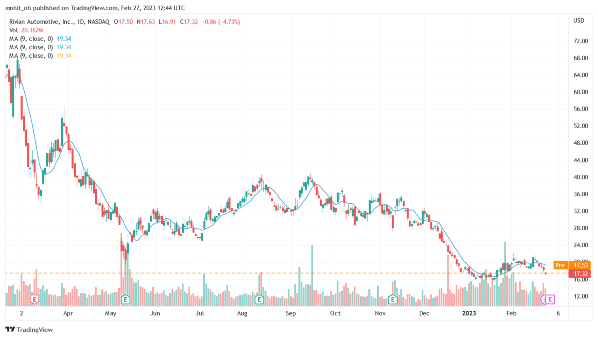

EV (electric vehicle) stocks plummeted in 2022. Among others, markets were concerned about the demand for electric cars. As multiple EV companies report their earnings this week, markets would look for comments on the EV demand environment.

This week, Rivian, Polestar, NIO, and Li Auto would release their earnings. Lordstown Motors and Fisker would also release their quarterly reports this week along with EV charging companies like ChargePoint and Blinks Charging.

We also have Tesla’s annual investor day where markets expect the EV giant to unveil its new lower-priced model.

Meanwhile, EV demand concerns have only compounded over the last couple of months. Until about a few quarters back, all the EV companies proclaimed that they are supply -constrained and could sell all that they could produce.

Notably, the automotive sector was also battling with supply chain issues that hampered production. Strong demand and lower production were just the right mixes for car companies to raise vehicle prices.

Almost all the automotive companies ranging from Tesla, NIO, Xpeng Motors, Rivian, and Ford raised EV prices in 2022. The steep rise in input prices was also a key reason behind the price rise but it was also reflective of the demand-supply issues.

Are EV Companies Facing a Slowdown in Demand?

As the automotive supply chain and by its extension car production improved in the second half of 2022, cracks started appearing in demand. Tesla took the lead and slashed car prices in China.

Almost all the EV companies including Tesla missed their 2022 delivery guidance. While it was also due to supply chain issues it soon became evident that demand slowdown was also playing a part.

At the beginning of 2023, Tesla cut car prices and other automakers like Xpeng Motors and Ford followed suit. Lucid Motors also offered a $7,500 “credit” on select models.

Meanwhile, Lucid Motors’ Q4 2022 earnings release yet again bought the demand slowdown to the forefront. The company expects to produce between 10,000-14,000 EVs in 2022 which it emphasized was below its production capacity.

The company’s CEO Peter Rawlinson attributed lower production, which is half of its reservations, to poor brand awareness. He said that the company has a quality product and just needs to create awareness terming it as an “entirely solvable problem.”

However, markets did not buy his argument and the stock slumped after its earnings release. LCID stock is nonetheless in the green in 2023 amid rumors that Saudi Arabia is considering acquiring the company. There is a guide on buying Lucid Motors stock.

Price War Escalates amid Rising Competition

The competition in the EV industry has escalated amid the launch of new vehicles. In order to spur sales, automotive companies are lowering prices which might take a toll on margins. EV companies would expect to somewhat offset lower pricing with economies of scale and lower input costs.

However, as EV companies ramp up production to achieve economies of scale, it would mean more supply of electric cars.

The tough macroeconomic situation is not helping matters either as car sales are expected to slow down amid the rise in interest rates.

Meanwhile, amid all the noise over demand, Tesla’s CEO Elon Musk emphasized during the Q4 2022 earnings call that the company is not facing any slowdown in demand.

Tesla said that it expects to produce 1.8 million cars in 2023. While it would imply a YoY growth of only about 31%, Musk said that the company could produce as many as 2 million cars in 2023.

He pointed out that despite growth being less than 50%, the company’s CAGR growth since 2021 is still above 50%. With EVs, solar energy, and energy storage products, Tesla is at the forefront of the green energy transition.

All said EV demand and margin pressure amid the price war would be in focus this week as we get a flurry of earnings from EV companies.

Related stock news and analysis

- Best Sustainable Investing Funds to Watch in 2023

- More Layoffs Reported at Twitter despite Elon Musk’s Promise

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards