Investors in the decentralized finance (DeFi) market experienced a sigh of relief following the partial repayment of a loan linked to Michael Egorov, founder of Curve Finance (CRV) protocol.

A wallet address traced back to Egorov reduced the hefty $70 million loan in Aave, another DeFi protocol by $1.35 million paid in stablecoin USDT.

This development from Egorov coincides with a considerable drop in the value of CRV, the ecosystem’s native token, utilized as collateral for the loan. This has led to a decreased health factor for the loan and amplified the risk of liquidation.

According to a report by Bloomberg, the loan was partially backed by CRV tokens, which have lost 20% of their value in the past week. CRV plunged to its lowest price point of 0.00035010 ETH on Thursday, sending shivers across its ecosystem.

Uhh seems like Curve’s founder has a $110m leverage position against his $CRV stack across all Defi.

If not repaid at some point (spoil: it prob won’t, my man is taking profit), this will cascade into a lot of bad debt for lending protocols https://t.co/kxwc0Sk65V pic.twitter.com/yhHp9JFWBV

— vapor (@trading_vapor) June 14, 2023

Based on the total value locked (TVL) metric, Curve ranks as the runner-up in the DeFi exchange landscape, second only to Uniswap.

Curve Founder’s Protocol Shuttering $101.5 Million Stablecoins Loan

On-chain analytics platform LookOnChain revealed that Egorov sent 431 million CRV (equivalent to about $246 million) into various decentralized lending protocols, procuring $101.5 million in stablecoins from multiple platforms. Egorov’s contributions constitute 50.5% of CRV’s circulating supply.

The founder of #Curvefi exchanged 800K $LDO ($1.33M), 565,579 $USDT and 1.3M $DOLA for 3.2M $FRAX in the past 6 hours.

Then repay 3.2M $FRAX on #Fraxlend to improve health rate.

He deposited 431M $CRV ($246M) in total and borrowed $101.5M of stablecoins on multiple platforms. pic.twitter.com/qDh5Yo4ckj

— Lookonchain (@lookonchain) June 15, 2023

Additional on-chain data from one of the leading DeFi market tracking platforms DefiLlama indicates a looming liquidation threat of $107 million on Aave in the event CRV price falls below $0.37.

At the time of writing, Curve is trading at $0.60 up 3% in the last 24 hours, as per price data provided by CoinGecko.

Once liquidation is initiated, the CRV tokens will be frozen within Aave’s smart contracts until a potential buyer steps in to settle and liquidate the collateral. A proposal has been advanced to halt Egorov’s loans on Aave and preclude additional CRV loans to evade a disastrous scenario, Cointelegraph reported on June 14.

Some industry players have opined that moving forward with such a proposal negates the very principle of censorship resistance or what many would like to refer to as “neutrality” in DeFi.

The proposal, according to The Block, was prepared by Gauntlet, a project that focuses on managing risk in the DeFi space.

It proposal recommends “freezing” the Curve DAO tokens on Aave v2 and revising the loan-to-value ratio for CRV to zero. Objectively, the proposal aims at preventing Aave from accumulating bad debt as a consequence of the declining liquidity of CRV tokens on exchanges.

Gauntlet specifically emphasized concerns surrounding the dwindling liquidity of the CRV token, which has experienced a significant downward trend in recent months.

Gauntlet further clarified that it doesn’t endorse the restriction of any particular address. On the contrary, a CRV freeze would stimulate the transfer of the previously mentioned loan position to Aave version 3, which is more optimally configured for effective risk management.

“We propose freezing CRV on Aave V2 to encourage migration to V3, where risk parameters are better suited for this market,” Gauntlet’s proposal stated. “Given the account is actively managed and frequently maintains its health, freezing CRV will incentivize the account to reduce its borrow or add other forms of collateral.”

To clarify, Gauntlet does NOT support restricting any specific address.

We propose freezing $CRV on @AaveAave V2 to encourage migration to V3, where risk parameters are better suited for this market.

A freeze on V2 restricts user actions as shown below:https://t.co/JzVk5XUnsq https://t.co/91ijY4Ij8V pic.twitter.com/SaeHeXLAgc

— Gauntlet (@gauntlet_xyz) June 14, 2023

Despite the enormous strain imposed on the token by the scale of Egorov’s loans, the number of bearish positions on CRV has surged, supplying the impetus for a potential swift upward shift.

Should Curve Investors Be Preparing for a Short Squeeze?

Tokens like CRV that exhibit low liquidity can present the hazard of unpredictable price fluctuations, says Clara Medalie, who heads research at the cryptocurrency data company, Kaiko. She argues that Aave could potentially face a financial setback should it be required to liquidate the position.

Off-chain $CRV liquidity is less than ~$1mn within 2% of current prices.

This means that any liquidation would cause huge slippage, so no wonder the founder chose AAVE… pic.twitter.com/t7rmUzwOW6

— Clara Medalie (@Clara_Medalie) June 15, 2023

Meanwhile, since the disclosure of Egorov’s loans, the open interest volume for CRV perpetual swap contracts saw a surge from $35.5 million to $46.3 million.

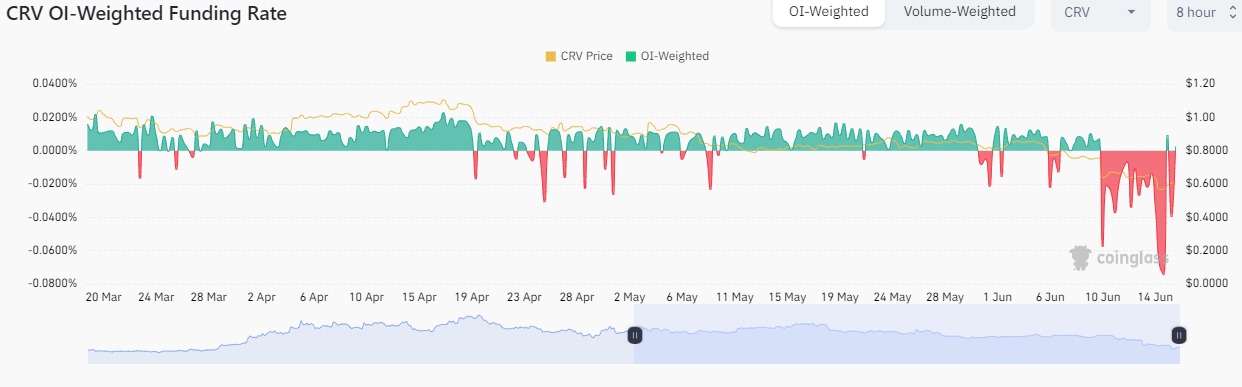

According to CoinGlass data, Centralized derivatives exchanges like Binance and OKX are experiencing a considerable drop in the funding rate for CRV to the extremes of hitting record lows, around 81% annually.

The negative funding rate implies that the majority of these novice traders are wagering more downside action.

Furthermore, as short sellers flood the market, the situation paves the way for buyers to target their stop losses, leading to what’s known as a short squeeze.

This event comes when there’s a swift upswing in the asset’s value and contrary to the direction anticipated by short sellers. Thus, compelling investors to safeguard their positions or purchase the asset to settle their positions.

Based on the daily timeframe chart for CRV/USD, the token has started nurturing a rebound after dropping to $0.55. This trend reversal, although minor, can be attributed to the extremely oversold conditions amid the two-week sell-off from highs approximately at $0.86.

As the Relative Strength Index (RSI) charges into the neutral region, more buyers are bound to stream into the market to capitalize on the low-priced CRV tokens. A daily close above the short-term support at $0.6 would also boost investor confidence.

On the upside, CRV may encounter more resistance at $0.65 and $0.8 – support highlighted by the 50-day Exponential Moving Average (EMA).

Although the Moving Average Convergence Divergence (MACD) still dons a vivid sell signal, investors should be on the lookout for an incoming call to buy CRV. Such a bullish gesture would manifest with the MACD line in blue crossing above the signal line in red.

The Curve Finance community may have dodged a bullet, following the partial repayment of the loan, but the network is far from being in the clear.

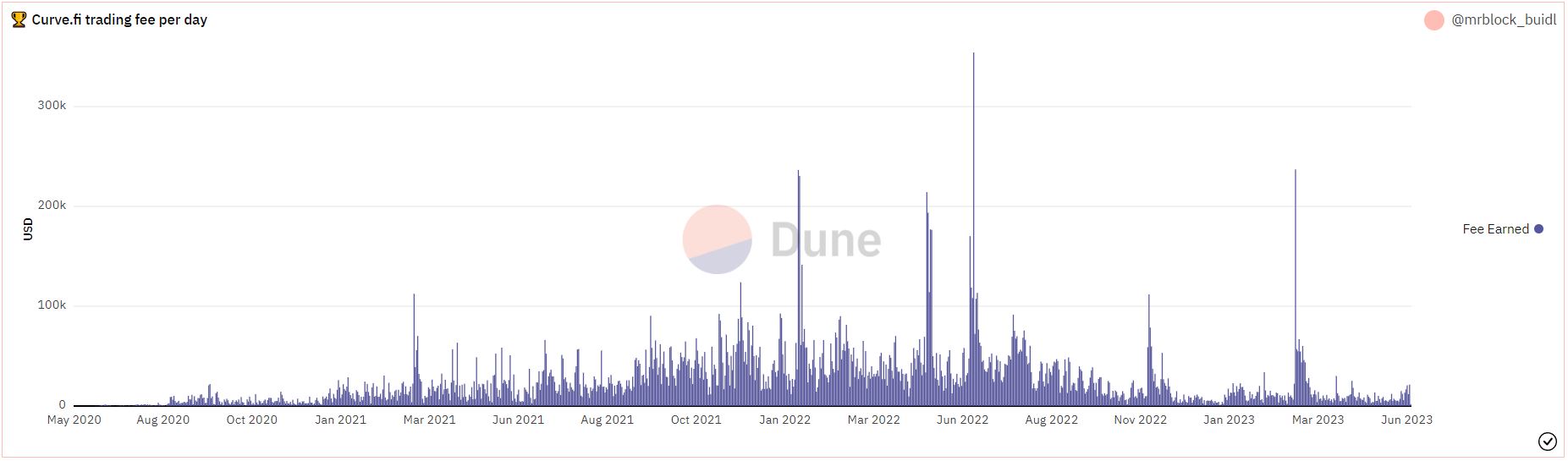

In addition to liquidity challenges, the protocols have remained depressed since the implosion of the FTX exchange in November 2022. This has shrunk CRV’s DeFi yield over time, with stakers feeling the pinch. CRV stakers earn their revenue from 50% of the trading fees.

Related Articles

- 10+ Best Crypto Presales to Invest in 2023 – Compare Pre-ICO Projects

- Crypto Markets Bounce as BlackRock Files for Spot Bitcoin ETF – How High Can the BTC Price Go?

- USDT Recovers from Depeg, But is More FUD Incoming?

AiDoge (AI) - Meme Generation Platform

- Create & Share AI-Generated Memes

- Newest Meme Coin in the AI Crypto Sector

- Listed on MEXC, Uniswap

- Token-Based Credit System

- Stake $AI Tokens to Earn Daily Rewards