Short video app TikTok, owned by China’s ByteDance, has announced its plans to invest billions of dollars in Southeast Asia over the next few years, as it focuses on the region amid increasing global scrutiny over data security.

With a collective population of 630 million, half of whom are under 30, Southeast Asia represents one of TikTok’s largest user markets, with over 325 million monthly visitors to the app.

TikTok CEO Shou Zi Chew stated:

“Across Southeast Asia, more than 325 million people come to TikTok every month and 15 million businesses use the platform. The role we’ve played in expanding economic opportunities, education and community-building in this region and around the world is immense.”

TikTok’s Challenging E-Commerce Revenue Source

Despite its significant user base, TikTok has struggled to transform its popularity into a major source of e-commerce revenue in the region. The platform faces tough competition from prominent rivals such as Sea’s Shopee, Alibaba’s Lazada, and GoTo’s Tokopedia.

Chew expressed their commitment to the region, stating:

“We’re going to invest billions of dollars in Indonesia and Southeast Asia over the next few years.”

Chew made this announcement at a forum organized by TikTok in Jakarta, which aimed to highlight the social and economic impact of the app in the region.

While TikTok did not provide a detailed breakdown of its spending plan, the company stated that it intends to invest in training, advertising, and supporting small vendors interested in joining its e-commerce platform, TikTok Shop.

Chew emphasized that the content on the platform is becoming more diverse, expanding beyond advertising into e-commerce. TikTok now enables consumers to purchase goods through links on the app during live-streaming sessions.

The executive asserted that TikTok currently employs 8,000 individuals in Southeast Asia, and its platform in Indonesia, the region’s largest economy, hosts 2 million small vendors selling their products.

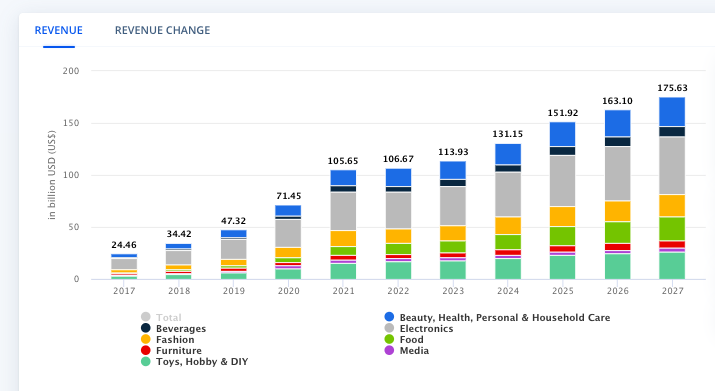

ECommerce – Southeast Asia Revenue 2023-2027

According to Statista, the Southeast Asian eCommerce market is predicted to reach a revenue of US$113.90 billion by 2023. This market is projected to experience a steady annual growth rate of 11.43% from 2023 to 2027, leading to an estimated market volume of US$175.60 billion by 2027.

For Indonesia specifically, the eCommerce market is expected to generate a revenue of US$46.92 billion in 2023. With an anticipated annual growth rate of 10.35% during the period of 2023 to 2027, the market is projected to expand, reaching a market volume of approximately US$69.57 billion by 2027.

While TikTok facilitated $4.4 billion of transactions across Southeast Asia in 2022, showing significant growth from the $600 million in 2021, it still lags behind Shopee’s impressive $48 billion in regional merchandise sales for the same period.

TikTok Data Security Concerns and Bans

TikTok’s investment plan coincides with growing scrutiny from governments and regulators worldwide regarding data security concerns and fears of potential exploitation by the Chinese government. The company is encountering resistance from US lawmakers who are advocating for a ban on the platform.

In March, Chew underwent extensive questioning during his congressional testimony, addressing concerns regarding data privacy, online safety, and the alleged connections between his company and China’s Communist Party.

Several other countries, including Britain and New Zealand, have banned the app on government devices, actions that TikTok believes are based on “fundamental misconceptions” driven by broader geopolitical factors.

TikTok has repeatedly stated that it does not share user data with the Chinese government and has promised not to do so even if asked. Although the app has not encountered many bans on government devices in Southeast Asia, it is fully banned in India and has faced content-related issues in other places as well.

Indonesia posed one of the earliest major policy challenges affecting TikTok in 2018 when authorities temporarily banned the app due to posts deemed to contain “pornography, inappropriate content, and blasphemy.”

Meanwhile, in Vietnam, regulators have expressed concerns about “toxic” content on the platform, which they believe poses a threat to the country’s youth, culture, and traditions. Consequently, they have announced plans to investigate TikTok’s operations in Vietnam.

As TikTok expands its investments in Southeast Asia, it aims to address both the challenges related to e-commerce revenue generation and the growing concerns surrounding data security and content moderation. The company seeks to establish a stronger presence in the region and capitalize on the immense user base it has cultivated.

Related Articles

- 15 Best Crypto Apps for 2023

- How TikTok is Shaking Up Mobile Monetization

- TikTok Aims to Quadruple Its Revenue in Merchandise Sales in 2023 to $20 Billion

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops