It is approximated that 42.8% of active gaming and esports content consumers in China make monthly in-game purchases in contrast to a mere 2.2% who don’t tune into esports or gaming content. These and other statistics emphasize China’s undisputed dominance in the global gaming industry.

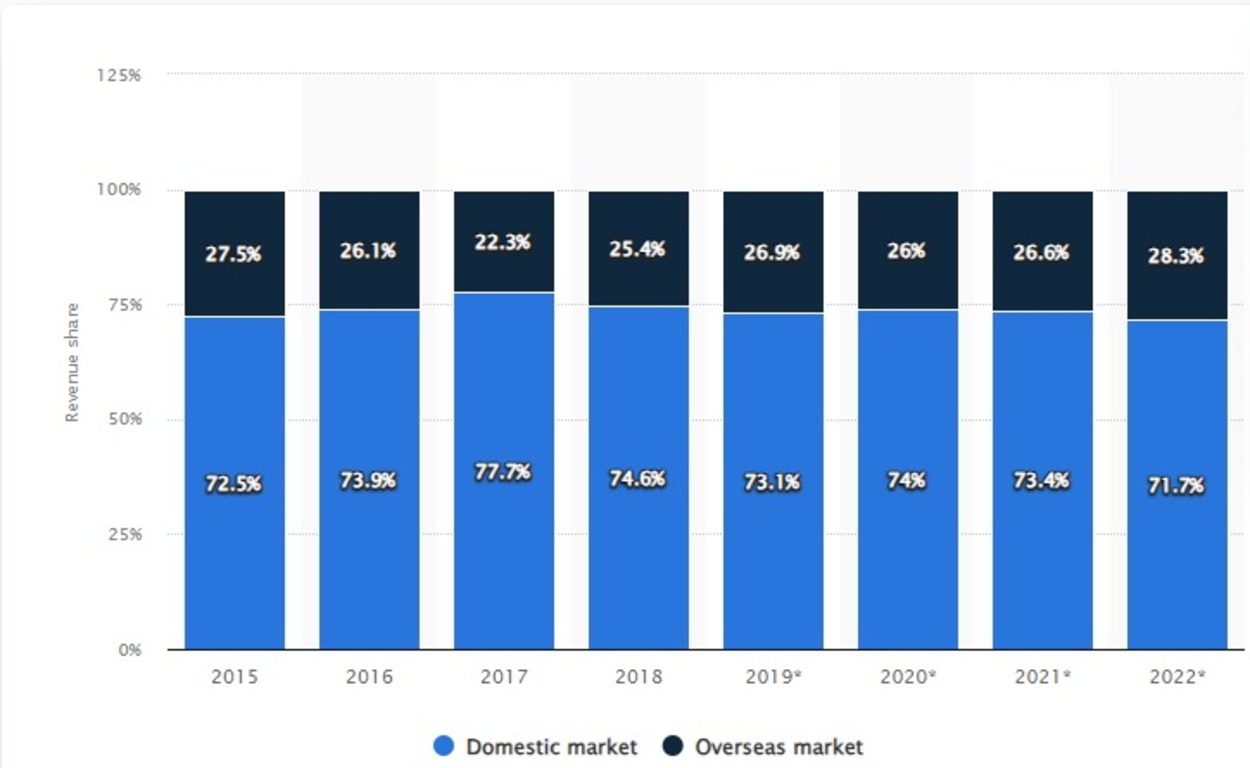

According to a recent industry report by Niko Partners, China-based game companies contribute up to 47% of the worldwide mobile gaming revenue. This comes on top of accounting for a staggering 39% of PC games revenue globally – inclusive of the revenue generated within the Chinese domestic market.

China is The Undisputed King of the Global Mobile Games Revenue

Chinese games companies are growing at an astronomical rate but again, according to the CEO and founder of Niko Partners, Lisa Hanson, they are not afraid to make bold moves at substantially higher rates.

Revenue from PC games, produced internationally by corporations based in China, saw an uptick of 22% in 2022. The projected growth stands at a 13.8% compound annual growth rate (CAGR) up to 2027. Intriguingly, this growth trajectory surpasses the domestic rate by a considerable extent.

“You must get to know Chinese developers and publishers both in the domestic market and abroad if you are serious about the global games industry,” Hanson said.

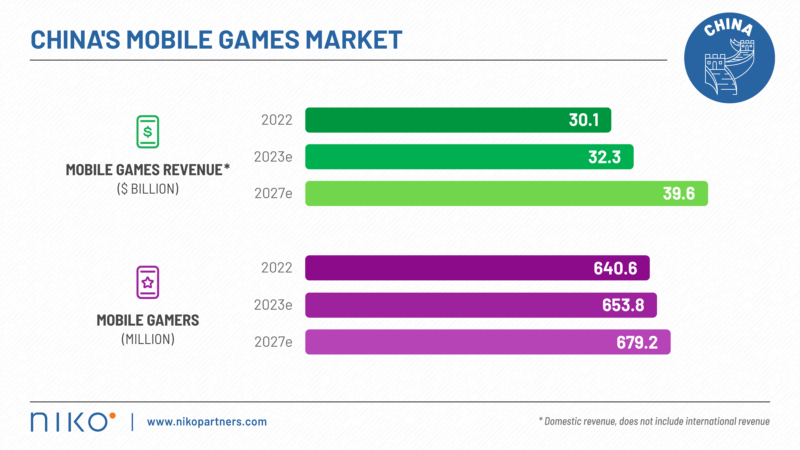

Key insights from the research conducted by Niko Partners, a leading market research firm majoring in video games and esports in the Middle East, Asia, and North Africa, project the Chinese games market to expand, amassing $57 billion in revenues by 2027.

Despite China’s population shrinking in recent years, the number of Chinese gamers are expected to grow to reach 730 million by 2027.

Revenue distribution within the domestic gaming market reveals that gamer expenditures lean heavily towards mobile at 66%, while PC games claim a 31% share, and console games account for a modest 3%.

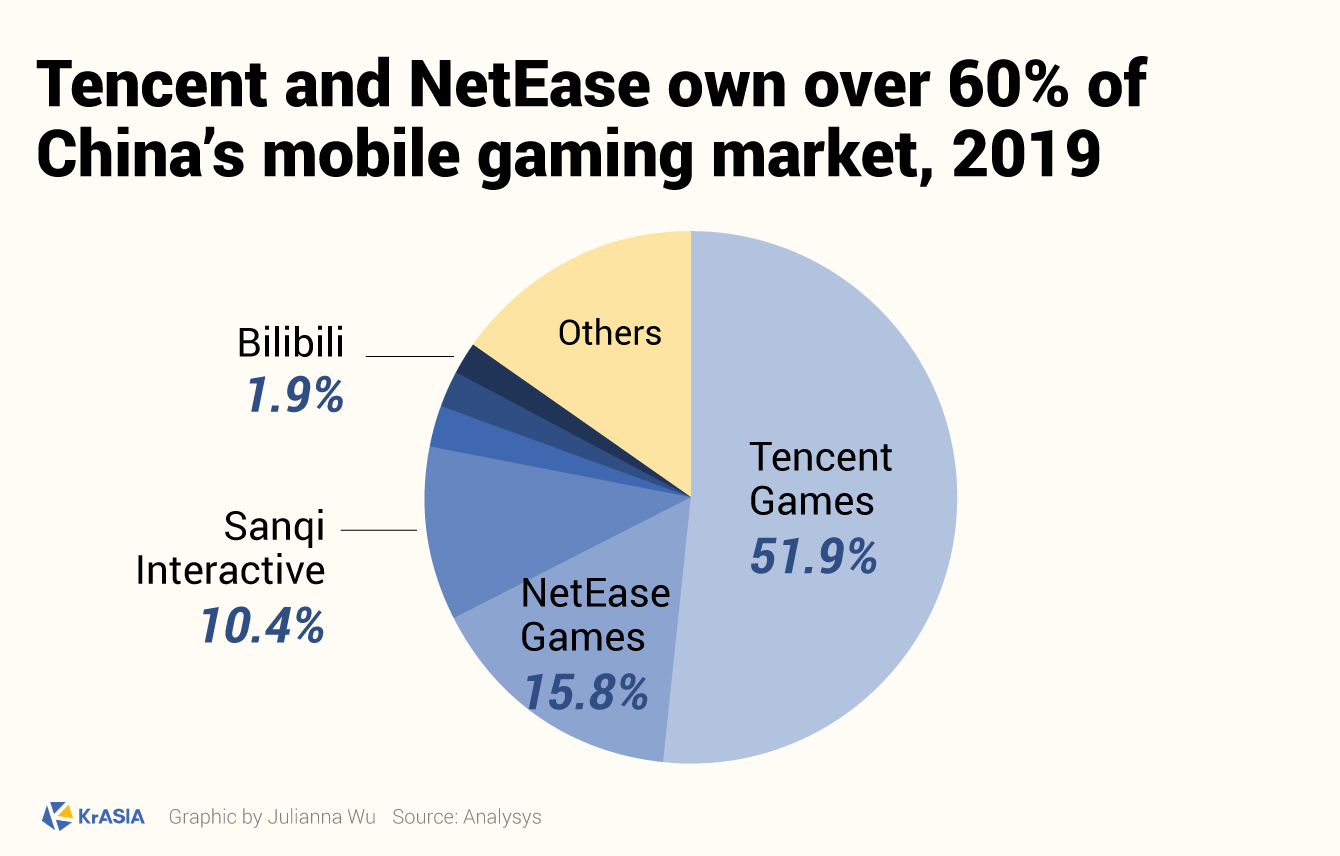

China’s gaming market is as centralized as it is concentrated on mobile. In 2022, the powerhouse pair of Tencent and NetEase towered over a collective 61% of the domestic revenue for PC and mobile games.

Despite their continued supremacy, their joint market share dipped compared to 2021, reflecting sluggish returns from longstanding titles and a dearth of fresh launches – a sign that rival players are gaining traction.

However, Q1 2023 brought encouraging earnings for both entities, with Tencent witnessing a 10.9% YoY rise in domestic game revenue and NetEase observing a 7.6% YoY increase in total games revenue.

Unleashing the Dragon – The Growth Spurt in China’s Mobile Gaming Arena

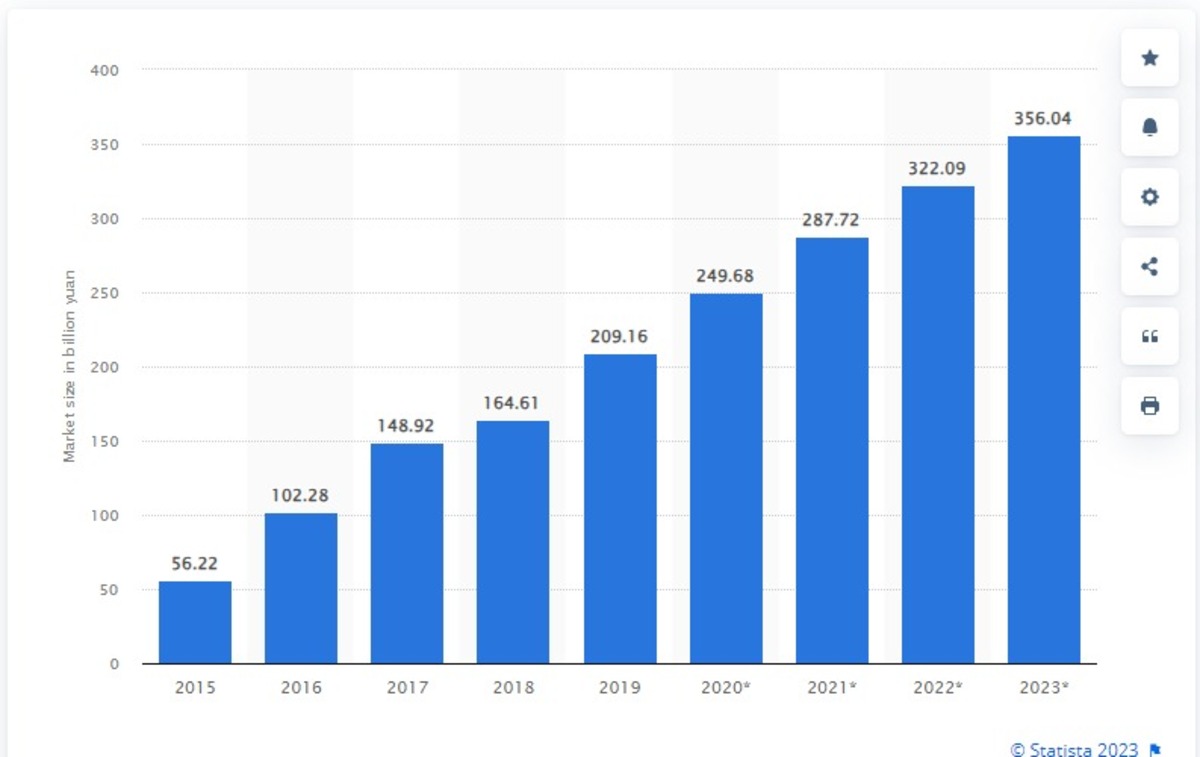

As smartphones became mainstream in China, so did mobile games. According to a related report by The Tech Guys, by 2012 China was recording more than one billion subscriptions on mobile phones.

This growth has mainly been attributed to the significant drop in the prices of smartphones, in comparison to PCs, which are often considered costly. Mobile gaming had far fewer restrictions that are synonymous with PC games. Moreover, they were the easiest way to access the internet for Chinese citizens.

While console bans were lifted later in 2010, mobile gaming had already spread its wings throughout the vastly populated country. It is without a doubt, the fastest-growing internet sector globally.

Global gaming companies are all looking toward China, for its position at the helm of the worldwide mobile gaming market, making it the most profitable.

In another report by BusinessofApps, the revenue stream from China’s mobile gaming swelled by 31%, inching toward the $30 billion mark in 2020.

Moreover, China’s game developers are still leaving their mark on the global gaming scene, with overseas game revenues outpacing domestic market growth at a rate of 36.7%.

Exploding Revenues But A Difficult Market To Navigate

The vast Chinese mobile gaming industry is bursting with mouthwatering revenues but the barriers to entry tend to lock out many domestic and international developer studios. For game development studios to successfully navigate the market, they need to have specialized local talent that understands the nitty-gritty of the landscape.

“The regulatory environment for games in China changes on an almost monthly basis. For this reason alone, it is becoming more difficult for foreign competitors to enter this market without an experienced China-based advisor or partner who is abreast of the latest laws and legal requirements,” Todd Kuhns, the marketing manager for AppInChina told The China Guys.

Kuhns added that although successfully navigating China’s mobile gaming industry is often smart, it is not exhaustive and does not guarantee massive revenue. Companies must also delve into the challenging user acquisition and marketing segment.

However, Kuhns advises both foreign and domestic game developer studios to seek the services of a reliable and experienced local partner who will assist in designing and managing all advertising, social media, and influencer campaigns to grow your user base at a faster rate.

“China’s market can be tough for domestic and foreign companies, but the country remains the #1 market globally for games revenue and the number of gamers, and cannot be ignored,” Hanson said in a statement.

Related Articles:

- Best VPN for Gaming 2023 – Top VPNs for Gaming Compared

- Porsche Reveals Record-Breaking, 900 Volt Super Car for Its 75th Anniversary

- DocuSign Adds 160,000 Customers to its Platform in The Past 12 Months

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops