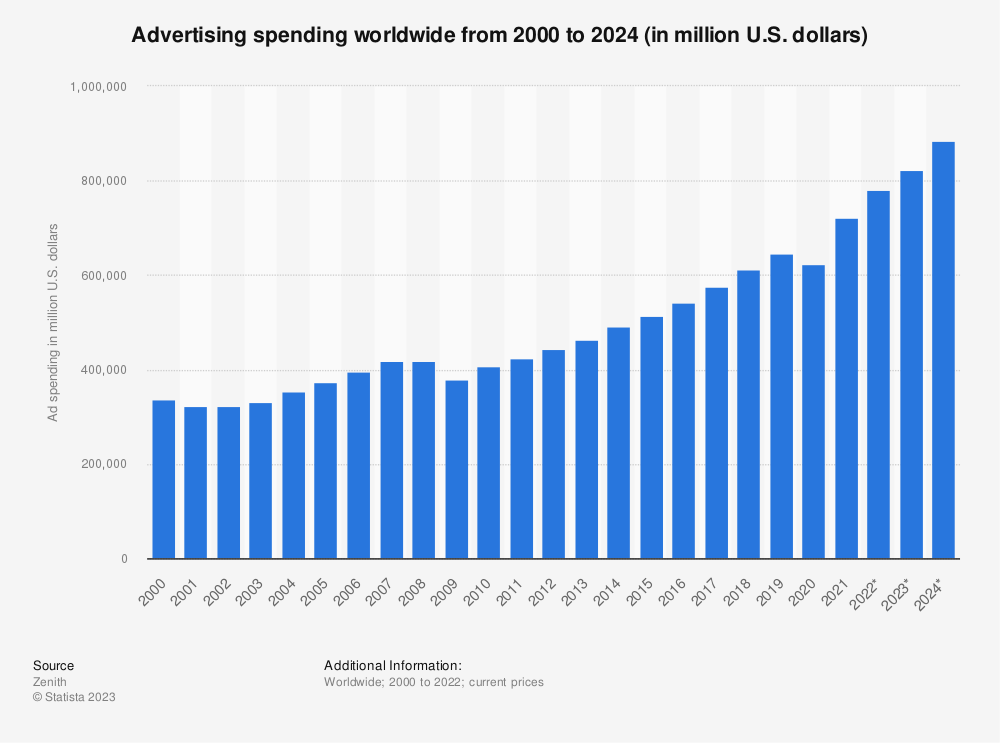

Media investment group GroupM predicts in its new report that global ad spending would rise 5.9% in 2023 while digital ad spending would rise 8.4%. Here are the other key takeaways from the report.

The forecast which was released earlier this week is in line with the firm’s previous forecast. Also, the predicted increase should be seen in light of still high inflation.

While US CPI rose at an annualized pace of 4% in May, the IMF expects global headline inflation to rise 7% this year.

Truflation’s real-time US inflation gauge has moved down to 2.5% from a peak of 12% last June.https://t.co/9R9R9EK5uf pic.twitter.com/tkbRVe4im0

— Charlie Bilello (@charliebilello) June 14, 2023

While high inflation is invariably a negative for stocks – especially the growth names – some investment strategies can outperform in high inflation.

That said, GroupM expects global ad spending to rise to $874.5 billion in 2023 – excluding US political advertisements.

US presidential elections are slated for 2024 and later this year we might a bump in political advertisements.

Over $2.5 billion was spent on political ads in the 2020 US elections. Incidentally, Twitter has also opened upto political ads under its new owner Elon Musk.

Incidentally, last month Florida Governor Ron DeSantis officially announced his 2024 presidential campaign with Elon Musk in a Twitter Space – an event that was marred by technical issues.

GroupM expects global ad spending to bounce back to more normal levels in the second half of the year. However, they warned, “There are still major events that stop any real normalcy; the war in Ukraine goes on, and the use of artificial intelligence in everything means there’s always something new happening.”

GroupM Predicts a 5.9% Rise in Ad Spending This Year

Over the last many years, digital and new media channels have been eating into TV’s share in total ad spending and GroupM expects the trend to continue.

For instance, it expects the retail media network which includes the likes of Uber, Walmart, Instacart, and Amazon to generate $125.7 billion in advertising revenues this year – up 9.9% as compared to the last year.

It expects the segment to account for 15.4% of total ad revenue by 2028 and exceed the total TV ad revenues that year.

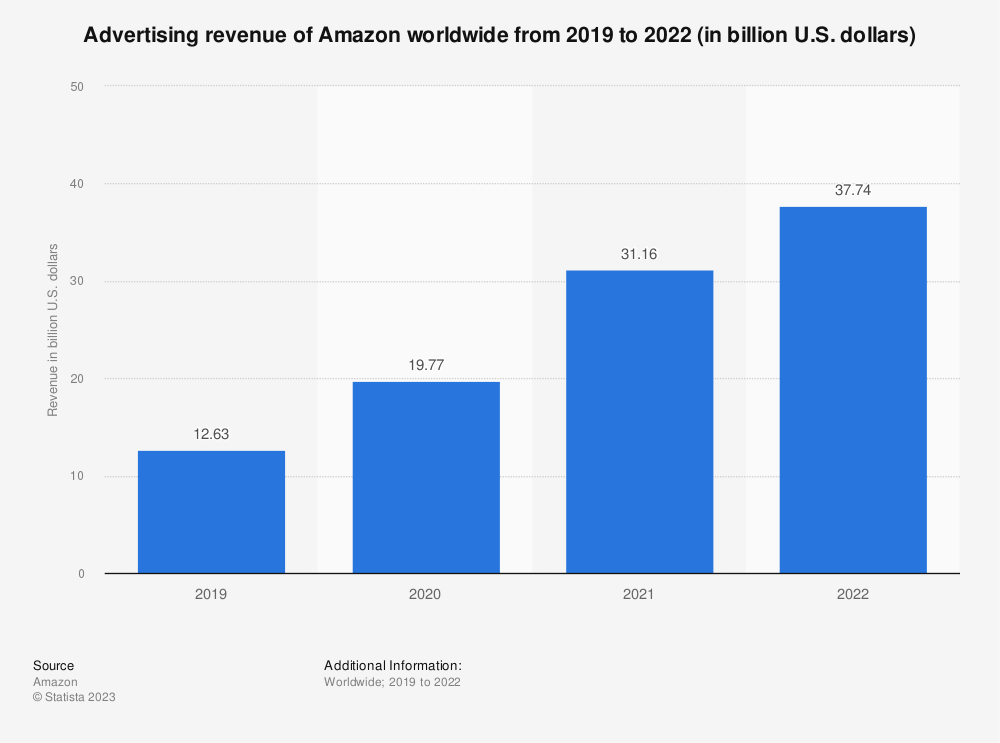

Notably, advertising has been among the strongest growth areas for Amazon and its advertisement segment reported revenues of $9.5 billion in the first quarter of 2023 – a YoY rise of 21%.

To put that in perspective, the company’s consolidated revenue growth was only 9% in the quarter, while AWS which has been growing at a brisk pace over the last many years, reported a 16% rise in revenues – its slowest pace ever.

Last year, Uber formally launched its advertising division and unveiled Uber Journey Ads.

Meanwhile, GroupM predicts that out-of-home advertising should grow 13.4% to $35.6 billion this year.

Streaming Companies Are Also Turning to Ad-Supported Tiers

GroupM expects connected TV ad revenue to rise 13.2% to $25.9 billion in 2023. It expects the segment’s ad revenues to grow 10.4% compounded between 2023 to 2028 and reach $42.5 billion.

Notably, streaming has gradually taken away market share from linear TV, and Kate Scott-Dawkins, global president of business intelligence at GroupM said, “The overwhelming trend for where people are spending their time is toward streaming, especially among younger generations.”

Notably, last year both Netflix and Disney launched their ad-supported tiers and Netflix now has over 5 million subscribers for the tier.

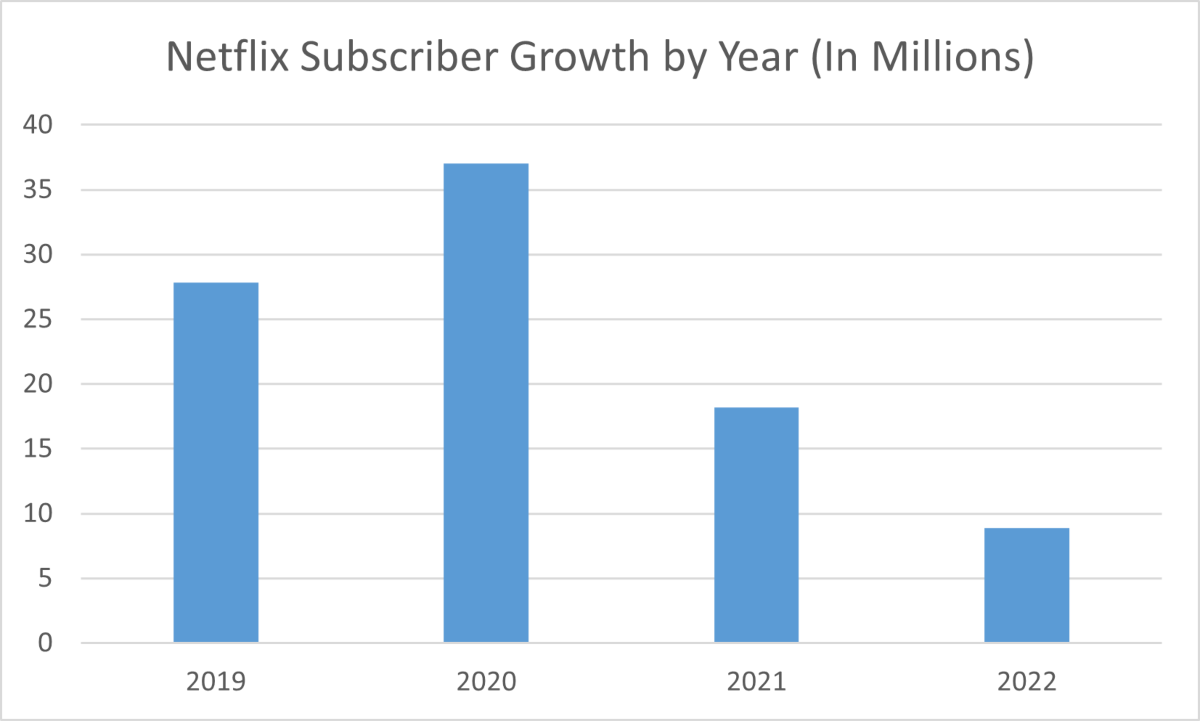

To put that in perspective, Netflix only added 8.9 million streaming subscribers last year and had 231 million total subscribers at the end of the year.

Global Digital Ad Spending Growth Has Slowed Down

While the streaming sector’s ad revenue growth is expected to rise above the industry average, global digital ad spending has slowed down and GroupM predicts that it would rise by only 8.4% this year – the slowest pace since the 2009 financial crisis.

The report said, “With digital now more than two-thirds of total advertising, digital growth at historic double-digit rates has become difficult to achieve, and we expect digital to decelerate further over the next five years.”

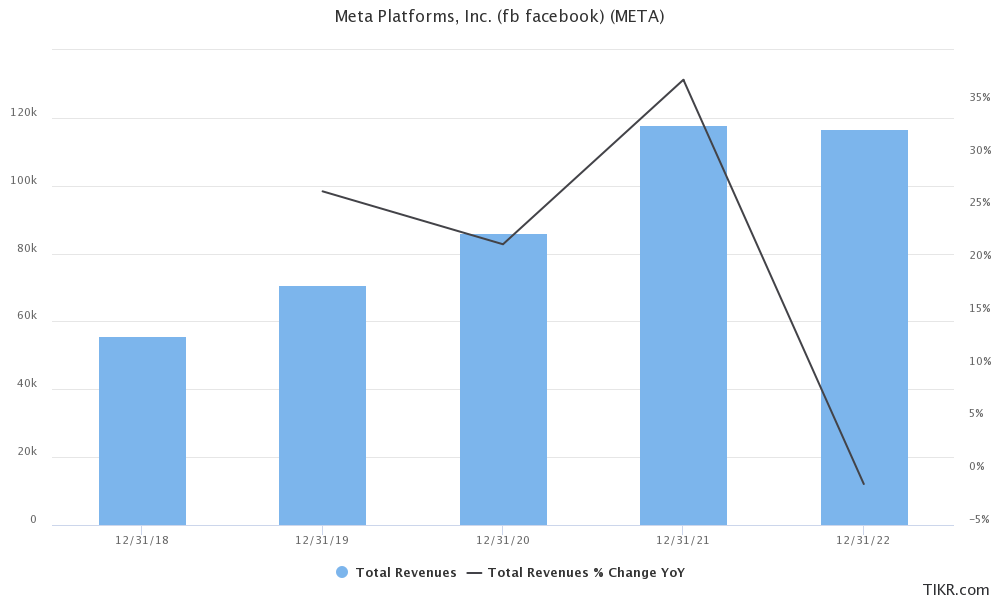

Slowing global digital ad spending has taken a toll on companies like Meta Platforms and Snap. In 2022, Meta’s revenues fell YoY for the first time ever.

Meanwhile, Meta Platforms has shown signs of turnaround and after reporting a yearly fall in revenues for three straight quarters, it reported a 2.6% rise in its Q1 2023 revenues.

Cathie Wood Bought Meta Platforms Stock

Cathie Wood of ARK Invest recently bought $47 million worth of Meta shares – the first time since 2021 when the growth-oriented fund manager bought the stock.

Wood has meanwhile faced flak for selling Nvidia shares before its massive rally that took its market cap beyond $1 trillion.

All said the competition for ad spending has now intensified as a new set of companies enter the space – ride-hailing and streaming companies for example.

Also, in the digital ad space, TikTok has emerged as a tough competitor to the likes of Facebook and YouTube even as a survey showed that only 3.8% of working professionals aged between 16 to 64 said that their companies use TikTok for social media marketing.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops