Corporations worldwide are pouring billions of dollars into artificial intelligence (AI) initiatives in hopes that they will likely play a pivotal role in future technology across multiple industries.

The trend has gained momentum during the recent macroeconomic headwinds that have negatively impacted deal-making and fundraising in the technology industry.

Investors are paying special attention to the AI sector, and nearly every tech company’s quarterly results conference call contains analysts asking how the company in question will find growth or operating leverage with AI-related tooling.

Tech giants, including Google, Microsoft, and Salesforce, are investing vast sums of money into AI startups while creating new AI-focused capital pools and directly investing in AI projects.

For one, Microsoft has so far invested $13 billion in ChatGPT maker OpenAI, which is also the largest AI company in the world.

Among other key investors in the sector is Nvidia, which has briefly joined the $1 trillion valuation club thanks to strong AI-related hardware and cloud sales.

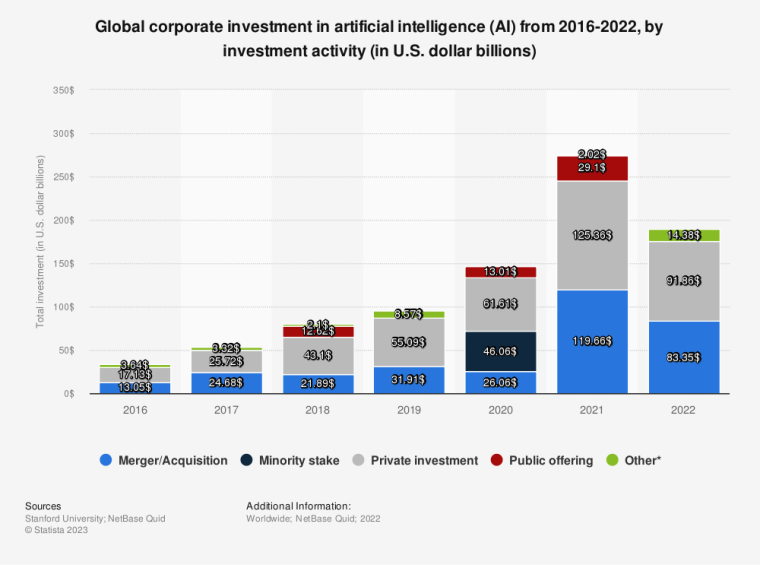

Meanwhile, data by Statista shows corporate investment in AI grew consistently up to 2019 when there was a surge in minority stake investment, pushing growth beyond historic levels.

This was then matched again in 2021 by a considerable jump in merger and acquisition investments as well as a doubling in private investment in AI projects.

However, the investment in the sector subsided in 2022 compared to the previous year, with a 30 percent reduction in both private and merger investments.

More Companies Jump on the Bandwagon as AI Hype Continues

More recently, services company Accenture announced that it would invest $3 billion in AI over the next three years.

The bulk will be spent on recruiting, with the company aiming to hire an additional 80,000 AI-focused consultants through a combination of hiring, acquisitions, and training.

Likewise, another major services company PwC plans to spend $1 billion on AI during the same period to expand and scale its AI offerings.

Despite concerns that corporations could be betting too much on the hype surrounding AI, these firms believe that the promise and potential of the technology far outweigh the investment risks.

Moreover, the consultants tend to focus heavily on proving the potential of new technology-based solutions, which has been driving their investment.

For instance, in one of McKinsey’s recent reports, the consultancy firm estimated that generative AI could add $4.4 trillion annually to the global economy, equivalent to adding a new productive country of the size of the UK to the world.

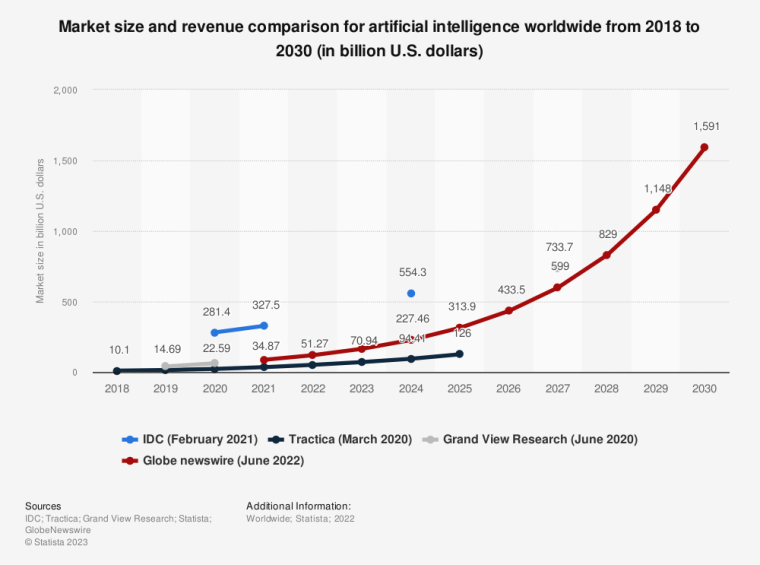

Likewise, in a recent research, Statista forecasted continued growth in the market size and revenue of AI firms.

The report predicted that the AI market size would reach around $1.6 trillion by 2030.

Some Experts Believe AI Bubble is Forming

In recent months, there has been increasing concern about the possibility of a bubble forming in publicly traded shares of companies involved in the use and development of AI.

While there have been powerful rallies in a few stocks, such as Nvidia, Microsoft, and Alphabet, as well as Oracle and Adobe, experts argue the intense interest in generative AI has not yet generated a bubble in these shares, according to former hedge fund manager Ron Insana.

Insana said that many market historians, including Charles MacKay, John Kenneth Galbraith, Edward Chancellor, and Charles Kindleberger have written about the recurring tendency for investors to become frenzied over stocks and the common characteristics that define bubbles.

These include early disbelief in a particular asset or technology’s transformational potential, rapid advances in asset prices, public participation in the mania, and massive issuance of stock by any company even marginally associated with the trend.

He added that the dotcom bubble serves as an example of the effects of a massive investment bubble.

At the height of the internet mania, 456 stocks went public, with 77% lacking profits. In 1999, the P/E of the remainder topped 3,000%; excluding the five biggest Nasdaq 100 stocks, that year’s P/E ratios were infinite.

As a result, many stocks with infinite P/E ratios crashed and simply went out of business.

AI Gains Push Nasdaq Up 33% YTD

It is worth noting that gains in AI stocks have been concentrated in five or six companies, pushing the Nasdaq 100 up 33% year to date.

While some may consider it a bubble, Insana, who is currently a senior analyst and commentator at CNBC, said this seems more like the performance of cutting-edge firms in the 1970s than it is like the internet bubble of the late 1990s.

Some experts say identifying a bubble while it’s inflating is impossible.

“I would argue, after having covered several, they are actually pretty easy to spot. And, even more importantly, there is an enormous difference between a tiny bubble and a massive one,” he said.

In the case of AI, while there is much interest and investment, it isn’t all-consuming.

“The day may come when intelligent investors speculate on artificial intelligence without care for revenues or profits, focused just on potential,” Insana said, adding:

“When that day comes truly smart money will be separated from the dumb money as bets on intelligence become extremely unintelligent.”

Pew Research Reveals 27% Use AI On a Daily Basis

As reported, a recent survey from the Pew Research Center has revealed that 27% of Americans interact with AI on a daily basis.

Conducted in December last year, the survey found that another 28% of individuals encounter AI about once a day or several times a week.

On the other hand, 44% believe they do not regularly interact with the technology, which highlights the need for better education about AI.

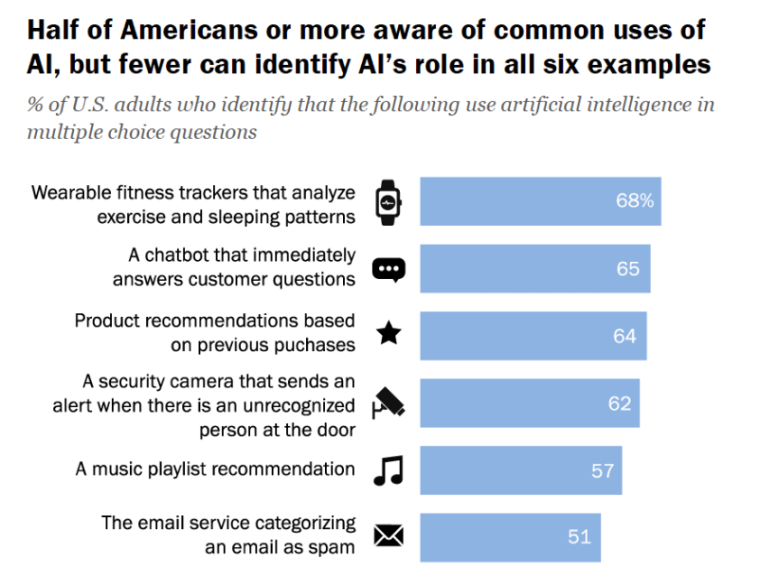

However, there is still room for growth as many still fail to understand some common use cases of AI.

Although the majority of respondents knew about common applications of AI, such as customer service chatbots and custom product recommendations in online shopping, only 30% could correctly identify all six uses of AI presented in the survey.