The hype around AI-powered vertical farming has come crashing down as profitability remains elusive and funding dries up, pushing several startups into bankruptcy or restructuring.

AeroFarms, an early pioneer in vertical farming, filed for bankruptcy last week after building a huge facility in Virginia that drained its cash.

Kalera, a local vertical farming company in Florida, also filed for Chapter 11 protection in April after struggling for months.

Furthermore, AppHarvest, which operates high-tech greenhouses, is facing lender threats and a sharp drop in its shares. The firm has warned it could become “bankrupt or insolvent” if the issue is not resolved.

vertical farming is just a concept. it has endless potential. packing shelves into a costco style warehouse is just stupid. they deserve to go bankrupt.

— Diamond Bay Research (@dbrgeo) June 10, 2023

“We really were in a hype cycle,” Vonnie Estes, vice president of innovation for the International Fresh Produce Association, told Bloomberg in an interview. He added:

“There was a lot of money that rushed in without really understanding that this is actually just farming.”

Investors Compared AI-Powered Vertical Farming to Software Firms

Investors viewed vertical farming as a modern and innovative industry, using robotics and AI to conserve water, combat food insecurity and save the environment.

They compared these companies to software firms, pushing valuations into the stratosphere.

However, investors began to scrutinize profitability as interest rates increased.

Furthermore, a vertical farm’s ability to gain meaningful market share on a national scale is still years away.

Vertical farming falls under the broad approach of controlled-environment agriculture that incorporates horticultural engineering to allow year-round growth in places where it would become impossible.

Industry experts have turned their attention to high-tech greenhouses, which rely on sunlight as opposed to LED lighting, and have less capital-intensive options.

The industry sees significant potential in high-tech greenhouses that rely on sunlight, but funding is becoming scarce.

Last year, vertical farming managed to raise more than $1 billion. However, that figure has dropped to less than $100 million so far this year, according to Adam Bergman, the global head of AgTech investment banking at Citigroup.

Notably, there are still some that see indoor farming as critical to the future of agriculture.

For one, Middle Eastern countries looking for investment alternatives beyond fossil fuels have shown interest in vertical farming, Bergman said.

“This is where the potential lifeline to vertical farming comes in,” he added.

Meanwhile, executives and investors in this industry are shifting their focus to unit economics, the cost, and revenue for each crop produced.

CFO Blanchard mentioned that AeroFarms is shifting production to its new Danville facility, mainly focussed on commercial output as opposed to innovation and scale.

The operating margins are where these kinds of companies are failing.

Eric Stein, founder and executive director of the Centre of Excellence for Indoor Agriculture, said that vertical farming corporations are “very complex modern corporations,” and even if the production side unites economics and has good gross margins, operating margins are where many businesses fall short.

Vertical Farming Expected to Grow Substantially

While AI-powered vertical farming has faced some hurdles, the global vertical farming market is expected to resume growth as population size increase and living in urban cities become more popular.

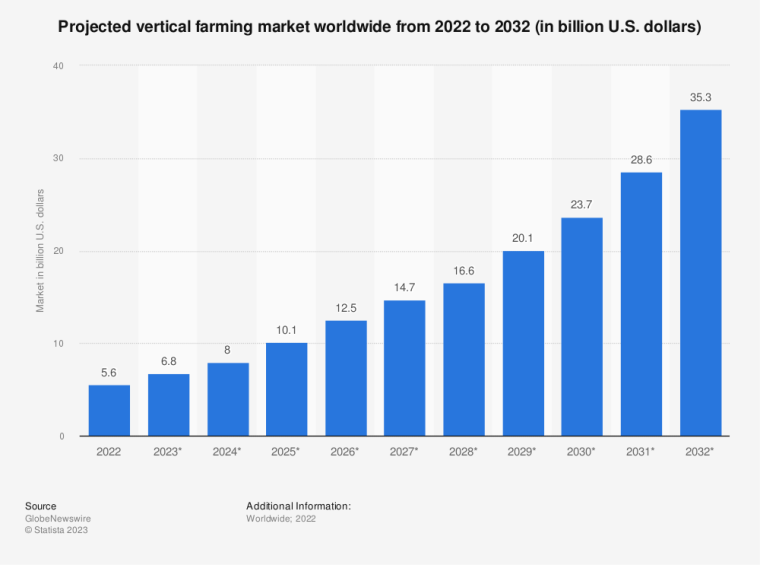

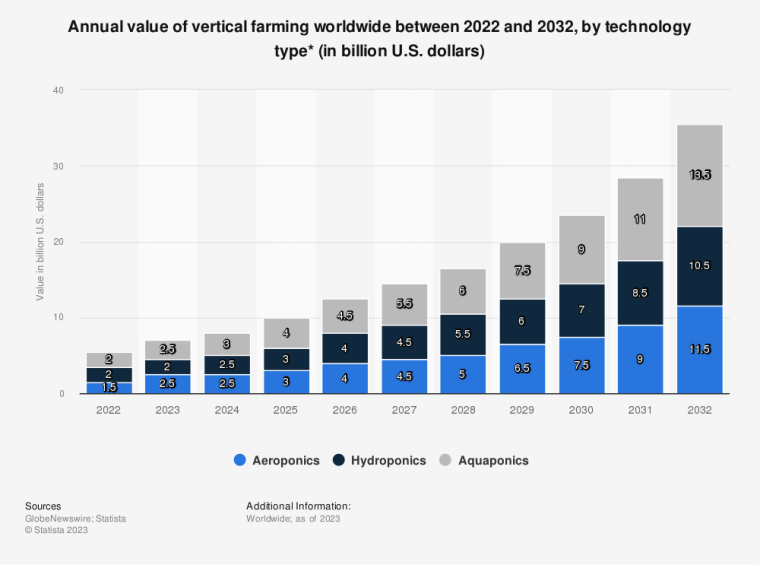

In 2022, the vertical farming market reached some $5.6 billion, but the market value is expected to increase to over $35 billion by 2032, according to a research by Statista.

The report said that a number of reasons would contribute to the growth of vertical farming in large cities.

For one, the strategy allows farmers to use vertical space and reduce the need for additional land and construction activity.

In addition, demand for vertical farming is expected to increase largely due to the popularity of organic food.

Another report from Statista predicts that the revenue of the global market for vertical farming is estimated to be $35.5 billion by 2032, compared to $7 billion in 2023.

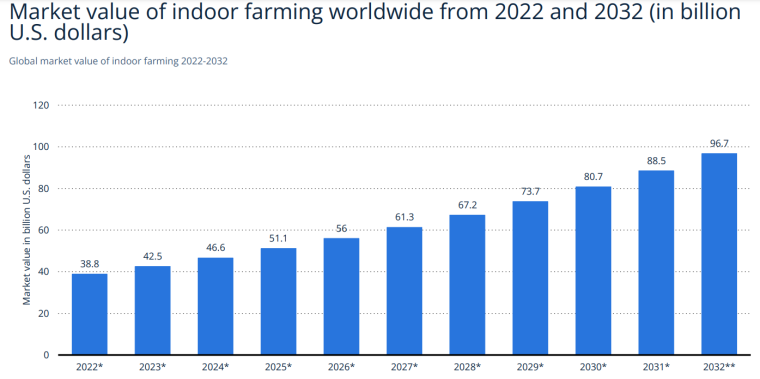

For context, the overall value of the market for indoor farming is expected to substantially outgrow vertical farming.

A 2023 report from Statista forecasts the market value of indoor farming worldwide to reach a staggering $96.7 billion, compared to $42.5 billion in 2023.

How AI Could Help Improve Agriculture

A growing global population is putting increasing strain on the world’s food supply chain.

To meet demand, farmers face the challenge of producing more food using fewer resources as climate change impacts agricultural production and water supplies. One solution to this problem is artificial intelligence (AI).

With the ever-increasing demands on the food supply chain, farmers need to use the technology to become experts in subjects like fertilizers, soil health, weather prediction, pest control, and irrigation, among others.

Farms are under pressure to produce more with fewer resources and less reliance on a workforce, due to factors such as urbanization, immigration policies, and a generational shift away from farming.

To this end, the autonomous-farming industry is starting to take off, with around 200 AI-based agricultural startups operating in the US alone, according to Wendy Gonzalez, CEO of AI analytics platform Sama.

She said that AI applications in agriculture range from autonomous tractors and combine harvesters to swarms of robots for crop inspection and sprayers.

Indoor farming companies like Plenty and AppHarvest use computer vision and AI to collect data on crops and create optimal growing environments.

Blue River Technology uses machine vision and AI to differentiate between crops and weeds, allowing for targeted herbicide application with less human labor.

AI Can Help Decrease Waste While Increasing Productivity

The disposal of food waste also has a significant impact on the food supply chain.

According to the United Nations, approximately 17% of global food production goes to waste, accounting for 38% of the total energy usage of the global food system.

The resources used in food production, including land, water, energy, labor, and capital, go to waste when food is wasted. Additionally, the disposal of food waste in landfills generates greenhouse gas emissions that contribute to climate change.

However, if properly utilized, AI can address this issue, decreasing waste while increasing productivity.

Incorporating multiple data types, such as IoT sensors or computer vision technology, gathering data regarding all factors affecting production, and utilizing constant AI learning to monitor crops and adjust to events like inclement weather, all enable farmers to make real-time adjustments to improve both crop quality and quantity, Gonzalez said.

Incorporating AI can also help farmers cut energy and water consumption by making smart choices about irrigation timing and the use of fertilizers and other soil treatments.

For example, a smart irrigation system uses information gathered about soil moisture, weather forecast, and incoming solar radiation to determine when to turn on the system. This results in less water waste, healthier soil, and more productive crops.

Similarly, AI can also be used to ensure that fertilizers are applied only where they’re needed, reducing costs and environmental impact.

Read More:

- How to Invest in Carbon Credits in 2023

- Best AI Stocks to Invest in 2023

- Best AI Crypto Tokens & Projects to Invest in 2023

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops