Binance.US is experiencing severe repercussions.

Within a week of the SEC lawsuit, numerous market makers and traders have rapidly departed from the exchange.

The SEC alleges that Binance.US operated as an unregistered securities exchange and that it failed to register with the agency as required by law.

Binance.US is a crypto exchange for Americans that use the same logo but Binance, the world’s largest crypto exchange, has always claimed that it is run independently (though the SEC disputes that in the lawsuit).

Key Takeaways: Breaking Down the Binance.us SEC Lawsuit

Impact of the Lawsuit on Binance.US

The SEC lawsuit has had a significant impact on Binance.US.

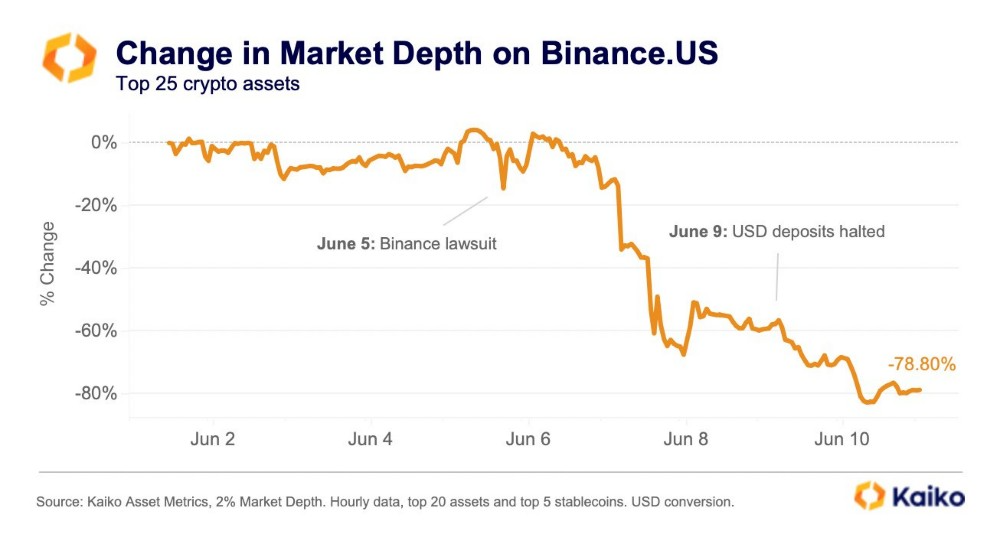

The company has experienced a decrease in market depth. This means that there are fewer buyers and sellers for certain token pairs, which can make it difficult to buy or sell these tokens at a fair price.

Data provided by Kaiko, a crypto data firm, reveals that market depth on the US-based sister exchange has significantly plummeted by nearly 80% following the lawsuit filed by the U.S. Securities and Exchange Commission last week.

On June 4, the market depth stood at $34 million, but today it has drastically dwindled to merely $7 million.

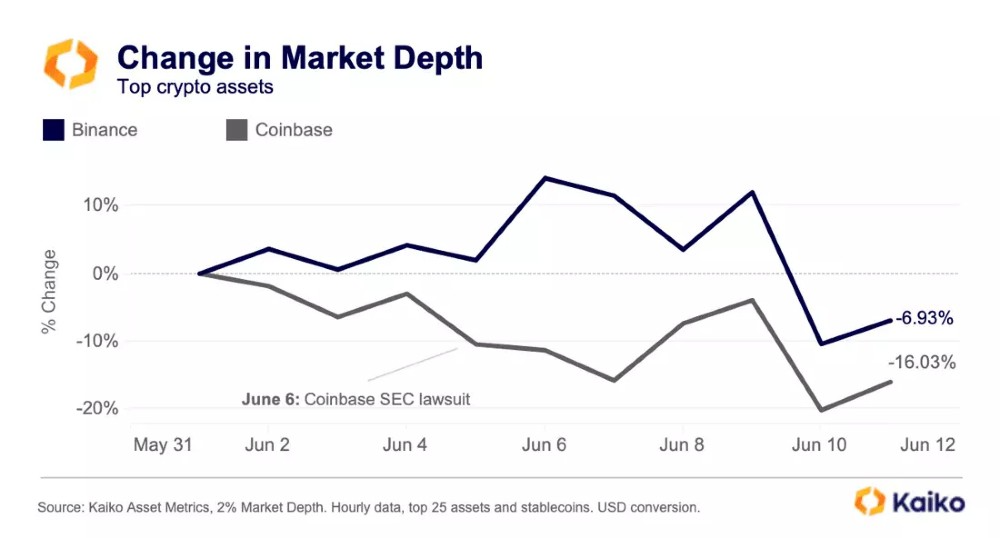

In addition to Binance.US, both Coinbase and global Binance have observed a decrease in market depth following the lawsuits.

Coinbase has experienced a liquidity decline of approximately 16%, while Binance’s market depth has dropped by around 7% since the beginning of June.

Initially, Binance’s market depth remained stable and even witnessed a slight increase immediately after the lawsuit was filed. However, over the weekend, as altcoin markets experienced sell-offs, Binance’s market depth also fell.

The significant decline in liquidity indicates that market makers are feeling anxious and aiming to steer clear of losses caused by volatility, as well as the realistic chance of their assets becoming trapped on an exchange similar to the FTX collapse.

Among the three exchanges implicated in the lawsuits, Binance.US has undoubtedly endured the most substantial impact, as evident in its market share compared to other U.S. exchanges. In April, Binance.US held a 20% market share, but currently, it has dwindled to a mere 4.8%.

Binance’s Response to the SEC Lawsuit

Binance.US has responded to the SEC’s lawsuit by filing over 20 motions and declarations in opposition to the charges.

The cryptocurrency exchange’s legal team argues that there is no risk to customer assets and criticizes the SEC’s request for a temporary restraining order, stating that the alleged securities law violations have been openly occurring for years.

They question the timing of the charges and raise concerns about due process implications, pointing out personal interactions between Chairman Gensler and Binance’s founder during the relevant period.

The SEC accuses Binance and its CEO of breaking US securities rules, including operating unregistered exchanges and misrepresenting trading controls In a statement, SEC Chair Gary Gensler said:

“As alleged, Zhao and Binance misled investors about their risk controls and corrupted trading volumes while actively concealing who was operating the platform, the manipulative trading of its affiliated market maker, and even where and with whom investor funds and crypto assets were custodied.”

They allege that Binance engaged in deceptive practices and attempted to evade US securities laws. Binance’s legal team questions why the SEC allowed the platforms to grow to their current size if they were always considered illegal.

They argue that the SEC’s enforcement actions violate the Administrative Procedure Act and request that the court reject the SEC’s drastic relief sought on an incomplete record and expedited schedule.

The Future of Binance.US

The legal battle between Binance.US and the SEC will likely continue for a long time as the court evaluates the arguments presented by both sides.

It is unclear what the future holds for Binance.US.

If it is able to overcome the challenges it is facing, it could continue to be a major player in the cryptocurrency industry. However, if it is unable to overcome these challenges, it could be forced to shut its doors.

Here are some key tips to stay safe when investing in crypto:

- Monitor Market Depth: Keep an eye on market depth and liquidity to understand the trading environment post-lawsuit.

- Prepare for Volatility: Be ready for potential market volatility and its impact on trading activities.

- Assess Legal Risks: Evaluate the legal landscape and potential risks associated with trading on platforms facing regulatory scrutiny.

- Consider Alternative Platforms: Diversify your trading activities across multiple platforms to mitigate risk.

- Stay Informed: Follow updates on the legal proceedings and their implications for the cryptocurrency market.

Related Articles

- How to Buy Bitcoin – Beginner’s Guide

- Larry Ellison Net Worth – The Oracle of Wealth’s Billion-Dollar Success Story

- Bitcoin Price Prediction: Bears Rejoice as BTC Miner Sell-off Adds Downward Pressure

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops