienced 65 cases, while Ethereum had 25 cases in the second quarter. However, in terms of total losses, Ethereum suffered more significant losses with $82.5 million compared to BNB Smart Chain’s $57.8 million.

BNB Chain has identified the Allbridge attacker following on-chain analysis. We are actively supporting the Allbridge team on the fund recovery. The Allbridge team has offered the hacker a bounty.

We'd like to recognize the effort of AvengerDAO in this recovery effort.

— BNB Chain (@BNBCHAIN) April 2, 2023

The report also shed light on access control issues, which accounted for over a quarter of all losses, totaling $75.8 million. This highlighted the vulnerabilities present in both centralized and decentralized finance systems, emphasizing the urgent need for stronger security measures.

While the industry witnessed a variety of exploits in the second quarter, rug pulls remained the most common form of scams with 55 reported cases.

The need for enhanced security in the web3 space has long been acknowledged, but it often takes a back seat to speed and growth. However, experts in the field believe that it is essential to prioritize protective measures and address the issue of bad actors to tackle this ongoing problem effectively.

Future Outlook of Cryptocurrency Scams

Kang Li, the chief security officer at CertiK, a blockchain security firm, explained that new technologies are often targets for exploitation due to the vulnerabilities they present.

“This has been seen throughout history, from the early days of the internet to the rise of email and, more recently, with the advent of blockchain and cryptocurrency,” he said.

Li also emphasized that as the crypto industry is still relatively new and rapidly evolving, some players focus more on growth and innovation than on security, making them susceptible to attacks and contributing to the substantial losses witnessed.

Looking ahead to the second half of 2023, it is anticipated that crypto losses will continue to rise as more investors, founders, and builders enter the space, providing additional opportunities for bad actors. To mitigate this problem, a concerted effort across the industry is needed to prioritize protective measures and weed out malicious actors.

Building a Safer Future for the Crypto Industry

Despite the challenges faced by the crypto industry, Omer Greisman, head of security services at blockchain cybersecurity firm OpenZeppelin, believes that it is still in its nascent stage, and some growing pains are inevitable. The rapidly evolving nature of the industry means that security measures and best practices are still being developed and implemented, and users are still learning how to safely navigate the technology.

“>However, advancements in security practices, such as the widespread adoption of security audits for smart contracts and bug bounty programs, have already made a positive impact.

As the crypto industry continues to expand globally, it is expected that losses will grow proportionally. However, increased regulatory scrutiny and user education are expected to play vital roles in reducing future scams, exploits, and hacks.

Greisman emphasized that regulatory measures help establish standards and guidelines for security practices, while user education enhances individuals’ ability to protect themselves.

Related Articles

- 10+ Best Crypto Presales to Invest in 2023 – Compare Pre-ICO Projects

- Bitcoin Derivative Open Interest is Surging on Spot ETF Hopes – Here’s What That Means For The BTC Price?

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops