DocuSign, Inc., which offers the world’s number one e-signature solution as part of its industry-leading product lineup, reported financial results for its first quarter of fiscal year 2024, which ended April 30, 2023.

In the past 12 months, DocuSign added 160,000 customers to its platform, resulting in 1.4 million total customers being served by the San Francisco-based tech company by the end of this past fiscal quarter.

Of that total, 16% corresponds to Enterprise & Commercial customers. These are organizations that the company takes care of via dedicated account management services and not through its self-service channels.

Moreover, DocuSign (DOCU) reported that the number of customers with annualized contract values (ACVs) exceeding $300,000 moved from 1,080 by the end of the past fiscal year to 1,063 by the end of this first quarter of FY2024.

New CFO Warns About Some Headwinds for the Business

DocuSign’s services were in high demand during the pandemic as organizations relied on this solution to sign agreements and contracts with their customers, employees, and other relevant parties.

However, now that most companies and workers are embracing a full-blown return to the physical office, the tech company is struggling to keep growing its customer base and revenues.

During the earnings call that came after the release of these results, executives within DocuSign discussed the state of the business and warned that they are “seeing a more moderate pipeline and cautious customer behavior coupled with smaller deal sizes and lower volumes”.

Also read: Free Project Management Software: Top 10 for 2023

“The macro environment continues to create uncertainty for our customers, and we’re seeing the impact of smaller deal sizes and lower expansion rates across the business as customers scrutinize budgets”, Cynthia Gaylor, DocuSign’s current Chief Financial Officer, emphasized.

The price of DocuSign shares initially jumped by as much as 11% during early stock trading action. However, after these comments, the stock is now retreating by 3% during what has been a positive day for technological shares as a whole as indicated by the performance of the tech-heavy Nasdaq 100 index.

DocuSign Reduces Headcount and Appoints New C-Level Executives

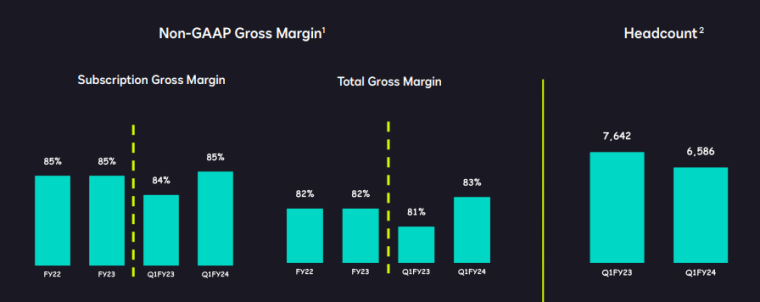

In the past 12 months, the software-as-a-service company reduced its headcount by more than 1,000, with total employees currently standing at 6,586. The latest wave of job cuts took place in February this year when the company let go of 700 people.

Total revenue increased 12% to $661.4 million, driven by a 12% increase in subscription revenue to $639.3 million. Billings increased 10% to $674.8 million. Subscription revenues continue to account for the majority of DocuSign’s revenues and the same goes for the Web & Mobile Channels. Meanwhile, enterprise customers and small-to-mid-sized businesses brought nearly $86 million to the firm.

GAAP net income was $0, compared to a loss of $0.14 per share in the same quarter last year. On a non-GAAP basis, DocuSign earned $0.72 per diluted share, up nearly 90% year-over-year. Free cash flow grew 23% to $214.6 million.

“DocuSign’s first quarter results reflect a solid start to the year,” said CEO Allan Thygesen. “While we have work ahead of us, I am encouraged by our progress and positioning for future growth.”

During the quarter, DocuSign made several executive appointments including Blake Grayson as CFO, Dmitri Krakovsky as CPO, and Kurt Sauer as Chief Information Security Officer.

Also read: Top 11 Paid and Free Digital Signature Software for 2023

DocuSign also released new product capabilities with enhancements to web forms, electronic health record integrations, identity verification for Europe, and features to generate and customize agreements.

“Our expansive product releases illustrate DocuSign’s commitment to innovation,” said Thygesen. “We are executing on our strategy to enable smarter, easier and more trusted agreements.”

DocuSign ended the quarter with $1.4 billion in total cash, cash equivalents, restricted cash, and investments. The company expects to see continued revenue growth and operating margin expansion throughout fiscal year 2024.