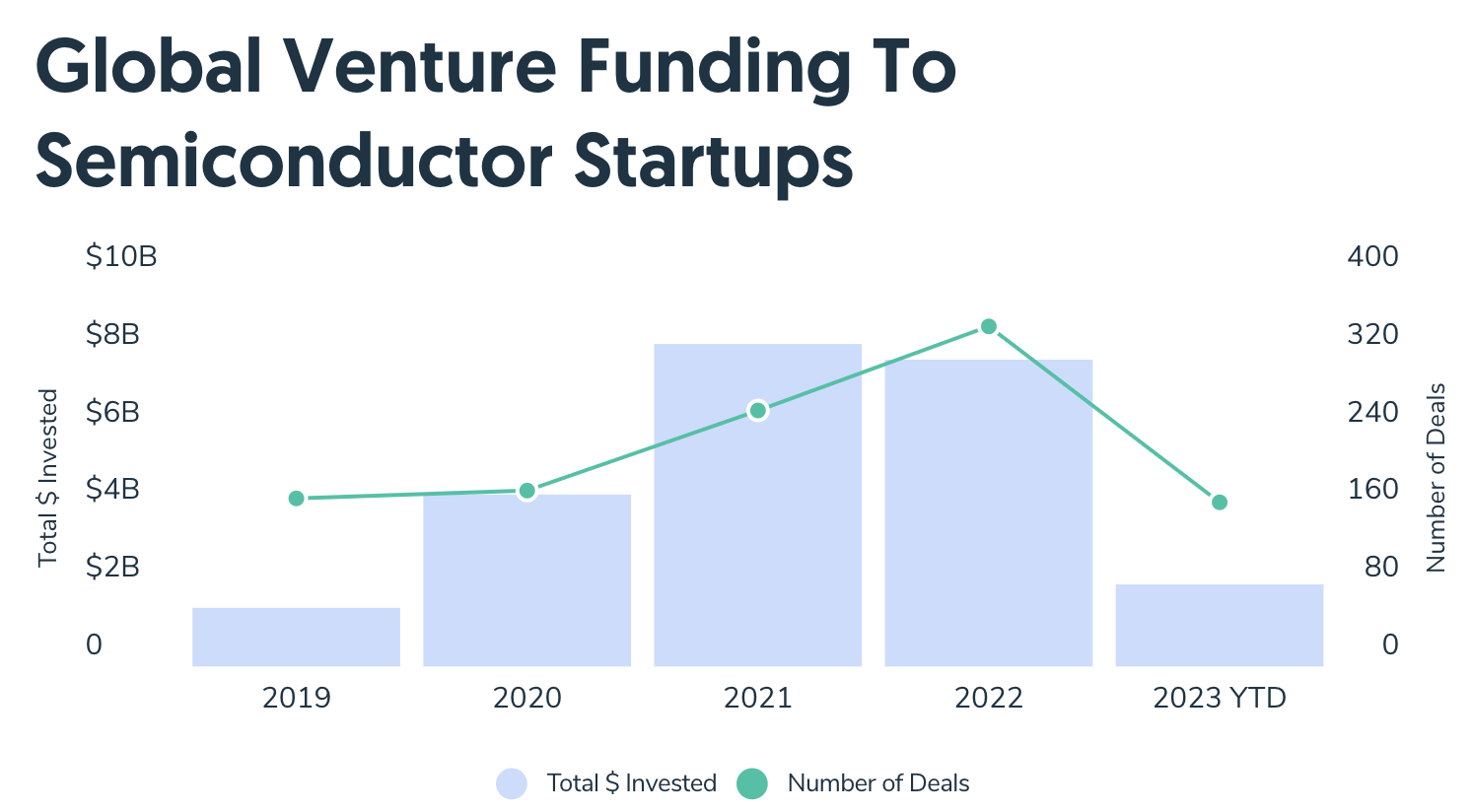

According to Crunchbase data, the global venture capital investment landscape has remained stable in the initial third of the year, with startups receiving around $2.3 billion in funding through 168 deals.

If this trend persists, the total funding for the year is projected to fall slightly short of the $7.9 billion invested in semiconductor startups last year, involving 349 deals.

Unlike many industries, semiconductors did not see a huge falloff last year in funding from 2021. Will AI play a role in the next chapter for the sector's startups?https://t.co/fe5mm2qxa1 pic.twitter.com/xzWmsooxX6

— Crunchbase News (@crunchbasenews) May 17, 2023

Chinese Semiconductor Startups Bolster Funding Numbers

In contrast to several industries, the semiconductor sector did not experience a significant decline in funding from 2021, largely due to substantial funding rounds secured by Chinese startups. Globally, semiconductor startups raised $8.3 billion across 263 deals in 2021.

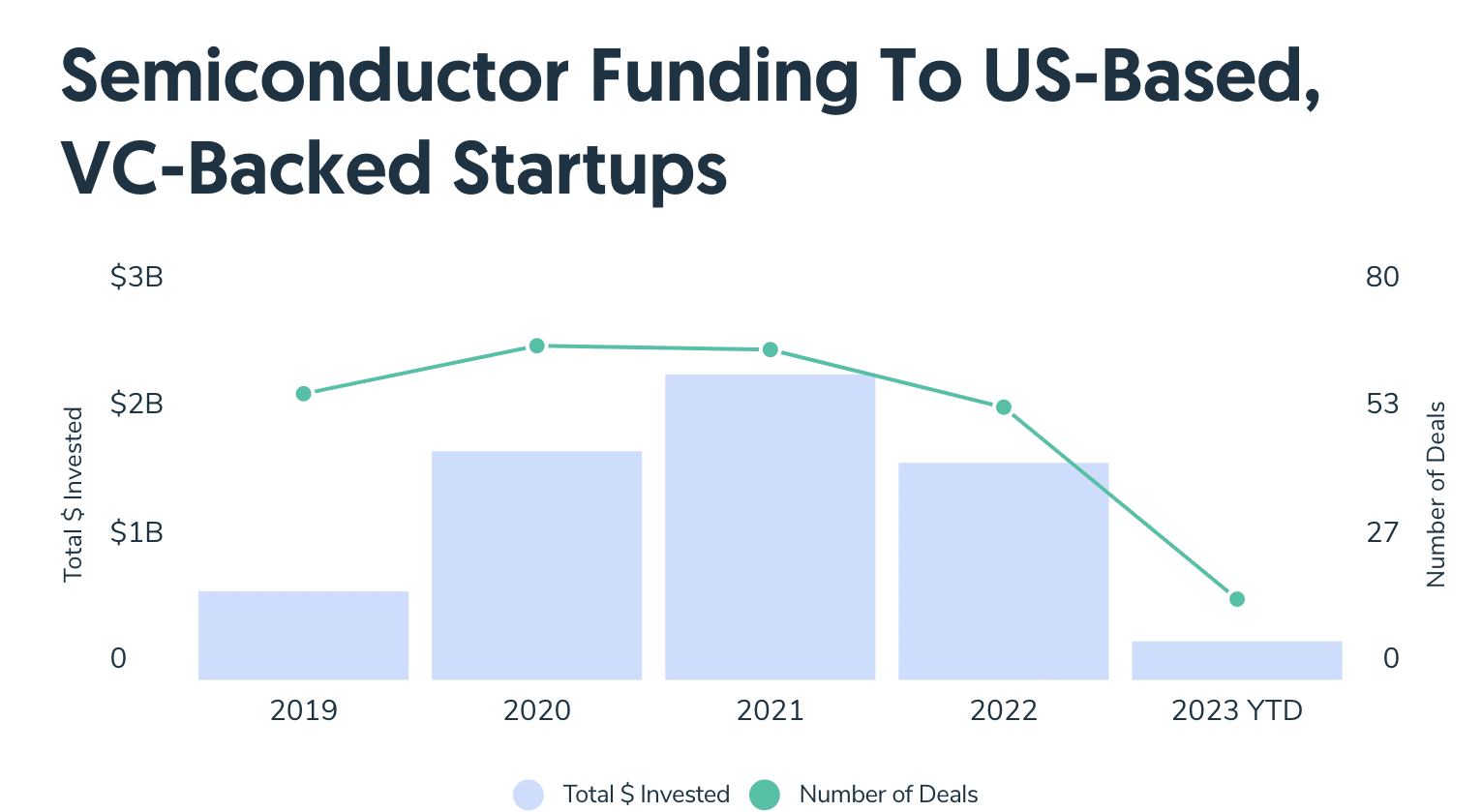

According to Crunchbase data, semiconductor startups in the United States have faced significant challenges. Venture funding for these startups is projected to reach its lowest total since 2019 when they raised a mere $712 million across 60 deals.

In 2023, the funding situation remains bleak, with U.S. semiconductor startups managing to secure only $262 million across 17 deals so far.

Overseas markets have contributed significantly to the global funding numbers, with China-based semiconductor startups leading the way.

One notable example is SJ Semi, a Chinese foundry serving customers worldwide, which secured an enormous $340 million in a Series C funding round in April.

Remarkably, the four largest funding rounds this year for semiconductor startups have all been obtained by Chinese firms.

Noteworthy Funding Rounds and Success Stories

On the other hand, the United States’ largest funding round went to EdgeQ, a 5G chipmaker based in Santa Clara, California. EdgeQ raised $75 million in investment from various institutional and strategic venture capitalists, including Strategic Development Fund, EDBI, Iron Grey, and ST Engineering, among others.

Amidst the challenging fundraising landscape, Vinay Ravuri, co-founder, and CEO of EdgeQ, acknowledged the difficulty of raising money but highlighted that their business stood out due to factors such as their chip product, existing customers, and revenue-generating capabilities.

Talking to Crunchbase, Ravuri asserted that the presence of a tangible chip product, along with established customer relationships, played a crucial role in EdgeQ’s success.

Additionally, maintaining strong connections with investors was vital in navigating the challenging funding environment.

Recently, significant funding deals have also taken place in other areas. For example, the Indian ed-tech startup BYJU’S raised an impressive $700 million in private equity funding, while the Seoul-based autonomous mobility company 42dot gathered around $787 million in a corporate round. Additionally, the Singapore-based online shopping platform Lazada Group secured a notable $353 million from its parent company, Alibaba.

Opportunities and Optimism in the Semiconductor Industry

The semiconductor industry in the United States has historically faced challenges in attracting significant fundraising due to the technology’s complexity, its unique ecosystem, and the limited pool of investors specializing in this field.

Stefan Dyckerhoff, managing partner at Sutter Hill Ventures in Palo Alto, California, spoke to Cruchbase noting that fluctuations in the semiconductor industry have always been a part of its nature.

Sutter Hill Ventures has invested in semiconductor startups such as Astera Labs, which secured $150 million in funding in November, and SiFive, an open-source semiconductor technology, and software provider.

Dyckerhoff emphasized that semiconductor investment requires specialization and expertise, making it a niche area of focus for investors. However, despite the challenges, there are notable opportunities in the industry.

With the emergence of new technologies that have complex requirements, investors recognize the potential for specialization in chip development for sectors like artificial intelligence (AI), sensing technology, automotive, and others.

We think this is one of the richest times for the industry because of all the emerging applications that will require the rethinking of the semiconductor architecture approach.

Celesta Capital focuses on deep tech investments and has invested in companies like SambaNova Systems, a Palo Alto-based semiconductor startup that raised a record-breaking $676 million funding round in 2021, the largest ever for a U.S.-based semiconductor startup.

This implies that there is substantial potential for innovative solutions and advancements in the semiconductor space to cater to evolving technological needs.

Related News:

- Restaurant365 Raises $135M to Keep Empowering Food Service Businesses

- UK Commits a Paltry $1.2 Billion to Semiconductors: Would It Be Enough?

- Where to Buy Stocks Online

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops