Indian edtech major Byju’s has said that it would list its test preparatory arm Aakash Education in 2024. Most Indian startups that went public over the last two years trade below the IPO price. Can Aakash dodge a similar fate?

In its release, Byju’s said that its board has given the approval for the IPO of Aakash Education Services Limited (AESL) which the company expects to complete by the middle of the next year.

It added, “The appointment of the merchant bankers for the IPO will be announced soon to ensure a planned and successful listing next year.”

Byju’s acquired Aakash in 2019 for $950 million and since the company’s revenues have risen three-fold in a span of two years.

Byju’s said, “The upcoming IPO will provide a significant capital infusion to bolster Aakash’s infrastructure, broaden its reach, and extend high-quality test-prep education to a larger number of students across the nation.”

Notably, Byju’s has announced the IPO of Aakash at a time when at least four Indian startups – skincare company Mamaearth, apparel retailer Fabindia, e-commerce company Snapdeal, and consumer electronics company BoAt – have withdrawn their IPOs over the last year.

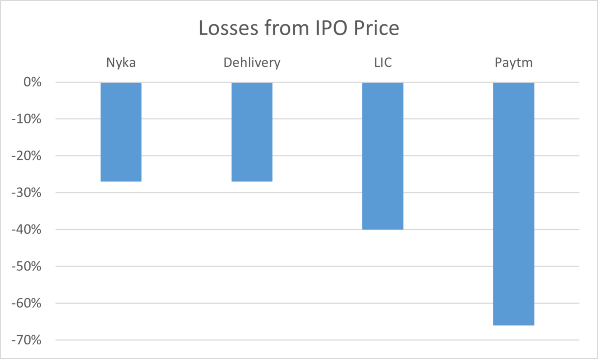

The price action of most Indian startups that listed during the 2021 boom has failed to instill any confidence.

Fintech giant Paytm trades at around a third of its IPO price while logistics company Delhivery has lost 27%. Even state-owned LIC – which is India’s largest insurance company – is down 40% from the IPO price.

Byju’s Is Looking to List Aakash in 2024

Meanwhile, Aakash has 325 centers across India with 400,000 students and Byju’s said that it could post revenues of $484 million with an operating profit of $109 million in the current fiscal year.

That said, Byju’s has been facing both macro as well as company-level headwinds. In what’s reminiscent of the bust in startup valuations, last week BlackRock marked down Byju’s valuation to less than $8.4 billion – at its peak the company was valued at $22 billion in 2021.

Last month, Davidson Kempner Capital Management, a New York-headquartered investment firm, invested $250 million in Byju’s structured debt.

At the company-specific level also, Byju’s has faced a lot of controversies over the last couple of years amid reports of toxic work culture which promotes misselling.

Last month, Indian authorities raided the company under the tough money laundering law.

Byju’s generated revenues of $1.26 billion (unaudited) in the fiscal year that ended in March 2022. However, its losses also ballooned to around $550 million amid an increase in promotions and higher employee expenses.

While Byju’s was previously looking to turn profitable in the previous fiscal year it has now pushed the deadline by a year and now expects to turn profitable only in the fiscal year 2024 which would end in March 2024.

Byju’s is the Most Valuable Indian Startup

Byju’s is the most valuable Indian startup and has received foreign investments worth around $3.4 billion so far – which is the highest for any Indian startup.

Good times are ahead – capitalize ✅

India received $5.9Bn FPI inflow in May 2023.

Second highest inflow in last 29 months (highest $7.1Bn in Aug’22)(Equity+Debt+DebtVRR+Hybrid)

Source: NSDL— SABARI SECURITIES (@sabarish091282) June 1, 2023

While foreign funding in Indian startups has dried up this year, the listed space has seen good buying interest and foreign institutional investors invested $3 billion in Indian stocks in nine trading days between April 26 and May 10.

All said it remains to be seen what valuation Aakash manages to get in the IPO – as well as the interest it generates among investors.

Amid the slump in newly-listed stocks, investors have been increasingly wary of investing in startup IPOs.

Related stock news and analysis

- How to Invest in Startups in 2023

- Alternative Funding Ideas For Small Business

- Tesla Receives a Boost as All Model 3 Variants Are Eligible for $7,500 EV Tax Credit

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops