China’s biggest retailer and the world’s third largest internet company, JD.com, said on Monday that its sales during the country’s mid-year shopping festival surpassed estimates and unveiled plans to open seven more publicly traded companies, each with a minimum market value of $14 billion.

JD.com Sales Exceed Analyst Expectations

On 17 June, JD.com’s 618 Grand Promotion sales reached their peak, triggering an extraordinary surge in sales with the transaction volume of 30% of domestic brands reaching a 100% year over year growth.

A report released by Citi analysts showed that the e-commerce firm’s sales rose between 6-8% from late May to mid-June, beating analyst forecasts of a growth amounting to 2-5%, Reuters reported.

The company is yet to release its gross merchandise value (GMV), however, estimates fall short of last year’s 10.3% and 2021’s 27.7%.

Even so, data released by Syntum showed that the GMV of the biggest e-commerce platforms in China (including JD.com) amounted to 614.3 billion (around $85.5 billion), a 5.4% surge since the previous year with JD.com ranking second after TMall, its competitor.

According to Synthum the surge in sales during this year’s festival “coincided with the 20th anniversary of JD.com, Father’s Day and the Dragon Boat Festival, prompting more activities on the platform than in previous years”.

JD.com is Expanding

Earlier this month China established itself as the “king of mobile gaming” with local companies making 47% of all mobile gaming revenue. Now, its e-commerce industry is also expanding.

In a WeVerse post, JD.com announced that it is planning to expand its business into new as well as e-commerce including online finance, logistics and health care.

The company is planning to establish seven publicly traded companies, each with a market value of at least 100 billion yuan (which amount to about $14 billion). The company already has a number of listed affiliates including JD Health International Inc. and JD Logistics Inc. which are based in Hong Kong.

JD.com additionally said it is aiming of achieving over 1 billion yuan in three of its companies and reaching a net profit surpassing 70 billion yuan.

JD.com stocks momentarily surge

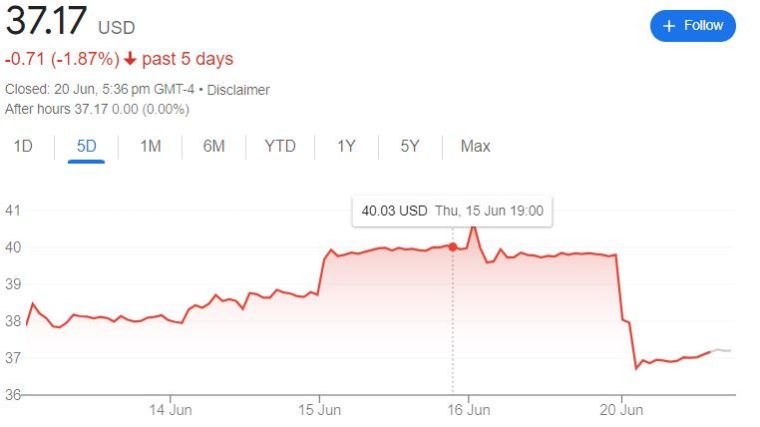

Following the positive sale news, JD.com’s stocks (NASDAQ: JD) momentarily surged, rising to $40.67 on 16 June, a 1.8% surge from the previous day.

The bullish run was not long-lived, however, as the company’s stocks fell back down to $36 by Monday morning, currently down by about 6.7%.

Global tech stocks have been fluctuating these past few days, with Amazon (NASDAQ: AMZN) losing 1.78% in the last five days and falling to about $126 by Monday.

Read more

- The Future of Cars is Autonomous – 1 in 10 Cars Will be Self-Driving by 2030

- Alibaba Makes Progress with LLM Research Amid Global AI Push

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops