Mobile marketers have had to change tactics to navigate a turbulent 2023, still reeling from the impact of the pandemic, which left inflation soaring across the world.

Despite facing challenges with privacy changes and reduced spending on acquisitions and non-organic installs (NOI), a report on the 2023 State of App Marketing for Subscription Apps report, by Liftoff in partnership with AppsFlyer, revealed a significant increase in consumer spending on subscription apps.

The two industry experts attribute this impressive performance to mobile app marketers, who had to reimagine the business model, thus paying more attention to customer loyalty in the face of a 41% drop in app install spending on Android subscriptions and a subsequent 30% decline posted on iOS.

The Surge in Consumer Spend on Subscription Apps

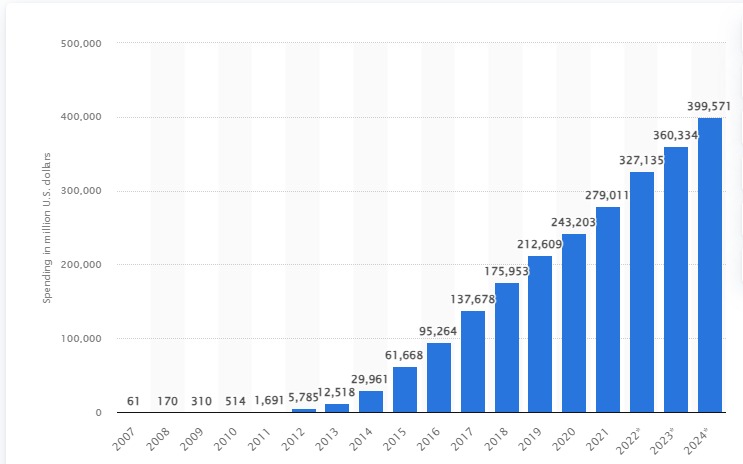

Mobile marketing has become an integral “tool for companies that want to ensure that their marketing messages are seen,” Statista reports. This trend gained momentum over the years, thanks to the mainstream adoption of smartphones and tablets, ensuring consumers have access to the internet from anywhere around the world.

“Data shows that the share of mobile in digital advertising spending is constantly increasing, and after overtaking desktop as the most invested-in global ad format in 2019, 64 percent of all digital ad funds are devoted to mobile today,” the Statista report added.

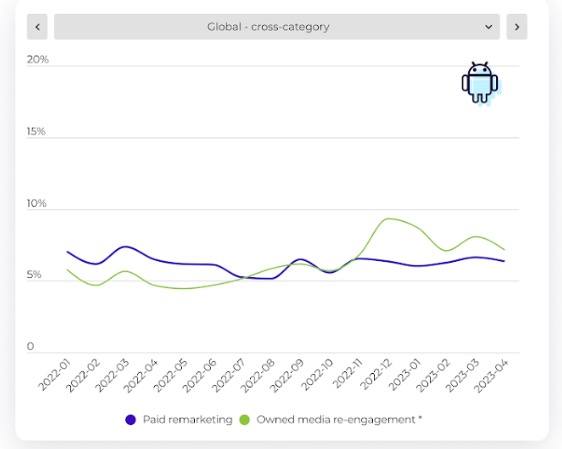

Despite this impressive outlook, mobile marketers struggled in 2022 and 2023, as user acquisition dropped on both Android and iOS.

According to BusinessofApps, the tactical change marketers adopted saw a 48% increase in media engagement, triggering a spike in consumer spend on subscriptions on both platforms.

Consumer expenditure on iOS apps rose by 35%, while that on Android apps saw a 22% growth. This trend has, as the Liftoff report, elicited responses from consumers in two ways: subscribing to additional services or absorbing hikes in the cost of their current subscriptions.

Apple Users Spending More on In-App Subscriptions

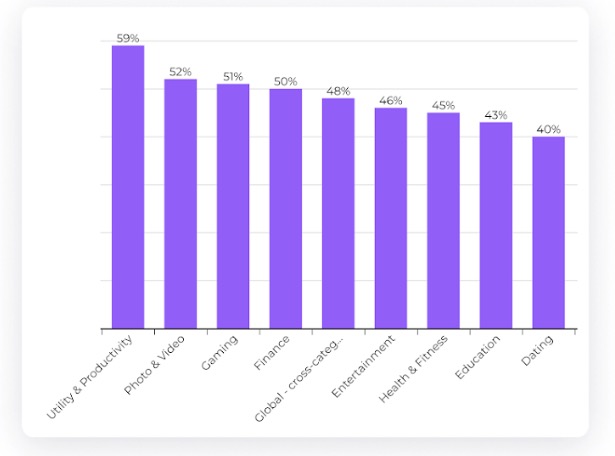

Studies have shown that Apple users have a tendency to spend more on in-app subscriptions compared to their Android counterparts – a notion the report on the state of the mobile marketing industry in 2023 reaffirmed.

At least 59% of iOS utility apps users nodded to being tracked when prompted with the app tracking transparency (ATT), with half of all the Apple App Store subscription users consenting.

This shows that when presented with a clear value proposition, users on iOS were highly likely to consent to ATT, which ensures app developers enhance user experience.

There was a considerable increase in the install-to-subscription conversion rates, largely owing to an intense focus on deep paywall optimization. Meanwhile, on the Android platform, conversion rates jumped by 20%, while on iOS, they saw a rise of 15%.

Scott Reyburn, Senior Content Marketing Manager at Liftoff assured app marketers that the report shows “a rise in consumer spend and revenue growth per user, especially where subscriptions are concerned.”

Furthermore, the trend is expected to remain northbound, bolstered by the growth in subscription-based apps. Mobile marketers are likely to continue enticing users with unbeatable discounts that encourage long-term commitments.

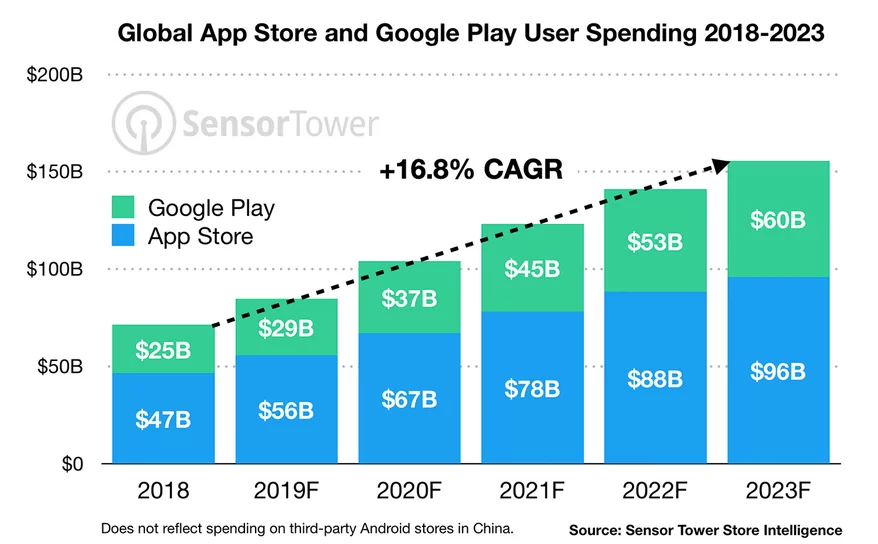

IdeaUsher, citing data by SensorTower, recently revealed that mobile app consumers are expected to spend a whopping $156 billion in app stores in 2023, marking a new record from the $141 billion recorded in 2022. Generally, mobile user spending is growing at a CAGR of 16.8%, and top $270 billion by 2025.

“Sensor Tower Store Intelligence data suggest that there will be a surge in global user spending on mobile apps on both Apple’s App Store and Google Play in the coming years,” IdeaUsher added. “By 2023, the estimated spending is $156 billion, marking a significant growth of 120 percent from 2018, with a compound annual growth rate (CAGR) of 16.8 percent over the next five years.”

Revenue From Non-Gaming App Subscribers On The Rise

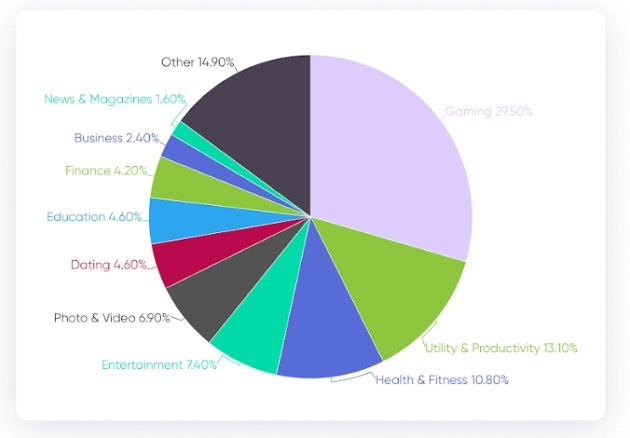

Non-gaming apps are outperforming gaming apps despite the latter accounting for 30% of all mobile app subscriptions.

According to the Liftoff report, subscription revenue from gaming apps significantly falls behind non-gaming apps.

Non-gaming apps such as entertainment apps, health, and fitness apps rely on subscription business models for their revenue.

Data released by Semrush on global mobile marketing shows that the US remains the undisputed king of the industry, worth $240 billion in 2022 from $189 billion in 2019. China comes in second position, with its mobile marketing market at $72.2 billion, while Thailand and India are the markets to watch, as they are growing in double figures of 46 and 42%, respectively.

Related Articles

- 5 Reasons Why You Need to Optimize Your Digital Marketing Tech Stack in 2022

- Amazon Dives Into Healthcare AI With AWS HealthScribe to Save Doctors From Endless Hours of Documentation

- Google’s YouTube Shorts is Winning the Short Form Video Race With Over 2 Billion Logged-In Monthly Users

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops