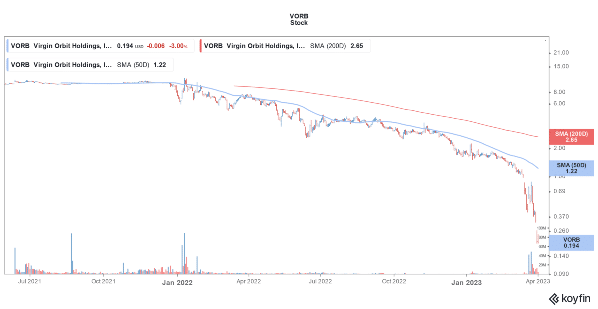

Virgin Orbit (NYSE: VORB) stock is down sharply in US premarket price action today after the company, which is majority owned by Sir Richard Branson filed for a Chapter 11 bankruptcy.

The bankruptcy did not come as a surprise though and recently, the company laid off most of its employees after failing to secure new funding.

Branson has invested around $1 billion in Virgin Orbit but of late has not been committing funds to the company. Virgin Orbit was reportedly in talks with Texas-based Matthew Brown last month to raise $200 million but the talks collapsed.

In its release announcing the bankruptcy, Virgin Galactic said, “While we have taken great efforts to address our financial position and secure additional financing, we ultimately must do what is best for the business.”

The company has meanwhile received $31.6 million DIP (debtor-in-possession) funding from Virgin Investments which is one of its sister companies.

In its filings, Virgin Orbit said that London-based Arqit Ltd is its biggest creditor with dues of around $10 million – followed by United States Space Force which held deposits of $6.8 million for future launches.

Virgin Galactic spun out of Branson’s space travel company Virgin Orbit in 2017 and went public in 2021 through a reverse merger with NextGen Acquisition Corp. II.

Virgin Orbit Files for Bankruptcy

The company raised $228 million in cash from the merger of which $160 million came from PIPE (private investment in public equity) while the remaining $68 million came from the SPAC trust.

As part of the merger, Virgin Orbit was supposed to get $483 million in cash of which only $100 million was through PIPE and the remaining from the NextGen Acquisition Corp. II SPAC trust.

However, like many SPAC mergers, there were large-scale redemptions in NextGen Acquisition Corp. II. Additional PIPE investments from Virgin Group and UAE’s sovereign wealth fund Mubadala Investment Company helped increase the PIPE funds to $160 million.

However, the cash pile gradually came down given the perennial cash burn.

De-SPACs Continue to Face the Heat

Yesterday only, the e-commerce grocery company Boxed filed for bankruptcy. Like Virgin, it also raised less-than-expected cash in its SPAC merger – and even that eventually eroded amid the continued cash burn.

Last month, Embark which went public through a SPAC reverse merger in November 2021 (a month before Virgin Orbit), said that it is exploring liquidation and asset sales as strategic alternatives.

At least 10 companies that went public through SPAC reverse merger including Enjoy Technology, Starry Group Holdings Inc, and Quanergy Systems Inc have filed for bankruptcy.

The performance of de-SPACs was terrible last year and the AXS de-SPAC ETF lost around three-fourths of its value in 2022.

The ETF has since liquidated which is reflective of the trouble that de-SPACs have faced over the last year.

Companies that went public through traditional IPOs fared no better – Renaissance IPO ETF, which invests in a portfolio of newly-listed companies and is overweight in the tech sector, fell 57% in 2022.

Many de-SPACs, including Paysafe, did reverse stock splits to meet the minimum exchange listing requirements. SPACs usually IPO at $10 and given the current macro environment many fell over 90% and plunged below $1.

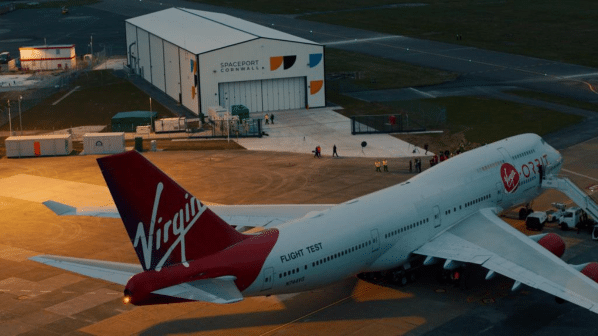

Virgin Orbit’s Last Launch Failed

Virgin Orbit’s January mission from Spaceport Cornwall ended in failure. If successful, the mission would have made Britain the first European country to put satellites into orbit.

Virgin Orbit’s next mission, this time for a commercial customer, was going to be launched from Mojave Air and Space Port in California.

The company uses a modified Boeing 747 plane to send satellites into orbit and so far it has successfully put 33 satellites into orbit.

While announcing the bankruptcy, Virgin Orbit said, “We believe that the cutting-edge launch technology that this team has created will have wide appeal to buyers as we continue in the process to sell the Company.”

Related stock news and analysis

- How to Invest $1,000 – Best $1k Investments Revealed

- Best Low-Cap Crypto Gems to Buy in 2023

- Markets Shrug Off Rise in Oil Prices but Fed Has a Reason to Worry

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops