Elon Musk’s X Corp has filed a lawsuit against law firm Wachtell, Lipton, Rosen & Katz over its “unconscionable” fee of $90 million for representing Twitter’s previous board.

Wachtell, Lipton, Rosen & Katz, renowned for its hefty fees, was hired by Twitter last year after Musk tried to walk away from the $44 billion acquisition agreement.

However, in a complaint filed on Wednesday in the California Superior Court in San Francisco, Musk accused Wachtell of exploiting Twitter by accepting a huge ‘success’ fee doled out by departing Twitter executives who were grateful that Musk would be forced to close.

The legal dispute also sheds light on Wachtell’s business practices. It shows that the firm charges clients a “success” fee for closed deals or won lawsuits.

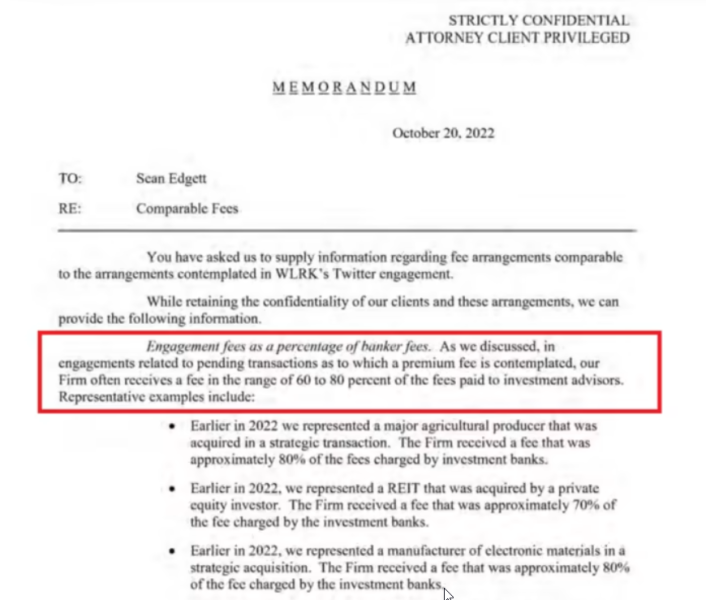

During negotiations, Wachtell openly references the fees charged by investment bankers for a deal closed, or a lawsuit won.

When negotiating the closure of the Twitter deal last year, Wachtell shared a document claiming that the firm “often receives a fee in the range of 60 to 80 percent of the fees paid to investment advisors.”

In other words, instead of employing a closed merger and acquisitions (M&A) transaction as a benchmark, the firm would receive double or triple their typical hourly billings.

According to the lawsuit, Wachtell billed a total of $26.6 million for the first four months of engagement with Musk and was on track to bill around $35 million in the final month.

Although the final fee amounted to 2.5 times that figure, it was in line with comparable fees paid to Twitter’s bankers, JPMorgan and Goldman Sachs.

These banks received a combined $133 million, with $113 million structured as a success fee, exclusively payable upon completion of the Musk buyout.

Wachtell’s Fee Was $5 Million Less Than Initially Proposed

Documents disclosed in the lawsuit show the board’s approval of $90 million in Wachtell fee was $5 million less than initially proposed.

Still, $90 million seems like a lot, even for a case that required the attention of dozens of elite lawyers for 5 months, according to Musk’s lawyers.

They argued that the case was a “relatively straightforward breach of contract dispute” that could have been handled by other reputable law firms experienced in Delaware Chancery Court.

The lawyers further claimed that the case required no specialized skills.

“there were not novel or difficult questions of law involved, nor did the litigation require any special skills beyond that which Twitter could have procured by paying hourly rates to many other reputable law firms with experience litigating in the Delaware Chancery Court, including those hired to work alongside Wachtell,” the complaint wrote.

What grounds does @elonmusk stand suing Wachtell; please refer me which law makes it illegal to pay your lawyers a bonus upon doing a successful business deal helping sell your company? You're the fool who easily parts with his money purchasing Twitter for 3x it's value https://t.co/OgQi6lCyh4 pic.twitter.com/H4ie7wwsaU

— FɆɌȺŁ THɆɆ FƗNNX️ (@Finkelmeister) July 8, 2023

On the other hand, Wachtell has justified its high fees by asserting that its lawyers excel in must-win situations, and their results justify the premium.

In this case, the potential collapse of the Twitter deal could have cost shareholders billions of dollars, making the $90 million fee appear justifiable as an insurance policy.

X Corp, Twitter’s holding company, is seeking repayment of “any associated excess fee payment” and attorneys’ fees associated with the cost of litigation. Musk’s company is represented by Reid Collins & Tsai, a litigation boutique based in Austin, Texas.

Twitter’s complaint against Wachtell comes as the company is facing more than 20 lawsuits over allegedly unpaid bills for rent and various services.

The social media platform is also facing a barrage of lawsuits from ex-employees over unpaid severance and bonuses, and a lawsuit from former CEO Parag Agrawal and other ex-executives over unpaid reimbursements.

Musk’s Twitter in Jeopardy as Threads Picks Up Momentum

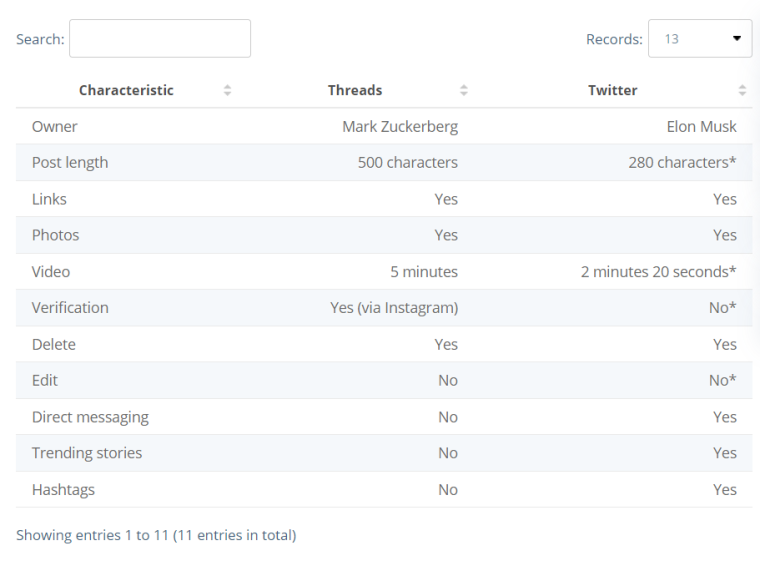

Musk’s Twitter is having a hard time keeping up with its new rival Threads, which has become the fastest-growing app over the past decade, attracting millions of users shortly after its public release.

The app has already surpassed 100 million users, outpacing even the highly successful AI-powered chatbot ChatGPT.

Launched on Wednesday, Threads is a new text-based social media app deeply intertwined with Instagram.

It acts as a standalone app linked to Instagram, allowing users to port over their accounts to the new platform, log in with their existing Instagram credentials, and maintain their handle and verification status.

Resembling the familiar look of Twitter, Threads allows users to post text and links, respond to or repost messages, and importantly, port over their existing follower lists and account names from Instagram, which boasts over 2 billion users.

The app has already claimed the top spot among free apps on Apple’s App Store in the US, which shows its growing popularity.

Meanwhile, Twitter has threatened legal action against Meta over its Twitter-like social media app, accusing the company of stealing its trade secrets.

In a letter dated Wednesday, Twitter lawyer Alex Spiro suggested that the company aims to pursue legal action.

He alleged that Meta hired former Twitter employees who had access to confidential information and trade secrets to develop the new app, adding:

“Twitter intends to strictly enforce its intellectual property rights, and demands that Meta take immediate steps to stop using any Twitter trade secrets or other highly confidential information.”

Read More:

- How to Buy Meta Stock in 2023

- Best Metaverse Stocks to Watch in 2023

- 60+ Twitter Statistics – Investment, Revenue, & Users for July 2023

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops