Baidu (NYSE: BIDU) has started offering robotaxis during the night in Wuhan. The company has been scaling up its autonomous driving operations even as many other companies have reversed course on their autonomous driving business.

From this week, people in Wuhan would be able to ride a Baidu robotaxis between 7 pm to 11 pm without safety drivers. Previously, the company’s robotaxis could operate between only 9 am and 5 pm.

Baidu started offering robotaxi rides in August only. It has been scaling up its autonomous driving operations even as some of the competitors have cut their bets in the sector.

Uber was among the first companies to ditch its autonomous driving business and in 2020 it sold the business to Aurora Innovation, a self-driving startup. In return, Uber took a stake in the company and is the biggest stockholder now.

Argo AI, an autonomous driving startup backed by Ford (NYSE: F) and Volkswagen also shut down. Ford wrote off its investment in the company and took a non-cash charge of $2.7 billion.

Doug Field, Ford’s chief advanced product development and technology officer said, “Commercialization of L4 autonomy, at scale, is going to take much longer than we previously expected.”

He added, “L2+ and L3 driver assist technologies have a larger addressable customer base, which will allow it to scale more quickly, and profitability.”

Baidu Scales up Robotaxi Operations While Others Reconsider Investments

While Baidu is scaling up autonomous operations, Alphabet, which has an autonomous driving subsidiary Waymo, is facing shareholder heat over the spiraling losses. TCI Fund Management, which holds around $6 billion worth of Alphabet stock, wrote a letter to the company calling upon the management to cut losses in Waymo.

TCI said, “Unfortunately, enthusiasm for self-driving cars has collapsed and competitors have exited the market.” It also talked about Volkswagen and Ford exiting the business.

In its letter, TCI said that Alphabet stock is undervalued. Most Wall Street analysts are also bullish on the stock. We have a guide on how investors can buy Alphabet stock.

Nuro, an autonomous driving startup backed by Alphabet, Tiger Global, and SoftBank announced that it is laying off a fifth of its workforce as it strives to save cash amid the perennial cash burn.

Tesla Robotaxis Are Yet to Hit the Ground

Tesla meanwhile sees autonomous driving as a key driver. The company has raised FSD (full self-driving) prices twice this year to $15,000. The company’s CEO Elon Musk believes that over the long term, FSD would cost $100,000. However, the company’s Robotaxis are yet to hit the road.

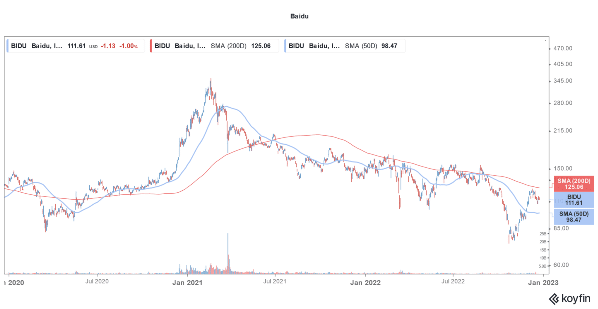

Tesla stock has crashed to the lowest level since 2020. Baidu stock has also fallen but rebounded in November amid the rise in Chinese stocks.

While the market outlook towards autonomous driving stocks has soared, in October, Intel listed Mobileye, its autonomous driving subsidiary.

Notably, Intel priced Mobileye IPO at $21. The shares surged on the listing and now trades around $26. The IPOs strong performance looks heartening as most IPOs of 2022 trade well below the IPO price. Companies that went public through SPAC reverse mergers have fared even poorly.

Coming back to Baidu, it has ramped up robotaxi operations and until the end of Q3 2022, Apollo Go, its robotaxi app, has completed over 1.4 million orders.

Related stock news and analysis

- Best Way to Invest $10k – Top Methods Compared

- Peloton to Offer Refurbished Bikes at Discount amid Sagging Sales

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards