Venture capital firm Atomico estimates that investments into European startups would drop 39% YoY in 2023. Despite the AI boom startup funding has sagged globally and Europe is no exception.

Notably, 2022 was also a dismal year for startups and funding for private European tech startups dipped 22% YoY to $83 billion. Going by Atomico’s forecast 2023 startup funding in Europe might be less than half of what it was in 2021.

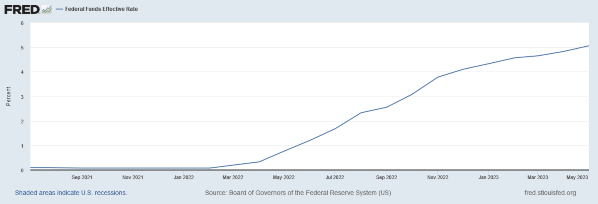

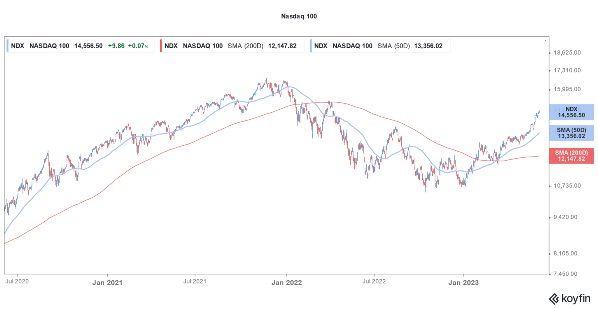

That said, the decline in startup funding is not hard to comprehend. Tech stocks crashed in 2022 amid Fed’s rate hikes and the tech-heavy Nasdaq 100 lost 33%.

Newly listed tech names performed even poorly. For instance, the Renaissance IPO ETF, which invests in a portfolio of newly-listed companies and is overweight in the tech sector, fell 57% in 2022.

The performance of de-SPACs was even terrible and the AXS de-SPAC ETF lost around three-fourths of its value in 2022. The ETF has since liquidated which is reflective of the trouble that de-SPACs, most of which are tech companies, have faced.

While listed tech stocks have seen upwards price action this year and the Nasdaq 100 is up almost 33% YTD – investors are still apprehensive of loss-making startup companies.

Meanwhile, Atomico which has backed names like Klarna, Stripe, and Graphcore believes there are signs of “resilience” in the European tech industry highlighting the fact that the combined value of listed and privately-held tech companies is now back to $3 trillion – a level it hit in 2021.

Incidentally, amid the rally in US tech stocks, the Nasdaq 100 has added over $4 trillion to its market cap even as the index is still below its all-time highs.

Atomico Expects European Startup Funding to Dip in 2023

In its report, Atomico said that the funding winter is more severe for late-stage companies as compared to their early-stage counterparts.

It highlighted that in the first half of 2023, the total funding for companies that raised less than $15 million dipped 21.3% YoY to $8.2 billion – which is much better than the funding slump in late-stage companies.

Atomico added that in the first quarter of 2023, a fifth of the companies raised money in a down round – which is 3.6 times higher than the figure in the corresponding quarter last year.

Many startups have taken a valuation cut – often in line with the carnage in listed space. Klarna for instance raised funds at haircut of 85% last year.

AI has been a notable exception this year. Not only are listed AI stocks outperforming the broader markets with Global X Robotics and Artificial Intelligence ETF up almost 38% YTD – but the startup AI universe is also seeing relatively better interest from investors.

Tom Wehmeier, partner at Atomico told CNBC “We are in the early innings of what is a new AI supercycle technology,” – while adding Europe “has a seat at the table” when it comes to AI innovation.

Startups Have Resorted to Layoffs amid Funding Winter

Amid the funding winter, several startups have resorted to layoffs in a bid to cut costs. Atomico estimates that in the first quarter, the European tech industry laid off 11,000 workers – which is around 6% of the total tech layoffs globally during that period.

Commenting on the layoffs, Wehmeier, said, “It’s too early to say now whether that’s explicitly the peak.” He added, “We would expect there to continue to be elevated levels of layoffs through 2023 beyond. It’s always part and parcel of the nature of market cycles.”

“Around a year ago, Son said #SoftBank would go into “defense” mode amid the headwinds and be more disciplined with its investments…”

No wonder. A $32 BILLION loss:

“SoftBank posts record $32 billion loss at its Vision Fund tech investment arm” https://t.co/nPVkyb4iDa

— TalesFromTheFuture (@talesftf) May 11, 2023

All said, the startup bust has also taken a toll on private equity funds and SoftBank Vision funds lost a massive $32 billion in the fiscal year that ended in March 2023.

Also, between Vision Fund 1 and 2, SoftBank invested only $0.4 billion in the March quarter – the third consecutive quarter when the quarterly investment was below $1 billion.

During the heydays of the tech boom, it was not unusual for SoftBank to invest over $1 billion in a single company only.

Things have changed dramatically for startup funding over the last year and Atomico’s report shows that that pain might continue in 2023 as well.

Related stock news and analysis

- How to Invest in Startups in 2023

- AI Startups Already Raised $20 Billion in 2023 and Show No Signs of Stopping

- EU Wants Companies to Label AI Content Amid Rising Disinformation

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops