Su Zhu and Kyle Davies, co-founders of bankrupt crypto hedge fund Three Arrows Capital have started a new venture capital fund 3AC Ventures which intends to invest in decentralized finance.

The duo founded Three Arrows Capital in 2012 which was initially focused on foreign exchange arbitrage but shifted focus to cryptocurrencies in 2017. The fund managed assets of around $18 billion at the peak.

However, amid the crash in crypto assets and the failure of multiple projects, VCs investing in digital assets were left running for cover.

Talking specifically of Three Arrows Capital, it suffered massive losses when the Terra Luna ecosystem crashed.

Three Arrows Capital eventually filed for bankruptcy last year amid creditor claims of over $3 billion.

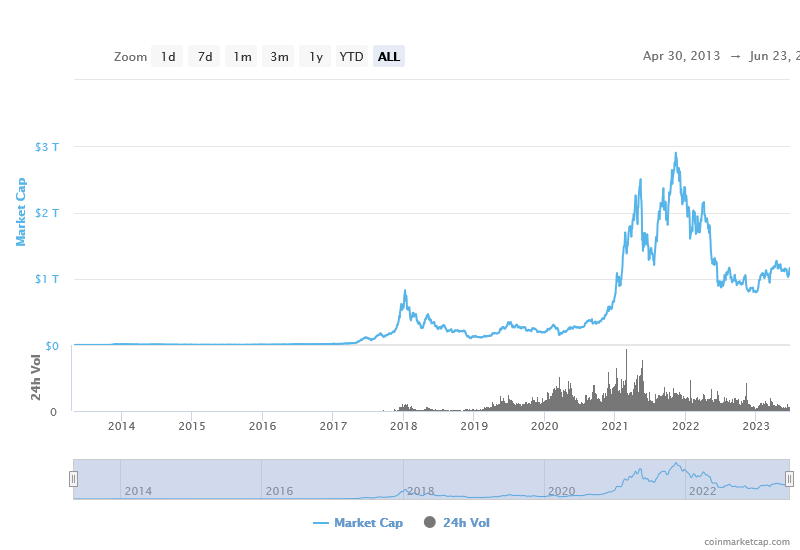

Notably, 2022 was a particularly bad year for investors and the total cryptocurrency market cap fell below $1 trillion in November. To put that in perspective, the total cryptocurrency market cap surpassed $3 trillion in November 2022.

The crypto market is now around $1.2 trillion and bitcoin is back above $30,000 – making it among the best-performing asset this year.

While cryptocurrencies are volatile as an asset class, many market experts recommend investing a portion of the portfolio in cryptocurrencies.

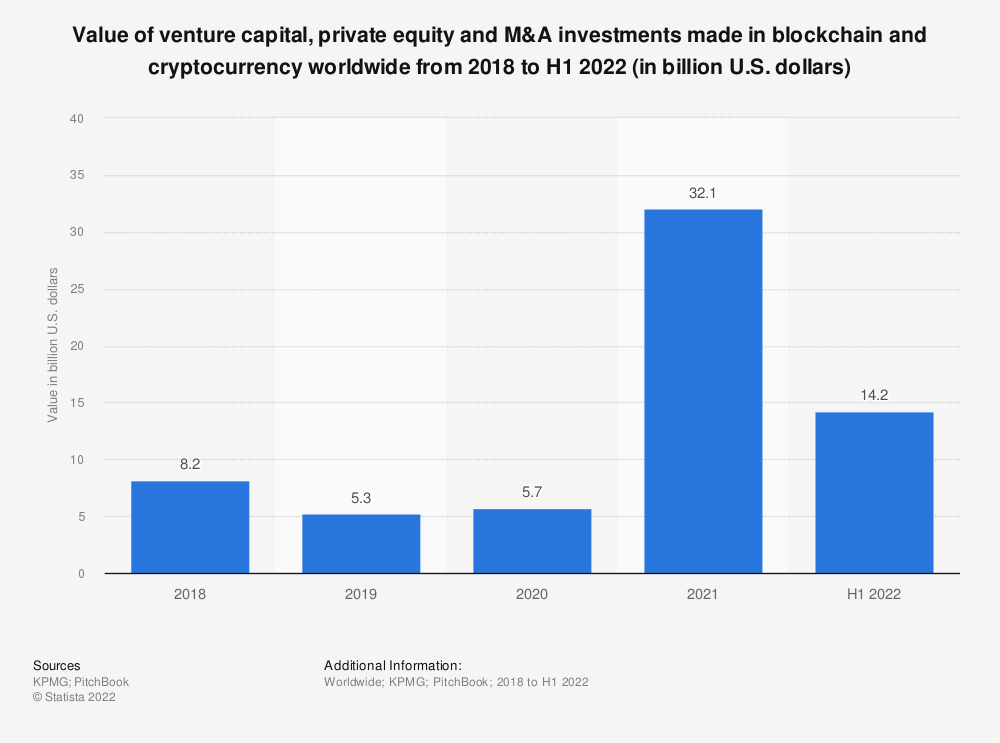

While the crypto market has rebounded, the VC activity in the industry is still tepid. According to Crunchbase, until about mid-May, crypto firms globally raised only $500 million across eight funds. That’s barely 2% of the money that the industry raised in 2022.

Incidentally, 2022 VC funding in the crypto industry was also way below the 2021 levels.

Meanwhile, after being in oblivion since the bankruptcy of Three Arrows Capital Fund, Su Zhu and Kyle Davies are back with a new fund with a similar name.

Founders of Bankrupt Three Arrows Capital Fund Started a New VC

They have started a new fund named “3AC” which intends to generate “superior risk-adjusted returns without leverage.”

The fund has partnered with Open Exchange (OPNX) which is a platform for trading claims against bankrupt crypto entities. Commenting on the deal, OPNX tweeted, “The partnership will invest in projects building in the OPNX ecosystem and working towards a decentralized future.”

The internet is split on the co-founders of the bankrupt Three Arrows Capital Fund launching a new fund with a similar name and logo.

I assume that any profits will go back to compensating the people that lost money the last time they blew up.

— Regular Dad ⌐- (@aRegularDad) June 21, 2023

Many Twitter users are wondering whether the news is real while others are speculating whether any profits from the new fund would compensate the investors of the previous fund that went bankrupt.

Global VC Activity Has Been Tepid in 2023

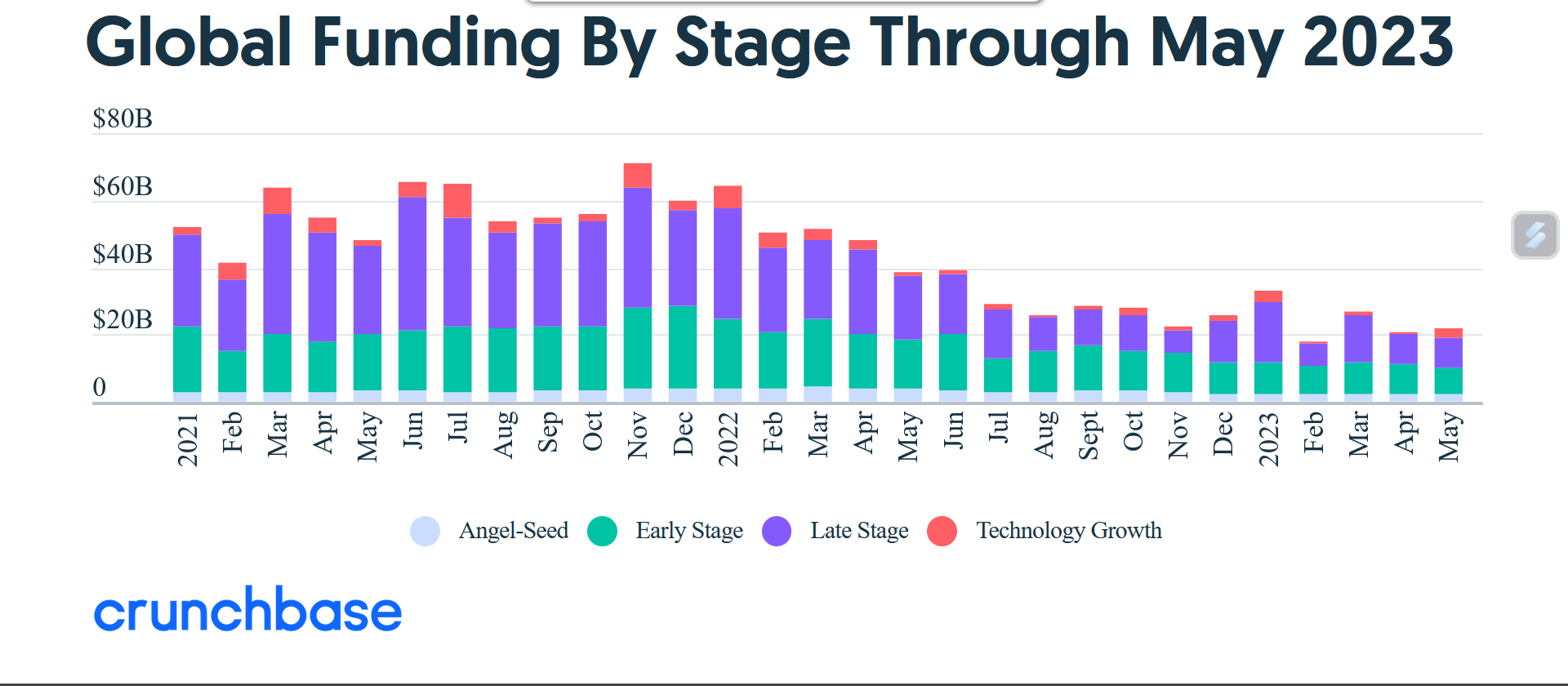

Global VC funding activity has been tepid and fell 44% YoY to $22 billion in May according to Crunchbase.

Crunchbase noted that in April and May, monthly VC funding is averaging above $20 billion which is way below what we saw in 2021 and the first half of 2022.

It however noted that the current levels are in line with 2018-2020 levels – which were incidentally higher than the previous years.

Meanwhile, in a refreshing sign for the startup ecosystem, May recorded 10 unicorns which were twice of April, and the first time since November that new unicorns reached double digits.

That said, the number of new unicorns in May was less than a third of what it was in the corresponding quarter month year.

Coming back to the 3AC fund, it looks like a bold move from the founders as investors in the previous fund might still not have gotten away with the massive losses.

Related Stock News and Analysis

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops