The failure of SVB (NYSE: SIVB) led to a sell-off in US stock markets last week. Here is the list of listed companies that have significant exposure to SVB.

For background, on Thursday, SVB Financial announced a capital raise amid plummeting deposits. Of this, $1.25 billion was going to be through an underwritten common stock offering and $500 million through a mandatory convertible preferred stock.

SVB also announced that General Atlantic, a US-based growth equity firm, would invest another $500 million at the same terms at its common stock offering. The company also announced the sale of bonds at a loss of $1.8 billion.

Regulatory filings show that depositors withdrew a massive $42 billion from SVB on Thursday and it had a negative cash balance of around $958 million at the end of the day.

Meanwhile, on Friday, regulators shut down the bank making it the first major bank failure since the 2008 financial crisis.

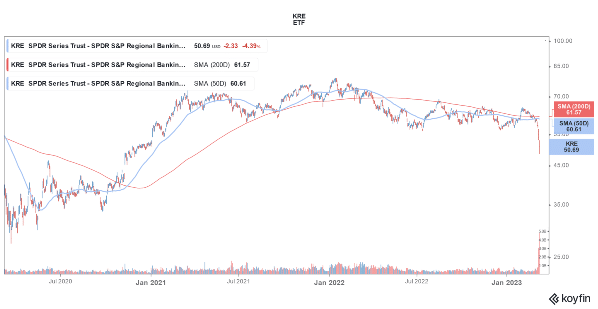

The fallout of SVB Financial’s collapse was visible in regional banks in particular and the SPDR S&P Regional Bank ETF fell almost 4.4% on Friday.

VC-backed privately held companies accounted for the bulk of SVB’s customer base. However, a lot of publicly-listed companies also had exposure to SVB.

List of Companies that Have Significant Exposure to SVB

A lot of companies have disclosed their exposure to SVB. The list is not exhaustive and over the course of the next week, more companies might also disclose their deposits with the bank.

Canadian advertising technology company AcuityAds Holdings holds around $55 million cash with SVB. It has only $4.8 million cash with other banks. The stock fell over 14% on Friday and trading was halted at the request of the company.

Bill.com also fell over 14% on Friday. The company said that out of its total cash and cash equivalents of $2.6 billion, it holds $300 million with SVB. Also, of the $3.3 billion worth of cash that it holds for its customers, $370 million is with SVB.

Roku Holds $487 Million with SIVB

Roku had $487 million worth of deposits with SVB which is around a quarter of its total cash.

Space launch startup Rocket Lab, which went public through a SPAC (special purpose acquisition company) reverse merger in 2021 also held $38 million cash with SVB, which is just under 8% of its total cash at the end of 2022.

Etsy too has exposure to SVB even as the company hasn’t yet disclosed the exact dollar amount. However, it informed sellers about delays in payments due to the failure of SVB.

Roblox also holds around $150 million or 5% of its cash with SVB. Gingko Bioworks held 6% of its cash with the bank. Solid state battery startup QuantumScape said that only a low single-digit percentage of its cash holdings are held at SVB.

QuantumScape is backed by Volkswagen and its solid-state batteries promise higher range and quicker charging which can expedite the pivot to electric cars and help lower carbon emissions. Read our guide on investing in carbon credits.

Companies With Low or No Exposure to SVB

LendingClub said that it holds $21 million in deposits with SVB which is non-material. Fubotv Inc. said that it has no exposure to SVB. Insurance company Lemonade also holds only about $7,000 with the bank.

Fintech company SoFi does not holds any deposits with SVB but has an almost $40 million lending facility through the bank which is not impacted by the bank’s closure.

Last year, SoFi set up its own bank which would help it bypass other banks.

What Happens to SVB Deposits?

The California Department of Financial Protection and Innovation closed SVB and put it under the control of FDIC (Federal Deposit Insurance Corporation).

The FDIC meanwhile covers only deposits upto $250,000 per depositor. At the end of 2022, over $151 billion of deposits at SVB, which was 89% of the total deposits, were above the FDIC insurance limit.

These depositors, assuming they haven’t yet pulled out their money from the bank, face an uncertain future and recovery would depend on how much SVB’s assets yield.

The FDIC would issue a “receivership certificate” to uninsured depositors even as it said that the total number of uninsured deposits is “undetermined.”

In past bank failures, including during the 2008 shutting down of Washington Mutual, the FDIC found a buyer who took over the troubled bank’s assets and as part of the process honored all the deposits.

Markets are speculating that the Biden administration might also jump in to bail out SVB given the already troubled economy. However, it remains to be seen whether the US government would come forward to help the troubled bank with taxpayers’ money.

Related stock news and analysis

- Best Sectors to Invest in 2023 – Top-Performing Industries Revealed

- New Upcoming Coins to List on Binance 2023 – Next Binance Listings

- Saudi Aramco Posts Record 2022 Profits amid Higher Oil Prices

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops